With investment from Arthur Hayes, what interactions can Elixir currently do?

Original author: Nian Qing, ChainCatcher

Original editor: Marco, ChainCatcher

Recently, the modular DPoS network Elixir announced the completion of an $8 million Series B round of financing. Mysten Labs and Maelstrom Capital, run by Arthur Hayes’ family office, jointly led the investment, with participation from Manifold, Arthur Hayes, Amber Group, GSR, Flowdesk, etc.

According to the RootData page, Elixir was founded in 2022 and is a modular DPoS liquidity network that allows anyone to provide liquidity directly to the order book, bringing liquidity to long-tail crypto assets and allowing exchanges and protocols to guide their Ledger liquidity. Elixir completed US$2.1 million in seed round financing and US$7.5 million in Series A financing in January and October last year respectively, with investors including Hack VC, NGC Ventures, FalconX and other well-known institutions.

In addition to the news of repeated financing, Elixir has always been relatively low-key in the Chinese community and has not received much attention. One of the main reasons is that unlike order book DEXs such as dYdX and Vertex, Elixir is a network that provides liquidity for these DEX projects. and infrastructure. The two versions of the test network previously launched did not have many direct interaction scenarios with users.

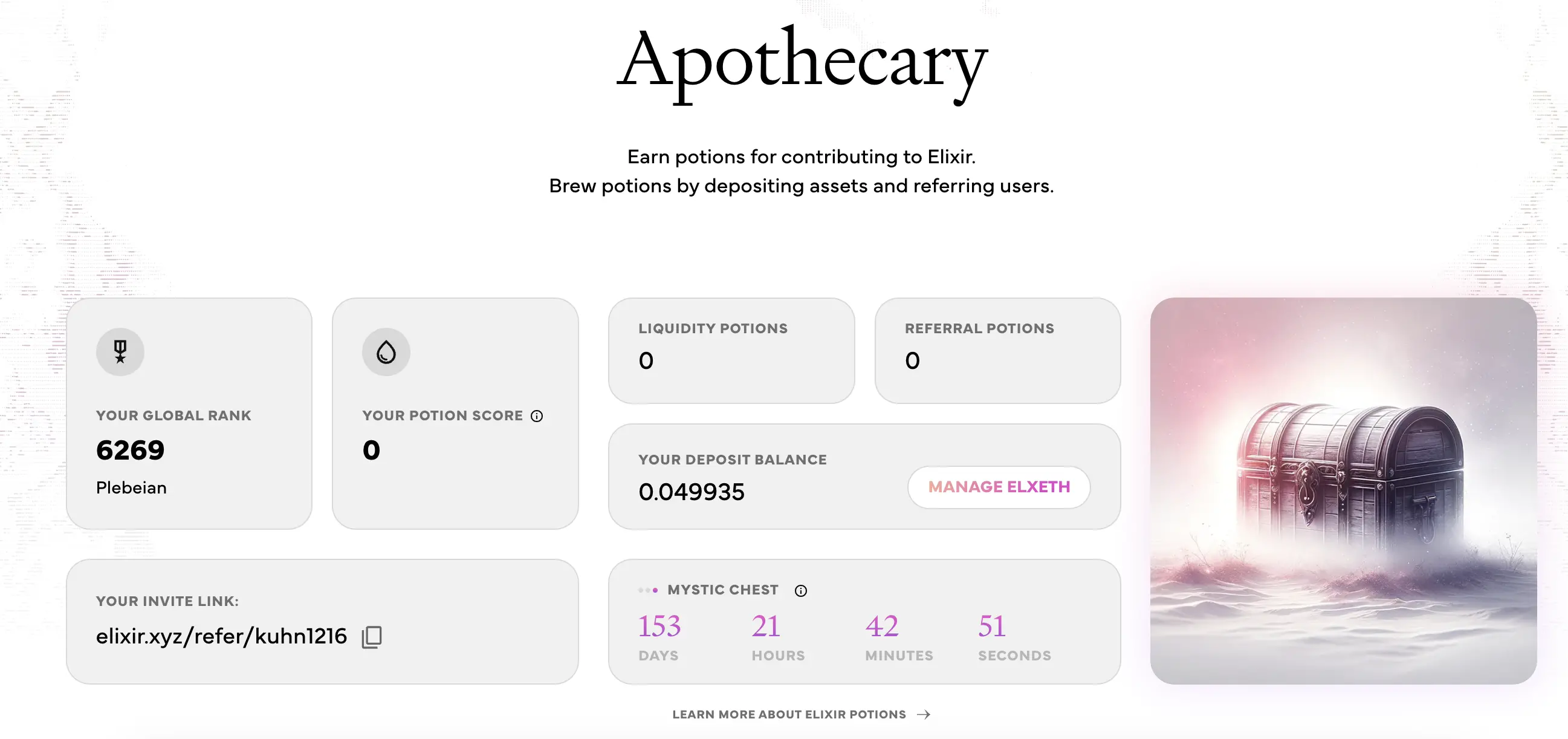

However, in addition to disclosing a new round of financing recently, Elixir also announced the launch of a new product Apothecary. Apothecary is a new points tracking system that supports users to earn some points (potions)/income by depositing assets and attracting new users, helping users track their contributions to the network before the mainnet is launched on August 15 this year.

What are the highlights of Elixir?

Traditional financial markets have long relied on centralized intermediaries to provide liquidity. These institutions and hedge funds optimize liquidity for exchanges through advanced trading strategies and algorithms. However, there are certain risks in entrusting funds to centralized institutions. Therefore, DeFi has been exploring a decentralized order book model. The so-called order book model enables traders to trade directly with each other, relying on mathematical models and liquidity pools to facilitate the trading of token pairs.

Ideally, the order book can not only improve the current problems of low capital efficiency and large slippage of AMM, but also ensure the flexibility of transactions and the decentralization of assets. In fact, order book DEX is more suitable for markets with a large number of tokens such as Bitcoin and Ethereum. However, in some markets with insufficient liquidity and long-tail assets with insufficient depth of supply and demand, the price difference will be too high and transactions cannot be completed. .

According to the official website, Elixir’s goal is to allow anyone to provide liquidity directly to the order book and bring liquidity to long-tail crypto assets. How to realize this idea? The Elixir network opens trading pairs to retail investors (including institutions and market makers) and subsidizes APY. Higher returns will naturally attract more users to provide liquidity directly to the order book through the network. Elixir can be combined with other projects cross-chain, and order book DEX can integrate Elixir into its core infrastructure.

On the one hand, the order book DEX can share the liquidity brought by Elixir as an infrastructure and improve the trading experience; on the other hand, it is difficult for ordinary users to provide liquidity on the order book DEX and can only manually place orders for transactions. Users can automatically do so through Elixir. Place buy and sell orders frequently to earn liquidity fees. In this way, users can provide liquidity more conveniently when using the order book DEX, just like AMM.

From a network architecture perspective, the order book run by Elixir is almost equivalent to the x*y=k curve of Uniswap v2. This curve is used to build liquidity and narrow the bid-ask spread on the order book. It has a very similar feature to AMM LP. Risk and reward. The network reaches a DPoS consensus on orders placed by the exchange.

Additionally, its infrastructure is similar to Arbitrum’s security model, with evidence of fraud published on the Ethereum mainnet. It is worth mentioning that Elixir also integrates public data from various exchanges (including centralized exchanges) to ensure low-latency updates of transactions, positions and order books and consistency of order books across exchanges.

In terms of ecology, the Elixir ecosystem has been integrated with more than 30 DEXs. Because the order book model requires cheap and high-frequency transactions, it has high requirements on the throughput of the blockchain. Most of these projects are exchanges in the L1 and L2 network ecosystem with high throughput and low gas fees, such as Sui, Sei, Starknet, Arbitrum, Blast, Injective, etc., including Vertex, RabbitX, NFTPerp, Orderly Network, dYdX, etc.

Currently, the Elixir network has plans to issue token ELX, but the token economic model has not yet been announced. According to reports, ELX has two main uses. One is for pledging nodes and validators to ensure network security, and the other is used as a community governance token.

What interactions can users do?

Elixir was founded in 2022. It has launched two versions of testnet and is about to launch v3 testnet. This is also the last testnet before the mainnet goes online in August. Currently, users can interact by running nodes, earning points, and providing liquidity for DEX integrated with Elixir.

1. Run node/validator

Currently, Elixir has 13,563 nodes around the world, and users can earn rewards by running nodes. However, the official has suspended node applications for testnet v2 and is preparing for the release of v3. Users can apply for running nodes after v3 goes online.

Related links: https://docs.elixir.xyz/running-an-elixir-validator

2. Apothecary: Earn points

Apothecary, a new product launched by Elixir on March 12, is actually a relatively systematic point tracking tool that can track users’ contributions to the network, integration, minting elxETH, and new additions. In addition, running nodes and integrating with Elixir You can also earn points (potions) by trading on the exchange.

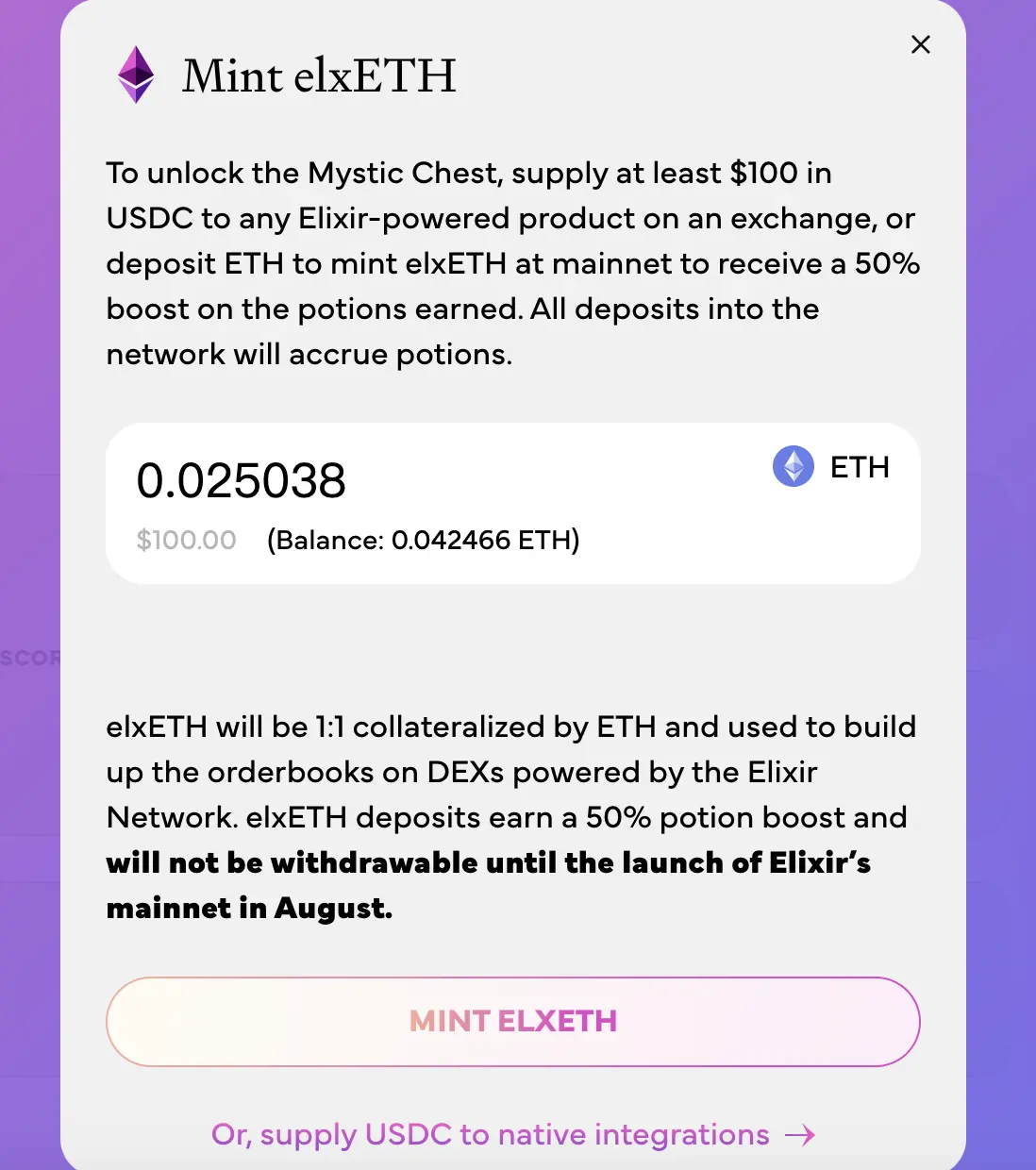

As shown in the picture, users can deposit at least $100 worth of ETH to mint elxETH to unlock the mystery chest. elxETH is a native income token supported by ETH 1:1 ratio. After the mainnet is launched, it will become a full-chain LP token, providing power for the exchanges order book liquidity. Deposited assets will be locked by the protocol and provide liquidity for Elixir-powered products and DEXs. After the mainnet goes online on August 15, users will be able to withdraw cash and unlock treasure chests to gain income. If they choose not to withdraw, the asset will automatically earn rewards from the exchange.

The amount of assets determines the number of points. In addition, inviting new users to deposit assets can also earn points.

Related links: https://www.elixir.xyz/apothecary

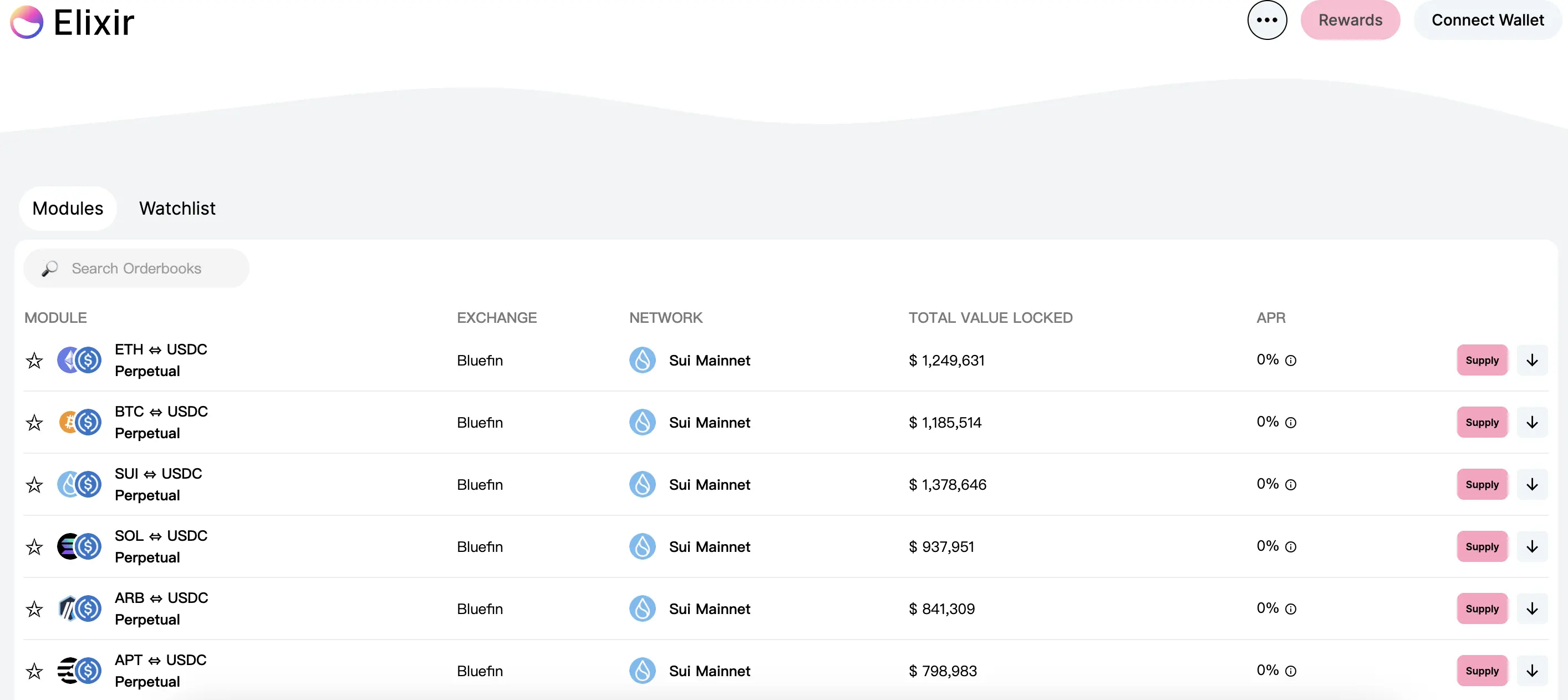

3. Provide liquidity for DEX products integrated with Elixir

Users can also earn points by depositing assets greater than $100 on exchanges in the Elixir ecosystem. But in comparison, you can get 50% more points by minting elxETH on the main network.

Elixir currently supports more than 50% of the order book liquidity on Bluefin, more than 20% of the order book liquidity on Vertex, and more than 40% of the order book liquidity on RabbitX. In addition, upcoming native integrations include dYdX, Hyperliquid, Orderly, etc. More than 30 others.

Related links: https://agg.elixir.xyz/