BTC breaks through its previous all-time high of $69,000, institutions continue to increase their holdings, aiming for $100,000?

Original - Odaily

Author - Azuma

After a long 28 months, Bitcoin has once again reached a new all-time high.

OKX market data shows that BTC broke through 69,000 USDT in the short term, reaching a maximum of 69,080 USDT, surpassing the previous high of 69,040.1 USDT set in November 2021. As of the publication of this article, BTC has fallen slightly and is temporarily trading at 67754 USDT, with a 24-hour increase of 2.51%.

Since it was first priced by the market on May 18, 2010, when Florida programmer Laszlo Hanyecz purchased pizza, BTC has appreciated more than 23 million times from its initial trading price of $0.003.

In addition to BTC, ETH also exceeded 3800 USDT in the short term, reaching a maximum of 3821.99 USDT. It has now fallen slightly to 3786.19 USDT, with a 24-hour increase of 6.52%.

Affected by the upward trend of the overall market, the total market value of cryptocurrency has also grown rapidly. CoinGecko data shows that the current total crypto market value exceeds US$2.65 trillion, up 4% in 24 hours.AlternativeData shows that the trading enthusiasm of crypto users has also increased significantly. Today, the panic and greed index has reached 90, and the level has reached extreme greed.

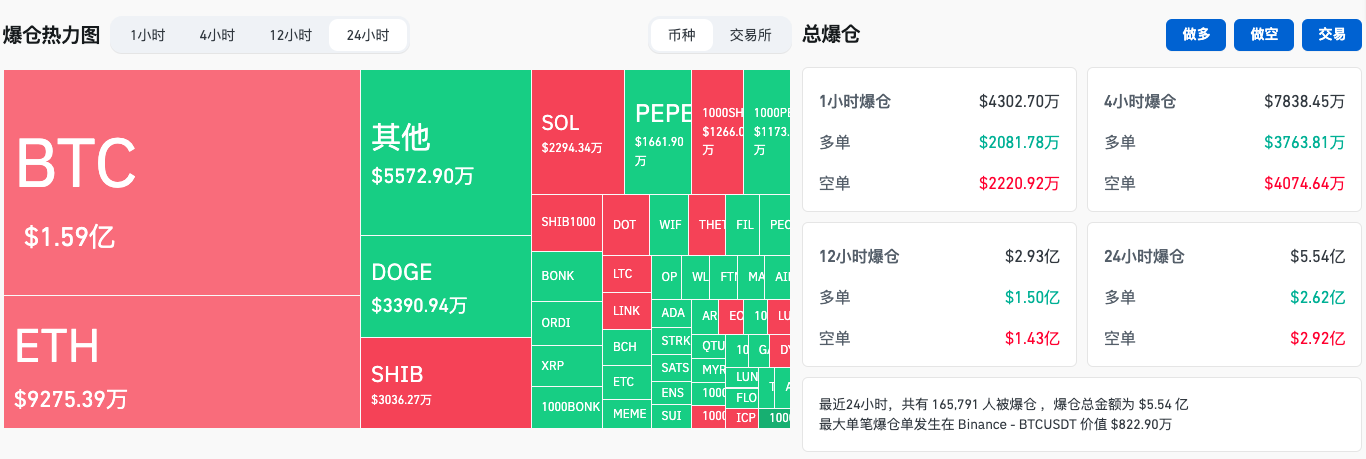

In terms of derivatives trading,CoinglassData shows that the entire network liquidated US$554 million in the past 24 hours, of which short orders liquidated US$292 million and long orders liquidated US$262 million; BTC liquidated US$159 million and ETH liquidated US$92.7539 million.

Spot buying remains strong

ETFs continue to flow in, and BlackRock makes another big move

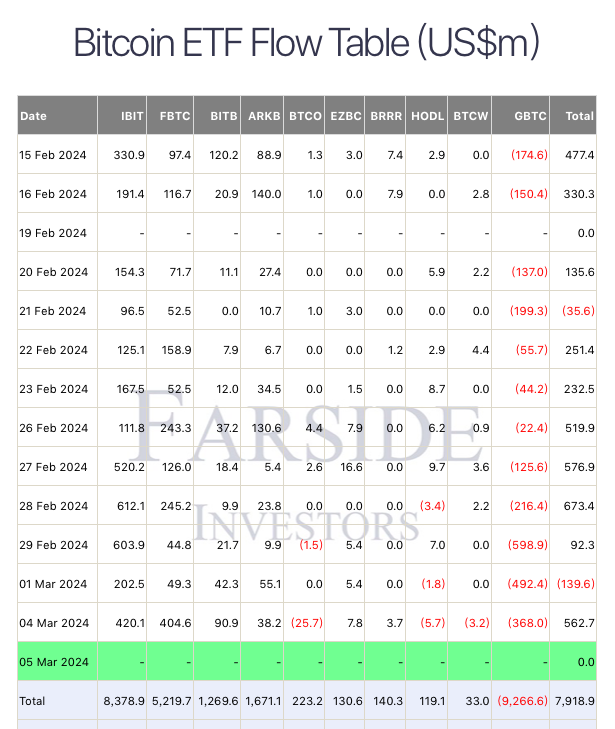

Farside InvestorsAccording to data, since the ETF was approved and launched on January 11, the historical cumulative net inflow of the top ten Bitcoin spot ETFs (including GBTC) has exceeded US$7.918 billion, of which BlackRocks IBIT and Fidelitys FBTC are the main inflows. Inflows of US$8.378 billion and US$5.219 billion respectively completely hedged and consumed GBTCs net outflow of US$9.266 billion.

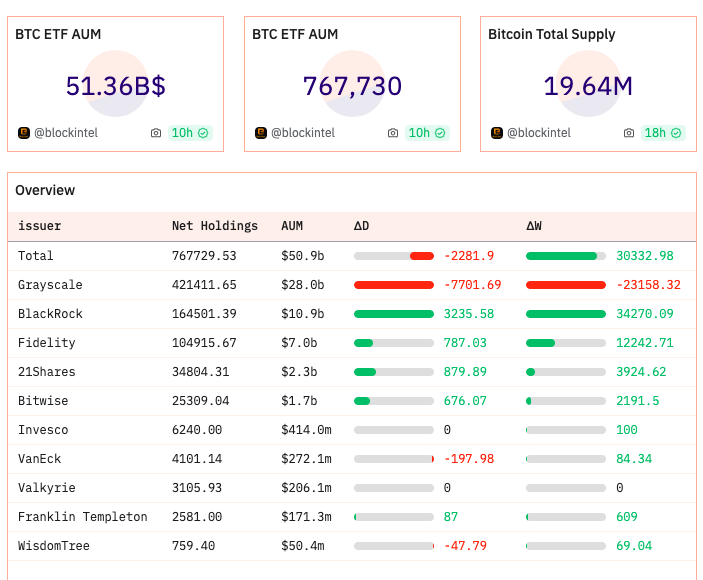

DuneData shows that the total number of BTC held by the top ten ETFs has reached 767,730, and the corresponding total asset management scale has increased to US$51.36 billion.

This morning, BlackRock took action again. In an application filed with the SEC,BlackRock expressed its hope to add Bitcoin ETF exposure to its Strategic Income Opportunities Fund portfolio, a move that will undoubtedly push BTC to more potential buying power.

Giant Whale is adding positions in progress

In addition to buying orders from ETFs, some institutions/whales are also increasing their buying efforts, either explicitly or covertly.

Data disclosed by Tree News shows that this morning MicroStrategy announced plans to sell convertible senior notes due in 2030 with an aggregate principal amount of US$600 million to qualified institutional buyers through private placements based on market conditions and other factors to increase its position. More BTC.

As of the publication of this article, MicroStrategy holds a total of 193,000 BTC, and the average purchase price is 31,544 USDT per coin. Calculated based on US$69,000, the floating profit exceeds US$7 billion. This has also directly stimulated MicroStrategys stock price performance. As of the publication of this article, MSTR is temporarily trading at $1,235, which has doubled in the past half month.

In addition, HODL15Capital also noticed the buying action of a mysterious whale. Since each increase in position is about 100 BTC, this mysterious address is also named Mr. 100. After recent frequent increase in positions, this address has held a total of approximately 51,064 BTC, worth approximately US$3.5 billion.

HODL15Capital emphasized that this is not an ETF address because before the ETF was approved, the address already held approximately 40,000 BTC.

The leverage market is gradually heating up

Posted this week by Greeks.liveMarket OutlookIt is pointed out that the current spot buyers in the mainstream currency market are still very strong.This week is very promising to reach a new high. At the same time, derivatives data became increasingly active last week, and the market leverage level gradually increased.. The strong spot bull market has driven market sentiment, and there is a greater expectation of an acceleration in the upward trend.

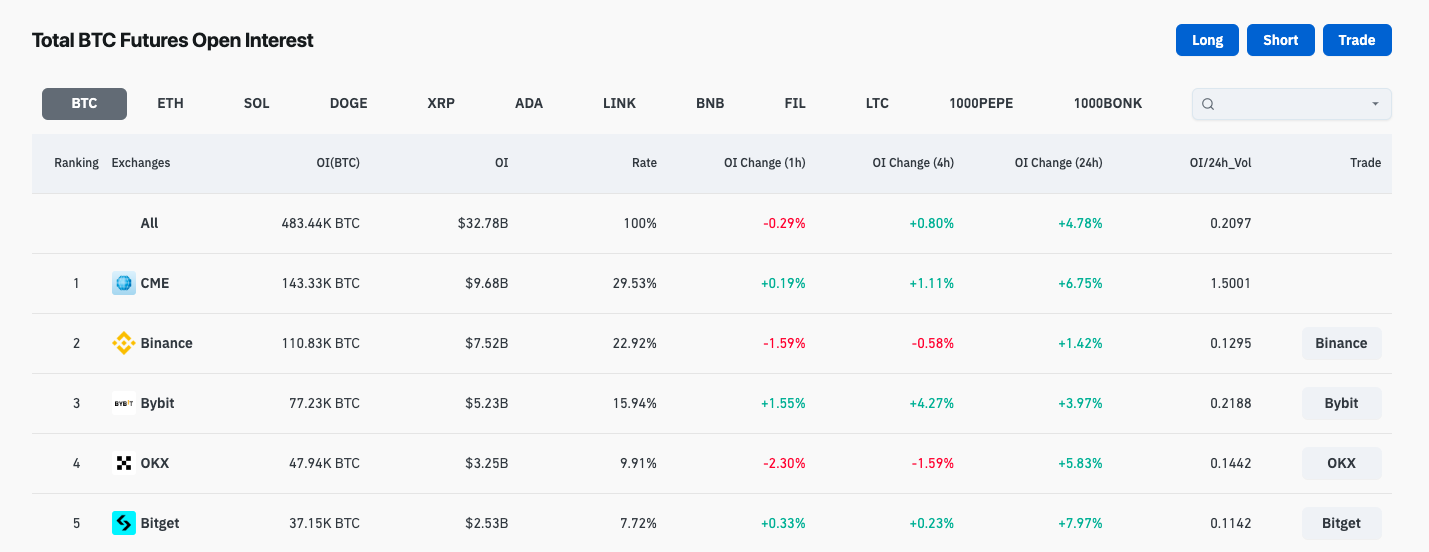

CoinglassData shows that the open positions of BTC futures contracts across the entire network have reached 483,440 BTC, equivalent to approximately US$32.78 billion, with a 24-hour increase of 4.87%.

Among them, the open position of CME BTC contract is 143,330 BTC (approximately 9.68 billion US dollars), with a 24-hour increase of 6.75%, ranking first; the open position of Binance BTC contract is 110,830 BTC (approximately 75.2 billion US dollars). billion), with a 24-hour growth rate of 1.42%, ranking second.

Next step, callback or continue flying?

As BTC refreshes its all-time high, the question that investors are most concerned about right now is undoubtedly whether BTC can stand firm here and continue its upward trend. Regarding this issue, some institutions/big names have recently given their own predictions.

Chris Burniske, Placeholder partner and former head of cryptocurrency at ARK Invest, who accurately predicted that the first day of ETF trading would be the short-term price high, previously said in We are still in the early stages of this cycle.

Pantera Capital also gave a clear direction prediction in the report: In the next 18 to 24 months, the cryptocurrency market is likely to usher in a strong bull market.

Different analysts at Matrixport have given different predictions. Analyst Markus Thielen said that based on past halving data, Bitcoin will reach $125,000 by the end of 2024.

However, Matrixport co-founder Daniel Yan reminded investors to pay attention to risks and predicted that we should see a healthy downward adjustment of about 15% at the end of April, and specific adjustments may occur in March.

Galaxy Digital founder and CEO Michael Novogratz also gave the same judgment. His prediction said: I would not be surprised if there are some adjustments at present. BTC may fall back to around $55,000 (mid-50,000), and then go back to $55,000. A new high.”

All in all, the vast majority of institutions/tycoons continue to be optimistic about the long-term growth trend of BTC, but some practitioners are also warning of potential correction risks. For investors, if they are still optimistic about the subsequent trend of BTC, they may try to conduct risk hedging operations through medium and long-term options.