EigenDA is officially launched on the mainnet. What new tasks are there?

Original - Odaily

Author - Azuma

In the early morning of April 10th,The most anticipated project in the current market (perhaps without adding one), the Ethereum re-staking protocol EigenLayer announced its official launch on the main network and launched the first Active Verification Service (AVS) EigenDA for data availability verification. .

At this time, some friends may be wondering, won’t EigenLayer be launched on the mainnet in June 2023? TVL now has more than 13 billion US dollars, why is it said to be launched on the mainnet this time?

The first thing that needs to be clarified is thatEigenLayer mentioned during the testnet stage that the launch of the protocol will be divided into three phases to gradually introduce different ecological participants and gradually activate new functions.

In June 2023, EigenLayer actually only launched the first phase of Stakers, which allows stakers to re-stake through EigenLayer; and what is online today is the second phase of Operators, which allows verification nodes to register and accept re-staking users. Commissioned, and the first AVS service EigenDA will also be launched at this stage; in the future, EigenLayer will launch more AVS services in addition to EigenDA (currently more than 10 AVS are being tested on Holesky).

Odaily Note: The three-step plan is the development roadmap proposed by EigenLayer when it first launched the test network last year. However, in some subsequent announcements, EigenLayer seems to have rarely mentioned the plan in concrete terms, but from EigenLayers Judging from actual progress, development is still following this path.

What is AVS? What is EigenDA?

A lot has been said in the previous article, but for friends who are not familiar with the basic concepts of EigenLayer, they may still be a little confused when they hear AVS and EigenDA.

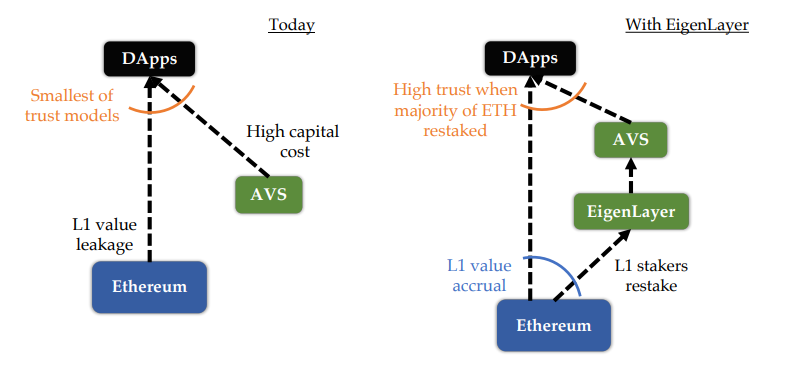

To understand these two concepts, we need to start with EigenLayers business model. In short, the business EigenLayer is doing can be divided into three parts:

First, re-pledge users can re-pledge their ETH and its derived LST on EigenLayer, and entrust the tokens to EigenLayer verification nodes;

Second, EigenLayer verification nodes can choose to join various AVSs and perform various verification services with the help of re-staking users’ entrustment;

Third, customers (such as oracles, cross-chain bridges, rollup...) can rent various verification services of AVS by paying (not activated yet).

You can further dismantle this cycle through the following steps.

First, as countless users re-stake their ETH, EigenLayer can gradually accumulate huge value;

Then, verification nodes can use these huge values to build a more secure verification system (Odaily Note: In PoS perspective mode, the larger the value scale, the stronger the consensus),These so-called verification systems are AVS, which can be used to help various types of downstream projects such as oracles, cross-chain bridges, and Rollup perform more secure verification services.;

From a client perspective, various downstream applications will no longer need to waste time and effort in building a weak verification network (Odaily Note: For example, some current cross-chain bridges have locked huge amounts of TVL, but the verification system depends on the project. Instead of operating on small market capitalization tokens), EigenLayers AVS can be used conveniently and efficiently to directly enjoy a more secure verification system;

In turn, re-staking users and verification nodes will continue to make profits from customers’ paid rentals.

The above is an overview of EigenLayer’s business logic.In short, AVS is the various verification services that EigenLayer can provide, and EigenDA, which is officially launched on the main network this time, is EigenLayers first AVS.

EigenDA focuses on providing data availability solutions for Rollup. You can simply and crudely understand it as Celestia nested within the EigenLayer protocol, and this solution is naturally backed by EigenLayers tens of billions of dollars in consensus security.

What can be done now?

For ordinary users, compared to understanding the business logic of EigenLayer frame by frame, how to interact effectively and win potential airdrops may be a more concerning issue.

As EigenLayer enters a new stage and officially activates EigenDA, the protocol does now have a new interactive space. As mentioned earlier, The content of the Operators stage is to allow verification nodes to register and accept the delegation of re-pledged users, so what we need to do is to entrust the re-pledged tokens to verification nodes.

For users who have re-pledged on EigenLayer before, you can follow the steps below. Users who have not deposited yet can first refer to EigenLayer is officially launched on the mainnet, how to interact?》。

Odaily Note: It should be noted that,If you do not deposit directly on the EigenLayer front-end, but interact indirectly through re-pledge protocols such as Renzo, Puffer, Ether.fi, etc., you don’t need to do anything now, the above protocols will perform the delegation operation on your behalf.

First we open EigenLayersOfficial website, users who are familiar with this interface may find that there is a Delegate Your Stake logo on the right side of the interface. Click on it to start delegating.

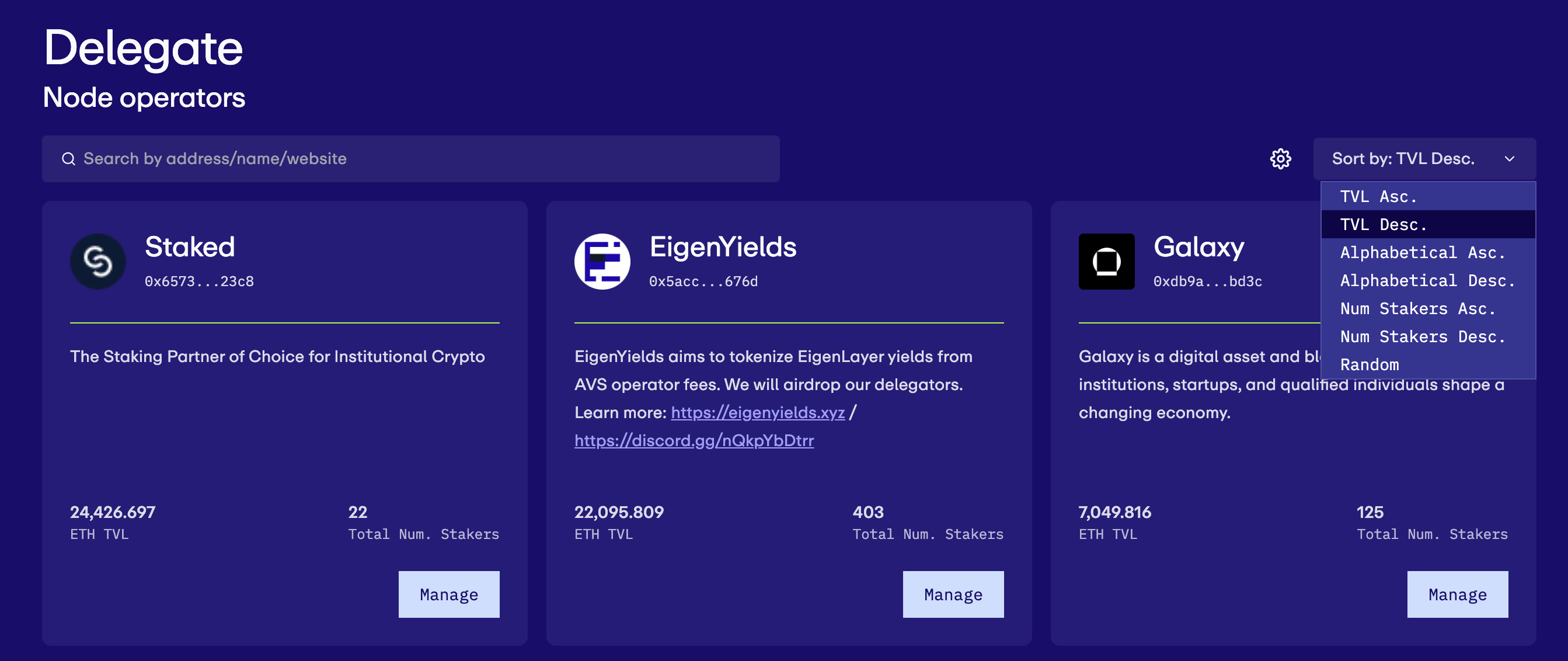

After that, we will enter the delegation interface of the verification node. There are currently hundreds of nodes in this interface. For the sake of operational stability, we can give priority to nodes with higher commission amounts for delegation (Odaily Note: Unlike other PoS systems Similarly, nodes have no right to steal funds, but may be punished for bad behavior), then we can click TVL Desc. in the sorting method on the right.

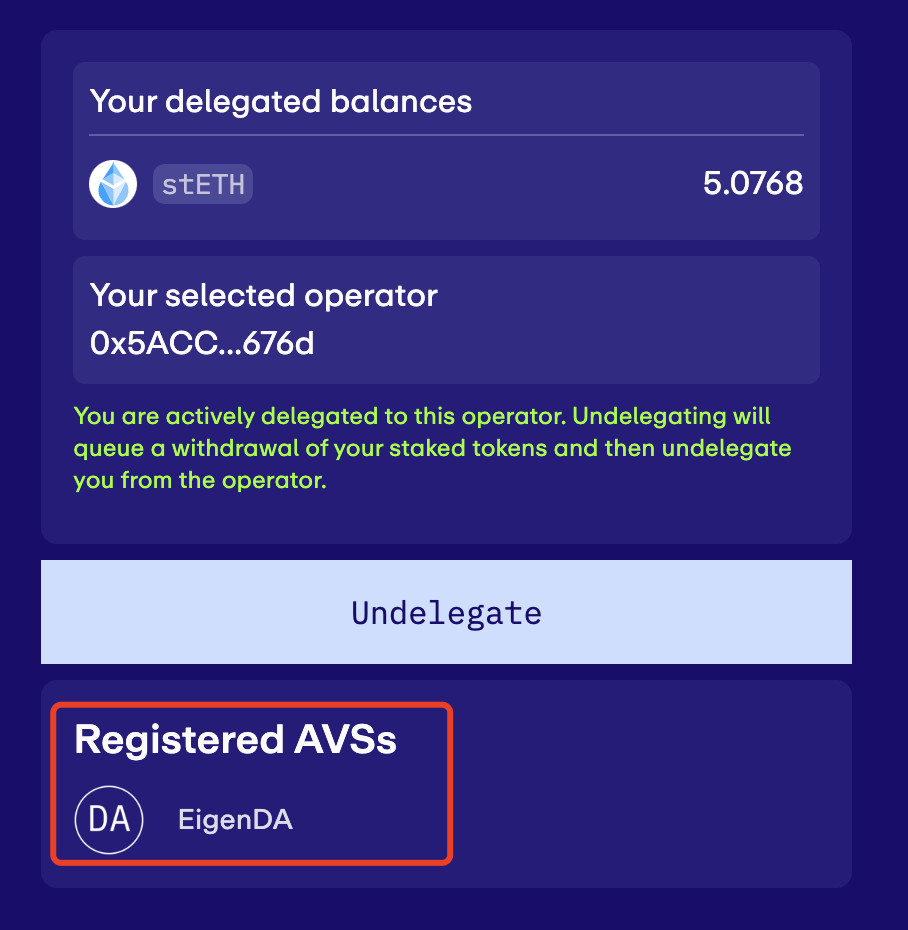

My personal choice is EigenYields, which currently ranks second in entrusted finance. Click delegate to complete the delegation. As you can see from the image below, the EigenYields node has been explicitly selected and joined EigenDA in the AVS Registration column (a large number of other nodes have not yet done this).

In addition to larger delegated size and faster execution efficiency, additional reasons to choose EigenYields are:This project was first unveiled on social platforms after EigenLayer’s official announcement this morning, but in a short period of timeMore than 20,000 ETH have been accumulated(It’s hard not to wonder about the team’s background…), in addition, the project also mentioned that it will announce the token economic model and governance-related information this quarter, so it can try to eat two fishes with one fish.

Two final points need to be emphasized.

First, currently EigenLayer does not support some delegation functions.Therefore, once a verification node is selected, all amounts can only be entrusted to that node.

The second is the slashing issue that many users are worried about, that is, if the node does not operate in a standardized manner, the funds may be punished by slashing. In this regard, EigenLayer has mentioned that for stability reasons,The slashing mechanism will not be activated until later this year, so users don’t need to worry too much about this issue at the moment. However, EigenLayer has mentioned that although there is no risk of slashing in the short term, if the verification nodes continue to behave irregularly, they will eventually be punished, so everyone must be more cautious when choosing entrustees - EigenYields is a new project after all, and risks The coefficient is relatively high, so don’t completely listen to me, DYOR.