SignalPlus波动率专栏(20240216):BTC上行势能衰弱,ETH接力继续突破

Yesterday (15 FEB), the U.S. retail sales in January recorded a monthly rate of -0.8%, lower than the expected -0.1%. After the data was released, the ten-year U.S. bond yield once fell below 4.2%, but then rebounded and is now at 4.267%. The two-year yield, which is more sensitive to interest rate policy, returned to above 4.6%, reporting at 4.607%. The Nasdaq/SP/Dow closed up 0.3%/0.58%/0.91% respectively.

Although Chicago Fed President Goolsby calmed the market after the CPI value came out in January that exceeded expectations, according to Golden Ten reports, Atlanta Fed President Bostic said in a conversation yesterday that due to the U.S. labor market and The economy remains strong and the Fed may be in no rush to cut interest rates, warning that its unclear whether inflation will move toward the Feds 2% target. His expectation is that inflation will continue to fall, but faster than market bets suggest. slow.

Source: SignalPlus, Economic Calendar

Source: Binance & TradingView

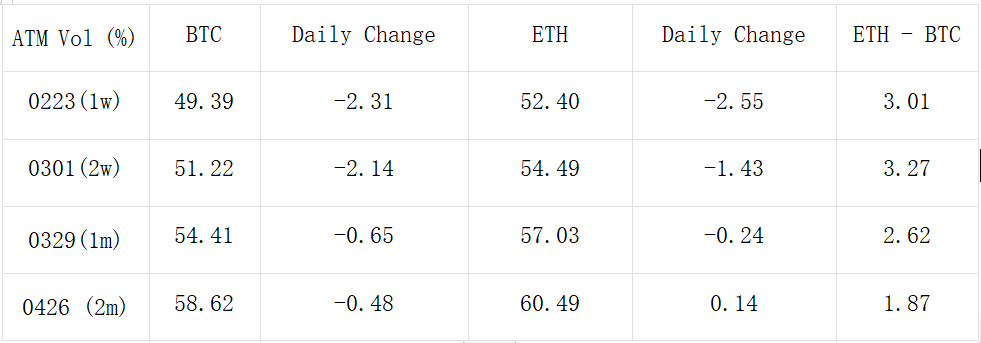

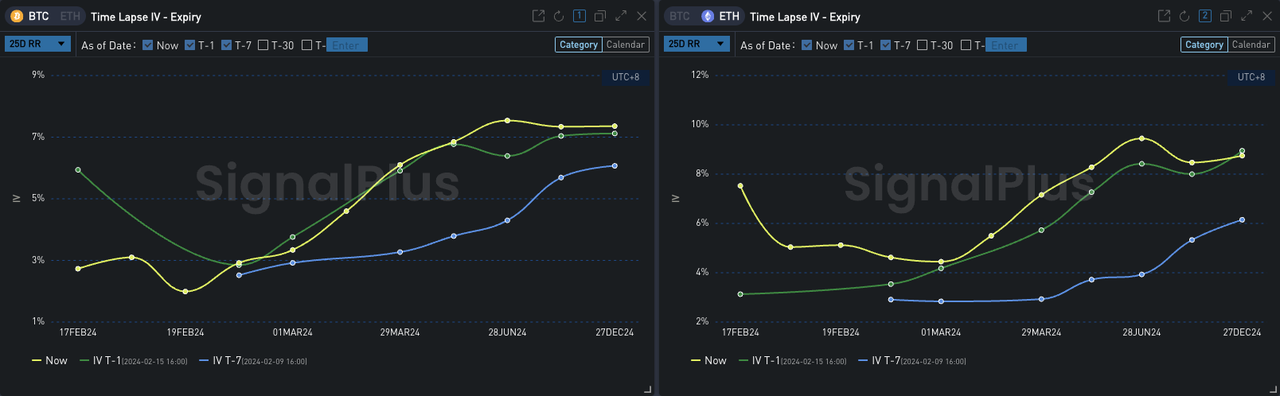

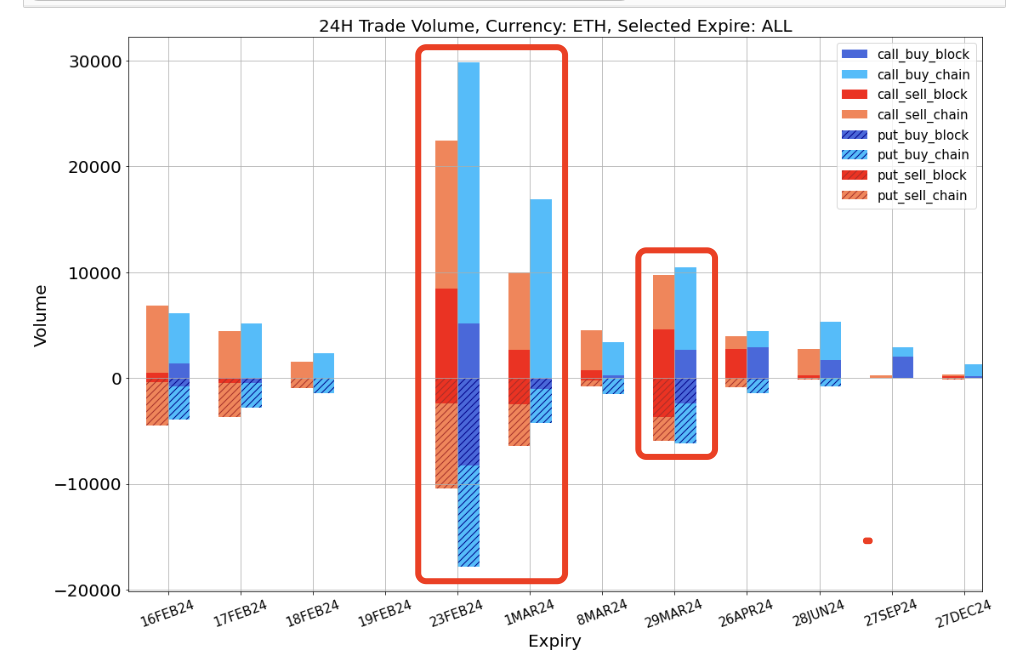

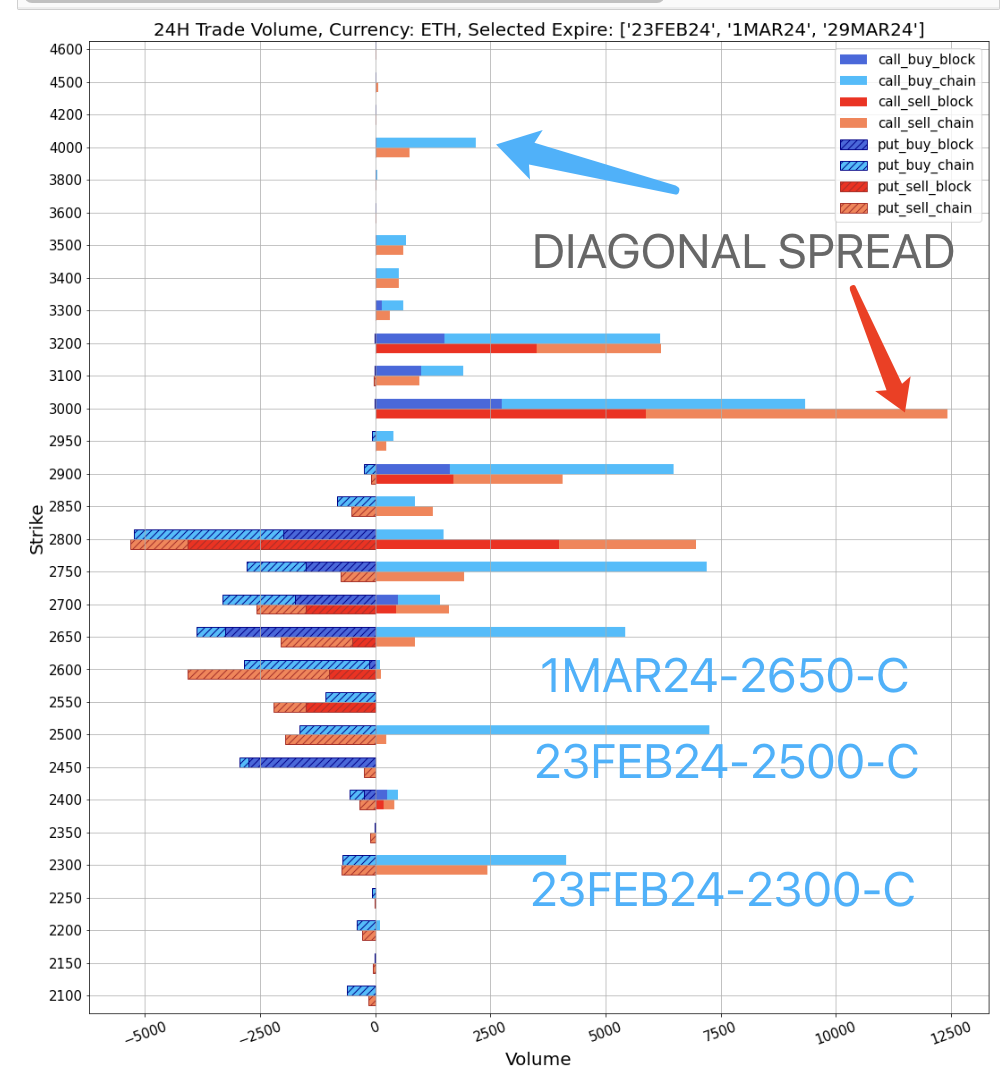

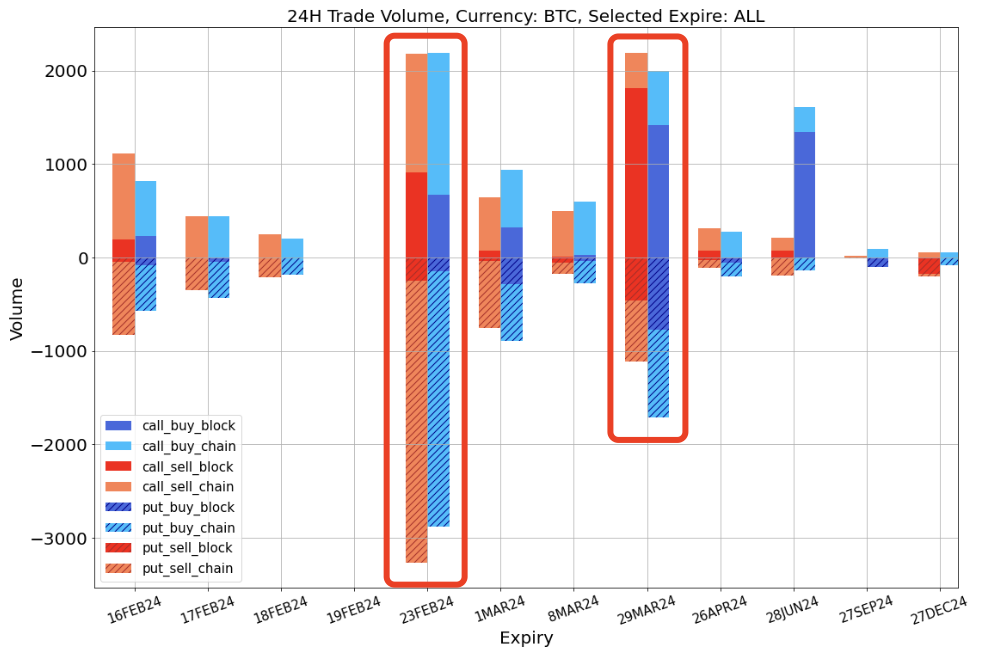

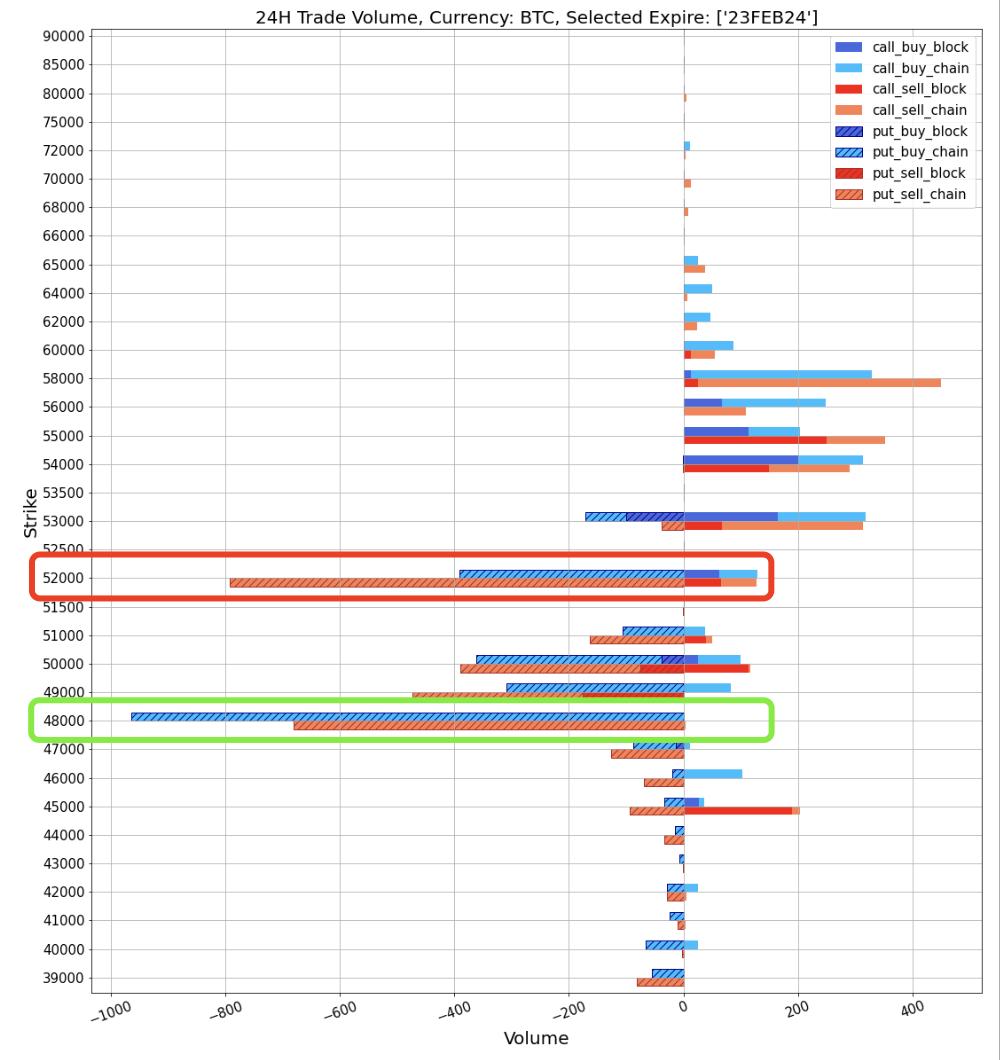

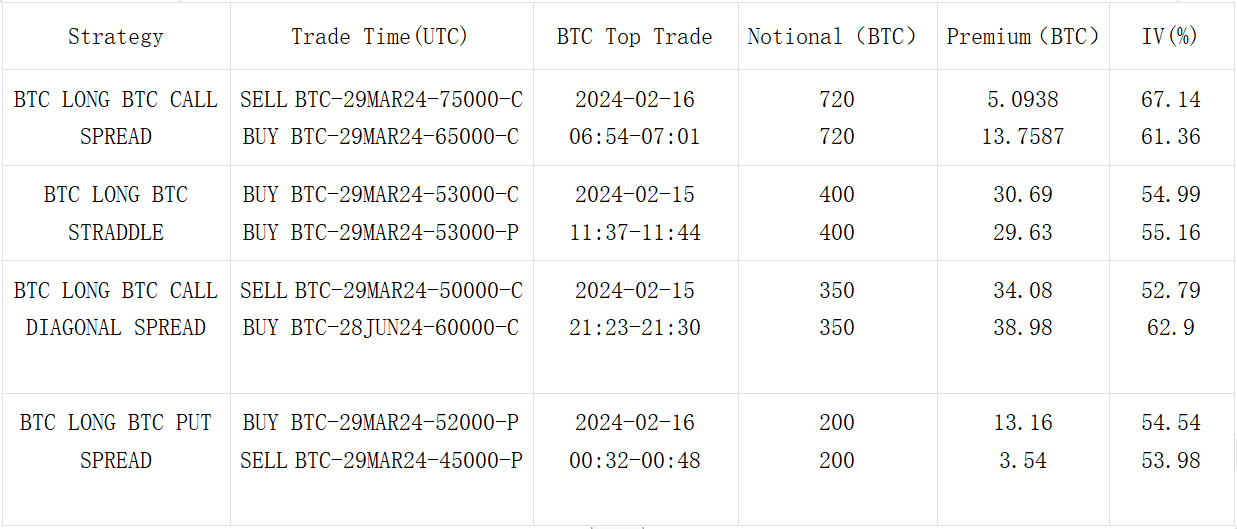

In terms of digital currency, the markets bullish sentiment towards BTC quickly weakened after reaching the $52,000 mark. The price has maintained a slight fluctuation (-0.08%) in the past 24 hours, making the implied volatility surface of options including ETH steeper, with the front-end It fell about 1.5-2.5% Vol. From the transaction distribution, we can observe the game of 23 FEB 52000 vs 48000 Put Spread. The selling pressure is slightly better. At the same time, there is still a large bullish strategy represented by 29 MAR 24 65000 vs 75000 Call Spread on the far end. Open a position (720 BTC per leg). On the other hand, ETH’s upward momentum continued, closing the day at 2819.22 (+1.53%), with a large number of stop-loss orders to close long real-money options near 23 FEB 2300/2500 and 1 MAR 2650.

Source: Deribit (as of 15 FEB 16:00 UTC+8)

Source: SignalPlus

Source: SignalPlus

Data Source: Deribit, ETH has seen a large number of real-valued option stop-loss orders in the short term

Data Source: Deribit

Source: Deribit Block Trade

Source: Deribit Block Trade

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website:https://www.signalplus.com