Folius Ventures: Special Report on Web3 Chinese Developers

Original author: Chris Lu, Kenny Dong, Jason Kam

Original source: Folius Ventures

Summary

Chinas Internet industry has given birth to countless technology giants and super applications in the past 30 years, and has accumulated a large number of engineers, technology entrepreneurs, and Internet talents who are good at consumer-oriented (2C) applications. This constitutes the basic base and foundation of Chinas Internet entrepreneurs. background color. We estimate that there are currently about 2-3 million Chinese Web2 practitioners who already have the knowledge and potential to start a Web3 business and will start a Web3 business in the next three years.This means that at least 200-300 potential top projects with Chinese backgrounds will appear on the market at a rate of 1-2 per week in the next three years.

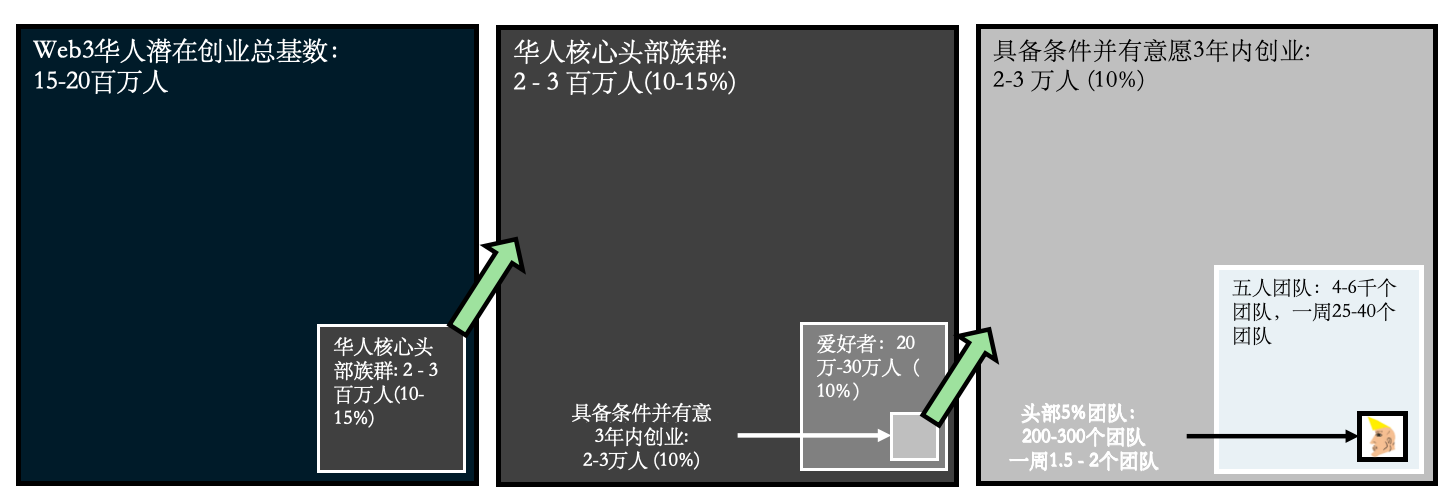

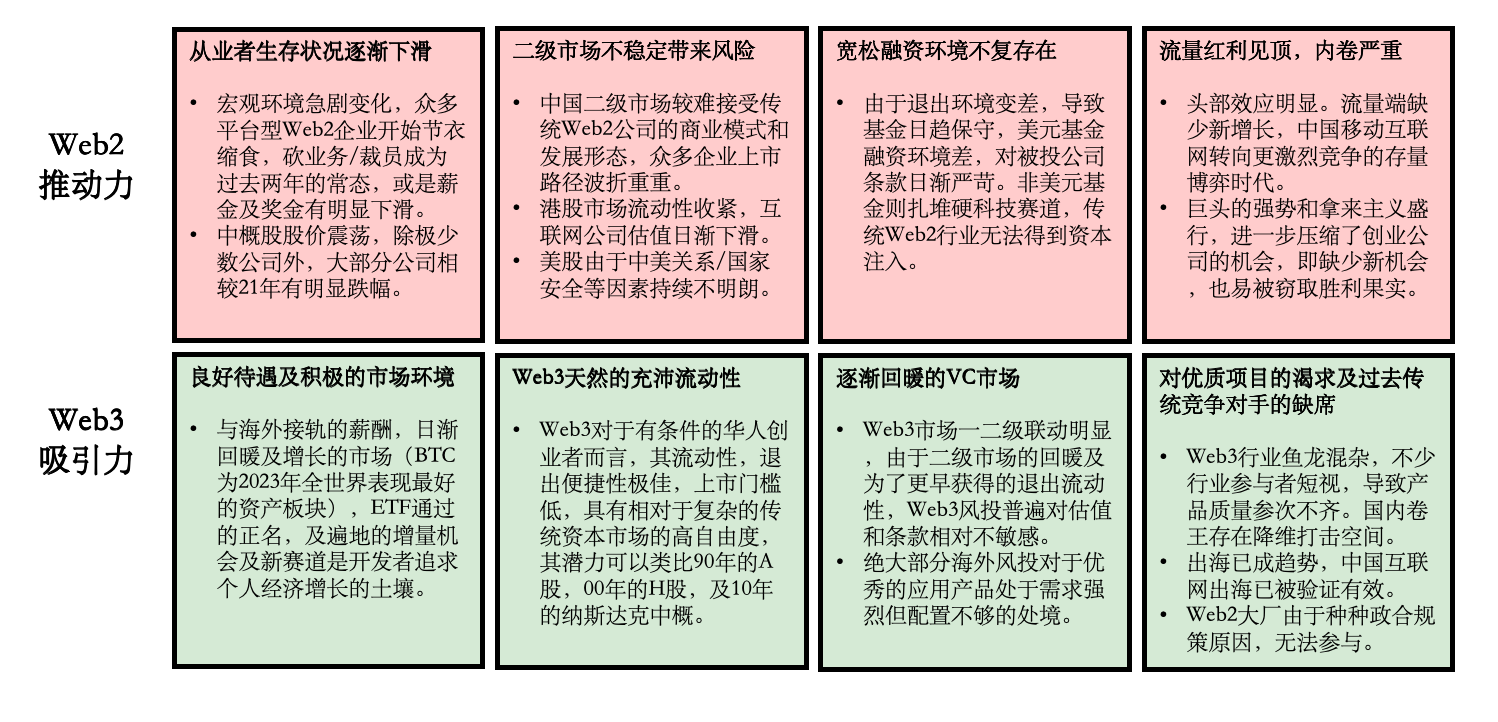

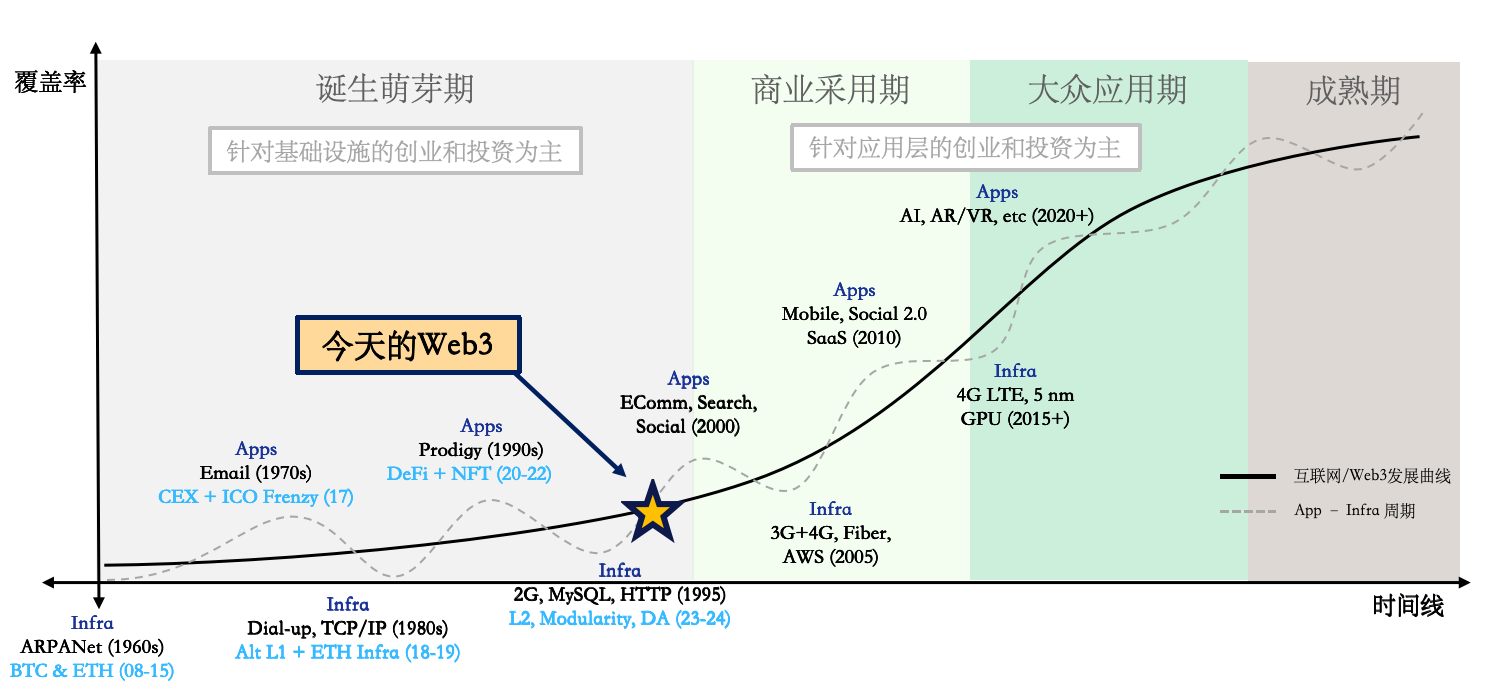

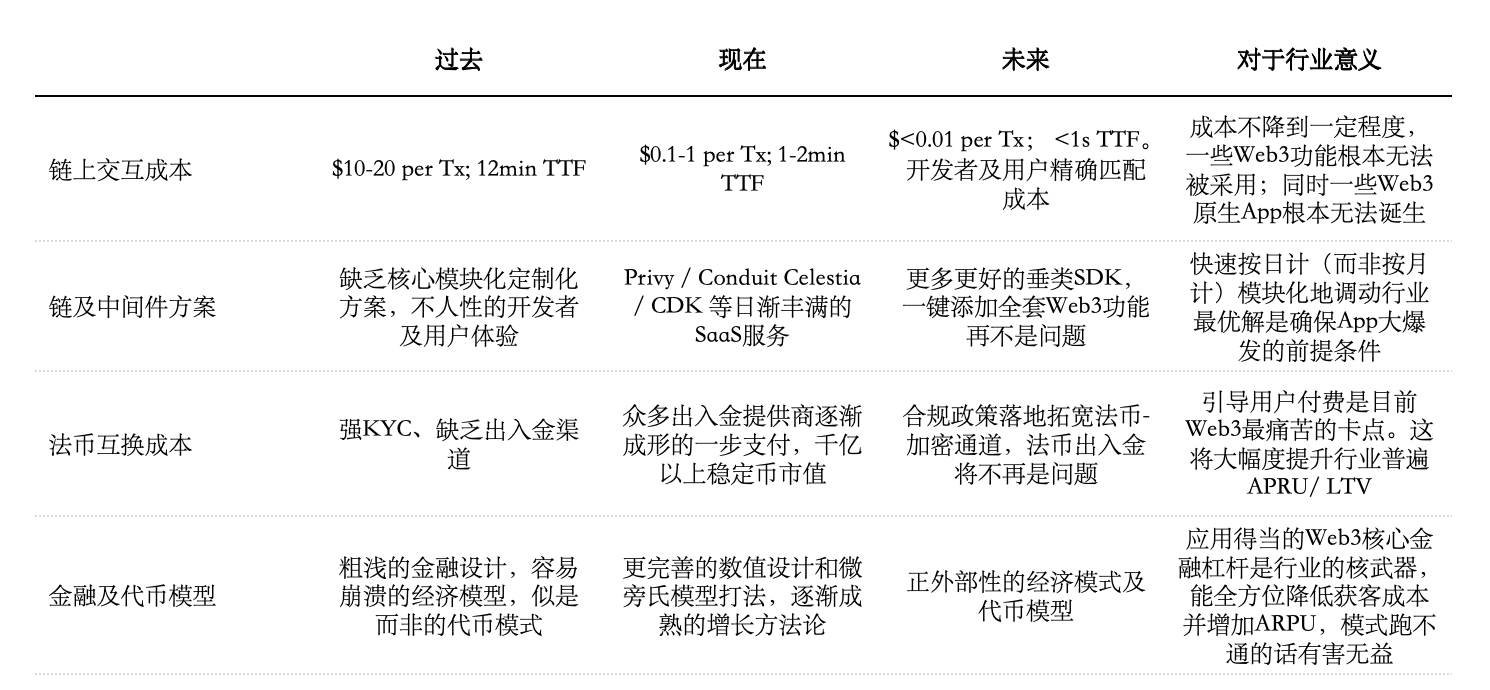

In recent years, due to the superposition of multiple macro-negative factors such as the slowdown in Chinas Internet growth, the peaking of traffic dividends, and the shrinking financing and exit opportunities in the Web2 field, the Web3 industry is an emerging blue ocean market with a positive environment, abundant liquidity, and huge room for growth. A sharp contrast. Therefore, we expect that more Chinese-speaking Web2 talents will accelerate their transfer to Web3 in the future. For those Chinese Internet people who are full of competitive and innovative spirit, executive learning ability and sufficient background conditions,We believe that Web3 is the next stop of their era, just like A-shares in the 1990s, H-shares in the 2000s, and Nasdaq in the 10s.And keep pace with AI, thus starting a new wave of Internet entrepreneurship and innovation in China. At the same time, we believe that the Web3 industry has accumulated and accumulated infrastructure for several years, which has given the industry the soil to host super applications. The pendulum that will allow the development of the industry will be shifted from strong infrastructure, weak applications to strong applications , the end of weak infrastructure. History shows that technology follows the application-infrastructure development law: applications appear before infrastructure and promote its iterative upgrades, and the improvement of infrastructure promotes the emergence of new application paradigms. Various signs such as the significant reduction of on-chain interaction costs, the popularization of customized solutions, the reduction of friction in fiat currency interactions, the improvement of data and middleware, and the update and iteration of financial gameplay are all indicating thatWeb3 is currently on the eve of its application dividend period, and the turning point will arrive in the next 12-18 months.

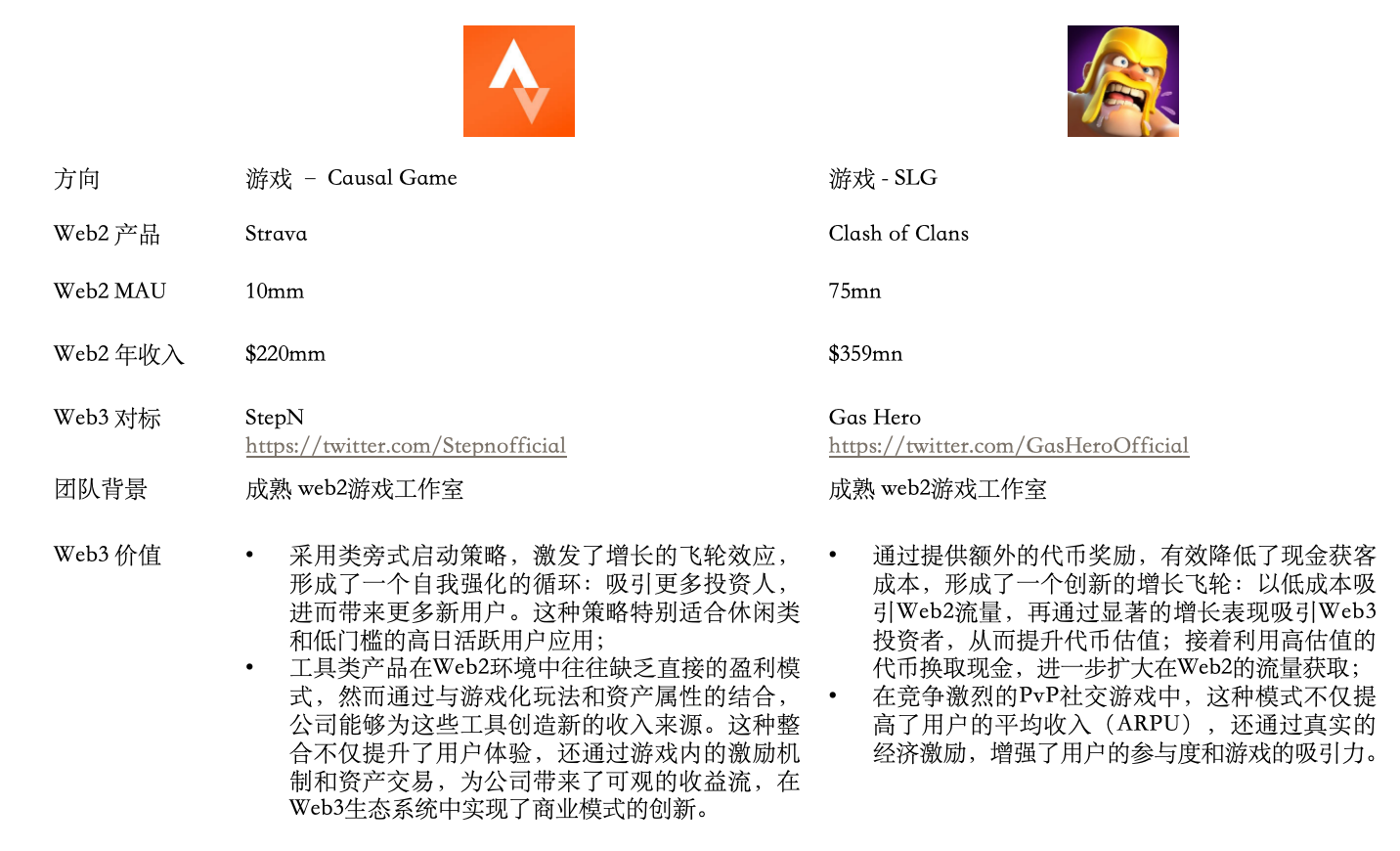

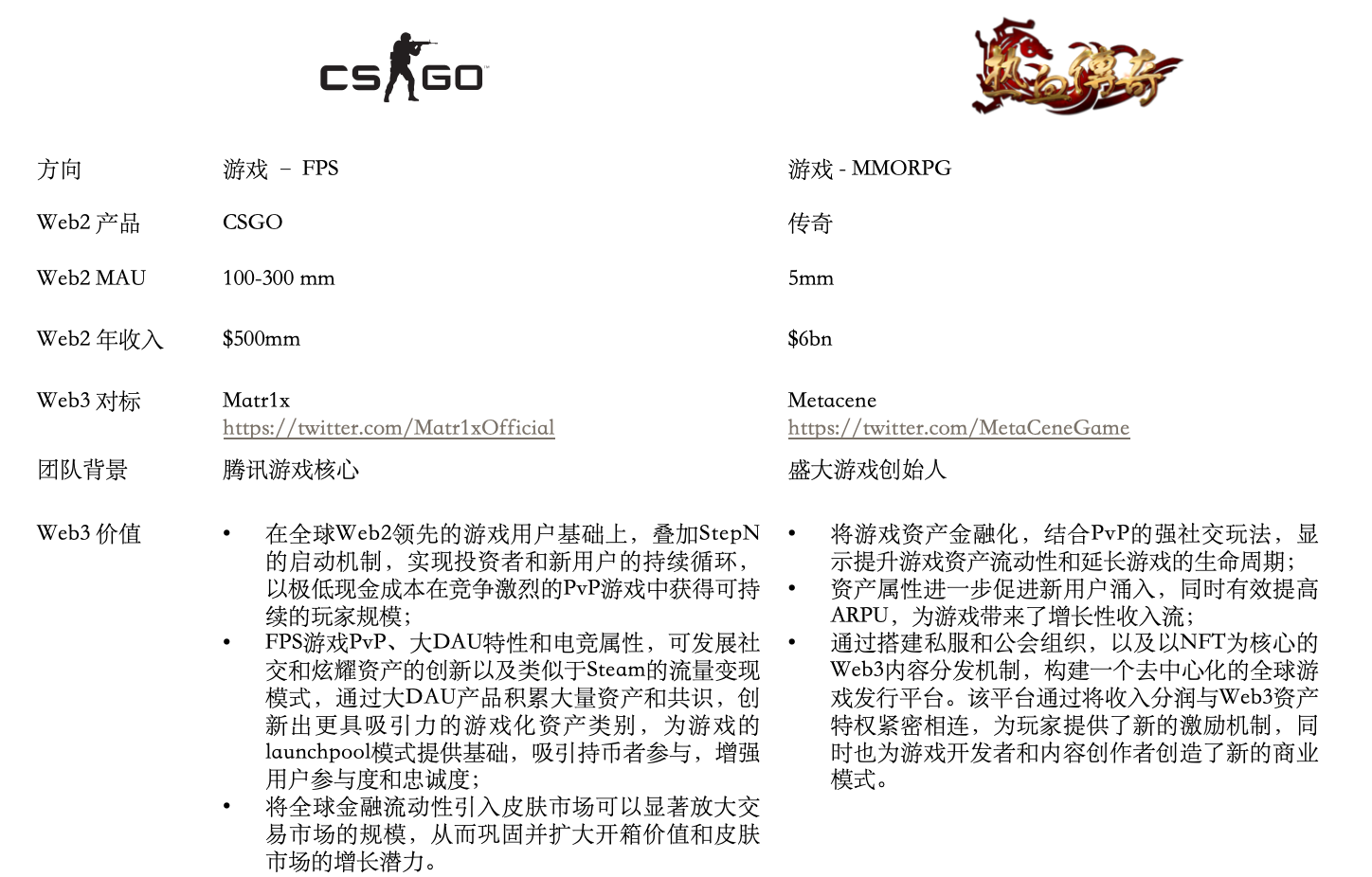

Chinese Internet entrepreneurs should make good use of the Web2 methodology to form differentiated advantages, focus on the scenario of migration from Web2 to Web3, and expand the incremental market.Chinese Internet practitioners in the Web2 era have made great achievements in C-side application fields such as social networking, entertainment, and e-commerce. They have rich cognition and methodology, and are well versed in user psychology, product design, and operations. However, the knowledge of Web2 is a double-edged sword in Web3: these experiences are both wealth and constraints. Web3s smaller user base, different product strategies, financialization, and cultural differences are all new challenges for Chinese entrepreneurs. However, we believe that Chinese Internet entrepreneurs can still reuse the Web2 methodology. We have observed the full potential of this group in Folius’ already deployed projects (StepN, Matr1x, SleeplessAI, Memeland, Metacene, Myshell, etc.). We encourage Chinese teams to leverage their advantages in Web2, especially to differentiate themselves from overseas teams in terms of user growth, community building, business model innovation, products and operations, etc., and should focus on exploring scenarios that promote the migration of Web2 to Web3. At the same time, we should also pay attention to cross-cultural exchanges and cooperation and broaden our international horizons to better adapt to the international environment of Web3.

1. Three factors for the explosion of Chinese entrepreneurs in this cycle

Huge dividends for consumer engineers, strong catalysts from internal and external factors, and an inflection point for Web3 infrastructure. Its advantages and disadvantages are equally outstanding.

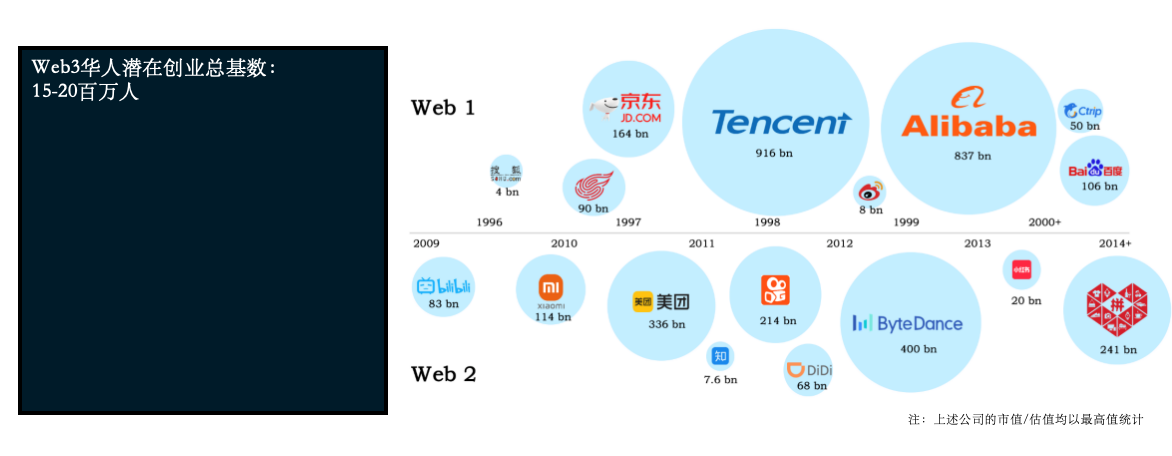

Chinas engineer bonus for consumer Internet products since 2000 has laid a base for the number of potential Chinese entrepreneurs in Web3, about 15-20 million people.

The total number of potential Chinese entrepreneurs in Web3: 15-20 million people

Chinas Internet industry started from scratch and accumulated 15-20 million employees in just 30 years. During the rapid development of mobile Internet after 2008, it accumulated a large number of reserve talents for consumers and applications. This number determines the basic base for Chinese entrepreneurs to start a business in Web3.

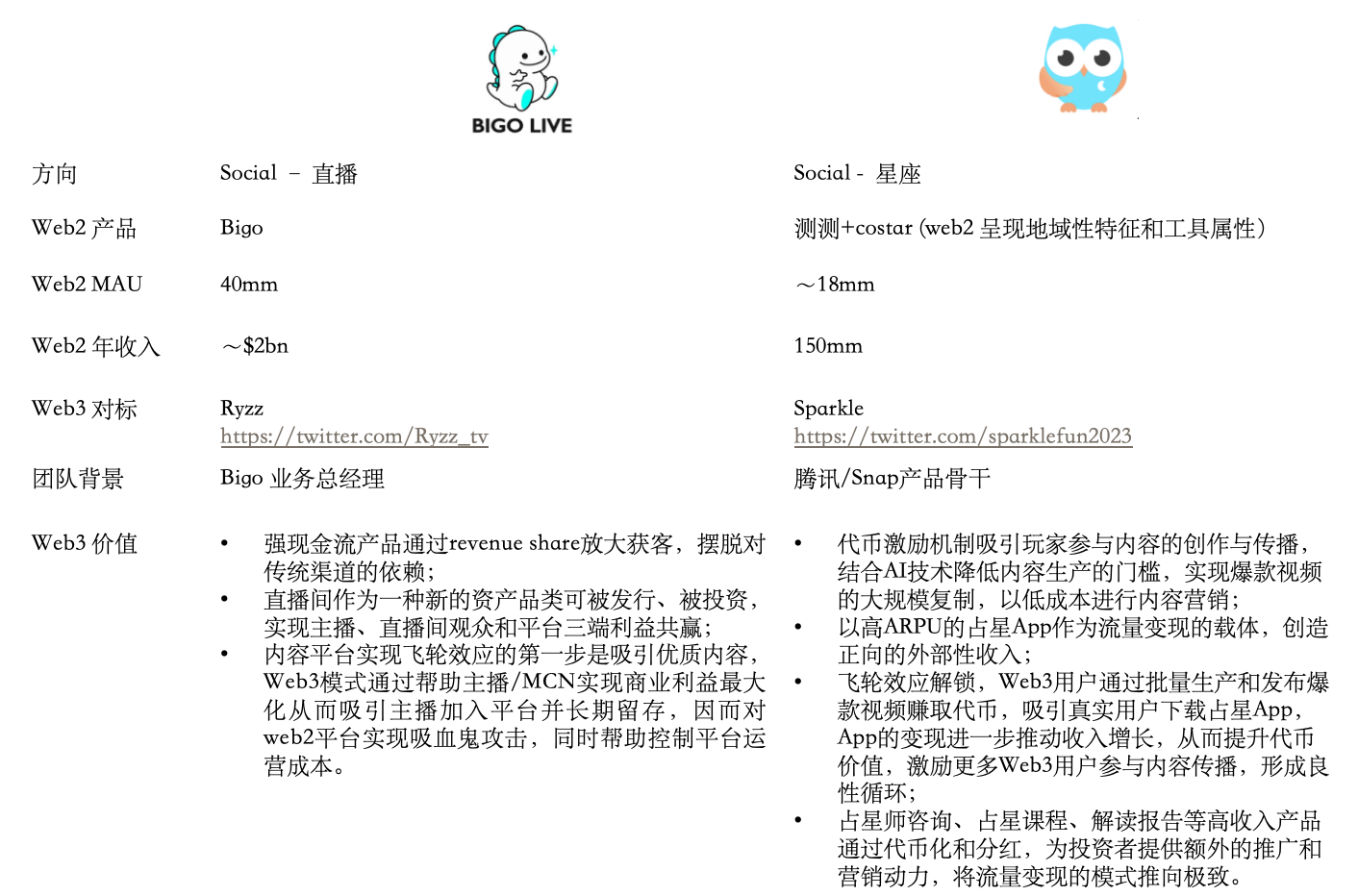

As the worlds largest single user market, China has seen the emergence of many world-leading innovative application categories in the past golden decade of mobile Internet, including social media (such as WeChat), mobile payment (such as WeChat Pay, Alipay), entertainment platforms ( Such as Bigo, Huya, Douyu), content sharing platforms (such as Xiaohongshu, Douyin), and e-commerce retail (such as Alibaba, Pinduoduo, Meituan). Each of these fields has developed innovative models and product forms that are completely different from those in overseas markets, and each has its own characteristics in terms of interaction methods and gameplay. The teams behind leading products all stand out after sufficient market competition. They have accumulated rich and proven methodologies in user insights, product design, operational strategies, traffic acquisition, growth fission, and commercialization. This group of Internet talents is the most competitive group of people. We have observed that many Internet people are beginning to join the encryption industry, and we expect this trend to continue to accelerate in the future.

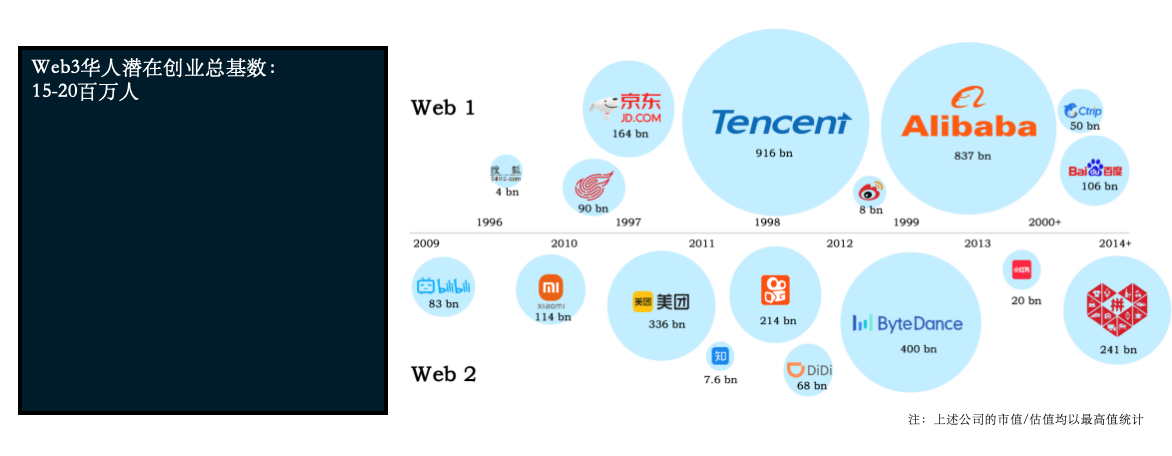

Under this base, we believe that there are 2-3 million people in the potential core head group, and this group has initially possessed the foundation for entrepreneurship and the ability to successfully obtain financing.

Chinese core head group: 2 – 3 million people (10-15%)

Many well-known major Web2 Internet companies are not only the cradle of technological innovation, but also an important source of Web3 talent ecology. In our initial assessment of the talents of Chinas top manufacturers, even conservative estimates indicate that there are already more than hundreds of thousands of product technology elites with high quality, rich experience and excellent innovation capabilities. These talents include not only a wide range of grassroots developers, but also many executives from the top of the industry. Their levels are equivalent to or exceeding ByteDances Level 3-2 and Alibabas P9. They devoted themselves to the Web3 field, and the projects they created not only demonstrated the efficient execution of the teams of major manufacturers, but also demonstrated the ultimate pursuit of fine polishing and perfection of products.

In addition to the leading Internet companies, Chinas game talents deserve to be discussed separately: China has 1.5 million game industry practitioners, of which RD personnel account for about 70%. Chinas game companies from the Shanda/Giant era have demonstrated top development And commercial innovation capabilities, especially the new production pipeline innovation changes brought about by the mobile game era, the ability to quickly iterate products in a short period of time, maintain a development rhythm of fine-tuning while entering the market, deeply listen to user feedback and improvements, and conduct multi-product matrix trials Through the wrong waiting method, a group of developers with strong execution ability have been trained. This group of game developers are naturally more suitable for the development of Crypto.

Therefore, we believe that among the 15-20 million people working in the industry, about 15%, or 2-3 million people, have initially acquired the vision, ability and background to start a business and successfully obtain financing and attention. This group of people is also the group that Web3 needs to win over most.

Under this base, we believe that the current Web2 -> Web3 conversion rate is about 1% in three years. In the next three years, the Chinese Web2 industry will provide 200-300 head teams for Web3, with an average rate of 1.5-2 high-quality teams emerging per week.

Web3 enthusiasts: 200,000 to 300,000 (10%)

In the head circle, we believe that there are currently 10 people who do not hold too much prejudice against Web3, are very curious, and then have enthusiasm for learning. Finally, they have a deeper understanding of the industry and have conducted on-chain interactions (not pure hype). There are about 1 people in . This ratio will change with the cycle.

Qualified and willing to start a business in the next 3 years: 20,000 to 30,000 people (10%)

Among enthusiasts, we believe that they are ultimately willing to go overseas, and their personality, wealth accumulation, industry accumulation, and family background are suitable for starting a business in the Web3 industry in the next three years under an unfriendly macro environment. 10 enthusiasts may not exceed 1 person. In other words, we believe that within the core Web2 circle, the conversion rate for Web3 entrepreneurship is about 1%.

Average founding team of 5 people: 4-6 thousand teams emerge in a three-year cycle. Top 5% of teams: 200 – 300 teams, average 65 – 100 per year, 1.5 – 2 teams per week

Given that the industry is relatively unstandardized and the team level is uneven, we believe that only a team that possesses polygonal combat effectiveness, long-term values, reliable business models and insights, the ability to go global in culture and language, and a relatively good understanding of the Web3 financial field will be the best choice. There will be a better chance of running out and becoming the leader. This ratio is probably 1 in 20 teams.

Therefore, we believe that in the next three years,The Chinese Web2 industry will provide 200-300 head teams for Web3, with an average rate of 1.5-2 teams emerging per week.We are extremely looking forward to in-depth exchanges and cooperation with them at the earliest possible stage.

Since 2020, a new world pattern of confrontation between China and the United States has taken shape. The traditional Web2 Internet industry is in sharp contrast with the ever-expanding Web3, which will make the latter the best cradle to take over these outstanding Web2 teams (especially Chinese teams).

The singularity of Web2 to Web3 has emerged, and the gradual improvement of Crypto infrastructure has given the industry the soil to host super applications. The pendulum of Web3 development is about to shift to strong applicationend.

Looking back at the history of technology, the iteration cycle of App-Infra is like a pendulum: App always appears before infra and encourages the latter to iteratively upgrade, and the improvement of infra promotes the emergence of new app paradigms. Email preceded TCP/IP, which prompted the emergence of early portals; portals prompted the emergence of browsers (Mosaic) and high-level programming languages, which brought the prosperity of Web1.0; the high-speed network was born to meet the needs of Web1.0 (Broadband) and cloud service providers (AWS) have made more complex social applications and streaming media possible, which has brought about the prosperity of Web2.0. At the same time, the demand for better and faster has promoted further iterations of wireless technology and semiconductors, allowing AI/AR/VR applications become possible.

We believe that Web3 also follows the above rules, and with the technological iterations in the past few cycles,The cryptocurrency industry pendulum is about to swing to the “strong application” end.

In the past cycle, the Web3 industry has developed infra components that can host explosive consumer applications. We are in the transition from an accumulation period to a dividend period, and it is expected that the inflection point of application explosion (LTV>=CAC) will be in the next 12-18 month comes.

In past cycles, the industry has developed infra components that can carry blockbuster consumer applications. We are in the transition from an accumulation period to a dividend period.. The driving factors include: 1/ The cost of interaction on the chain is greatly reduced, making user conversion possible; 2/ The development and customization solutions are democratized, allowing most developers to quickly trial and error; 3/ The friction of fiat currency interaction is reduced, greatly increasing the number of users. Willingness to pay; 4/ The improvement of financial and token models can boost ARPU in all aspects, improve retention, and reduce user acquisition costs. These factors greatly promote the unit economics (LTV/CAC) of dApps and can form a positive flywheel. We expect that the inflection point of application explosion (LTV>=CAC) will arrive in the next 12-18 months.

Seven major advantages and seven major disadvantages of Chinese entrepreneurs

But we remain optimistic and see many advantages from Chinese entrepreneurs, and these advantages will continue to shine in Web3 in the future:

Grasp of human nature and matching mechanism design:Major Chinese manufacturers are good at cultivating excellent product managers with delicate human perception and aesthetic pursuits. They have not only explored different interaction methods and gameplay strategies in the mobile era and those in Europe and the United States, but are also extremely good at fission growth, using WeChat’s social interaction and Pinduoduo Take the innovative shopping model as an example. These strategies not only accelerate the expansion of the user base, but also increase user activity and brand loyalty. These product strategies that have been tested in actual combat are particularly prominent in the face of the relatively monotonous and rudimentary growth methods in the current Web3 field. It is a general consensus that Web3 urgently needs excellent and high-quality consumer products that can be promoted to the public. How to identify the native needs of the web3 user group and the obstacles to the migration of web2 users is an important issue.

Comprehensive operational capabilities:Chinas Web2 platform operational strength and business closed-loop capabilities in the face of low ARPU markets are eye-catching. Whether it is the complex creator ecology, diverse revenue distribution mechanisms, or advanced algorithm-driven content recommendation systems, its team has demonstrated Strong foundation in platform operations. The achievements of Chinese entrepreneurs in the field of platform operations such as cryptocurrency exchanges have proven their excellent ability to build and manage complex platforms. While Web3 content creation and operation are still in the exploratory stage, the Chinese team should focus on measuring how to combine the incentive effect of the token model on the original basis to further amplify the network on the creator and consumer sides.effect.

Core technical strength:The technical strength of the Chinese team is a key point that people easily forget. The Chinese have advanced technology accumulation and research in ZK, ML, AI and many other possible future technical directions to innovate Web3. Chinese scholars/technical talents in related fields are all They occupy a large proportion, but Chinese teams are often the technology providers behind many first-line projects. We should focus on exploring key talents like technical guru who stand in the center of the stage.

Methodology for rapid iteration:The Chinese are diligent and well versed in the rolling methodology. They are not just stupid overtime workers but have strong execution ability to quickly deliver products. Faced with the dual blessings of Chinas existing supply chain dividends and engineering dividends, they abandon the big factory mentality and in the future Rapid growth requires running PMF quickly. The Web3 era of rapid trial and error takes advantage of strong execution capabilities.

The insights and pursuits of Chinese entrepreneurs: A very valuable natural advantage. The ten-year growth rate of China Mobile Internet is nothing short of miraculous. Chinese entrepreneurs who were born in the high-speed system pursue system efficiency, have strong learning ability and the fastest reaction speed. They are pragmatic in the face of demand, have experienced large-scale, systematic and efficient business systems, and practical experience in high-speed environments is more important. This group of people is a generation born of globalization.

Understanding of the latest consumer application routines:Copy from China has proven in the past few years that it can be successful and continues to create new greatness. The time machine theory has changed its subject and object. With reference to the models, products, and businesses that have been verified in the Chinese market, we are seeking blue oceans in overseas markets and the future. Chinese entrepreneurs are very likely to have strong copy from Web2 advantages in 2C/games and other fields.

For the group of Web3 entrepreneurs who are certain and can only go overseas to start a business, another advantage is the Chinese community all over the world. The Chinese have had the spirit of adventuring into the world since ancient times. The innate population base has led to the establishment of gathering areas and hometown groups all over the world. , such as Singapore/Hong Kong, where a large number of Web3 OGs from the previous era have gathered, and Chinese even dominate in fields such as mining and exchanges. Giving full play to the resource advantages of the race will get twice the result with half the effort.

2. Advantages of Chinese developers

Large DAU base, creator economy, strong operation platform economic system, and business model that have been verified in Web2.

We believe that a track with the following characteristics can unleash the greatest potential of Chinese entrepreneurs:

Large DAU base, strong social attributes:It can form a powerful network effect by combining token incentives and gamification gameplay. Compared with traditional marketing and customer acquisition, this model does not require close cooperation, high costs, and increasingly low efficiency, and can especially unleash the potential of web3 decentralized marketing/distribution.

Creator economy:China has a large group of content creators and abundant human resources, and breakthroughs in AI have further enhanced individual creativity. In such an environment, everyone has the possibility of becoming a traffic node or a creative node, becoming a super individual/node.

Strong operational platform economic system:A platform economic system that can make full use of the capabilities of Chinas operational experts, especially through crypto, can provide new value exchange methods and incentive mechanisms to promote broader participation and collaboration.

Business models proven in Web2:The business model has been successfully verified in Web2, especially the direction with the characteristics of high ARPU, good cash flow and high profit margin potential. If the vertical user behavior, user relationship chain, user data, etc. can be superimposed on the possibility of being capitalized, and at the same time, the scene can be embedded in transactions, and probabilistic gameplay models such as blind boxes can be added, the business potential can be further released. .

At the same time, we believe that the entrepreneurial tracks selected through the above dimensions combined with the web3 token playbook (wealth effect/revenue share) can greatly amplify this flywheel effect:

Lower user acquisition costs;

Higher user ARPU and Retention;

Lower group operating costs, especially multi-sided network platform systems;

The possibility of more revenue from a more diversified business model, further enhanced by the addition of over-the-counter liquidity;

However, it should be noted that the focus of different types of directions will be different. For example, high ARPU products are more likely to drive user growth through revenue share, thereby getting rid of dependence on traditional channels.

Game categories with large user base

Creator Economy and UGC Content Platform

Heavy vertical social scene

Hardware supply chain advantages and platform economy

Disclaimer

The information in this presentation was prepared by Folius Ventures LLC (Folius), is believed by Folius Ventures to be reliable, and was obtained from public sources believed to be reliable. Folius Ventures makes no representations as to the accuracy or completeness of such information. The opinions, estimates and forecasts in this presentation constitute the current judgment of Folius Ventures and are subject to change without notice. Any forecasts, forecasts and estimates contained in this presentation are necessarily speculative in nature and are based on certain assumptions. In addition, the matters they describe are subject to known (and unknown) risks, uncertainties and other unpredictable factors, many of which are beyond Folius Ventures control. No representation or warranty is made as to the accuracy of such forward-looking statements. It can be expected that some or all of these forward-looking assumptions will not materialize or will differ materially from actual results. Therefore, any forecasts are only estimates and actual results will vary and may differ materially from the forecasts or estimates shown. Investing in any strategy, including the strategies described herein, involves a high degree of risk. The possibility of loss exists and all investing involves risk, including loss of principal. This presentation is not an offer to sell or the solicitation of an offer to buy any investment fund securities or a recommendation to buy or sell any digital assets or securities. This presentation does not consider and does not provide any tax, legal or investment advice or opinion regarding any persons specific investment objectives or financial situation. Folius Ventures has no obligation to update, amend or revise this presentation or otherwise notify its readers if any matter stated herein or any opinion, project, forecast or estimate stated herein changes or subsequently becomes inaccurate . Graphs, charts and other visual aids are provided for reference only. None of these charts, graphs or visual aids should be used to make investment decisions. No representation is made that these will assist anyone in making an investment decision, nor are charts, graphs, or other visual aids capable of capturing all of the factors and variables necessary to make such a decision. The descriptions herein of the target characteristics of Folius Ventures approach and its strategies and investments are based on current expectations and should not be considered a certainty or a guarantee that the methods, strategies and investment portfolios will actually have those characteristics. These descriptions are based on information available as of the date of preparation of this presentation, and descriptions may change over time. Past performance of these strategies is not necessarily indicative of future results.