数字经济风云:Web3.0进化与全球融资动态

Web3 evolution history

Web 1.0: Read-only (1990-2004) Web 1.0 was static and mainly used for information transfer. Users are primarily passive consumers.

Web 2.0: Read and write (2004-present), the rise of Web2.0. This phase focuses on user-generated content, social media, and cloud computing. But data is controlled centrally, and users lose control of their personal data.

In addition to providing content to users, Internet companies have also begun to provide platforms to share content produced by users and participate in interactions between users.

Web 3.0: Can read - can write - can own

Shortly after the launch of Ethereum in 2014, Ethereum co-founder Gavin Wood proposed the premise of Web 3.0. Web3 is an emerging Internet paradigm that aims to reshape and improve our understanding of digital interaction and value delivery. Compared with traditional Web2, the core concepts of Web3 include decentralization, user data ownership, integration of smart contracts and blockchain technology.

Web3 is the next stage of the Internet, which emphasizes decentralization, user data ownership and smart contracts. Compared with the traditional Internet, Web3 uses blockchain technology to make digital interactions more decentralized, transparent and secure. This means that users can control their own data and achieve trustless digital interactions through smart contracts. Web3s goal is to create a more open and fair digital ecosystem.

With the gradual evolution of Web3, its decentralized and open features have attracted great attention in the industry. This attention not only comes from technology enthusiasts and the community, but also attracts the attention of investors. Investors are beginning to realize that Web3 is not just an evolution of technology, but also a disruptive change that may redefine the rules of the digital world. Therefore, the financing storm unfolded rapidly in the history of Web3. Let’s take a deeper look at the financing situation of the Web3 industry in recent years, and how this new trend will shape the future of the digital economy.

Financing Rhythm: Web3’s Financial Journey

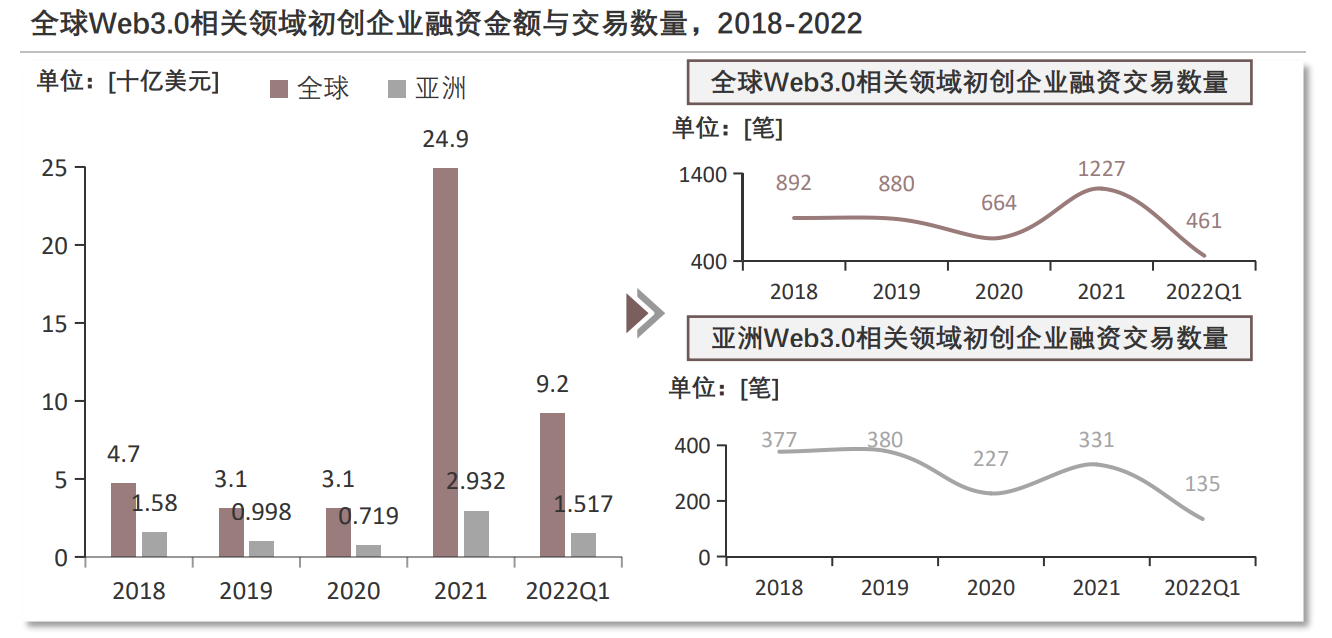

The Web3 investment and financing market is extremely hot. PE/VC investment in the Web3 field has surged since 2021, but most projects are still located in Western countries such as Europe and the United States, while Asian countries are relatively conservative in developing Web3. Although Asia has made great progress in Web3 and digital The asset field faces challenges, but its unique market size, investment activity and policy openness in some countries give it unique competitiveness in global competition. As technology advances and markets develop, Asia is expected to play an increasingly important role in this field.

Here we only take stock of the financing situation of the Web3 industry in recent years.

Globally, companies and projects in Web3.0 related fields remained stable from 2018 to 2020 and were less than US$500 million for the whole year. However, in 2021, they achieved financing of approximately US$24 billion, achieving explosive growth. In terms of investment volume, in 2021 1,277 cases were completed in the year. The total amount of PE/VC investment in Asias Web3.0 related fields was approximately US$2.9 billion, and the number of transactions was 331 cases. . The sense of smell of capital is often very sensitive and good at capturing new business opportunities. Therefore, it can be seen that the development of Web3.0 is still in a relatively early stage.

The activity of the Asian market in Web3.0 related fields is second only to the United States. In 2021, the cumulative financing scale of the Asian market reached 2.9 billion U.S. dollars, and in the first quarter of 2022, it reached 1.5 billion U.S. dollars, half of the total amount in 2021. The number of investments increased , there were less than 400 cases before 2021, but there were nearly 150 cases in the first quarter of 2022. Asian countries and regions including Singapore, Japan, Hong Kong, China, etc. are developing rapidly, while mainland China is still in the exploratory stage. In the future, as regulatory policies It is gradually becoming clear that more adaptable Web3.0 companies will emerge.

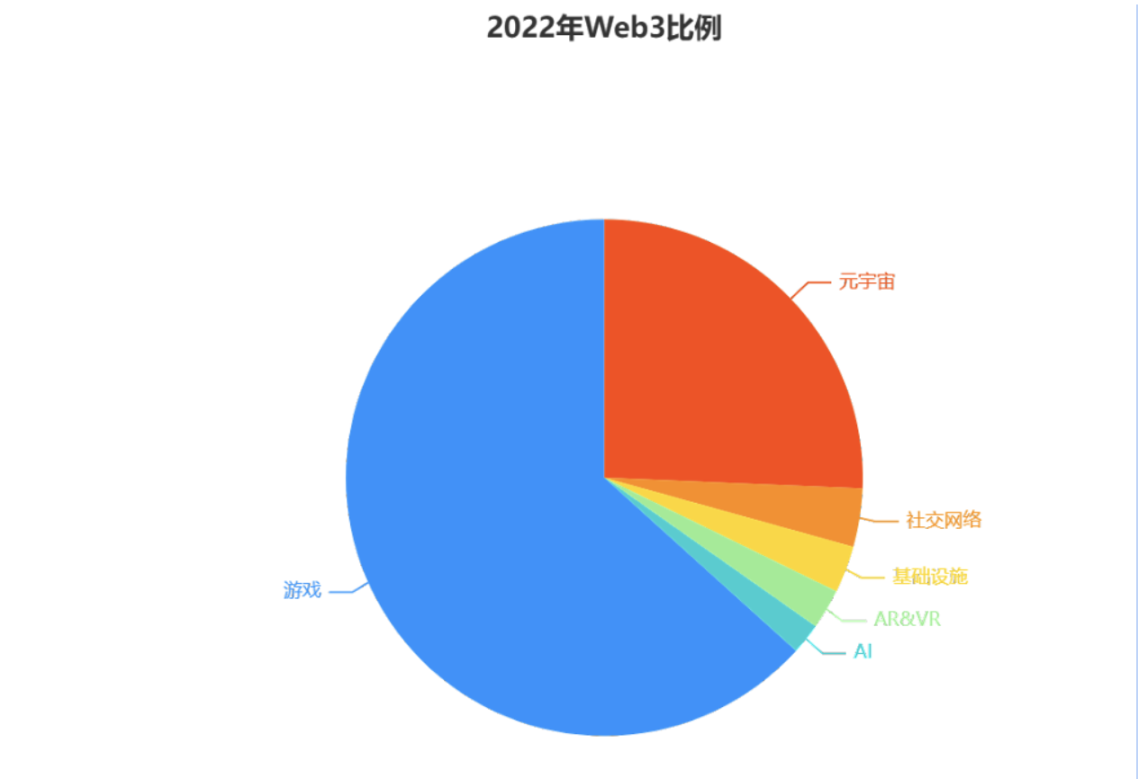

According to Metaverse Posts year-end report, startups in the Web3 field received a total of US$7.17 billion in financing in 2022, an increase of US$4.8 billion from 2021. Games, metaverse and social networks are the three categories with the most financing, receiving US$4.49 billion (accounting for 62.5% of the total investment in Web3), US$1.82 billion (accounting for 25.4%), and US$259.1 million (accounting for 3.6%) respectively. . In addition, the infrastructure, ARVR and AI categories received investments of US$208 million, US$178.6 million and US$136.5 million respectively.

Citing startups in the fields of gaming, metaverse, social networks, infrastructure, artificial reality and virtual reality (AR VR), and artificial intelligence (AI) as examples, the report calculates the exact amount of investment collected to be 7,169,997 , $888. Despite the bear market impact, the total is still $4.8 billion higher than in 2021. Generally speaking, 2022 is a critical year for the outbreak of the Web3 industry.

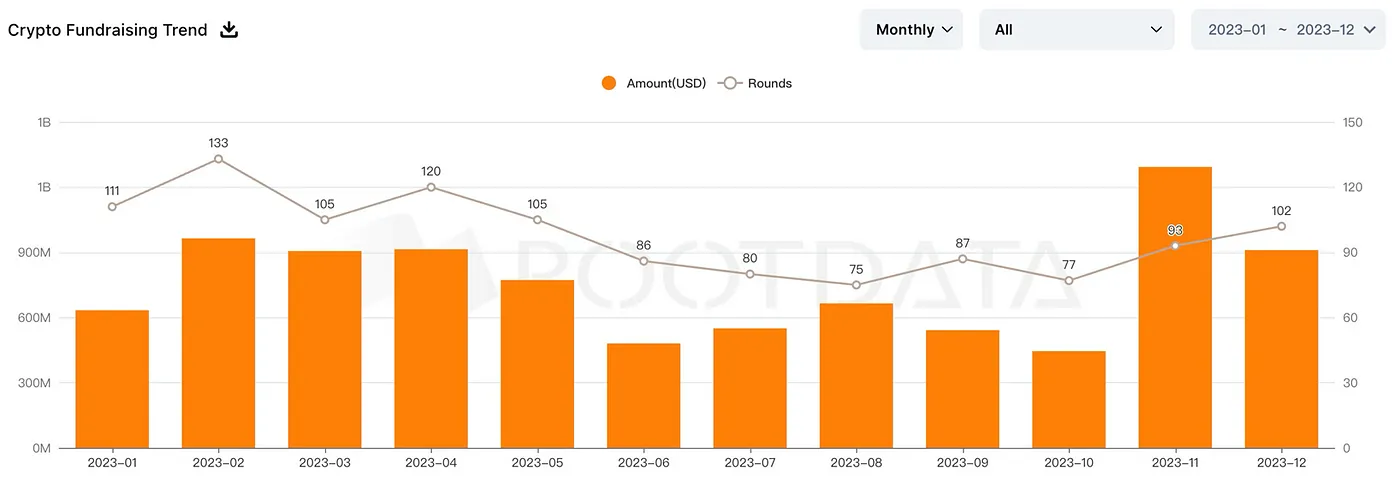

According to the 2023 Web3 Industry Development Research Report and Annual List released by RootData, the total financing of the Web3 industry in 2023 will be US$9.13 billion, a decrease of 68.8% from 2022, and the number of financings will be 1,174, a decrease of 35.9% from 2022. Among them, the ten projects with the highest financing amounts are Phoenix Group, Ramp, Wormhole, Swan, LINE NEXT, Blockstream, LayerZero, Worldcoin, Arkon Energy, and Blockchain.com, all exceeding US$100 million.

Spurred by the good news about the Bitcoin spot ETF, BTC price tested the $30,000 mark several times before breaking through. Benefiting from the short primary and secondary market channels of Web3, financing in the fourth quarter exceeded that of the first three quarters, showing a gradual recovery and growth trajectory.

Web3 has seen frequent primary fundraising since Q3 2023. Lightspeed Faction announced the completion of US$285 million in fundraising (14% oversubscribed), Standard Chartered Bank and Japanese financial giant SBI launched a US$100 million Web3 fund, and CMCC Global, a Web3 fund supported by Richard Li, completed US$100 million in financing. As Web3 moves towards compliance, the close connection between the primary and secondary markets is prompting more investors to regard the primary and secondary markets as a key investment and exit path.

Financing in the Web3 industry has not been smooth sailing. While this innovative field is constantly being explored, it also faces some potential challenges. In particular, it is closely related to regulatory and policy changes on a global scale. The Web3 industry not only needs to respond to market changes, but also must move forward cautiously in a complex and ever-changing regulatory environment. We cannot ignore the policy challenges we face and the continuous adjustments in supervision. Only through joint efforts and close cooperation within and outside the industry can we ensure the continued prosperity of the Web3 industry and lay a solid foundation for future digital innovation. In this journey of innovation, Web3 is destined to continue to lead the wave of digital revolution.