SignalPlus Volatility Column (20240521): The probability of ETF approval unexpectedly increases

Early this morning, Bloomberg ETF analyst Eric Balchunas unexpectedly raised the chances of the ETH spot ETF being approved from 25% to 75% on Twitter. He said he had heard some rumors that the SEC’s attitude towards this issue might take a 180-degree turn because the incident is increasingly influenced by political factors, so everyone is desperately preparing for it. At the same time, Coindesk published an article saying that three people familiar with the matter said the SEC asked ETF exchanges to speed up the update of 19 b-4 applications, indicating that the SEC may approve the application before the critical deadline this week, but 19 b-4 is only a prelude to the approval of the Ethereum spot ETF. Issuers also need to apply for approval through S-1 before they can trade ETF products.

Source: Twitter

The news quickly spread to the market, and the price of ETH rose by 20%, catching up with the recent rise of BTC, breaking through several resistance levels and challenging the $3,700 mark. BTC also took advantage of the upward trend, breaking through the highest level since April and returning to above $71,000. This round of surge caused by unexpected news triggered a large-scale short position liquidation. According to coinglass data, the volume of ETH short position liquidation yesterday alone was as high as $80.7M.

Source: TradingView, ETH surges to catch up with BTC’s recent gains

Source: Coinglass, massive short position liquidation in the past 24 hours

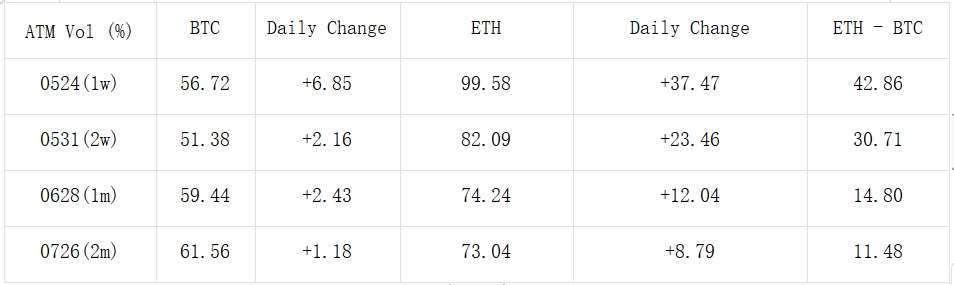

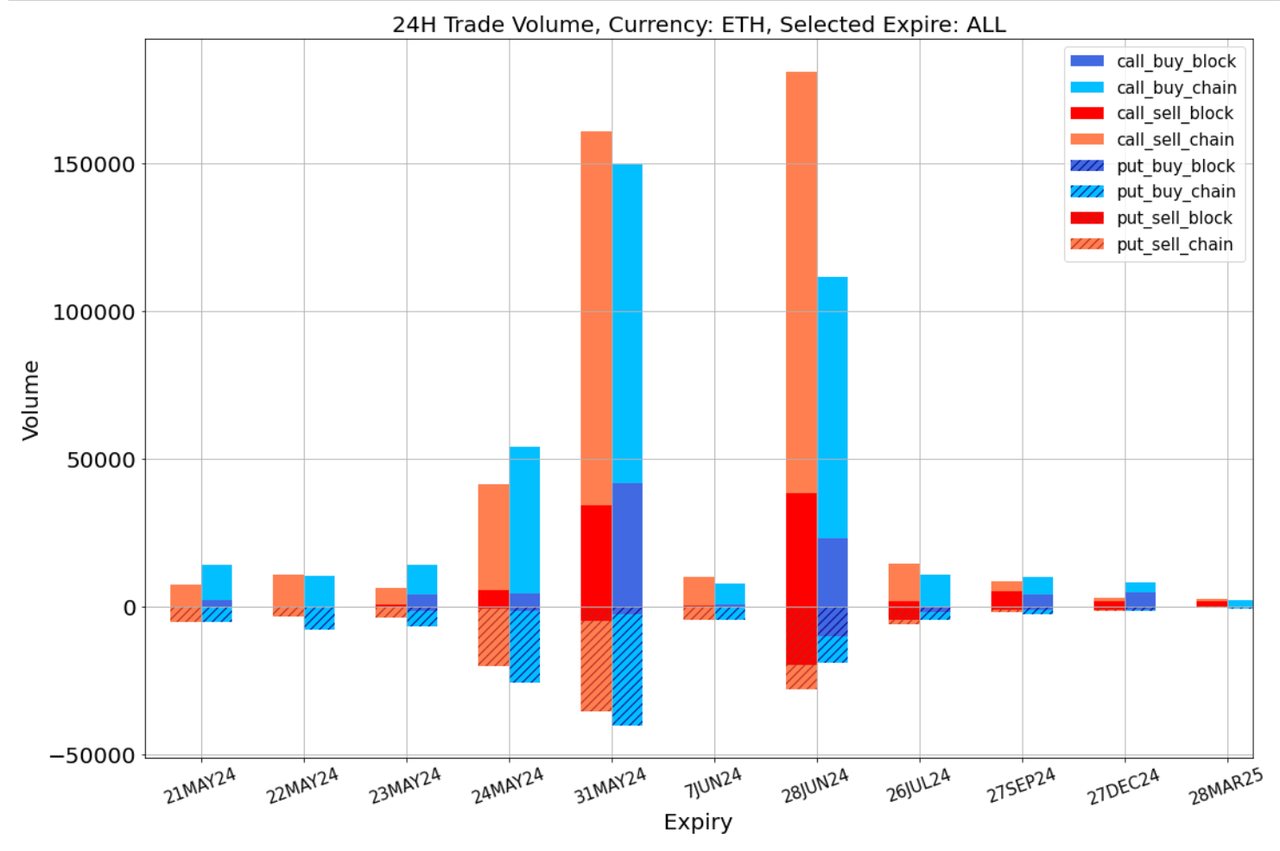

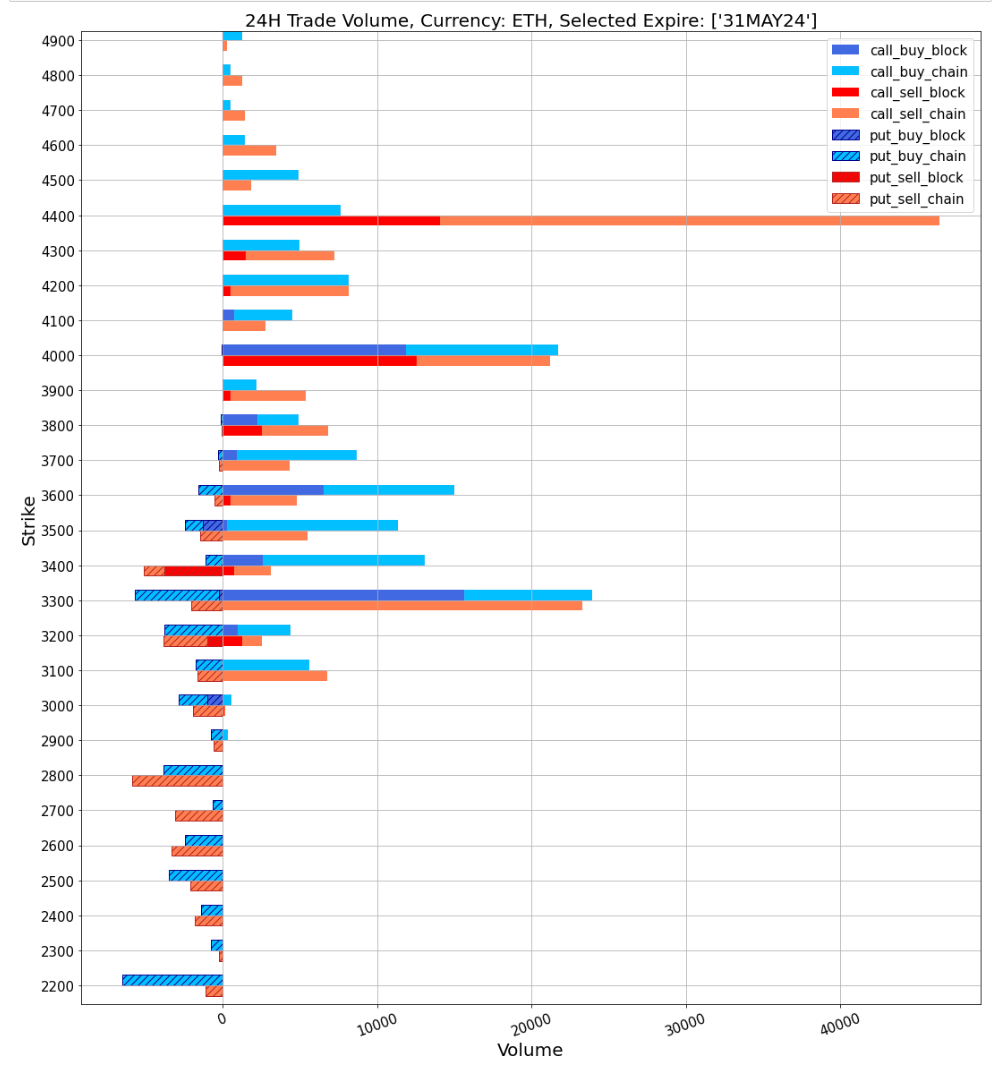

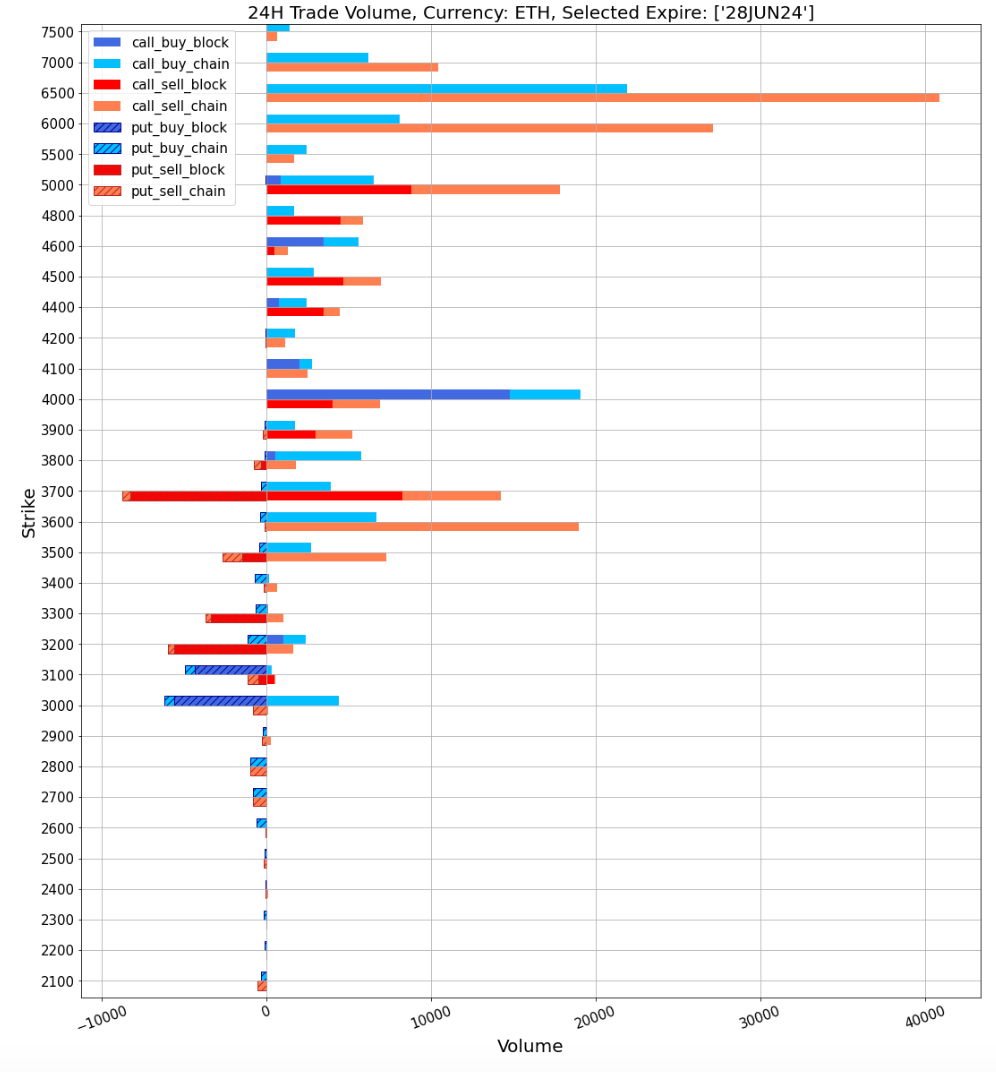

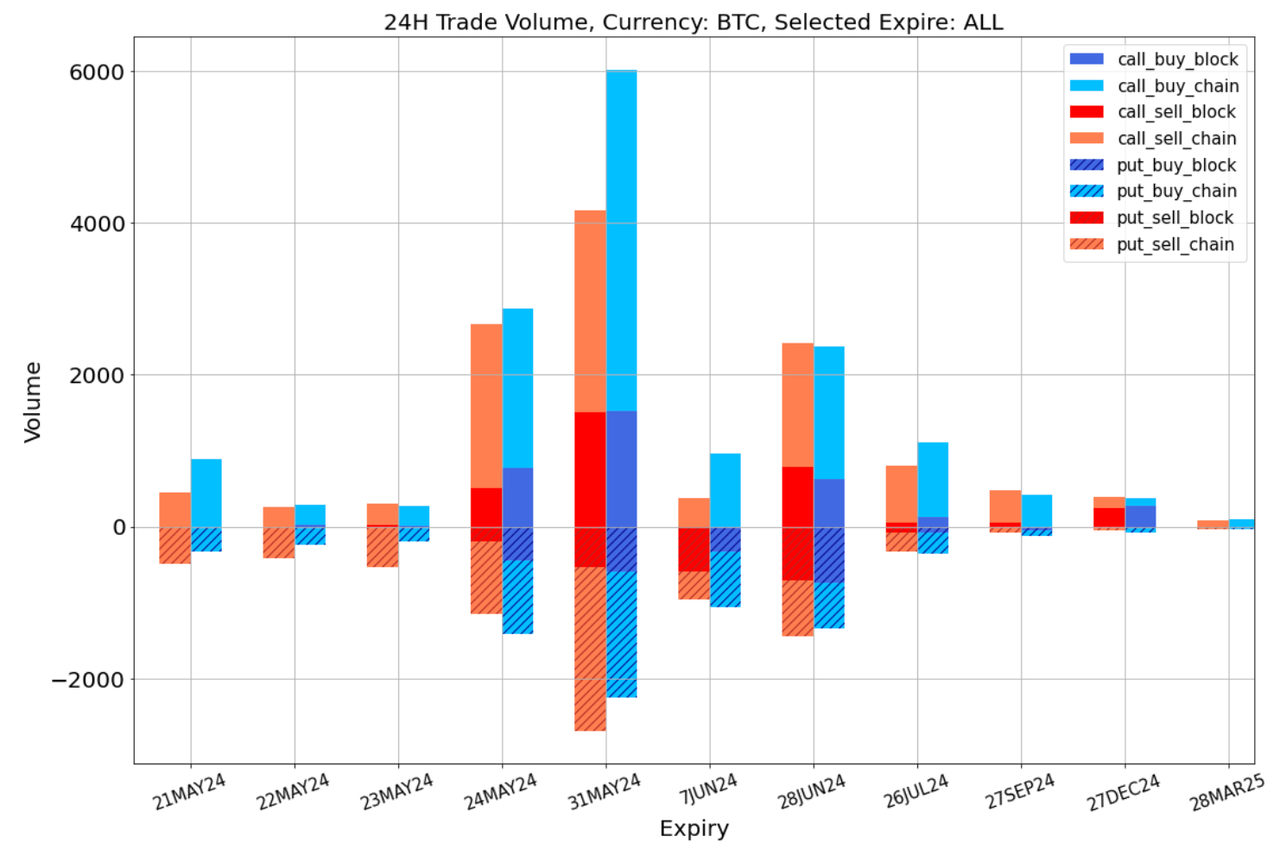

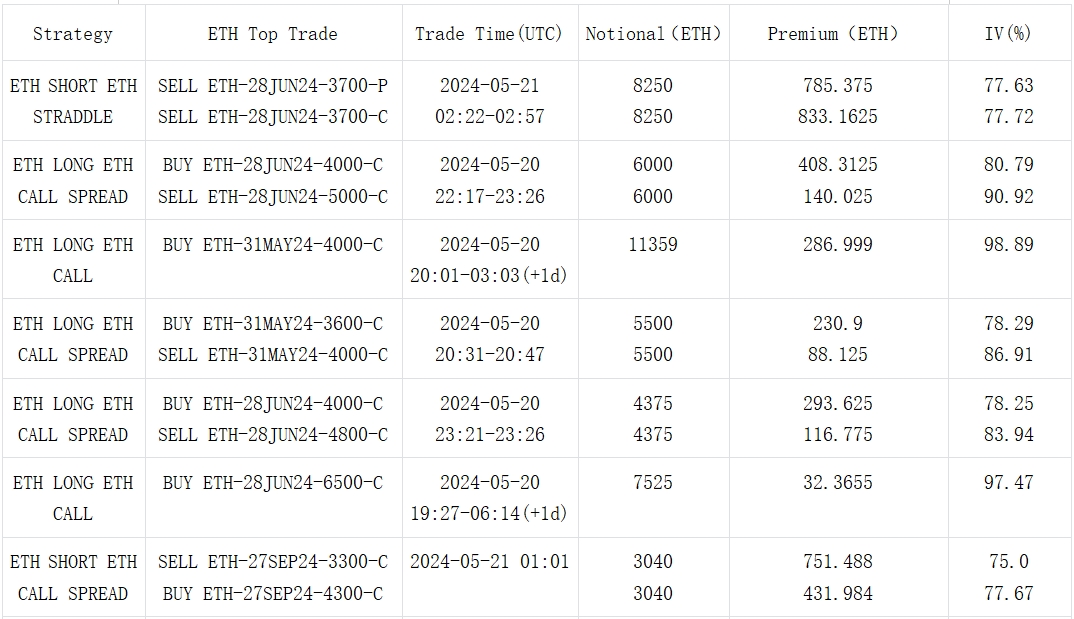

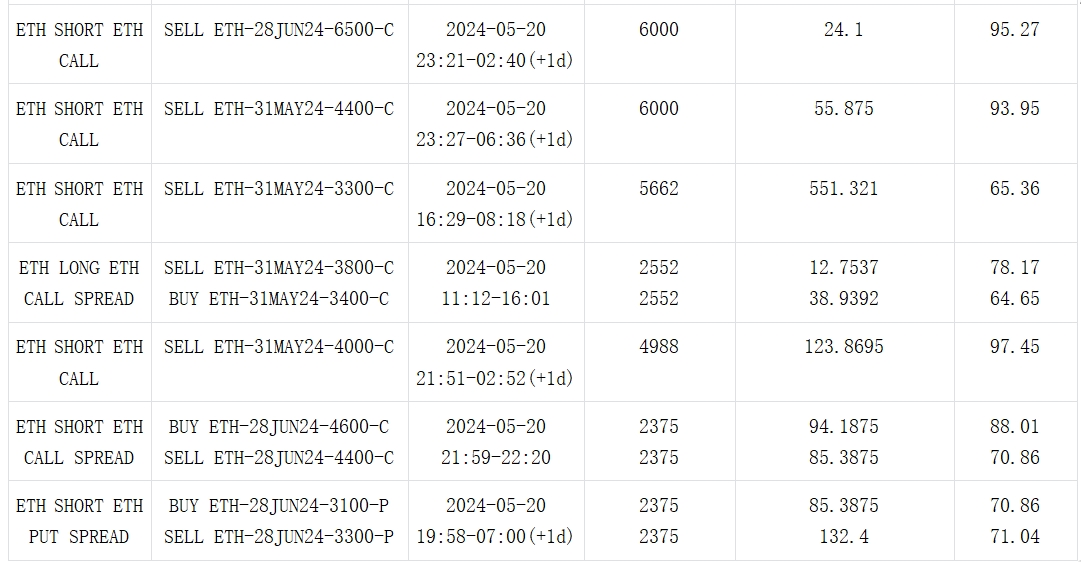

In terms of options, the jump in ETH's actual volatility has pushed option IV to flatten and rise sharply. Compared with BTC's 2-6% Vol increase at the front end, ETH has almost 6 times the increase in BTC's 30% -40% Vol at the short end. The market is more eager to pay attention to the resolution of ETH Spot ETF this week, pushing ETH's ATM IV on the 24th to a historical high of nearly 100%. From the perspective of trading, the number of ETH call options is relatively balanced and concentrated in late May and June, including May OTM Call and June purchases represented by 4000-C. At the same time, we can also see a larger proportion of selling transactions at more distant strike prices, or the overbought sentiment of the market is consumed in advance under the market conditions of higher IV.

Source: Deribit (as of 21 MAY 16: 00 UTC+ 8)

Source: SignalPlus

Data Source: Deribit, overall distribution of ETH transactions

Data Source: Deribit, ETH 31 MAY 24/28 JUN 24 transaction distribution

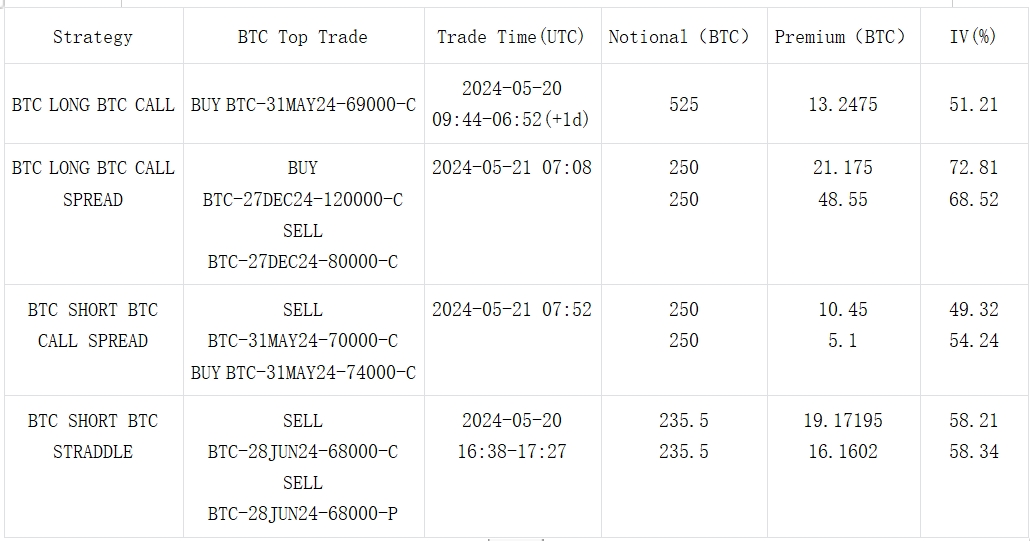

Data Source: Deribit, overall distribution of BTC transactions

Source: Deribit Block Trade

Source: Deribit Block Trade

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends. SignalPlus Official Website: https://www.signalplus.com