TokenInsight: 2024 Q1 Crypto Exchange Liquidity Report

Liquidity is an important factor in evaluating the situation of exchanges. TokenInsight has collected data on the spot and derivatives order books of 9 influential centralized exchanges in the industry within a specific time section, and selected BTC, ETH and SOL, three popular cryptocurrencies, as samples for liquidity analysis. The data comparison involves five dimensions: transaction depth, bid-ask spread, order volume, slippage, and transaction fee rate. This report comprehensively displays the current liquidity situation of different exchanges and is supported by a large amount of data, hoping to objectively provide traders with effective reference.

In the cryptocurrency space, liquidity is defined as the ability to quickly buy or sell an asset in the market without affecting the price stability of a particular asset. In other words, it measures the ability to quickly convert a particular asset into other assets or cash.

The liquidity and price of crypto assets are greatly affected by the liquidity of the trading market. The investigation and analysis of the liquidity of different exchanges is an indispensable part of the secondary market analysis of cryptocurrencies. TokenInsight selected BTC , ETH and SOL , three popular cryptocurrencies, as samples for liquidity analysis.

Ranking

Contract data analysis

Contract transaction depth

In terms of contract trading depth, TokenInsight counted 0.1% and 0.3% depth data of BTCUSDT, ETHUSDT and SOLUSDT contract trading pairs on various exchanges, and the conclusions are as follows:

Binance and OKX ranked first and second in BTCUSDT contract trading depth. Among them, OKX's data at 0.1% depth is better than Binance.

Binance and OKX perform similarly to BTCUSDT in terms of ETHUSDT contract trading depth. OKX performs significantly better than Binance in terms of shallow depth (0.1%), while Binance has a slight advantage in terms of mid- to long-range depth.

Binance ranks first in both contract depths of SOLUSDT.

Slippage of contract trading pairs

In order to test the transaction slippage that retail large-order users and whales may face, TokenInsight simulated the purchase of BTC, ETH and SOL with 1 million, 5 million and 10 million US dollars in the analysis of the slippage of contract currency pairs, and calculated the slippage under different purchase amounts. The conclusion is as follows:

Binance has the smallest slippage for both $1 million and $5 million BTC buy orders. OKX is second, and the gap between its slippage and Binance decreases as the buy order amount increases. At $10 million, OKX's slippage performance surpasses Binance, ranking first among all exchanges.

In terms of ETH slippage, OKX has the lowest simulated buy order slippage in all three segments among all exchanges. Binance ranks second, but as the simulated buy order amount increases, the slippage gap between it and OKX is gradually increasing.

In terms of SOL slippage, Binance is in an absolute leading position in all three segments of SOL slippage, and its advantage is gradually increasing with the increase of the simulated buy order amount.

Contract transaction fee

Gate ’s contract VIP 0 Maker fee is the lowest among all exchanges, 0.015%. The VIP 0 Taker fee varies slightly from exchange to exchange, ranging from 0.05% to 0.06%.

OKX, HTX and KuCoin all have negative VIP Maker fees. HTX has the lowest fee rate among the three exchanges. But OKX performs better in terms of the highest VIP Taker fee rate.

Spot data analysis

Spot Trading Depth

Regarding the spot trading depth, TokenInsight has counted the average depth of BTC/USDT, ETH/USDT and SOL/USDT in the price ranges of 0.1%, 0.3% and 0.5% for each exchange, and the conclusions are as follows:

Binance has the best performance in terms of depth in every price range of BTC/USDT, far exceeding other exchanges. Bybit and OKX follow closely behind. Their depth performance in the mid- and long-term is better than that in the near-term, and they can provide a relatively stable trading environment and meet large and super-large transaction orders.

Binance ranks first in depth performance at all price ranges for both the buy and sell sides of ETH/USDT. Bybit ranks second in 0.1% and 0.3% depth, but its buy order performance at 0.5% depth is slightly worse than HTX.

Binance still ranks first in depth in the three price ranges of SOL/USDT, and OKX ranks first in each range.

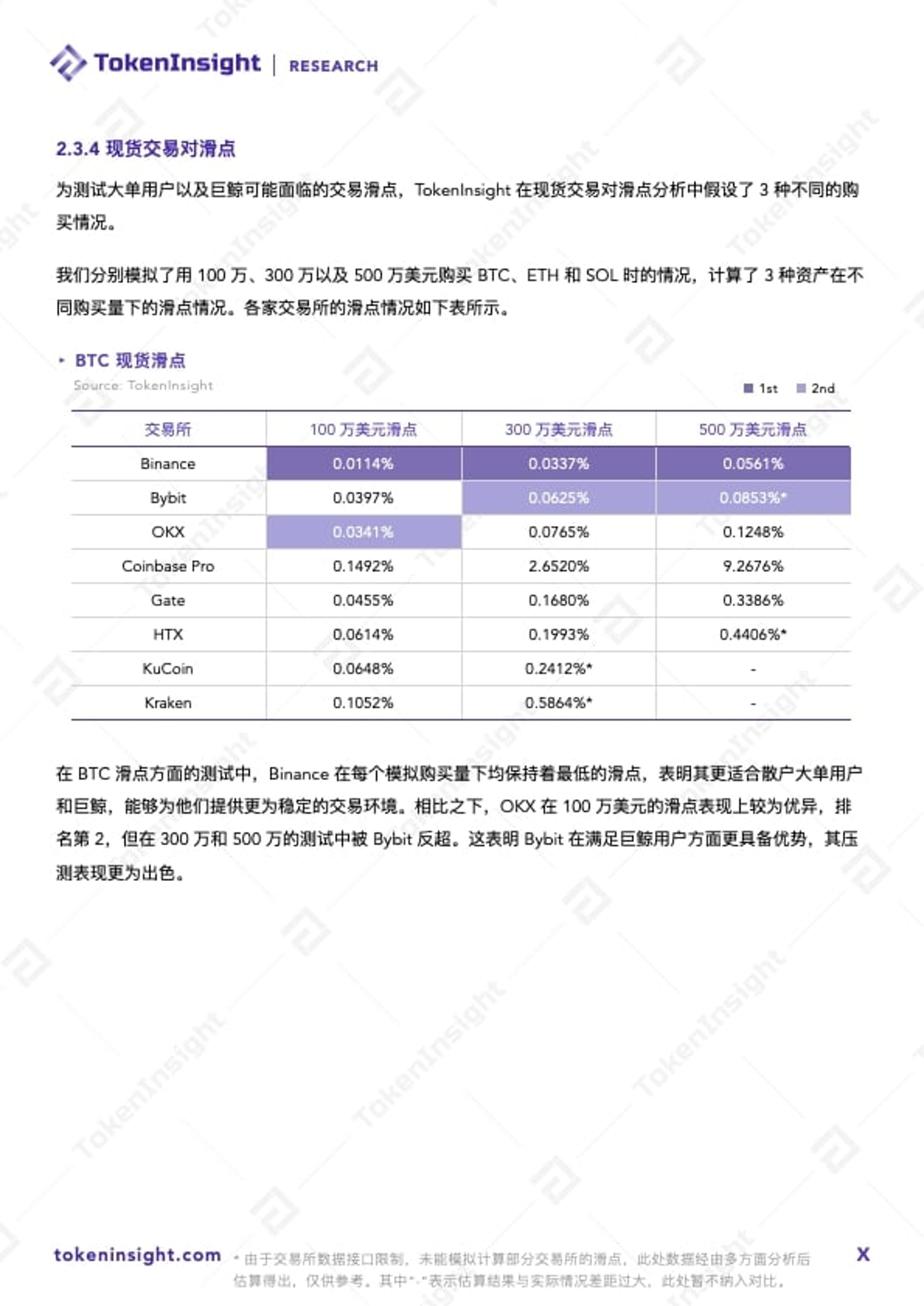

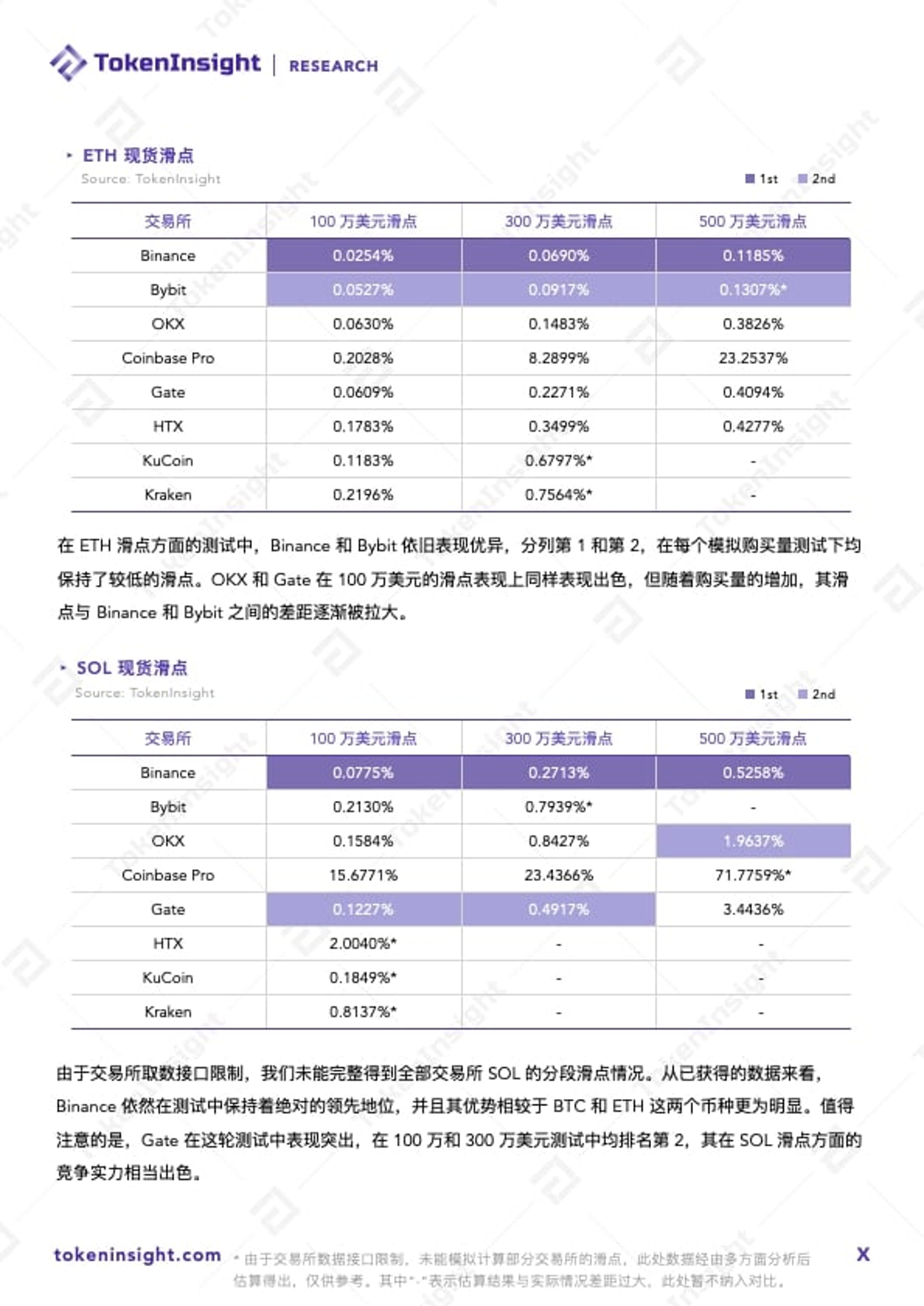

Slippage for spot trading pairs

In its analysis of the slippage of spot currency pairs, TokenInsight simulated the purchase of BTC, ETH, and SOL with $1 million, $3 million, and $5 million, and calculated the slippage under different purchase amounts. The conclusions are as follows:

Binance has the smallest BTC buy order slippage under the three simulated purchase volumes. OKX ranks second in slippage performance of $1 million, but is surpassed by Bybit in the tests of $3 million and $5 million.

Binance and Bybit ranked first and second in ETH buy order slippage. OKX and Gate performed relatively well in the slippage performance of $1 million, but as the purchase volume increased, the gap between their slippage and Binance and Bybit gradually widened.

Binance's advantage in SOL slippage is more obvious than BTC and ETH. Gate ranks 2nd in the 1 million and 3 million USD tests.

Spot Transaction Fee Rate

OKX's spot VIP 0 Maker and Taker fees are the lowest among all exchanges, performing best in terms of retail trading costs, making it easier to attract new users to trade.

OKX and KuCoin have the lowest highest-level VIP Maker rates, both of which are negative. However, the entry threshold for OKX's highest-level VIP users is relatively high. In terms of the highest-level VIP Taker rates, OKX's performance is far better than KuCoin's.

The following is a partial display of the relevant contents of the report:

Trading Depth

Trading Depth

Spot Slippage

Spot Slippage