A comprehensive analysis of friend.tech V2: core functions, platform economy and token potential

Original author: Karen, Foresight News

Friend.tech, the Web3 social transaction protocol that once became popular overnight, launched its V2 version during the May Day holiday. Although its token experienced a process of opening high, closing low and then rebounding, friend.tech has once again become a hot topic thanks to its new paid group Club feature, unique fee design mechanism and LP APY of nearly 600% (even reaching 1400% yesterday).

The friend.tech V2 page continues the simple design style. Taking the official website as an example, there are Club and creator search boxes at the top, and the left navigation bar is divided into wallet, activity and Chat modules from top to bottom. Among them, the wallet displays the ETH, FRIEND, Keys and mining rewards held; the activity page lists the Key trading activities of the creators you follow; the Chat page aggregates the Clubs and creators holding keys to facilitate user social interaction.

friend.tech V2 Core Function: Paid Group Club

The paid group Club is the biggest highlight of friend.tech V2. On the basis of V1 monetization of KOL and creators, the Clubs space is added, which is equivalent to the existence of paid groups. However, those who join the group later need to pay a higher price, and transactions only support friend.tech platform token FRIEND, and each transaction will be charged a 1.5% fee (this part will be discussed later). Key holders can also vote for the chairman of their Club at any time. The chairman of Clubs is responsible for managing the club and selecting moderators.

The price of Club Key follows a specific formula, the price of the next Key is S^2/100 (in FRIEND), S is the number of current Keys. The following table is the price chart of the Sth Key counted by the author for readers' reference.

Anyone can create a Club with any theme. When creating a Club, you can choose the standard curve (according to the above formula) or a special curve that is 10 times the price of the standard curve. If you choose the standard curve, when the number of people in a Club reaches 50, the Key price is 25 FRIEND; if you choose the special curve, at this time, the Key price is 250 FRIEND. It should be noted that different Clubs can have the same name, so you need to pay special attention when trading.

According to Dune data, as of the time of writing on May 6, the number of Clubs on the friend.tech platform has exceeded 110,000, with more than 61,592 Club members, more than 450,000 transactions, and a total Club transaction volume of nearly 17 million FRIENDs. The total fees generated by friend.tech within 24 hours have reached US$820,000.

Source: Dune

According to the Club market value, the top two groups of friend.tech Club are "Ansem's Army" created by trader Ansem: number #59528, Key price is 2766 FRIEND, and there are 371 members in the group, and "Fight Club" created by friend.tech founder Racer: number #1, Key price is 2371 FRIEND, and there are 125 members in the group.

In addition to Club, friend.tech said it will also launch new features such as Keydrops, Memeclubs and Pinned Rooms to bring users a more diversified social experience. Memeclubs alone are enough to make the community excited and imaginative.

Platform Economics and Token Distribution

When friend.tech released the V2 airdrop, each point could be exchanged for 1 FRIEND, but at the beginning, only 10% of FRIEND could be claimed, and then the remaining 90% could be claimed after joining a Club and following 10 people. This helped to greatly stimulate the activity of the platform in the short term, but it was also complained by community users.

friend.tech has not enabled token transferability. Currently, it only provides token exchange and FRIEND/ETH liquidity services on its own platform (DEX "Bunnyswap" https://www.friend.tech/lp). Since the returns provided by liquidity on friend.tech's own platform are very high (currently close to 600%), the current liquidity of FRIEND/ETH is close to 47 million US dollars.

On friend.tech, users will be charged a 1.5% exchange fee when exchanging in the FRIEND/ETH pool, and will also be required to pay 1.5% when trading Club Key. These fees will be shared by LP providers (in the form of FRIEND). In addition, in the next 12 months, friend.tech will also distribute a total of 12 million FRIEND incentives to LP providers.

That is, providing FRIEND/ETH liquidity on friend.tech can obtain three kinds of benefits, including 1.5% exchange fee (current APY is 1071%), 1.5% Club Key transaction fee (current APY is 202%) and sharing of 12 million FRIEND incentives (current APY is 135%).

Regarding the distribution of tokens, friend.tech has stated that its investors have agreed to give up the right to sell tokens to users. The tokens will be controlled by users, and points from venture capitalists including Paradigm will be distributed to users.

However, friend.tech has not released detailed token supply details, which has also aroused doubts from the community. According to the BaseScan page, the current maximum total supply is 91,082,420, and the contract details show that there is no upper limit for tokens. The official LP page of friend.tech shows that the circulating supply is 79.1 million FRIEND (combined with Dune data, the circulating supply is the claimed token airdrop and token incentive release), and the circulating market value is US$204 million (calculated based on the FRIEND price of US$2.65 as of the time of writing).

However, in August last year, when friend.tech was just launched on the platform, it stated that it planned to distribute 100 million points in 6 months (every Friday). Based on the current exchange rate of one point for one FRIEND, the airdrop amount is 100 million. In addition, with the 12 million FRIEND incentives allocated to LP providers in the next 12 months, the total supply will be at least 112 million.

Who are FRIEND holders and LP providers?

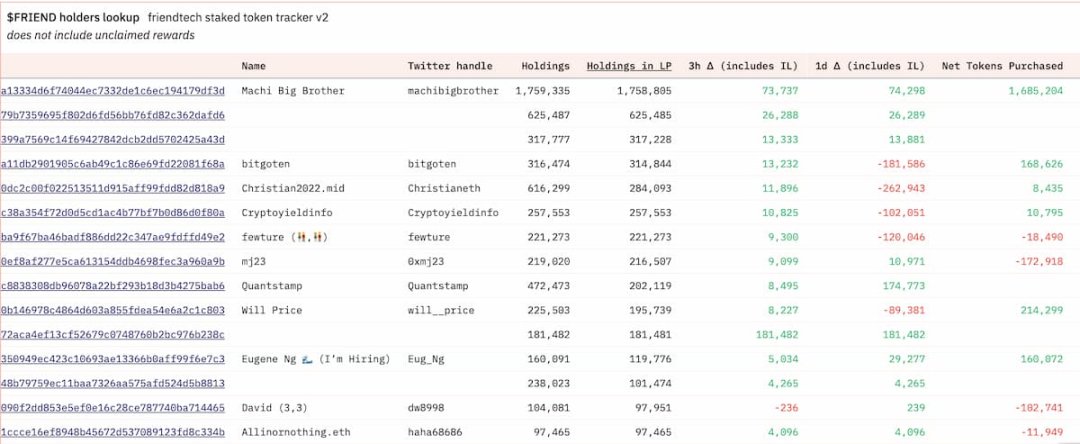

According to Dune data produced by @willprice, the address that provides the most liquidity on friend.tech is owned by Taiwanese singer Huang Licheng, who provides 1.7588 million FRIEND liquidity (on May 7, he spent 661 ETH to purchase nearly 800,000 FRIEND at a price of 2.57 per unit); followed by the address starting with 0x e 3879 b, which provides 625,500 FRIEND in LP, and 263 ETH and 42,552 PRIME liquidity in Aerodrome ETH/PRIME. The fourth, fifth and sixth users are @bitgoten, Christian 2022.eth (Partner of NextGen Digital Venture) and Cryptoyieldinfo, etc. NFT KOL dingaling also holds more than 410,000 FRIEND, but has not yet been pledged.

What is the room for growth for FRIEND?

The author believes that in the context of the recent widespread controversy over token airdrops, friend.tech distributed 100% to the community, and the token launch was relatively successful, which also gave FRIEND the practicality of payment in the Club. It can be imagined that as the number of Clubs increases and develops, the FRIEND tokens paid by users will also increase. These tokens are essentially locked in the system, forming a stable value support. In addition, friend.tech provides LPs with generous rewards, which will also attract more FRIEND token liquidity locks.

As mentioned before, friend.tech has not yet enabled token transferability, which means that CEX cannot list FRIEND tokens. The only way to obtain FRIEND is to claim airdrops or buy FRIEND with ETH on the friend.tech platform. At the same time, users can also combine FRIEND and ETH into LP to provide liquidity and earn rewards.

What will happen if friend.tech enables token transferability? I believe this will greatly improve the liquidity of FRIEND and further drive FRIEND into the price discovery stage. However, this may also lead to the cancellation of the 1.5% exchange fee mechanism originally set by the platform, thereby reducing LP rewards. However, in the long run, the widespread circulation of tokens will help improve their market awareness and value stability.

DeFi researcher Ignas put forward a unique point of view. He hopes that FRIEND will not enable transferability. Instead, a packaged FRIEND, namely wFRIEND, can be created. Exchanges can list wFRIEND, but at the same time, the functions of the original token will not be affected. However, I personally think that there will not be much difference in essence, because once wFRIEND is listed on the exchange, on-chain traders can still purchase wFRIEND from the exchange first, and then unpack it to provide liquidity. Therefore, the key lies in how friend.tech balances the liquidity and transferability of tokens with the stability of platform functions to achieve long-term value growth of FRIEND tokens.

Of course, in the process of observing the transaction data of FRIEND, the author found an interesting sign. In the first two or three days after the token was launched, although the amount of buy orders was significantly more than the amount of sell orders, the number of buy orders was much lower than the number of sell orders. Such single buy orders of thousands or even tens of thousands of dollars were common. Calculated based on the data of the past 24 hours at a certain moment on May 5, although the total transaction amount of buy orders was 15% higher than that of sell orders, the number of buy orders was 70% less than that of sell orders. However, since yesterday, there have been many buy orders with very small amounts, even less than $0.01, in the market, which equalized the number of buy orders and sell orders. These transactions are most likely to be executed by robots. The motivation behind them is still unclear, and it is difficult for us to determine whether this is an operation for a specific purpose. This phenomenon undoubtedly adds a touch of mystery and uncertainty to FRIEND. However, as of 17:15 on May 7, the number of FRIEND buyers continued to decrease, only 1/10 of the number of sellers, while the transaction amount was not much different.