Data review of the crypto market performance in October: BTC on-chain transaction volume increased by 32%

Original author: Lars , The Block Researcher

Original translation: TechFlow

Most metrics improved. Adjusted total on-chain transaction volume increased by 28.1% to $420 billion, with Bitcoin (BTC) up 32.1% and Ethereum (ETH) up 20.9%:

Stablecoin on-chain transaction volume increased by 8% to $899 billion after adjustment; at the same time, the total issuance decreased by 0.7% to $149.3 billion, with Tether (USDT) accounting for 79.5% of the market share and USD Coin (USDC) accounting for 16.9%:

Bitcoin miners saw their revenue increase by 25.4% to $1.02 billion, while Ethereum stakers saw their revenue increase by 5.8% to $221.5 million:

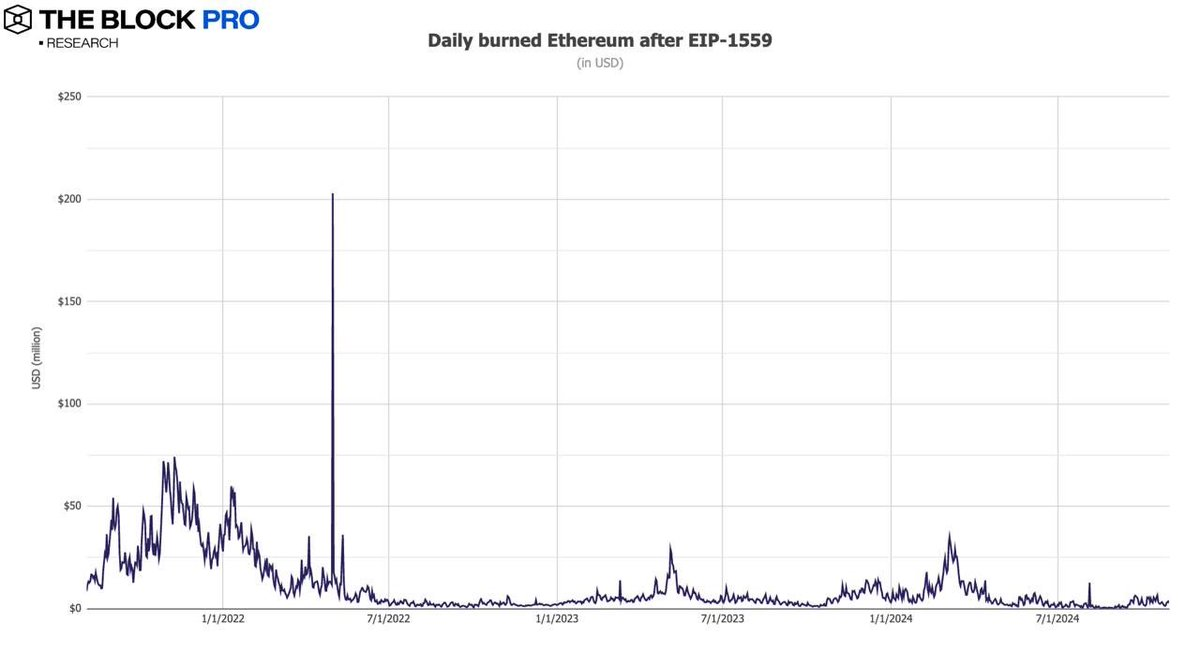

A total of 41,648 Ethereum (ETH) have been destroyed this month, equivalent to $105 million. Since the introduction of the EIP-1559 protocol in early August 2021, a total of 4.43 million ETH have been destroyed, worth approximately $12.5 billion:

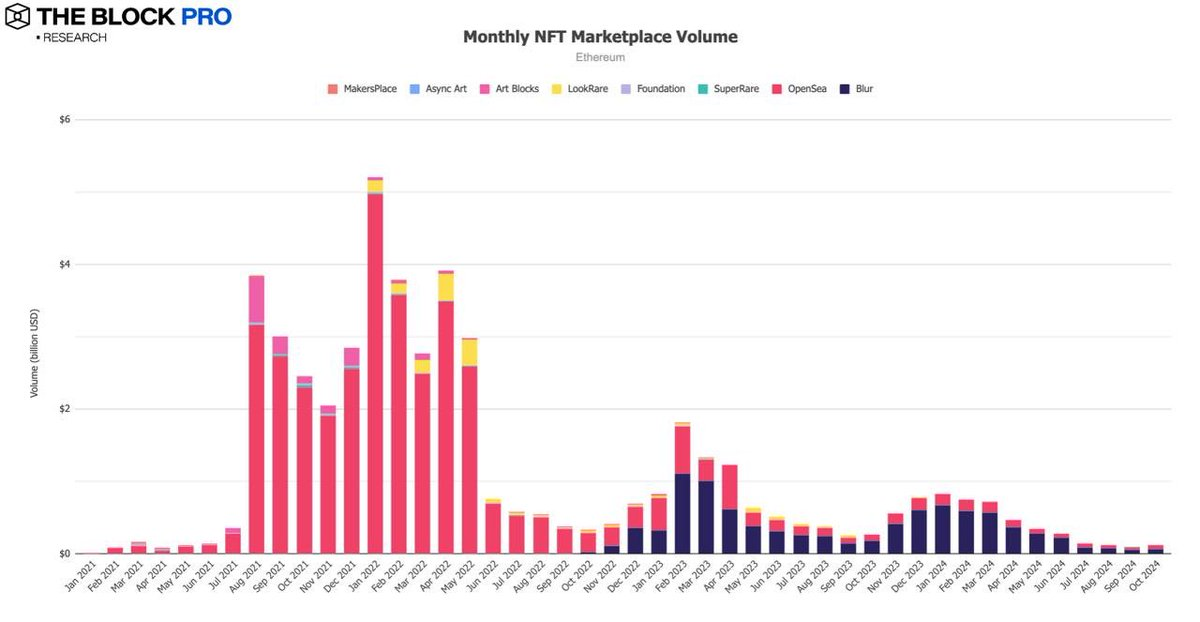

The NFT market on Ethereum saw a 26.5% increase in monthly volume to $121.6 million:

Spot trading volume on compliant centralized exchanges (CEXs) grew 16.3% to $843 billion:

The monthly net inflow for all Bitcoin spot ETFs was $5.3 billion. IBIT hit an all-time high of $872 million in one day on October 30:

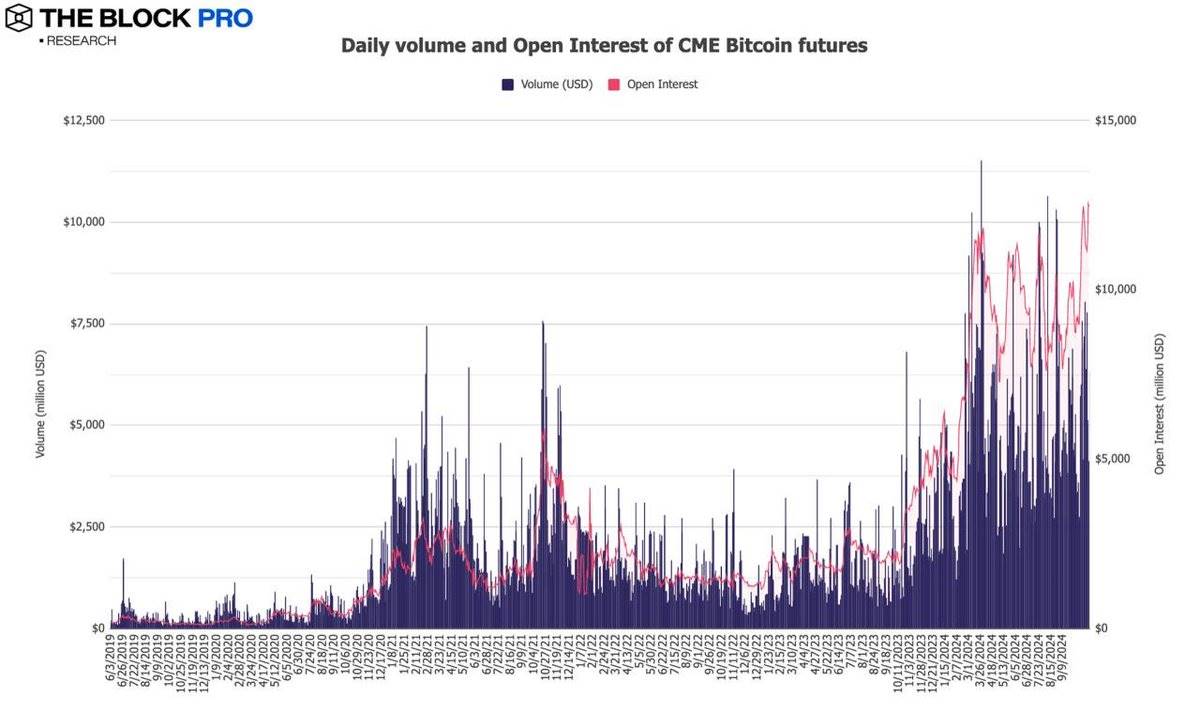

Futures Market: In terms of open interest, Bitcoin (BTC) hit a new high, up 22.9%, and Ethereum (ETH) increased by 14.6%; in terms of trading volume, BTC's monthly futures trading volume increased by 12.1% to $1.25 trillion, while ETH increased by 4.8%:

Open interest in CME Bitcoin futures increased by 21.5% to a new all-time high of $12.5 billion, while average daily volume increased by 9.6% to $5.3 billion:

Ethereum futures monthly volume increased by 4.8% to $488 billion:

In the options market, BTC has increased by 35.7% in terms of open interest, while ETH has remained unchanged. BTC’s monthly options volume increased by 39.8% to $54 billion, while ETH increased by 4.7% to $10.2 billion: