解析Sui生态流动性协议龙头NAVI:NAVX借贷+LSD双轮驱动

introduction

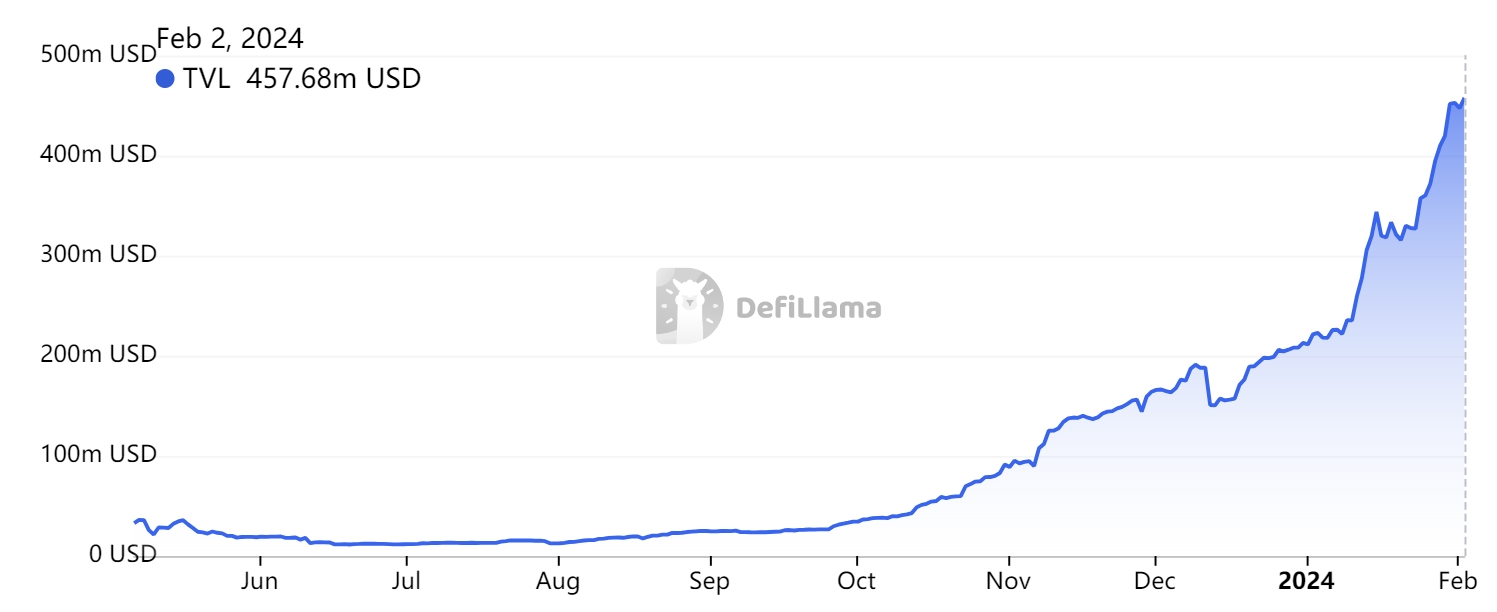

Transaction and lending protocols are the cornerstone of the ecological development of all chains. The former is the basic need of users, while the latter meets users diverse needs such as liquidity, leverage, and hedging. Recently, the Sui ecosystem has experienced explosive growth. One month ago, Sui TVL exceeded US$200 million, an increase of nearly 500% compared to September. And just last week, TVL exploded again, exceeding US$400 million.

With the explosion of Sui, NAVI Protocol, the first native one-stop liquidity protocol on Sui, has also experienced substantial growth in users, TVL and strategic development. On January 31, NAVI Protocol’s TVL exceeded US$150 million, with a weekly increase of more than 80%, becoming the DeFi project with the highest TVL in the Sui ecosystem.SuiVision data display, NAVI has completed more than 5.4 million transactions and has 1.11 million active addresses. In addition, NAVI Protocol recently acquired the liquidity staking protocol Volo, acquiring nearly 35% of the Sui ecological liquidity staking track. NAVI aims to strategically and simultaneously develop lending + liquidity staking, and through two-wheel drive, it will help Sui explode. Gain leadership at the same time.

One-stop liquidity protocol

Mainstream vs. long-tail lending

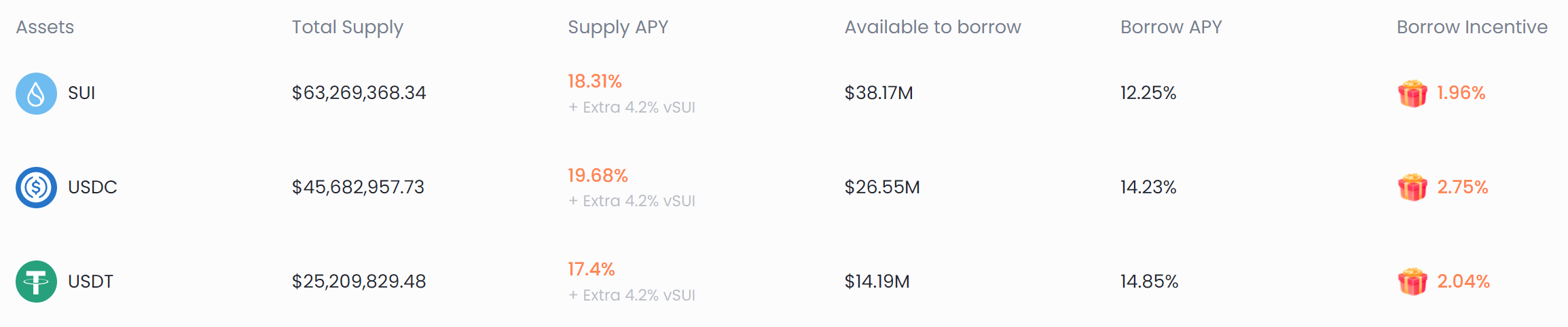

NAVI provides lending services for a series of mainstream tokens (including SUI, USDC, USDT, etc.), with deposits exceeding US$63.26 million, US$45.68 million, and US$25.2 million respectively. Compared with the entire ecosystem’s US$400 million TVL funding, And the relevant token pools all support cross-pool lending, so ecological users of all fund sizes can make full use of NAVIs fund pool for DeFi applications.

NAVIs lending interest rate model is a double-line interest rate model. The interest rate for borrowing is different according to the different utilization rates of the capital pool. Users can borrow money according to the interest rate after sufficient market pricing and will receive NAVIs borrowing incentives. The following official data shows that SUI, USDC The supply interest rates of USDT and USDT are 18.3%, 19.6% and 17.4% respectively. Especially after the huge market demand enters the second fold, adding the Boosted rewards provided by NAVI will also bring significant benefits to lenders.

Among the three leading lending protocols on Sui, NAVI’s user borrowing amount reached $60 million, Scallop’s borrowing amount was $14.1 million, and OmniBTC’s borrowing amount was $22.4 million.Market share as high as 62%, highlighting the significant competitive advantages of the protocols design structure and operation, and users strong willingness to use NAVI as the main lending channel. In addition, NAVIs fund utilization rate is 40%, once again demonstrating the borrowers willingness to apply. On the other hand, the full utilization rate is also more attractive to lenders.

In addition to the above assets, NAVI also supports tokens such as CETUS (the DEX with the largest TVL on Sui), vSUI (SUI LSD token issued by LSD protocol Volo), haSUI (SUI LSD token issued by LSD protocol Haedal), etc., through rich The lending support currency ensures users’ DeFi composability and also brings a second growth curve to the protocol.

Robust risk control design

While providing users with rich lending assets and depth, NAVI Protocol has also established a series of mechanisms to reduce the risk of bad debts and other extreme situations, and provide effective risk control for user assets.

Long-tail asset deposit limits: NAVI limits the supply of collateral assets to avoid risks from specific long-tail assets. Specifically, for various tokens with small market capitalization, high FDV and weak liquidity, the excessive supply of such tokens will bring structural risks. Whether it is a huge amount of unlocking or being attacked, after such assets occur, There is a high probability that a supported position will not be liquidated, resulting in a bad debt, and this mechanism is designed to avoid such a situation.

Long-tail asset borrowing restrictions: NAVI also sets an upper limit for borrowing in full capital pools using specific pools as collateral. Similar to the supply cap, the debt ceiling can ensure that certain long-tail assets cannot be used to mortgage excessive borrowing positions, thereby achieving fine-grained risk control.

Borrowing Limits: NAVI sets mandatory borrowing limits on all accounts, calculated as a percentage of the value of the collateral, to ensure that users maintain a safe collateral ratio and protect the loan pool from defaults.

The current liquidity of NAVI’s 150 million TVL is evenly distributed. According to Leaderboard data, the largest lender provided $7.9 million in liquidity, and the remaining 9 addresses in the top ten provided $27.7 million in liquidity. According to official data, 50% of liquidity providers supply funds between 5,000 and 500,000 US dollars. The platform’s liquidity levels are reasonably distributed, and there is no risk of sudden withdrawal of liquidity from large users. However, a large number of users Participation further laid the foundation for the stability of the capital pool.

In summary, through the borrowing-side mechanism, numerical limits, and loan-side distribution control, NAVIs lending capital pool provides a safe and stable guarantee without affecting efficient operation.

One-stop platform

As mentioned above, transactions, lending agreements and even further leverage and hedging are the basic activities of users and the cornerstone of chain development. The vast majority of activities fall into this scope, and the demand for the use of protocols is strong. In the current process of users participating in a specific ecosystem, users often face problems such as the complexity of finding protocols that meet their needs, excessive management costs of too many protocols, and insufficient security. NAVI Protocol effectively solves the above difficulties and problems by building a one-stop platform that links the front and back ends of user needs.

At the front end of the activity, that is, fund transfer, NAVI has integrated HeroSwap, allowing users to directly cross-chain trade ETH, BTC, SOL and other assets from other chains to Sui. In addition, it has also incorporated the cross-chain protocol Portal Bridge, which enhances Suis Accessibility and fast lanes for user introduction.

In the middle core part, NAVI’s core business of lending, NAVI provides a deep lending pool of mainstream and long-tail assets, ensuring that users’ various DeFi needs can be met. The asset categories supported by NAVI are still expanding, and the acquisition of Volo further demonstrates its ambitious goal of vertical expansion.

In the back-end part, that is, the management and monitoring aspects after ecological participation. NAVI launches a centralized reward management page to provide the most direct Farming channel for all basic participants. NAVI cooperates with BlockVision to launch a one-click query function for transaction history, providing advanced users with the most detailed data to further guide DeFi transactions. Its Leaderboard aims to help users identify the community and early supporters in a systematic way, and help large traders make decisions.

Multidimensional strategic expansion

Financing situation

On January 31, NAVI Protocol announced the completion of US$2 million in financing. OKX Ventures, dao 5 and Hashed three first-line cryptocurrency funds jointly led the investment, Mysten Labs, Comma 3 Ventures, Mechanism Capital, GeekCartel Capital, Nomad Capital, Coin 98 Ventures, Cetus Protocol, Maverick, Viabtc, Assembly Partners, Gate. io, Hailstone Labs, Benqi, LBank Labs, etc. participated in the investment.

NAVI Protocol said it will use this round of financing to expand its one-stop lending and LSD platform.

Acquisition of Volo, expanding LSD territory

On January 17, NAVI Protocol announced the acquisition of Volo, a decentralized liquidity staking protocol. The liquidity pledge agreement allows users to deposit the original locked assets into the agreement, deposit the locked assets into the agreement on behalf of the user and issue asset certificates to the user. The user retains the asset income rights while releasing liquidity. Representative assets include stETH, CRX, stATOM wait. Volo allows users to stake SUI and issue them the liquid staking token vSUI. Currently, vSUI has no locking restrictions and can be used in a series of ecological protocols such as NAVI Protocol, as well as in DEXs such as Cetus, FlowX, Turbos and Kriya Dex. Trading.

DefiLlama data shows that the current TVL of the Liquid Staking category in the Sui ecosystem is US$24.8 million, with Volo accounting for 26.6%. Through this acquisition, NAVI Protocol quickly entered the LSD track and occupied an important strategic position.

Analysis of NAVI LSD’s strategic intent

Whether it is tokens, protocols or ecology, one of the elements that Web3 users are most concerned about is liquidity, including the liquidity of funds entering and exiting the market and the liquidity of assets. In the current DeFi design, in order to avoid panic stampedes, there are often waiting period restrictions for the release of token pledges. The most well-known ones in terms of ecology are ETH PoS pledge, ATOM node pledge, and in terms of protocols, CRV (Curve), etc. The vast demand for liquidity has led to the emergence of liquid collateral derivatives (LSD) such as stETH, stATOM, and CRX. Users can obtain liquidity without losing the value of the collateral.

However, not all LSD protocols can ensure that the ratio of mortgage assets and liquid staking tokens (Liquid Staking Token, LST) remains or is close to 1:1. Even stETH has experienced an unanchoring of more than 10% in 22 years. For example, the ARB staking agreement PlutusDAO on Arbitrum, its ARBs LST plsARB is currently unanchored by 47%, and has remained at this level of unanchoring for several months. Therefore, for an ecosystem, an LSD protocol that can provide sufficient liquidity and operate effectively to ensure the anchor ratio is crucial.

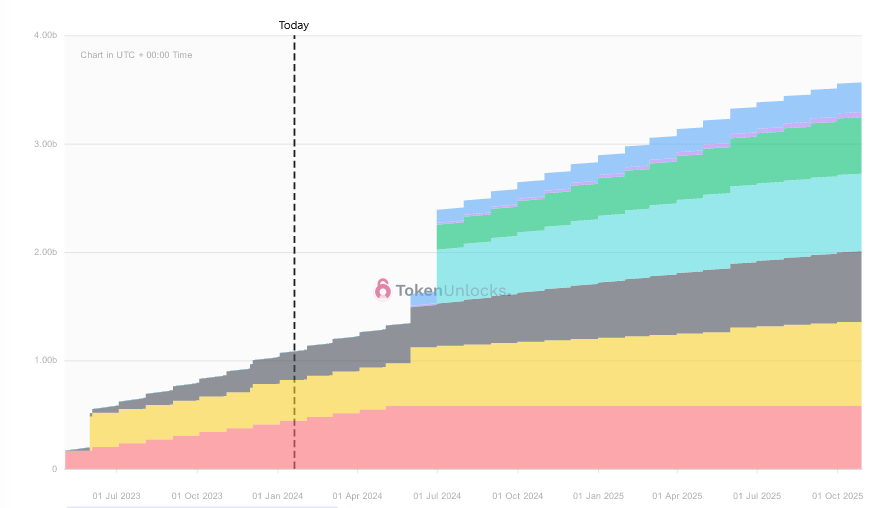

TokenUnlocks data shows that the current circulation of SUI is 1.1 billion. In addition to regular monthly unlocks, there will be two large-scale unlocks in July 2024. By the end of 2024, the circulation will be close to 2.9 billion.

As the 24-year bull market is expected to increase, the circulation and market value of SUI are expected to increase accordingly. A suitable agreement is needed to undertake the demand for SUI and ensure its liquidity and stability. NAVIs acquisition of Volo ensures its strategic position and lays the foundation for further development. As an ecological-grade LSD, SUIs considerable volume and revenue will effectively promote the development of NAVI. In addition, the LSD business can be combined with NAVI’s lending business to fully unleash its DeFi portfolio and comprehensively and continuously leverage the advantages of vertical two-wheel drive.

Open the governance token NAVX IDO

While announcing the financing, NAVI also announced its IDO plan for the governance token NAVX on Cetus. The IDO event will start at 20:00 (UTC+ 8) on February 4 and last for three days. The number of IDO tokens accounts for 1.2% of the total NAVX (12 million), 0.96% is allocated to the NAVX-SUI pool, and 0.24% is allocated to the NAVX-CETUS pool. in:

The NAVX-SUI pool adopts the form of whitelist + over-raising public sale. The whitelist quota can reach up to 75%. That is, when the fundraising exceeds the target amount, it will be allocated to whitelist participants first, and then the public sale users will be allocated proportionally. Distribution, return of excess raised funds.

The NAVX-CETUS pool is 100% over-raised and has no whitelist.

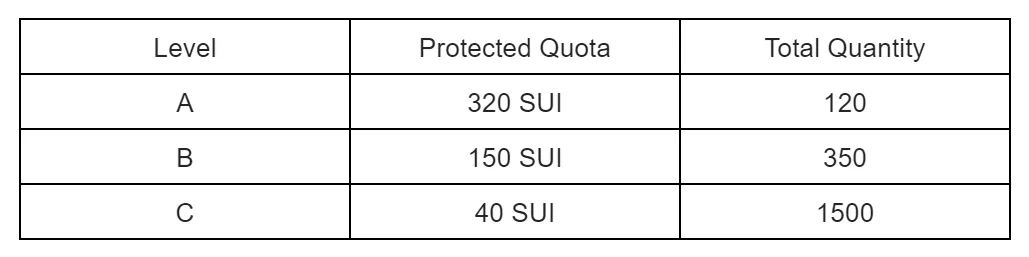

The whitelist will be distributed to community users, partners and the top 500 xCEUTS holding addresses. The number of lists and corresponding quotas are as shown in the figure below:

In terms of price, the NAVX-SUI pool raises funds at NAVX= 0.021 SUI per coin. The current price of SUI is about 1.5 USDT, so the unit price and FDV of NAVX are 0.0315 USDT and 31.5 million US dollars respectively.

The NAVX-CETUS pool fundraising price is NAVX= 0.26 CETUS per coin. The current price of CETUS is approximately 0.11 USDT, and the corresponding unit price and FDV are 0.0286 USDT and 28.6 million US dollars respectively.

Conclusion

While NAVI Protocol lending users can fully enjoy the advantages of the protocol’s deep capital pool and effectively build DeFi strategies, they will also enjoy further incentive bonuses from the protocol. The growth momentum of the Sui ecosystem is also continuing. NAVI is expected to usher in a new round of explosive growth through the dual-wheel drive of its core lending business and the strategic layout of the LSD track.