Matrixdock releases gold token XAUm: new opportunities for DeFi & TradFi

Original|Odaily Planet Daily ( @OdailyChina )

Author: Wenser ( @wenser 2010 )

With the successive approval of Bitcoin spot ETF and Ethereum spot ETF, the RWA track, as the intersection of real assets and crypto assets, has once again attracted great attention from the market. At the same time, the spot gold price has repeatedly hit new highs, and investors' enthusiasm for gold investment has also been rising. The traditional financial market and the cryptocurrency industry are jointly calling for the emergence of "gold tokenization" related products.

Matrixdock, an RWA brand under Matrixport, a leader in the crypto asset management industry, launched the gold tokenization product XAUm on September 16, aiming directly at the "next new asset class" with a scale of more than 10 trillion US dollars.

Odaily Planet Daily also contacted Eva, the business manager of Matrixdock, and had an in-depth conversation with her. The following is the interview record, and some content has been deleted.

Q1: Based on what long-term value proposition considerations, the Matrixport team focused on the RWA track and established Matrixdock?

Eva: In April 2022, the RWA team of Matrixport was officially established; at the end of 2022, the Matrixdock sub-brand was officially launched. Just as we successfully predicted at the end of 2022 that "U.S. Treasuries will become the first asset class to stand out in the RWA track" and launched Asia's first U.S. Treasury token "STBT" in February 2023 (the project is "Asia's highest historical locked-in value project"), with the arrival of the Fed's interest rate cut cycle, putting high-quality assets on the chain through blockchain technology and enhancing the connection with real-world assets will also become one of the strong narratives in the future.

Based on the two-way needs between DeFi capital management to attract more liquidity in the crypto industry and TradFi fund transactions for traditional financial institutions to open up new markets, Matrixdock came into being, dedicated to bridging the existing gap between DeFi and TradFi, and striving to become "the preferred platform for users to invest in on-chain RWA."

Combining the thinking of infrastructure assets and financial innovation, precious metal tokens may become the next financial service field leading the technological innovation of underlying assets. As the first product in the precious metal token series, the gold token XAUm, which was successfully launched on September 16, is Matrixdock’s latest attempt.

In the future, Matrixdock’s main development direction will be to combine its own high-quality service capabilities, carefully screen high-quality assets that truly meet market demand, and seek a dynamic balance between short-term market selection and long-term value selection.

Q: How does XAUm reflect its value in terms of two-way demand? What are its advantages compared with physical precious metals and fund-based gold products?

Eva: The gold token XAUm combines the stability of traditional gold and the flexible innovation capabilities of blockchain technology, giving it advantages in both the gold industry and the crypto market - it can not only improve the market transaction efficiency of the gold industry, but also provide the crypto market with high-quality asset allocation options with value support.

XAUm is fully backed by physical gold bars certified by LBMA (London Bullion Market Association, a global independent precious metals authority and standard-setting organization) with a purity of no less than 99.99%, and each XAUm token is anchored to 1 troy ounce (toz) of gold assets. XAUm combines the physical properties of gold with the flexibility of crypto assets, not only delivering physical assets, but also providing cryptocurrency investors with a reliable, risk-resistant configuration asset. Compared with other asset classes, XAUm can balance the volatility of the crypto market and has long-term investment value that is inflation-resistant and risk-resistant.

Compared with traditional gold products, XAUm's main advantages include:

First, it greatly reduces the investment threshold for fine gold. For ordinary investors, it is difficult to buy LBMA-certified gold, the process is complicated and the threshold is high. XAUm uses blockchain technology to open up the entire process of purchase and storage, and reduces the investment threshold to 1 troy ounce (about 31.1 grams). If customers want to withdraw physical gold, they can also withdraw from Singapore and Hong Kong.

Secondly, the price advantage is very cost-effective. LBMA gold is an important reference standard for global spot gold prices, and all spot gold transactions will be priced at a premium based on the LBMA gold price. XAUm provides a channel with transparent prices and clear sources, allowing customers to obtain LBMA gold at a better price without having to bear the additional costs of transportation, warehousing, management, etc. in traditional channels.

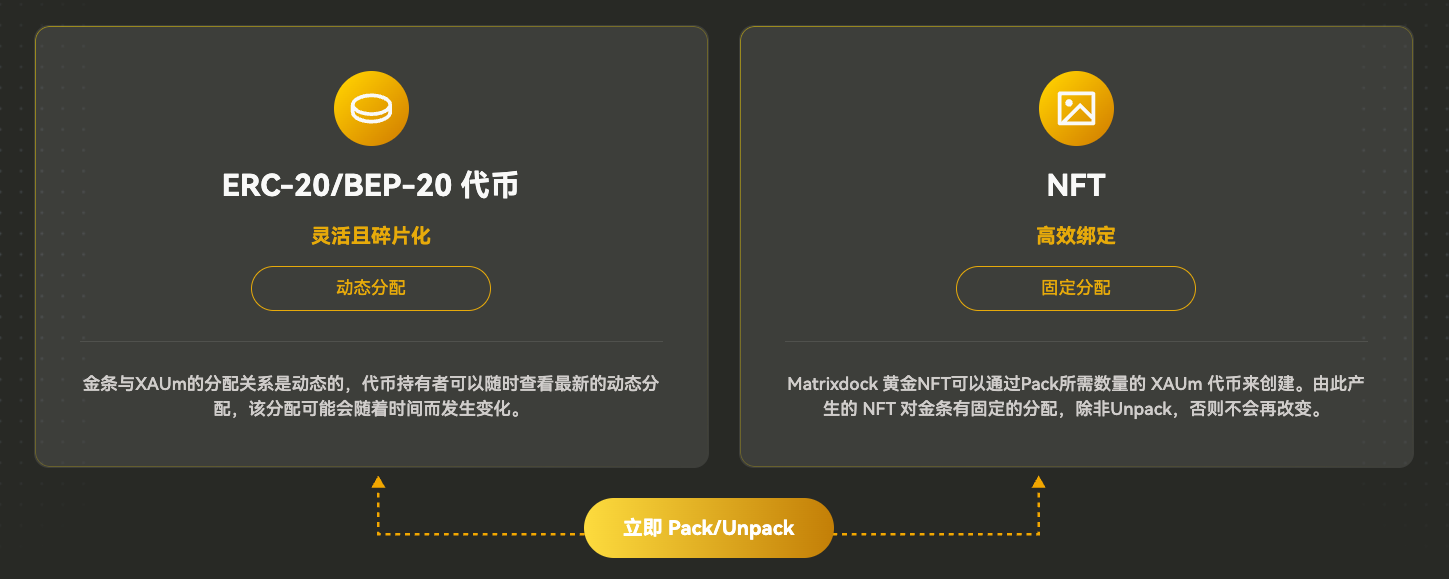

Finally, management costs and application efficiency are optimized. With the help of tokenization technology, XAUm helps users hold and transfer tokens on the chain at any time. More importantly, XAUm supports the conversion between NFT and Token, which can meet the needs of different application scenarios and is more flexible. In the future, Matrixdock will also provide more lending and derivative services based on XAUm through diversified cooperation in the RWA ecosystem, further enhancing the liquidity and practicality of tokens.

In addition, XAUm gives users the "redemption rights" of physical gold. Customers can request a corresponding list of physical gold assets (Gold Bar List) and package these gold assets into NFTs. If users want to redeem specific gold bars, Matrixdock can also give priority. This innovation means that XAUm is like a bridge between on-chain and off-chain assets. Through the design of "nested assets", it can be used as collateral in DeFi or CeFi scenarios for lending or secondary market transactions, greatly improving the liquidity and compatibility of gold assets.

Binding relationship between XAUm tokens and NFT asset packages

Wenser: Can you briefly share the operating mechanism of XAUm and how to connect the entire asset chain?

Eva: In simple terms, the XAUm gold token works in 6 steps:

1. The customer submits the demand for casting XAUm to Matrixdock.

2. Matrixdock purchases gold that meets the standards from Brokers and Refiners within the LBMA system.

3. Gold is stored in a professional warehouse certified by LBMA through a professional transportation company.

4. The warehouse returns an asset table with the gold bar details.

5. Based on the actual amount of gold deposited, Matrixdock mints the corresponding number of XAUm tokens and delivers them to the customer.

6. When the customer wishes to redeem the gold, Matrixdock destroys the corresponding XAUm tokens and delivers the corresponding weight of physical gold to the customer.

Different from other service providers on the market, Matrixdock adheres to the concept of "assets first, then tokens", and prioritizes ensuring that each XAUm token is backed by sufficient physical gold, and the number of underlying assets is always greater than or equal to the token supply. Therefore, although there is a slight delay in the experience (because it takes a certain amount of time to confirm and reserve assets), the security and authenticity of the assets are indeed greatly guaranteed.

Reporter Wenser: So what is the current delivery cycle of Matrixdock?

Eva: For small purchases, we can currently deliver on T+0 (i.e., same-day processing), because Matrixdock itself has a certain amount of gold reserves. However, for larger purchases, the delivery time is usually T+2 (i.e., T+2 days, application initiated on the first day, processing completed on the third day), because offline gold procurement and asset confirmation need to be completed on working days. While maintaining rigor, our team is also continuously optimizing these processes. In the future, we hope to further shorten the delivery cycle and enhance customer experience while improving asset security.

Q: What efforts has Matrixdock made in terms of asset transparency, compliance supervision, and asset management?

Eva: Building trust is crucial for the crypto industry, and it is also a reflection of a brand's strength and value. In order to ensure customer trust, Matrixdock has taken multiple measures in asset transparency and compliance supervision:

1. Asset transparency: 1) Product design transparency: strictly follow the principle of "1 XAUm = 1 troy ounce (toz) of gold", which provides customers with a transparent benchmark, allowing them to easily verify the logic of the product and the corresponding amount of physical gold; 2) On-chain transparency: by managing the casting volume asset pool to ensure that "new XAUm will only be minted when the underlying assets grow". At the same time, the underlying asset proof has been kept public to ensure that customers can see the support behind the assets in real time; 3) Traditional audit transparency: authoritative audit institutions will regularly audit assets and issue audit reports and related certificates. It not only serves the trust building of the crypto industry, but also solves the "worries" in the traditional financial field for customers.

2. In terms of compliance supervision, the SPV bankruptcy isolation structure (full name: Special Purpose Vehicle) is adopted, which is completely isolated from Matrixdock's operating assets. This means that even in extreme cases, if Matrixdock encounters operating problems, customer assets will not be liquidated or misappropriated. In addition, the gold procurement channels are well-known LBMA providers such as Point Gold and Heraeus, and the transportation, custody and insurance of gold are handled by the world's top transportation and custody service providers, such as Brink's. These professional and authoritative third-party partners are equivalent to adding a layer of "independent insurance" to the assets.

XAUm Gold Token Authoritative Third Party Partner

3. In terms of policy compliance and region selection, due to policy and regulatory considerations, the main operating markets are regions that are friendly to personal gold trading, including Singapore and Hong Kong, so that users can redeem physical assets at any time, truly "thinking what users think".

Q: Matrixdock and XAUm are mainly aimed at the Asian market. What are the considerations?

Eva: From the demand side, as a globally recognized high-quality means of value storage, gold is particularly well-recognized in Asia and is seen as the best way to preserve wealth. There is even a saying that it is “gold in troubled times.” The strong demand for gold in the Asian market is also the main driving force behind the rise in global gold trading prices.

From the supply side, Matrixdock, based in Singapore, can better understand and meet the needs of the Asian market, and its localized physical gold extraction support services also meet regional customer needs.

The combination of market demand, compliance management and technological innovation has pushed Matrixdock to the main stage of gold trading in Asia and laid the foundation for further market development.

Q: Could you please share your views on the opportunities and challenges of the RWA track? How can you stand out from the crowd?

Eva: First of all, broadly speaking, stablecoins can be regarded as "the earliest product to stand out in the RWA track." As a medium of exchange, it meets the rigid demand for market transactions, and thus quickly gains a first-mover advantage. Following closely behind is tokenized U.S. Treasuries, especially in the context of the U.S. dollar rate hike, U.S. Treasury tokens have become a hot asset in the market. Data shows that the size of the tokenized U.S. Treasury market was only US$769 million at the beginning of 2024, but by early October, this figure had rapidly grown to US$2.2 billion, an increase of nearly 300%.

Currently, the development demand for on-chain assets is showing a diversified trend, including:

Income-based assets: such as Private Credit, including products like PayFi, which realize income flow through tokenization.

Tokenization of stocks or fund indexes: This product aims to introduce traditional financial assets into the crypto market and expand its investor base.

Tokenization of commodities: XAUm belongs to this category. The value of such assets is relatively stable and has a clear valuation. In an environment where the US dollar cuts interest rates or increases currency issuance, due to concerns about geopolitical instability and US dollar inflation, the market demand for risk-hedging tools has soared, and assets including BTC and physical precious metals will become important incremental markets.

What is certain is that the RWA track has introduced more liquidity to the traditional financial market. Both crypto companies and traditional institutions want to leverage the advantages of tokenization to open up new markets. For market participants, this is undoubtedly an important two-way opportunity - it can not only bring more high-quality assets to the crypto industry, but also provide more capital and liquidity to traditional markets.

However, the challenges facing the industry remain daunting, mainly reflected in the complexity of tokenization, namely the on-chain compatibility of assets and the complexity of multiple links in management. Practitioners not only need to have the ability to identify the standard underlying assets, but also have comprehensive asset management experience and the technical ability to cope with on-chain liquidity requirements.

However, as more participants enter the RWA track, I believe these challenges will be gradually overcome. Matrixdock's launch of XAUm is a preemptive attempt to introduce traditional high-quality assets into the crypto industry, which will also bring more diversified investment options to the crypto market. This is also the core strategy implemented in the "RWA Asset Breakout Competition" - "Based on the crypto field, expanding the boundaries of assets."

Q: Do Matrixdock and XAUm plan to expand to different blockchain network ecosystems in the future? Will they use the advantages of Matrixport to expand application scenarios?

Eva: Of course, multi-chain expansion and application is an important direction for the development of the crypto industry. Matrixdock is also actively promoting this work, which can be seen from the product route around multi-chain compatibility: At present, XAUm already supports native deployment and unified management on the Ethereum mainnet and BNB Chain, and users can use it in different blockchain networks. Multiple active ecological networks including the Bitcoin ecosystem are also considered for future development.

As an RWA brand under Matrixport, XAUm will also be launched on the Matrixport APP in the future to further enrich users' usage scenarios. Subsequent XUAm gold token lending service cooperation will provide users with more financial tool options.

Q: Finally, can you talk about the vision and mission of Matrixdock?

Eva: Since its inception, Matrixdock's vision has been to steadily achieve the goal of "Asia's leading real-world asset on-chain platform." Contributing to the development of the global RWA ecosystem is both a self-requirement and an industry responsibility.

It is worth mentioning that Matrixdock recently joined the industry-renowned Tokenized Asset Coalition . The alliance was established in the fall of 2023 and has now brought together more than 40 leading organizations in the RWA field, including well-known institutions such as a16z, WisdomTree and Galaxy. On the one hand, this is an important step in "promoting the on-chainization of real-world assets" and providing investors with a more transparent, secure and efficient way of asset management; on the other hand, it also shows that changing the formation, investment and management methods of on-chain capital has become a definite consensus of the crypto industry and mainstream capital, and the development prospects of the RWA track are broad.

The mission of Matrixdock is to create a reliable real-world asset ecosystem for the crypto industry. At the same time, we also hope that more customers will join this trend in the future and promote the deep integration of blockchain and real assets.