Rune market value hits new high, but why are my friends and I losing money?

Original | Odaily Planet Daily

Author | Golem

Today, the overall market value of Rune hit a new high, reaching 1.92 billion US dollars. With the recent recovery of the Rune market, the new Rune issuance on the chain has become more and more active. Many players have begun to pay attention to the primary market in the hope of winning the Rune Golden Dog. However, the actual situation may be different from what you imagine. Even though the primary new issuance market is prosperous, few people take over new assets in the secondary market, and most of the funds are concentrated in the top few Rune projects.

Below, Odaily Planet Daily will reveal the current overall situation of the Rune track, the performance of new assets and the resulting strategic recommendations from a data perspective.

Matthew effect: the strong get stronger

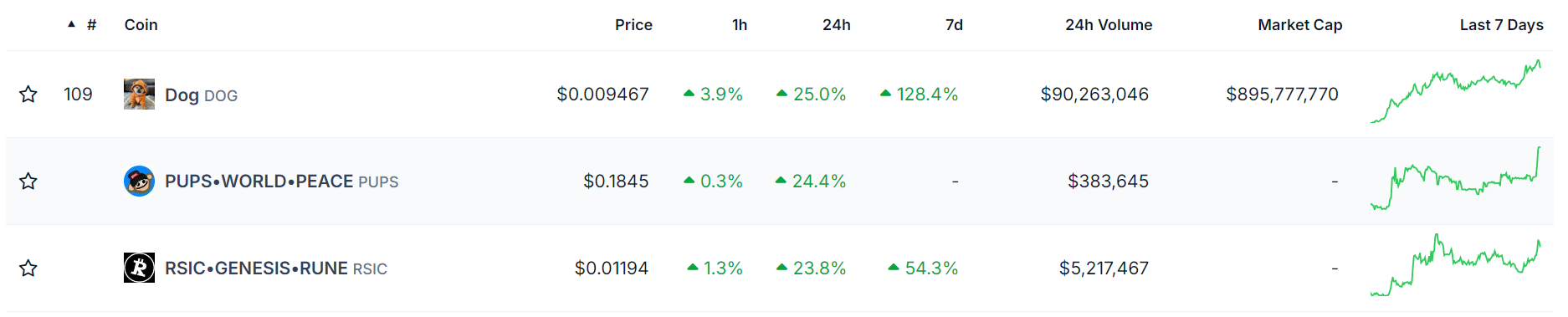

According to Geniidata data, from the perspective of market value, the top three Rune games, DOG•GO•TO•THE•MOON, RSIC•GENESIS•RUNE and PUPS•WORLD•PEACE, have market values of approximately US$920 million, US$230 million and US$160 million, respectively, accounting for 70% of the total market value of the Rune track.

From the perspective of 24-hour trading volume, as of now, the total 24-hour trading volume of Rune is approximately US$14.58 million, while the 24-hour total trading volume of Rune DOG•GO•TO•THE•MOON, which ranks first in market value, is approximately US$7.64 million, accounting for more than 50% of the total 24-hour trading volume of Rune.

In summary, although the market value of Rune has reached 1.92 billion US dollars and the number of deployed Runes has reached 72,764, there has not been a grand event of full blossoming of the track. Instead, the Matthew effect has intensified - the top Rune projects are getting stronger and stronger, occupying most of the funds and liquidity in the market, and no new Rune assets have performed better than the leaders to break the pattern.

What about Rune IPO? The performance is not satisfactory either

When a leading token of a protocol in the Bitcoin ecosystem leads the market, it will inevitably increase users' enthusiasm for buying new tokens on the chain. For example, ORDI led the market in June last year and started the BRC 20 craze. As the market recovered, new users and funds entered the market, and many of them doubled in value shortly after they were bought.

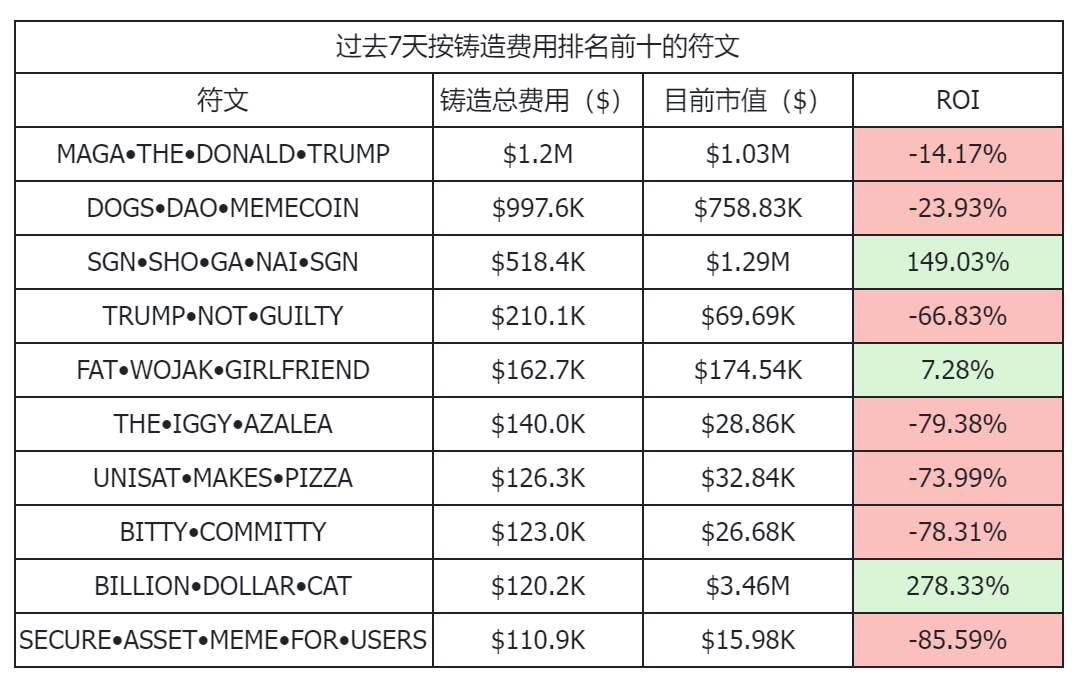

The Rune DOG•GO•TO•THE•MOON airdropped by Runestone is undoubtedly the leading token in the Runes protocol. The recent continuous rise in token prices has naturally stimulated the enthusiasm of users to buy new rune assets on the chain. However, this round of rune new issuance craze is different from BRC 20. Is the performance of new assets on the chain not satisfactory? The following table records the earnings of the top 10 runes ranked by casting fee in the past 7 days.

Reference map: @satosea_xyz

It can be seen that in the past 7 days, only 3 of the top 10 runes in terms of casting fees had relatively good new returns, while the other 7 performed poorly, and some even fell by more than 70%.

Furthermore, from the perspective of asset liquidity, as shown in the Geniidata data in the figure below, the transactions of rune casting on the Bitcoin chain in the past 30 days have far exceeded the transactions of buying, selling and transferring runes. This further shows that most of the new rune assets are actually facing liquidity difficulties after casting. There are no secondary assets to take over, and the phenomenon of PVP of funds on the market is very serious.

Strategy: Buying a new one is better than buying a big one

In the past week, although the market value of the head runes has exceeded 100 million, there have also been good increases. According to Coingecko data, DOG•GO•TO•THE•MOON has increased by 118.6% and RSIC•GENESIS•RUNE has increased by 55.9% in the past 7 days.

Although the odds of buying new projects on the RuneChain level may be high, it is difficult to select the 30% of the golden dogs from the numerous new projects without keen insight, strong analytical ability and the energy to keep a close eye on the dynamics of the chain. Moreover, as analyzed in the previous article, the Rune track is currently mostly for on-site capital PVP. Even if new players and funds enter the market, they may give priority to the top Rune projects, rather than new assets with small on-chain volume and short community development time.

To sum up, instead of spending all your energy on new assets, it is better to directly buy leading assets with large market capitalization and strong consensus.