SignalPlus Macro Analysis (20240403): Risk aversion continues to intensify, stocks, bonds and cryptocurrencies all fall

The risk aversion that started the day before continued to intensify, with stocks, bonds and cryptocurrencies falling simultaneously. On the policy front, Fed officials continued to withdraw Powells dovish comments at the March FOMC meeting, with Loretta, Mester and Daly all trying to withdraw any expectations of imminent interest rate cuts.

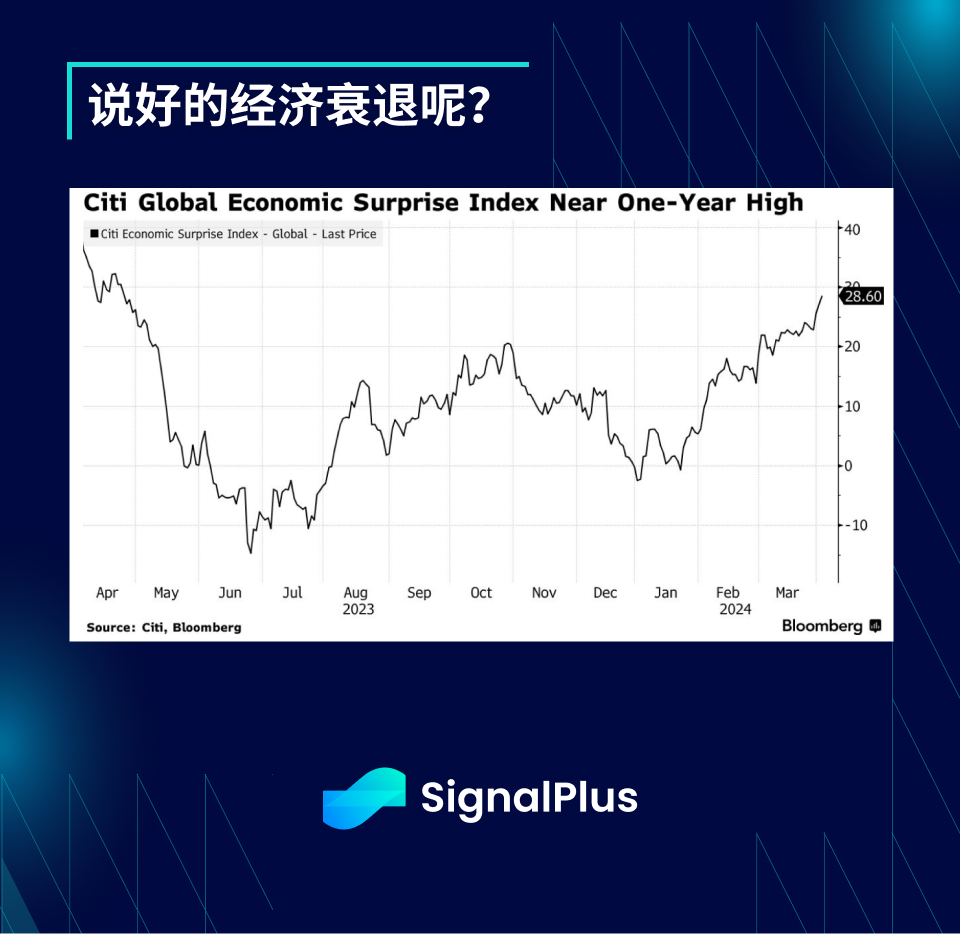

The Feds behavior is not surprising. In addition to the previously mentioned high inflation data, Citis Global Economic Surprise Index also rose to a one-year high on continued strong economic performance.

Bond investors may be starting to feel uneasy, as the MOVE Bond Volatility Index rebounded sharply from its lows yesterday, while the 10-year yield is heading towards 4.50%, and the likelihood of a rate cut in June currently seems 50/50. In addition, despite market expectations for interest rate cuts, companies continue to flood the issuance market to lock in borrowing rates. About US$20 billion in new debt issuance is expected this week, and this month may reach as high as US$100 billion, an increase of 50% from the same period last year. % above.

In terms of risk aversion, oil prices have quietly climbed back to their 2023 highs of around US$85 per barrel and have risen 20% this year. This may be the main CPI indicator that consumers really care about. Additionally, despite Powells dovish turn and contrarian assets such as gold and BTC rising this year, the dollar has continued to uncharacteristically appreciate against most major currencies (European inflation falls short of expectations, Bank of Japan exits zero interest rate policy, Chinas economic woes) , which has brought huge depreciation pressure to currencies such as the RMB. As the market is still worried about the state of the Chinese economy, the premium of RMB foreign exchange forward points has been higher than the worst level in 2023.

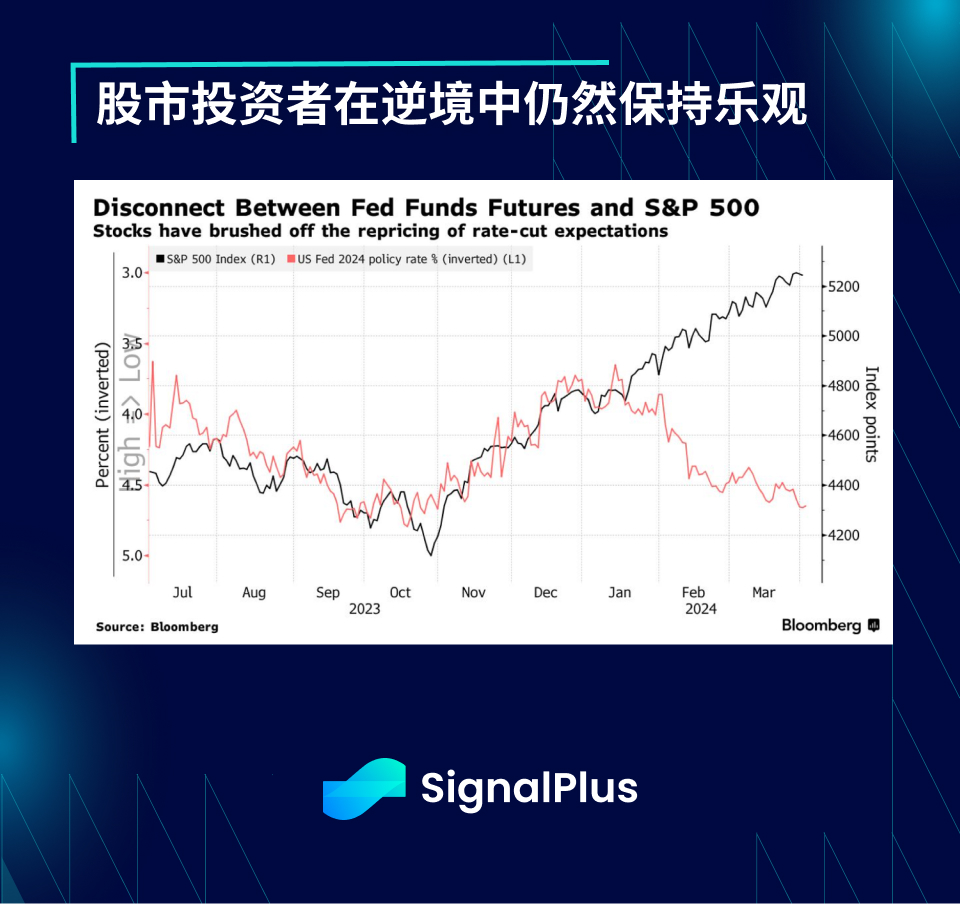

On the stock market side, in addition to fading interest rate cut expectations, the index was also weighed down by Tesla (-7%), which reported quite poor first-quarter results that were significantly below expectations and a sharp decline in vehicle deliveries (-14%) , concerns about factory shutdowns, rising inventories and concerns about increased competition from BYD and Chinese automakers have all added to the negative sentiment on the stock. Will the SPX underperform in April as the market catches up to changes in rate cut expectations? Or will we enjoy another quarter of prosperity?

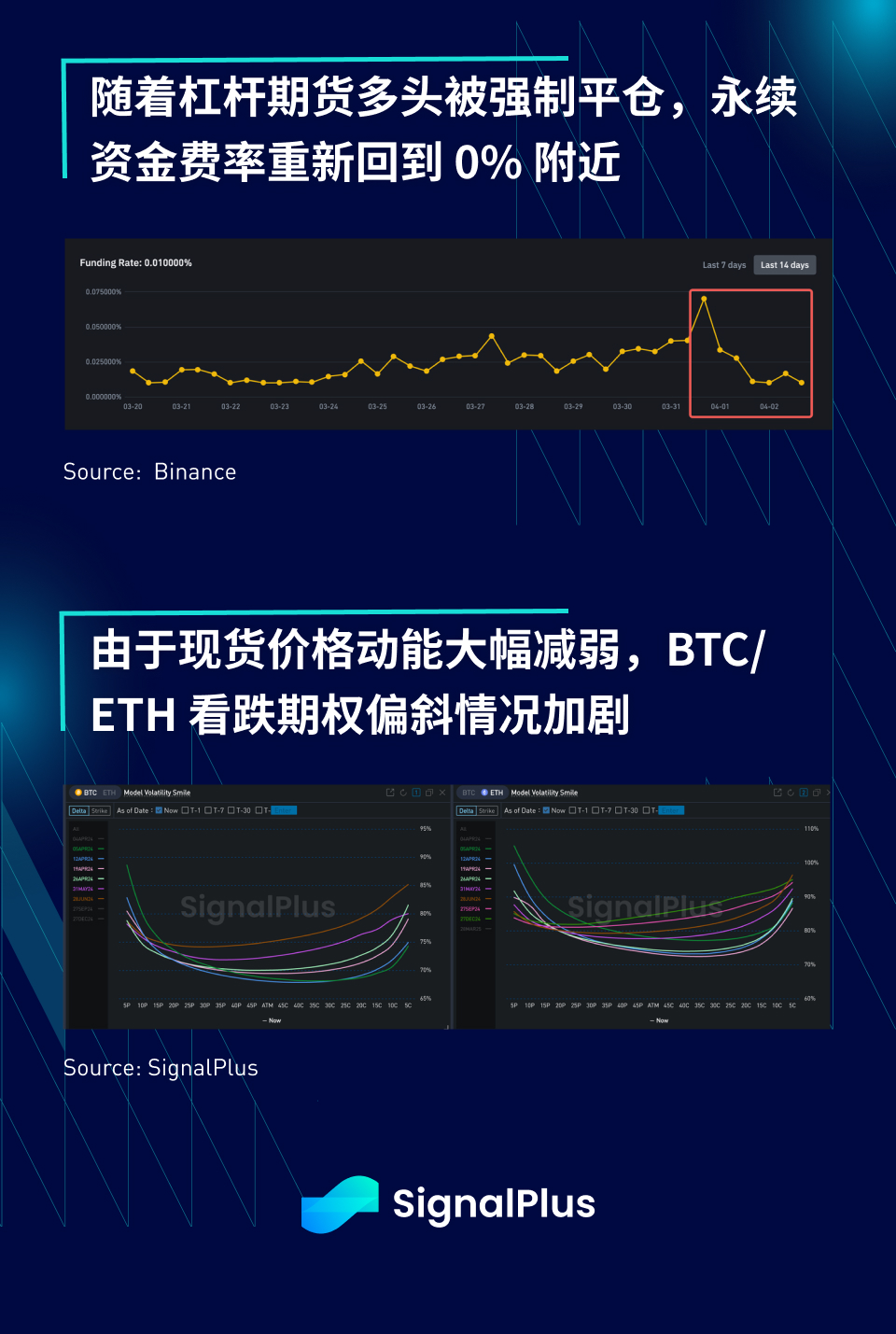

Speaking of risk aversion, cryptocurrency prices have plummeted, with BTC falling from 69k to a low of 64.5k yesterday, with nearly $400 million in futures positions being liquidated in 18 hours. The decline, as usual, occurred during Asian trading hours, likely in response to ETF net inflow figures (-86 million) released after the U.S. close, coupled with Asian investors holding mostly long positions.

Future positions should be clearer due to this wave of stops, perpetual funding rates have fallen sharply, and short-term put skew has intensified as spot price momentum has weakened significantly.

Volatility is likely to persist for a while in the short term, with blockchain analytics firm Arkham reporting that a wallet under government control has been activated and performed several test transfers to Coinbase, expected to be a precursor to larger transfers, U.S. The government may sell the tokens back for fiat currency. Additionally, ETF issuer Proshares has launched several leveraged Bitcoin ETFs (BITU and SBIT) targeting retail investors, so enjoy!

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: xdengalin), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website:https://www.signalplus.com