Bitcoin ETF investors face $2 billion in losses, what should ordinary investors do?

Original source: 10x Research

Compiled by: Odaily Planet Daily Wenser ( @wenser 2010 )

Editor's note: On the eve of the September rate cut and the US presidential election debate, the well-known crypto research institution 10x Research once again conducted an in-depth analysis of the market situation and believed that there are three major uncertainties in the market, especially Bitcoin ETF investors are currently facing potential losses of up to $2 billion. Odaily Planet Daily will compile and share the relevant views of 10x Research in this article for readers' reference.

Market uncertainties: Wait and see while testing support levels

At present, the two major uncertainties in the market are the Federal Reserve’s actions in September and the outcome of the US presidential election.

Over the next two weeks, (traditional) financial markets are likely to remain on the sidelines as the Federal Reserve enters a quiet period (before policy announcements).

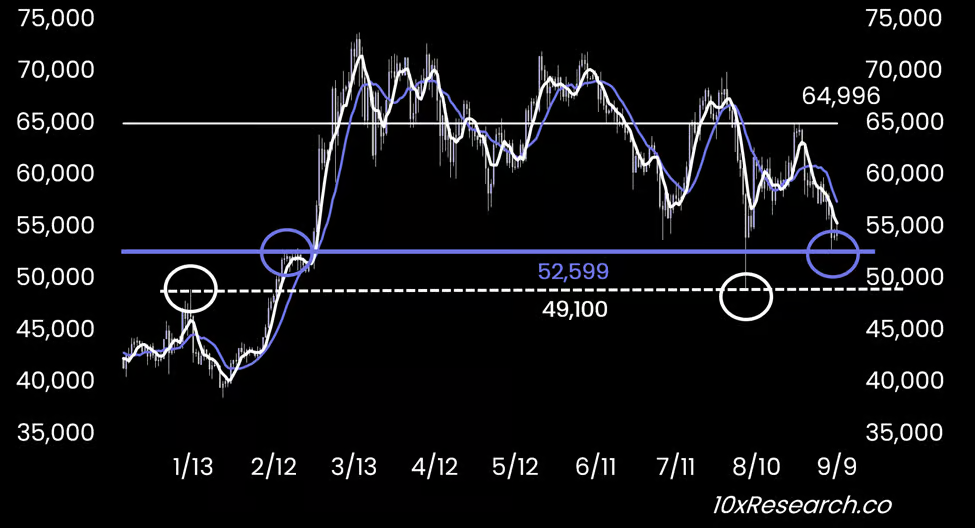

On the other hand, Bitcoin is testing its technical support level. (Note from Odaily Planet Daily: According to the chart information, 10x Research believes that the technical support level of Bitcoin price is around $49,100-52,599.)

Bitcoin technical support level testing

We expect the Fed to cut rates by 50 basis points to stay ahead of economic fluctuations, as a 25 basis point rate cut may still not be enough to avoid greater damage to the economic situation, given the lagged effects of monetary policy in subsequent quarters.

While a 50bp rate cut by the Fed may signal deeper concerns to the market, the Fed’s primary focus is on mitigating economic risks rather than managing market reactions. This is despite the 29% probability of a 50bp rate cut, which is clearly contrary to our view and general consensus. There is a growing perception that the Fed is behind the times — ignoring signs of labor market weakness after being caught off guard by various market data in July.

Trump has a relatively high chance of winning, and the presidential debate may further clarify the direction of the election

In the political sphere, election predictions from prediction market Polymarket show Trump with a 51% chance of winning the election, while Kamala Harris has a 46% chance. Well-known political commentator Nate Silver also gave a corresponding ratio: Trump has a 63.8% chance of winning; in contrast, Harris has a 36% chance of winning, which marks another new high for Trump. The main reason for these predictions is the Democratic National Convention, where Harris reiterated her commitment to a high-tax policy agenda.

However, Alan Lichtman, who has accurately predicted the results of 9 of the past 10 presidential elections using the "13 Keys" method, currently predicts that Harris will win this year's presidential election because in his model, Harris holds 8 of the 13 keys (equivalent to an 8/13 probability of winning).

The Harris vs. Trump presidential debate on Tuesday, September 10, is expected to provide a clearer picture of the race. Harris has so far avoided extensive media exposure, relying on favorable media coverage rather than direct outreach to voters, an approach that gives the impression that the Democratic leadership is orchestrating her campaign and shaping the narrative, rather than Harris herself. Despite the coordinated efforts of certain establishment forces behind the campaign, we still favor a Trump win, just as we predicted in 2016.

CPI is about to be released, and Bitcoin rebounds

The US CPI report, released the day after the election debate, will be more important than usual. Currently, the market is expecting a significant drop from 2.9% to 2.6%, which could provide ample justification for a 50bps rate cut from the Fed. With the Fed rate currently at 5.25% to 5.50%, and monetary policy above 3.0% generally considered to be tight, the range of interest rate adjustments could be around 200bps higher. This view is also somewhat confirmed by the 2-year Treasury yield, which expects a 160bps rate cut. Unless the CPI data remains at 2.9% or higher, we expect a 50bps rate cut.

Previously, the market had generally expected six rate cuts in 2024; however, at the FOMC meeting in March this year, Fed Chairman Powell emphasized that a more flexible approach to rate cuts was needed because of the continued uncertainty in economic development, especially after mixed inflation data and signs of slowing economic growth. At the same time, he himself acknowledged the difficulty of reaching the Fed's 2% inflation target. Bitcoin reached a price high when the March CPI data was higher than expected, but fell sharply after the March FOMC meeting, highlighting the critical importance of the next ten days.

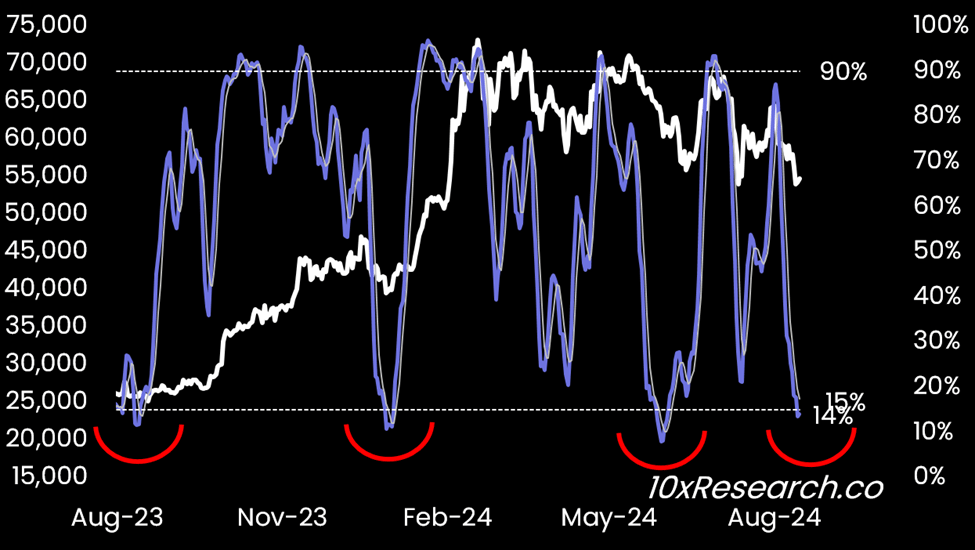

Bitcoin spot ETF inflows lost momentum after the March FOMC meeting. While inflows recovered in May and July, the average ETF entry price remains close to $60,000. $17 billion in inflows face a $2 billion loss (currently BTC price is around $53,000). This week, the U.S. presidential debate may help ease some election-related uncertainty, but on the other hand, the FOMC meeting may add uncertainty - as the Fed may emphasize concerns about downside risks to the economy after the recent downward revision of labor market data.

After last week's sharp drop, Bitcoin is attempting to rebound. Two of the three reversal indicators have recovered from deeply oversold levels, further indicating the potential for a short-term rebound and counter-trend rally. The last three times in history when the stochastic indicators reached similar levels, Bitcoin reached relative lows.

Stochastics show a possible reversal is imminent

Operation reference: From the perspective of carving a boat to find a sword, pay attention to the points of 52600 US dollars and 49100 US dollars

Given the current technical analysis, it might be more advantageous to open new short positions at higher levels.

A tactical approach for reference is to close short positions and wait for Bitcoin to approach the $58,000 level, especially before the "Harris VS Trump debate" when market traders may be generally optimistic about a "Trump victory."

After falling below the $56,000 support level, Bitcoin dropped to precisely $52,600, the February 2024 high price, establishing a medium-strength support zone. In February, Bitcoin rebounded at the end of the month, after which MicroStrategy purchased 3,000 BTC and again acquired 21,000 BTC by mid-March, marking the peak high of the price rebound.

Tactical long positions based on a short-term technical reversal before Tuesday’s presidential debate should use $52,600 as a stop loss. The next support level is $49,100, which is the price high when the Bitcoin spot ETF was launched in January and also triggered a reversal of Bitcoin’s decline in early August.

It is worth mentioning that while these may only be temporary rebounds, they may provide tactical long-term trading opportunities. Lower CPI data may also provide temporary impetus for bulls. However, with the FOMC meeting expected to cause more uncertainty next week and the US election results still uncertain after the surge in optimism about Trump's possible victory (as the election debate took place on Tuesday), Bitcoin may continue to search for stronger support levels to launch a more significant rebound before the end of the year.

In summary, the three major uncertainties - the US presidential election, CPI data report and the Federal Reserve FOMC meeting - may increase volatility, but tactical traders can still use this uncertainty to profit.