加密经济实验Orb Land:600%哈伯格税能否实现个人咨询服务?

In World of Warcraft, the most attractive items are usually those that can be used continuously but require a cooldown, rather than static rings or ordinary items. What if this interesting concept is extended to the NFT field? We can think of the NFT wallet as the magic bag in the World of Warcraft game. So besides simple small pictures, what else can we store in this wallet?

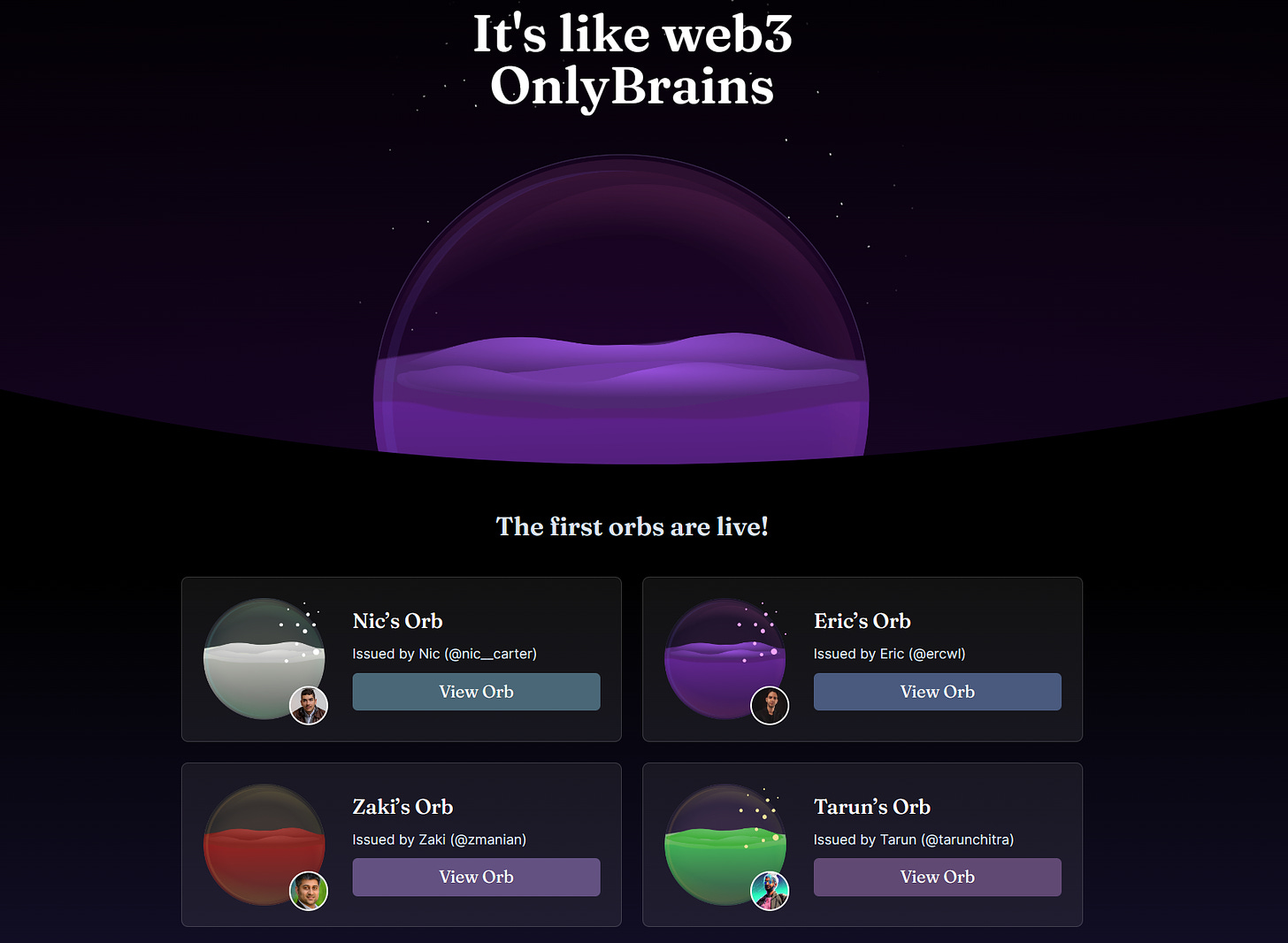

Eric Wall, founder of Taproot Wizards, has launched a project called “Orb Land”’s cryptoeconomic experiment aims to tokenize personal consulting services into NFTs. Holders who purchase Orb will gain the right to ask questions to the Orb creator and resell this right. Technically speaking, Orb is an improved ERC-721 that supports the ERC-721 interface and all transfer-related functions are restored. Although Orb can be displayed on OpenSea, it cannot be listed for sale on NFT trading markets such as OpenSea, Sudoswap or Blur. In addition, Orb manages ownership features through auctions and the Harberger tax system.

(Eric Wall is a cryptocurrency researcher, critic and investor who once served as chief investment officer of Arcane Assets. He is currently a member of the board of directors of the StarkNet Foundation, the founder of the Bitcoin Ordinals project Taproot Wizards and the Bitcoin NFT project Quantum Cats.)

On the Orb Land page, we can browse each creators Orb. Different Orbs have different functions. Currently, the QA Orb is the dominant one. In other words, Orb holders have the right to submit questions to the Orb creator and receive text replies within a certain period of time (cooling time). These interactive information will be recorded and submitted to the Ethereum chain. Note that only one question can be submitted per call. In addition, the liquid inside the Orb represents the remaining time the holder can hold the Orb, and the radiance emitted by the Orb is related to the cooling time. As the cooldown approaches, the radiance effect will gradually increase.

Harberger tax

The Harberger tax is a radical economic policy proposed by Arnold Harberger that changes the definition of ownership. It mainly includes two core ideas:

The price of the asset is self-assessed by the asset owner, and taxes are payable on this self-assessed value;

Anyone can acquire ownership of an asset by purchasing it at any time at a price set by the asset owner;

Under a Harberger tax system, asset owners would be incentivized to set a relatively low sale price to minimize the amount of tax that must be paid, effectively allowing the market to price the asset. In the Web3 project, combining the Harberger tax can promote NFT circulation, because all NFTs will be permanently auctioned, and NFT holders must set a price at which they are willing to sell, allowing anyone to buy at any time.

Orb Land is an encryption use case that incorporates Harbergers Harberger tax. When purchasing Orb, users need to set a price they are willing to sell at, and must pay a certain percentage of tax to the Orb smart contract to maintain Orb ownership. For example, if you purchased an Orb for 1 ETH and set a sale price of 2 ETH, the Harburg tax rate for the Orb is set to 150% per year. In order to maintain ownership of the Orb, you must Pay 2 × 150% = 3 ETH in taxes. Of course, if someone bids 2 ETH to buy, you will get 2 ETH, minus the fees.

The benefits brought by Orbs adoption of Harberger Harberger tax include promoting reasonable pricing for users and increasing asset circulation. On the one hand, it enhances the practicality of Orb. If the user who originally purchased Orb has no intention of using Orb and does not want to sell it to other users, Orb will lose its meaning. On the other hand, the Harberger tax can also ensure that the Orb sales price is within a reasonable range, because once the sales price is set too high, the holder will have to pay a high monthly tax to maintain Orb ownership.

How does Orb work?

Currently, Orbs cannot be created at will, but the application list is open to the public. Once the Orb is successfully created, it will be sold through auction. During this process, creators need to provide a series of commitments for their Orb, including the Orbs Harberger tax rate, cooling time, privacy settings, exclusivity conditions and deadlines, etc.

The auction winner will become the Orb holder. According to the rules of Harberger tax, the holder needs to set a sale price and pay the corresponding Harberger tax based on the set sale price and holding time. Anyone has the right to purchase Orb at any time and become a new holder, while current holders can adjust the sales price at any time. If no one buys in the end and the holding funds are exhausted, the system will automatically start the auction mechanism, and if no one bids at the end of the auction, the Orb will be returned to the creator.

Orb holders have the right to ask questions to the creator, and the creator needs to answer the questions within a set cooling time. If the creator fails to answer the questions within the specified time, he will lose the Harberger tax and future sales from the Orb. the ability to collect royalties. In addition, the Orb contract also provides a feature where Orb holders can flag any low-quality replies on the chain, and the Orb Land website will display a list of flagged replies.

During the entire process, Orb Land will charge a 5% platform fee. In addition, the initial auction revenue and Harberger tax revenue belong to the creator, and the creator can also receive royalties from secondary market sales and auctions. In addition to earning income through re-auctions, Orb holders can also earn potential tip income by asking questions suggested by bystanders. Theoretically, if the benefits from tips are greater than the Harberger tax, a net surplus is possible. From this perspective, Orb Land is more like a strategy game. The holder can attract others to buy Orb by asking interesting questions and hiding the answers.

What are some interesting questions and answers on Orb Land:

Currently, there are four Orbs on Orb Land, each belonging to the general partner of Castle Island VenturesNic Carter, Founder of Taproot WizardsEric Wall, founder of on-chain investment protocol Sommelier FinanceZaki Manianand founder of DeFi risk manager GauntletTarun Chitra。

Nics Orb: Selling price is 6 ETH, Harberger tax rate is 150% for one year, cooling time is 7 days.

Erics Orb: The price is 4 ETH, the Harberger tax rate is 600% for one year, and the cooldown time is 7 days.

Zakis Orb: Selling for 2 ETH, Harberger has a tax rate of 600% for one year and a cooldown of 14 days.

Taruns Orb: Selling price is 2 ETH, Harberger tax rate is 150% for one year, cooling time is 10 days. Also, all Tarun Chitra answers are kept private.

These creators gave their own opinions on various cryptocurrency and blockchain-related questions. This article excerpts some interesting content:

In response to questions about the performance of ETH, BTC and SOL, Nic Carter said: Although Bitcoin will usher in many positive factors from ETFs and other aspects in 2024, compared with BTC and SOL, I still think that ETH will eventually perform better performance. The market needs to recognize that Ethereum has a unique and achievable roadmap. To ultimately realize Vitalik’s Rollup-centric vision, the short-term pain of a non-uniform roadmap is worth it. In my opinion, ETH is the only platform that has really figured out how to charge fees at Layer 1 and return funds to token holders, although it is currently facing some crises and is not sure whether to lean towards capital returns or lowering overall fees to compete (which seems to be the case now) toward low fees), but Ethereum has executed on its roadmap better than any project.”

Regarding the question of which projects can participate in the seed round, Eric Wall responded, “There are currently many seed round financing projects emerging in the Bitcoin Layer 2 and Ordinals fields, with valuations ranging from 15 million to 40 million US dollars, such as Alpen Labs, Xverse and Chainway.”

Regarding the question of how ChainLink can become a solution to Ethereum consensus overload, Eric Wall said, Chainlink itself cannot solve any problem, but if the Chainlink oracle is allowed to decide what is true and what is false in an independent system, such as Bitcoin Coin Drive Chain or Ethereum Layer 2 protocol, then these systems will become Chainlink licensed side chains. Taking the drive chain as an example, we can design it like this: when miners transfer drive chain funds, the Chainlink oracle can be supported as a backstop , miners need permission from the Chainlink oracle in order to move funds. While I do not recommend using the Chainlink algorithm to power the chain, I see no harm in adding a Chainlink oracle as a watchtower in a fraud-provable system. However, even if Chainlink can alleviate the problem, but what happens when Chainlink fails?”

In terms of ensuring the impact of the PoS chain on Bitcoin’s security budget, Zaki Manian said, “Bitcoin’s power as a timestamping system is closely related to the release volume, so it needs to be a valuable data availability system to ensure that the release volume is exhausted. and ultimately its own security. I think if PoS starts adding timestamps to Bitcoin, Bitcoin’s relevance will increase in the growing world of high-throughput chains.”

Regarding whether only the DA layer and consensus chain can achieve sustainable development, Zaki Manian said, “Unless there are significant network effects between multiple applications sharing a DA layer, the sustainability of a pure DA system is still a question of Challenge. Staking derivatives provide the possibility for pure DA systems to achieve similar currency properties, while heavy staking allows it to explore higher-level valuable services, such as oracles and sorters. New tokens like TIA are in application The layers ability to capture opportunities is vertical at best.

Summarize

Combined with the Harberger tax, Orb does bring advantages in NFT utility and market liquidity, and provides creators with ongoing monetary value. But for holders, the so-called Harberger tax system may bring a heavy financial burden. Eric Walls Orb was auctioned in April 2023. Pawle.eth initially purchased it for 10 ETH, but eventually chose to give up ownership because under the Harberger tax system, he had to pay Eric Wall $3,700 per month. However, in response to this incident, the Orb Land team also proposed a solution, introducing a new function relinquishWithAuction for Orb, encouraging holders who want to sell Orb to conduct a Dutch auction, thereby promoting a smooth transition of ownership and maintaining Market liquidity.