Messari Researcher: Overview of the various products and features in the stablecoin market

Original author: Addy

Original translation: TechFlow

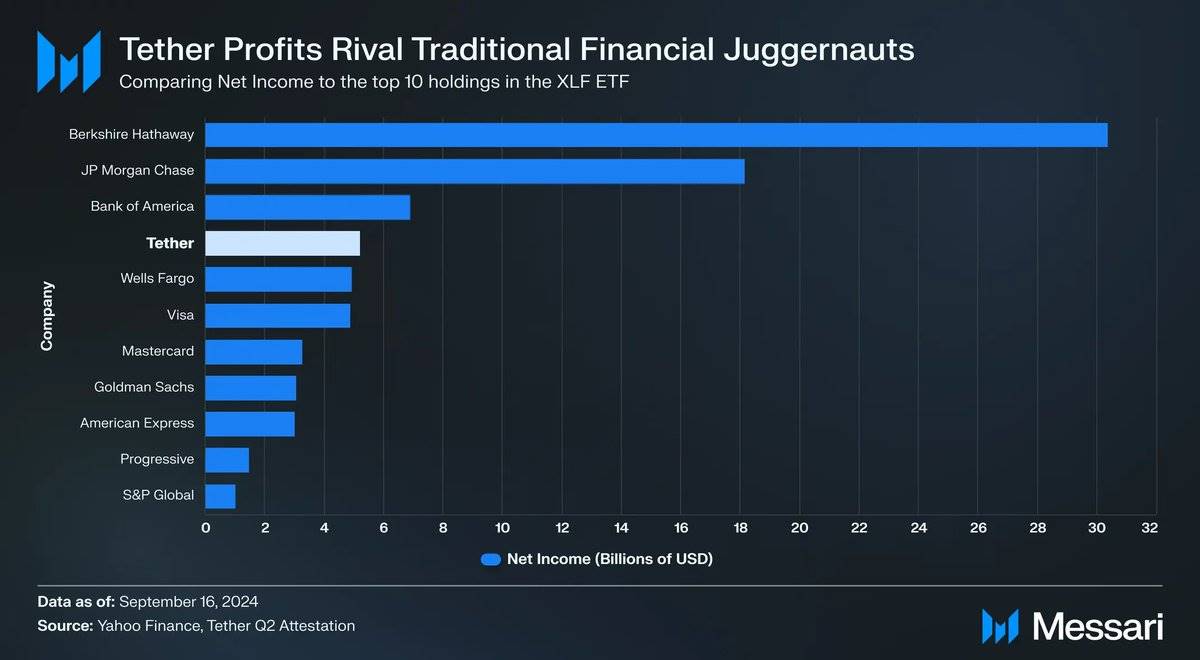

Tether’s record profits last quarter put it among the giants of traditional finance. But the $5.2 billion profit figure also puts it in the crosshairs of new competitors looking to grab a piece of that market share:

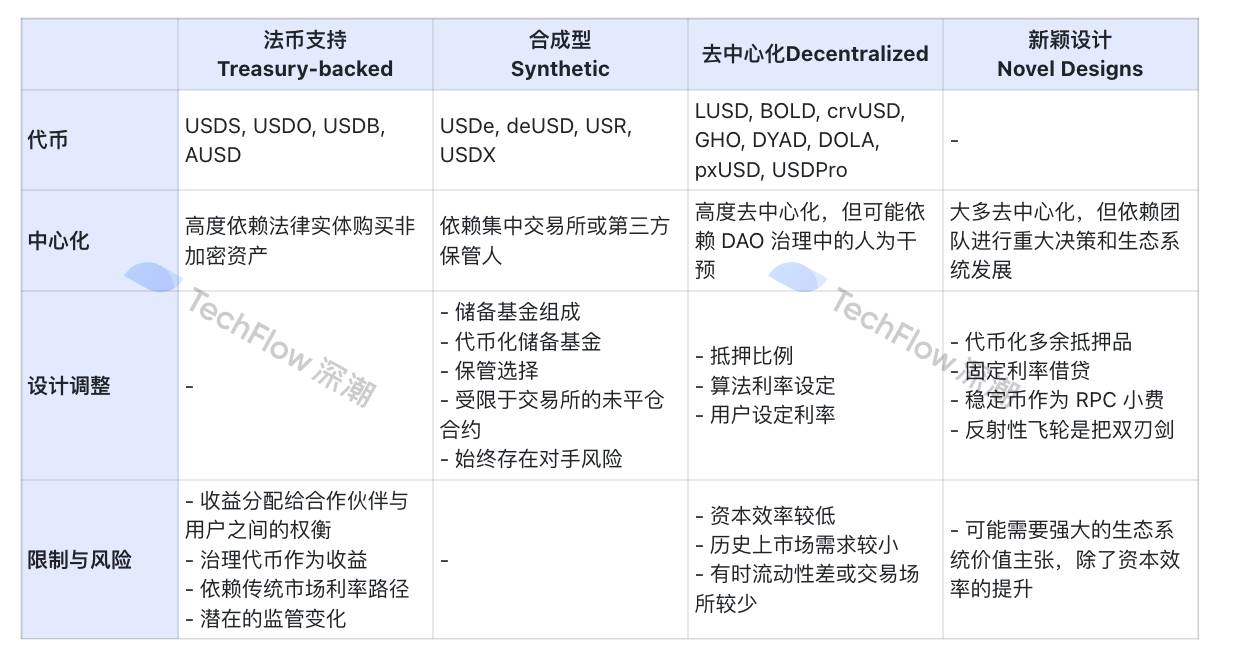

My latest article provides an in-depth analysis of the rapidly evolving stablecoin space, covering both the centralized and decentralized sectors. We divide the space into several main categories:

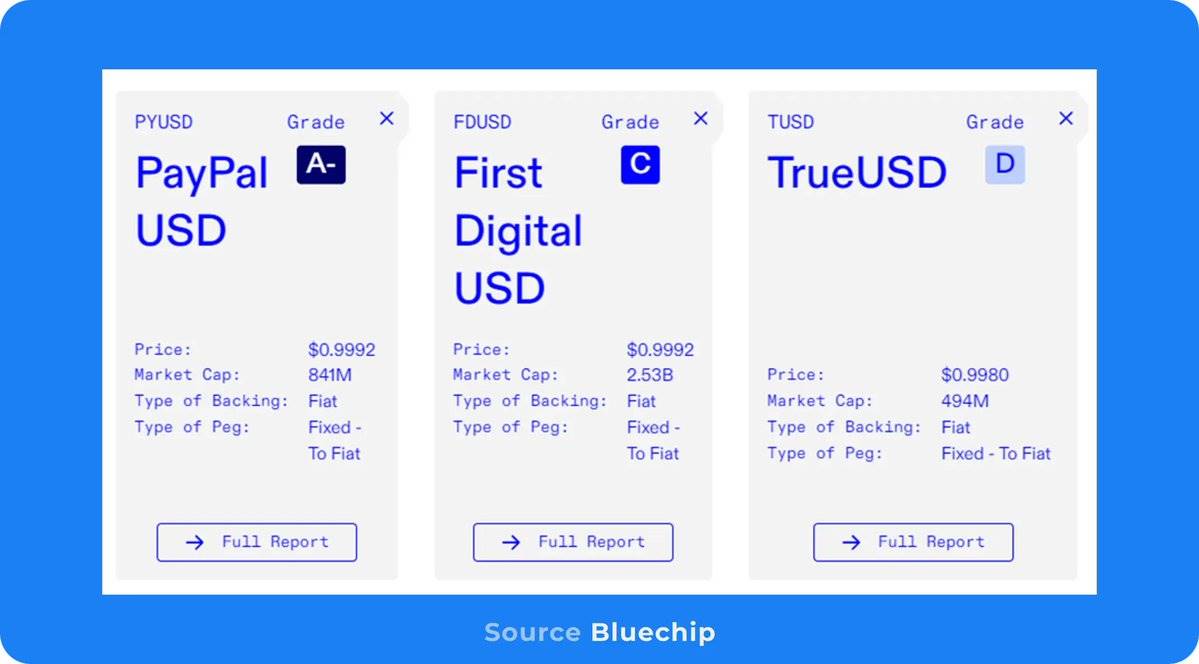

Centralized alternatives often lack transparency and typically only see high volumes when there are clear incentives. PYUSD is one of the few stablecoins that has gained trust and a billion-dollar market cap:

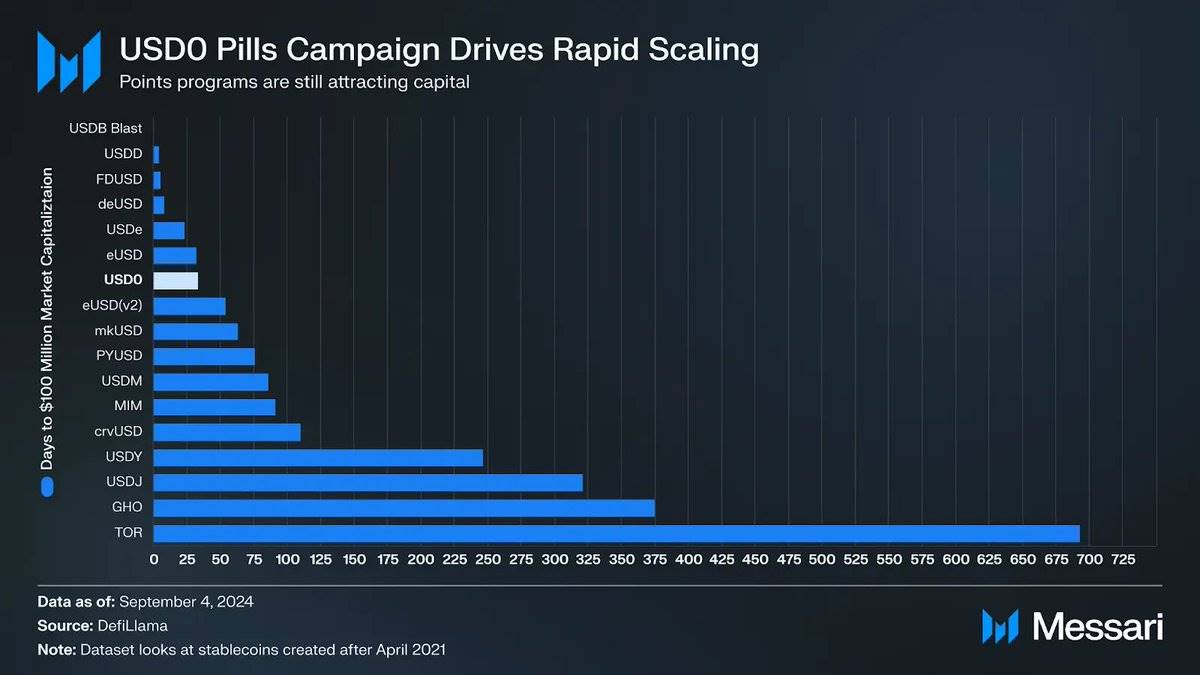

More decentralized treasury-backed stablecoins like USD 0 have grown rapidly through airdrop incentives and partnership integrations with DeFi platforms like Morpho. USD 0 has a market cap of around $250 million and has reached this level quickly:

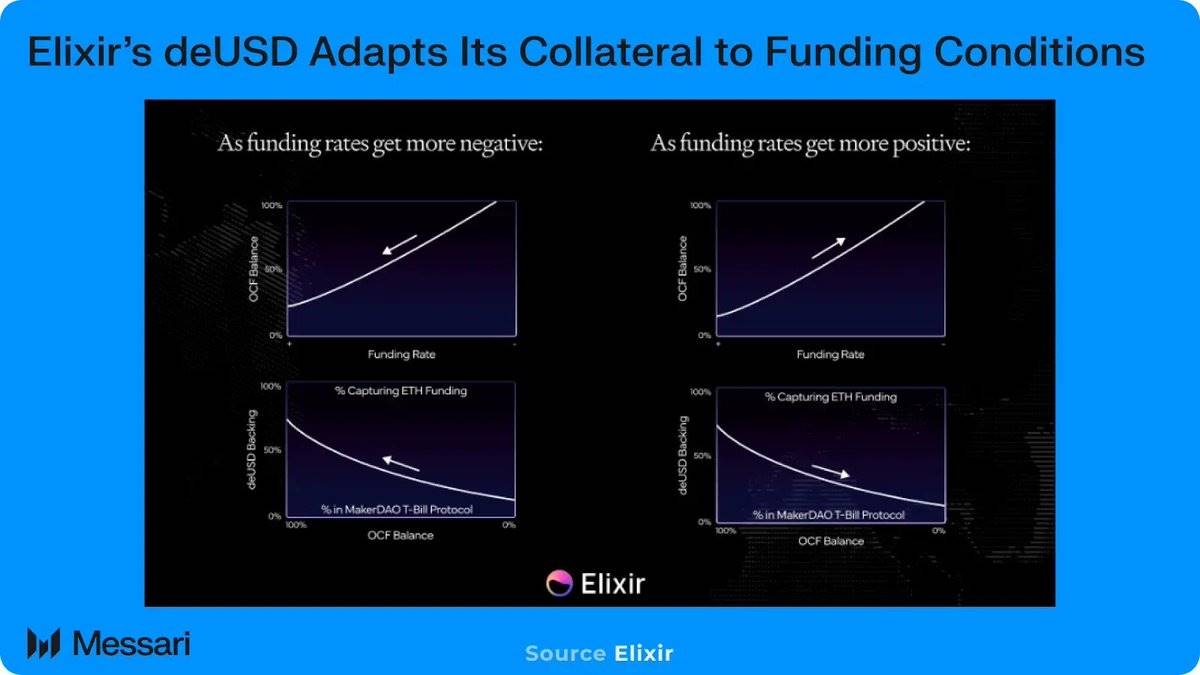

Synthetic stablecoins like USDe maintain their peg by holding both long spot and short futures positions. As the basis narrows, USDe loses market share. But new protocols like Elixir aim to improve on the Ethena model by adjusting their collateral backing:

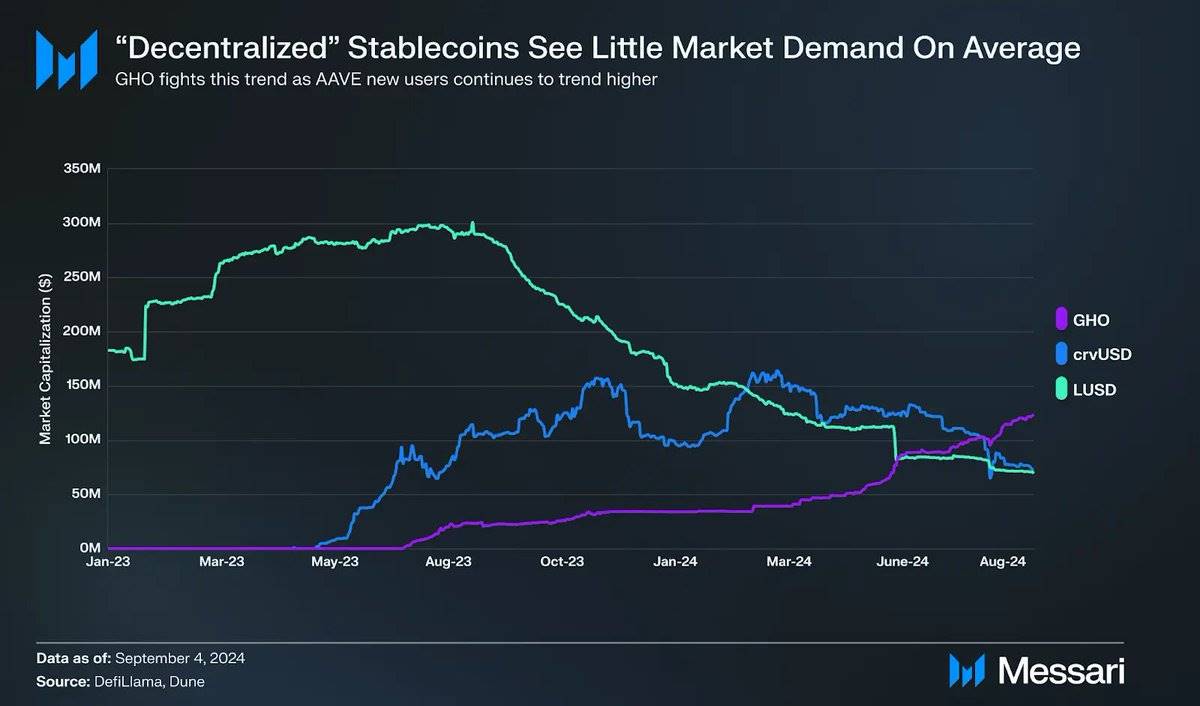

Historically, stablecoins that focus on maximizing decentralization and minimizing human intervention have not been in high demand. GHO may be an exception as it relies on the already growing number of active users on AAVE:

Novel designs often try to implement mechanisms that improve upon the traditional collateralized debt position model. DYAD is one of those stablecoins that seeks to leverage excess collateral in the system through a second-generation token called KEROSENE. KEROSENE allows users to mint more DYAD based on their external capital. The more KEROSENE a user holds on their NFT called NOTE, the more they earn from the liquidity pool:

DYAD-KEROSENE FLYWHEEL

-> 1. TVL rises - TVL (Total Value Locked) rises as users look to take advantage of high-yielding liquidity providers (LPs).

-> 2. KEROSENE Deterministic Value Increases - The Deterministic Value (DV) of KEROSENE is calculated as: KEROSENE DV = (TVL - DYAD Minted) / KEROSENE Supply.

- > 3. KEROSENE price increases - The price of KEROSENE should match its Deterministic Value (DV).

-> 4. DYAD-USDC pool’s yields rise - KEROSENE emissions from the pool become more valuable based on USD value.

These categories of new stablecoins compete on yield, accessibility, liquidity, stability, and capital efficiency. New designs or tweaks to old ones make different tradeoffs:

Original image source: Messari, translated by TechFlow

The landscape of the stablecoin space is changing with new entrants entering the space every week.