SignalPlus波动率专栏(20240411):ETH四月底看涨期权被大量抛售,IV持续下滑

Yesterday (10 APR) US CPI data that was higher than expected across the board gave the market a heavy blow. Specifically, CPI in March increased by 3.5% year-on-year, higher than market expectations and the previous value, while core CPI excluding food and energy costs increased by 3.8% year-on-year, 0.1% higher than expected, and the same as the previous value. According to the report, soaring gasoline and housing spending contributed to nearly 50% of the CPIs rise in March. Car insurance, medical spending and clothing costs also increased. In the core index, the growth rate of commodity costs declined and the service industry reheated.

Source: SignalPlus, Economic Calendar

After the data was released, U.S. bond yields jumped sharply, with the ten-year yield breaking through the 4.5% mark, and the two-year yield approaching the 5% mark, currently at 4.967%. The 5/30-year yield has dropped sharply since September last year. Hanging upside down for the first time. As a result, the swap market has postponed the expected time of interest rate cuts. As of now, the probability of no interest rate cut in June has risen from the original 50/50 to 83.5%, and the number of interest rate cuts throughout the year is expected to be less than two. The delay in cutting interest rates put pressure on U.S. stocks to fall, especially for companies with higher borrowing costs. The three major stock indexes closed down around -1%. From another perspective, although expectations of interest rate cuts have dropped again and again, U.S. economic data is still very strong. At this point, instead of betting on the direction, reducing risk exposure may be a better choice?

Source: Investing; Sharp jump in interest rate policy-sensitive U.S. two-year Treasury yields challenges 5.0% mark

Source: SignalPlus & TradingView

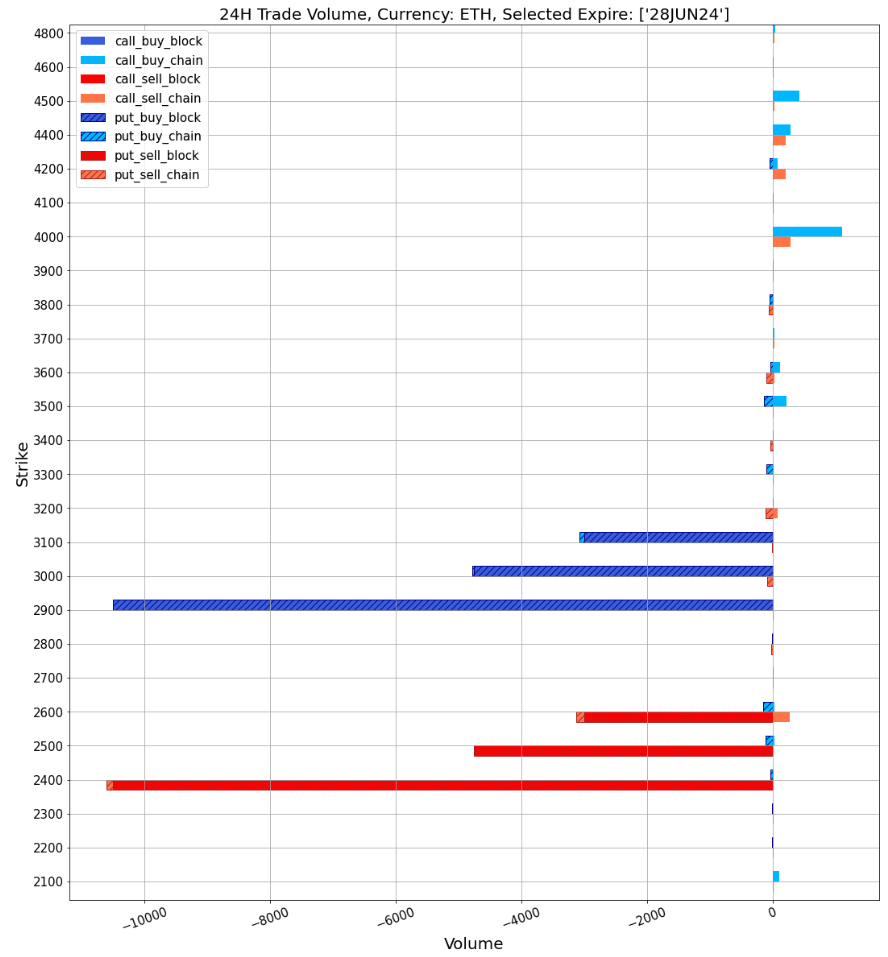

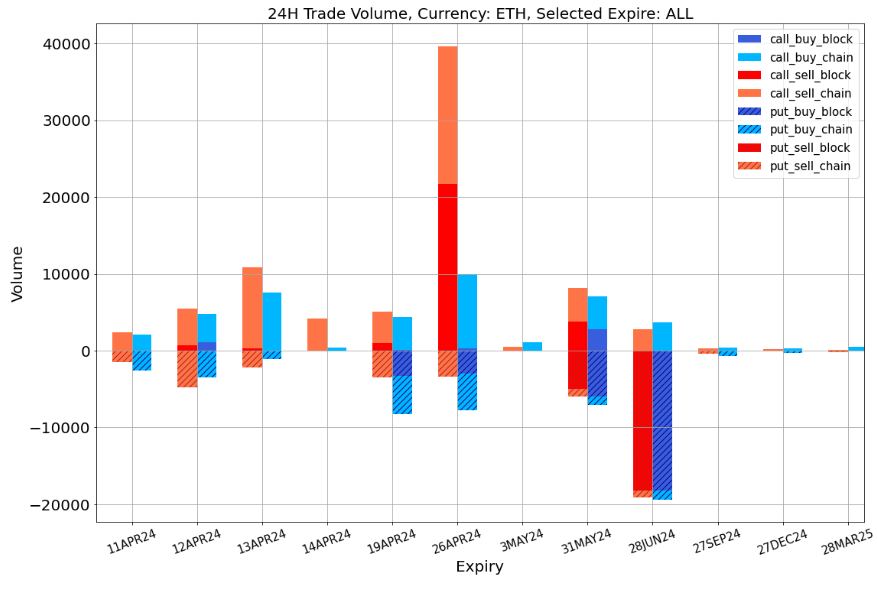

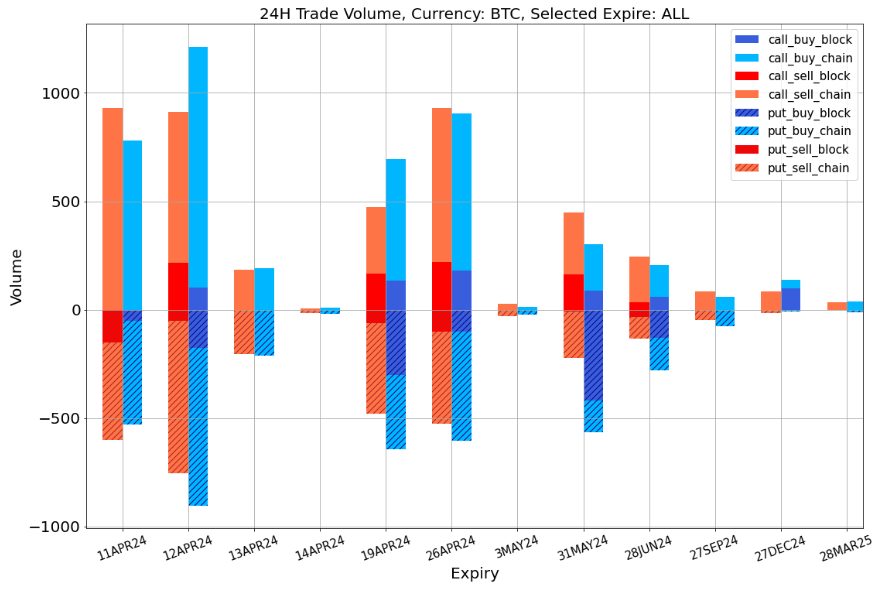

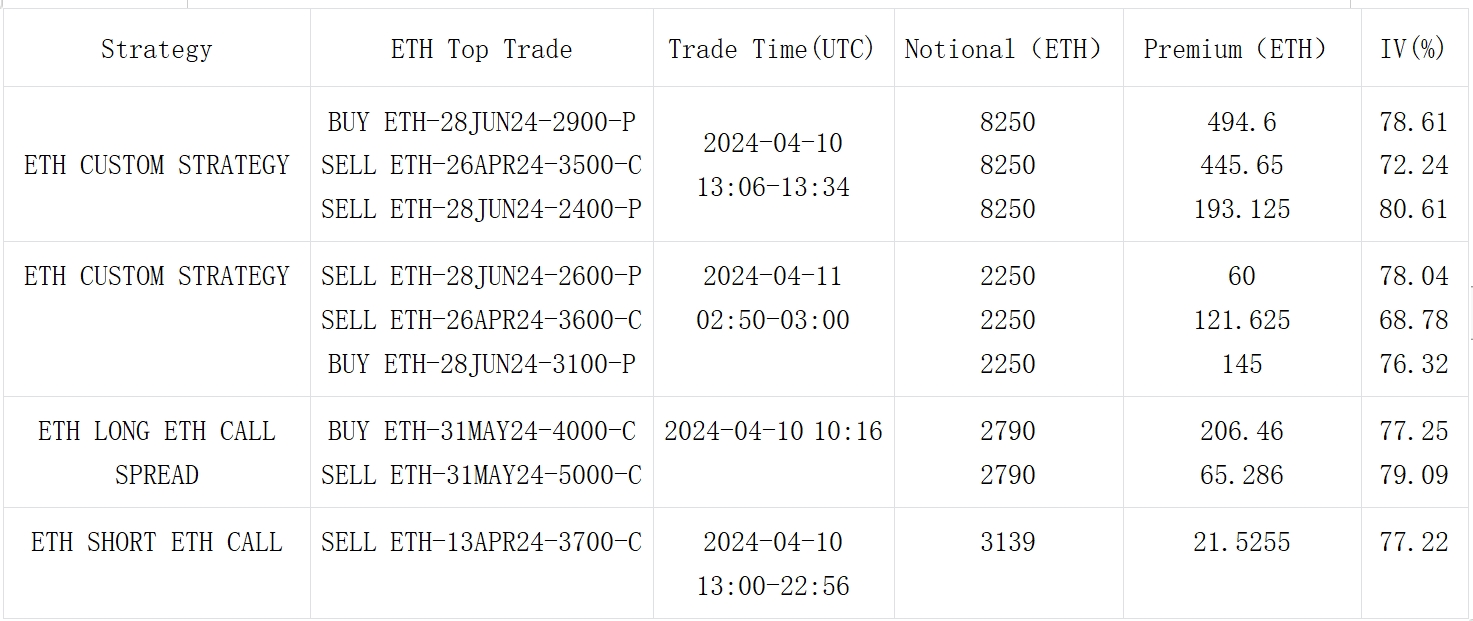

In terms of digital currency, BTC rebounded to above 7W, and the long-term shock trend is still within the contraction range. From the perspective of options, the IV/RV fluctuation exposure reflected in the statistical data is still significant, and the front-end implied volatility is significantly bullish. The sell-off in options continued, with ETH’s call at the end of April following closely the pace of yesterday’s BTC, showing overwhelming call option sales; in addition, ETH’s large buy put spread protection at the end of June was also the focus of market attention, while BTC’s bearish Options also gained favor from the market yesterday.

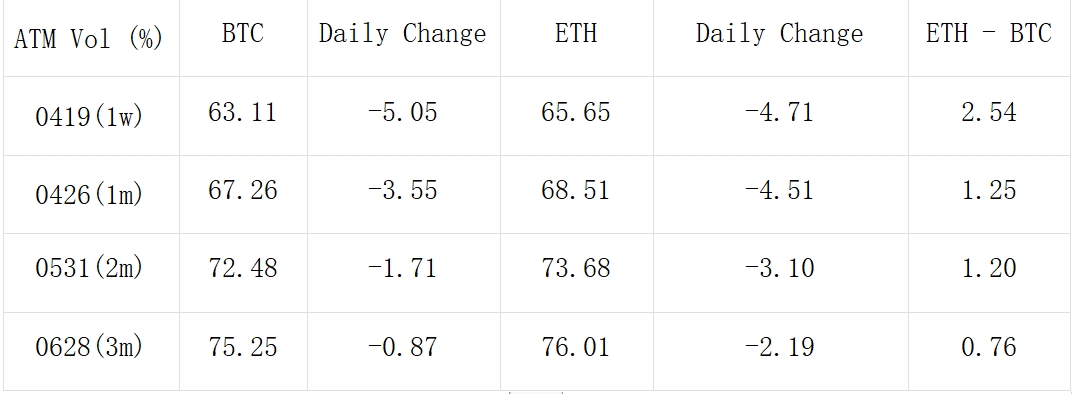

Source: Deribit (as of 11 APR 16:00 UTC+8)

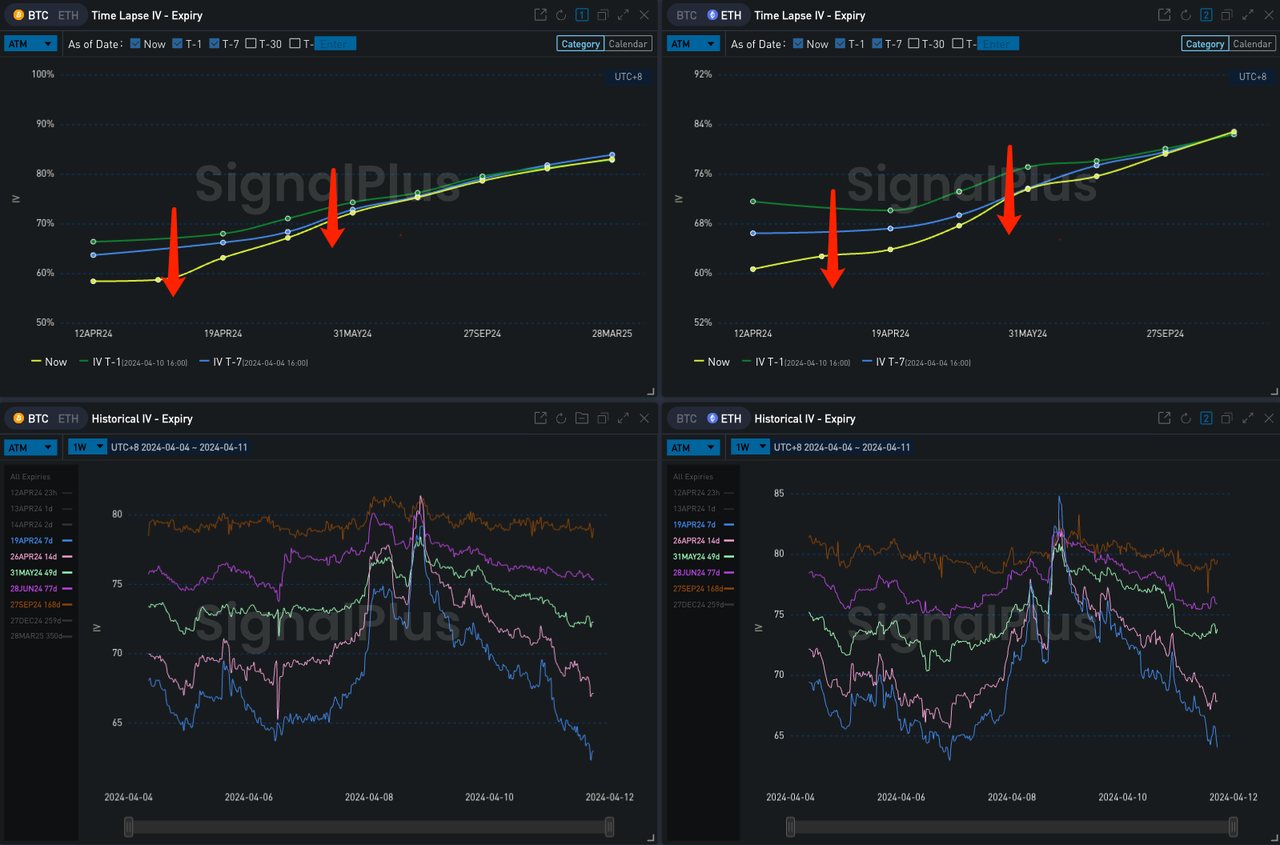

Source: SignalPlus,ATM Vol continues to decline

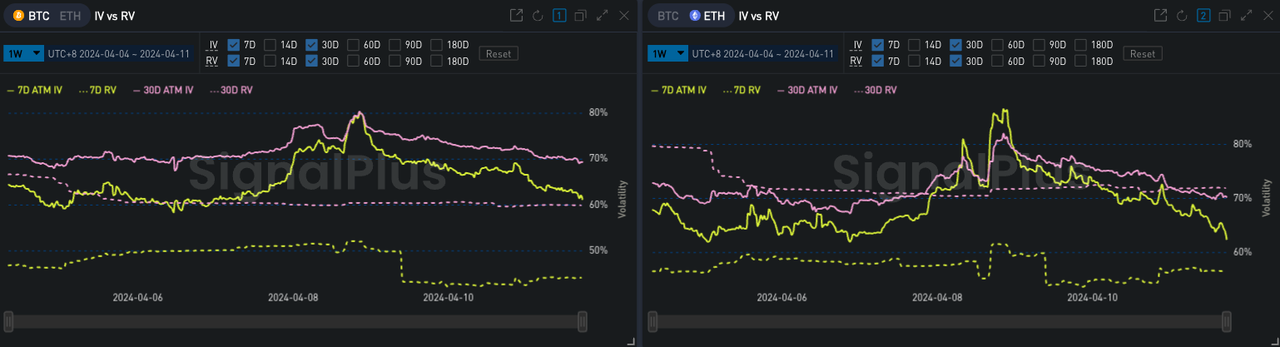

Source: SignalPlus,Volatility exposure remains significant, ETH retreats amid heavy selling pressure

Data Source: Deribit, ETH call options were sold at the end of April, and Long Put Spread positions were opened at the end of June.

Data Source: Deribit, BTC transaction distribution

Source: Deribit Block Trade

Source: Deribit Block Trade

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: xdengalin), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website:https://www.signalplus.com