12张图解读1月加密市场:多项链上指标持续增长

Original author:Lars, Head of Research at The Block

Original compilation: Jordan, PANews

Thanks to the impact of the US spot Bitcoin ETF being approved for listing, in the past January 2024, most crypto industry indicators continued to show a strong growth trend. This article will use 12 charts to interpret the crypto industry in the past month. market conditions.

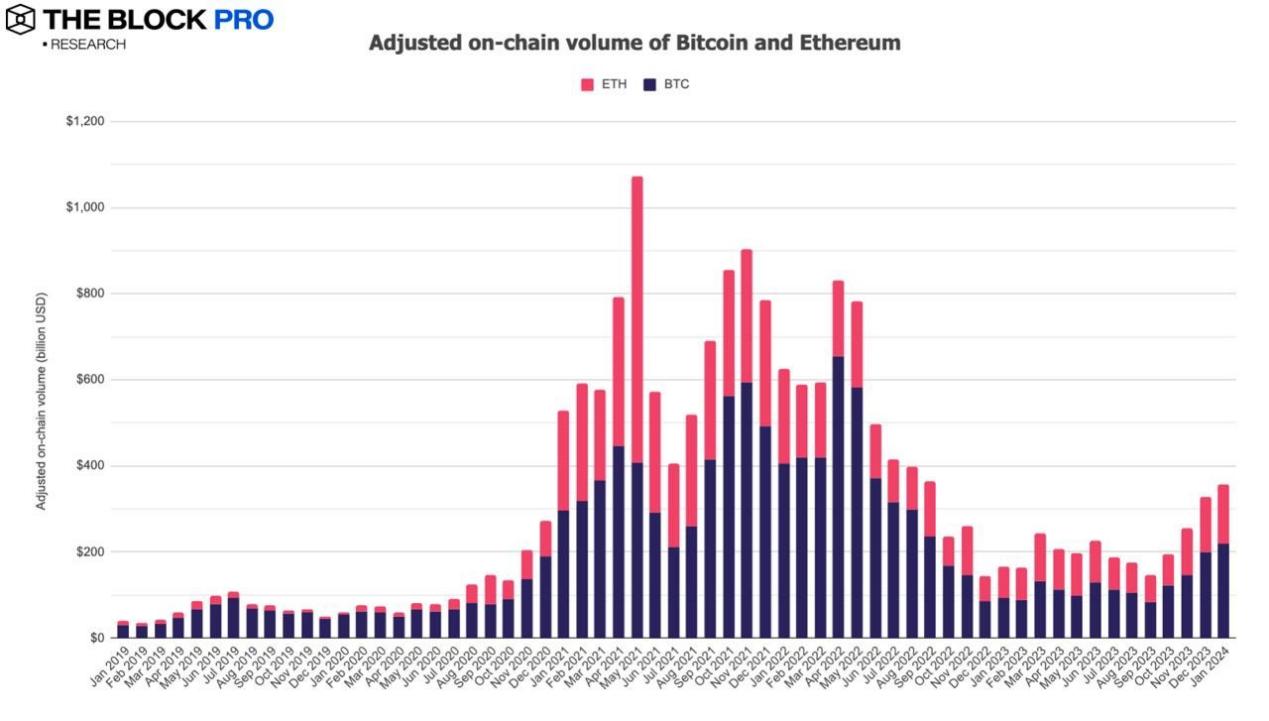

1. In January, a total of 11 spot Bitcoin ETFs were approved by the U.S. Securities and Exchange Commission for listing. This news also pushed the overall adjusted total on-chain transaction volume of Bitcoin and Ethereum to increase by 8.8% to US$357 billion, of which After adjustment, Bitcoin’s on-chain transaction volume increased by 10.6%, and Ethereum’s on-chain transaction volume increased by 6%.

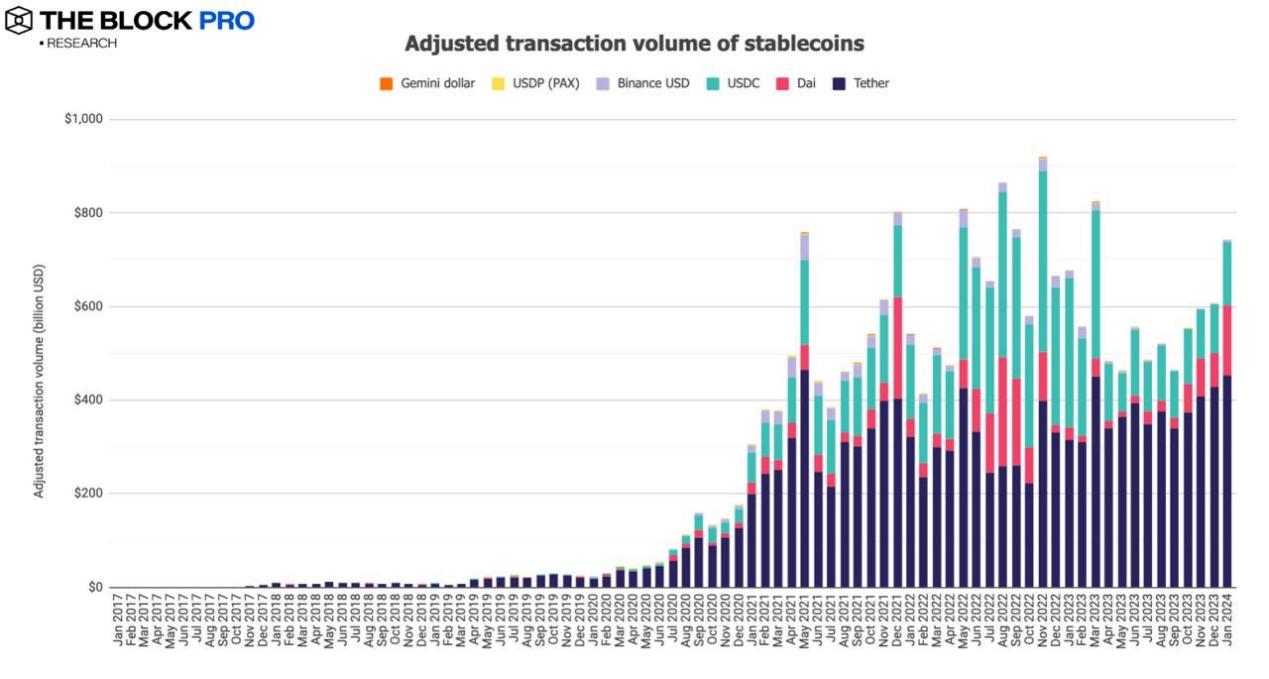

2. The adjusted transaction volume of stablecoins on the chain continued to rise in January, rising to US$742.6 billion, an increase of 22.2%; the supply of issued stablecoins also increased, with an increase of 4.1% to US$125.8 billion. Among them, the US dollar stable currency USDT has a market share of 77% (it has increased for five consecutive months), while the market share of USDC has increased slightly to 18.6%.

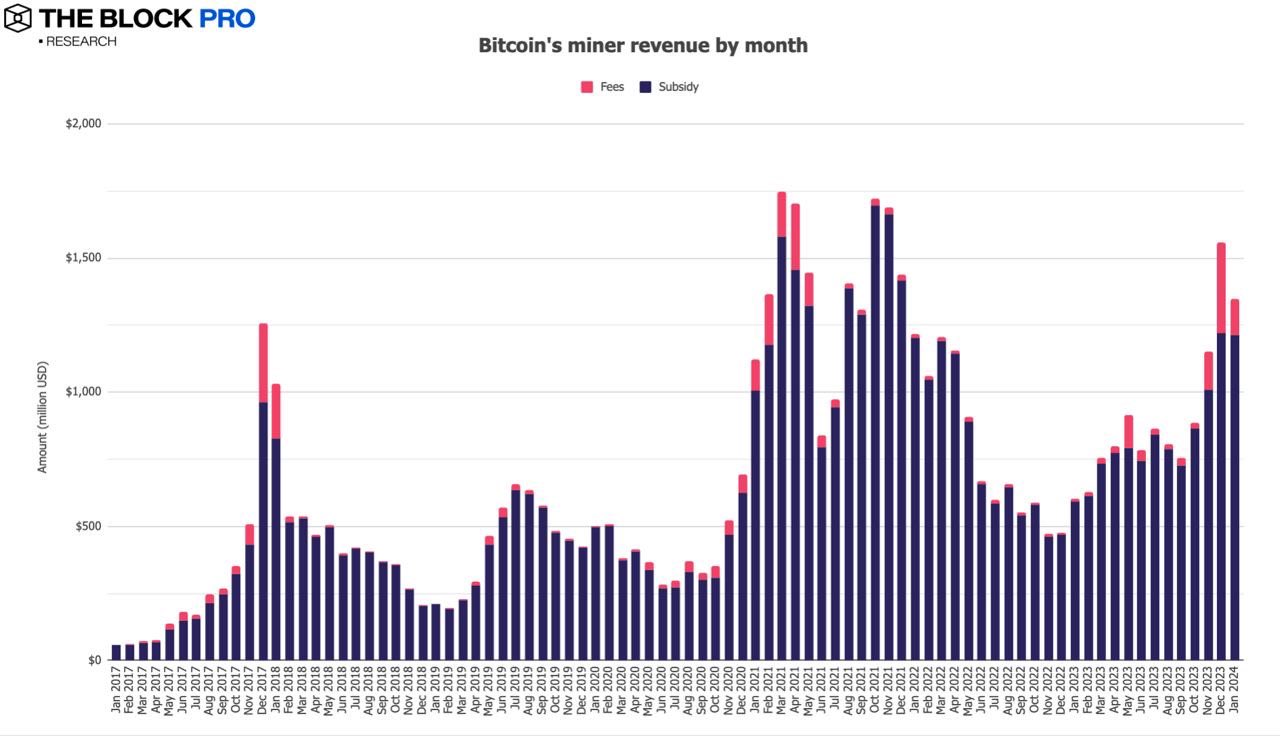

3. Bitcoin miner revenue changed in January, falling to $1.35 billion, a decrease of 13.6%. In addition, although Ethereum staking revenue continued to grow, the increase was modest, about 1.4%, rising to $1.87 million.

4. In January, a total of 75,037 ETH were destroyed on the Ethereum network, with a value equivalent to US$180 million. Data shows that since the implementation of EIP-1559 in early August 2021, Ethereum has destroyed a total of approximately 3.97 million ETH, worth approximately $10.98 billion.

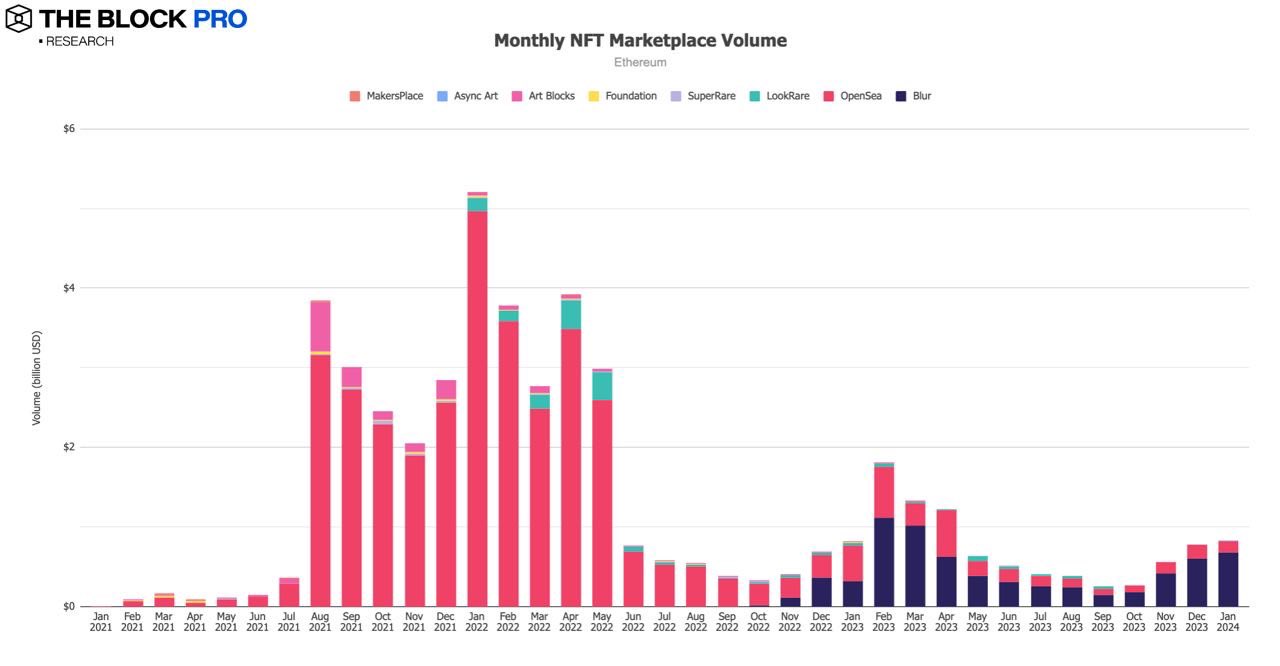

5. The transaction volume of the NFT market on the Ethereum chain increased by 6.2% in January, reaching approximately US$828.8 million.

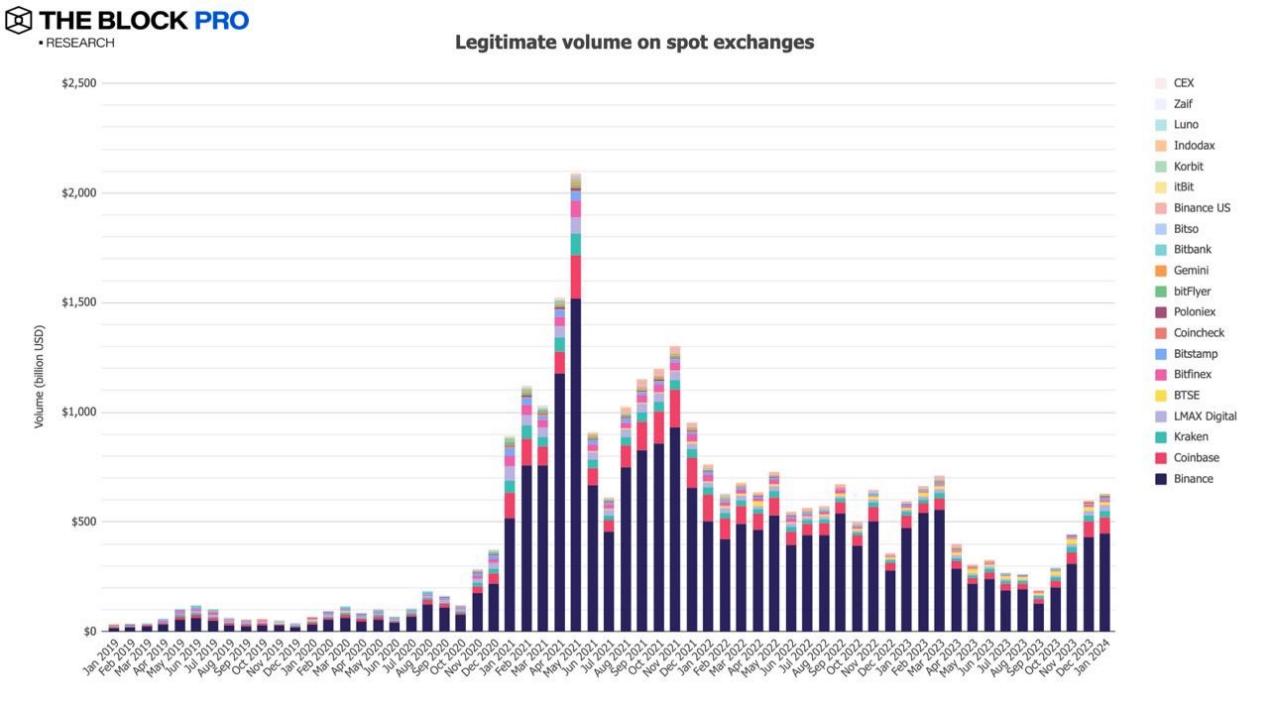

6. The spot trading volume of compliance centralized exchanges (CEX) continued to show an upward trend in January, with an increase of approximately 4.9%, rising to US$628.1 billion.

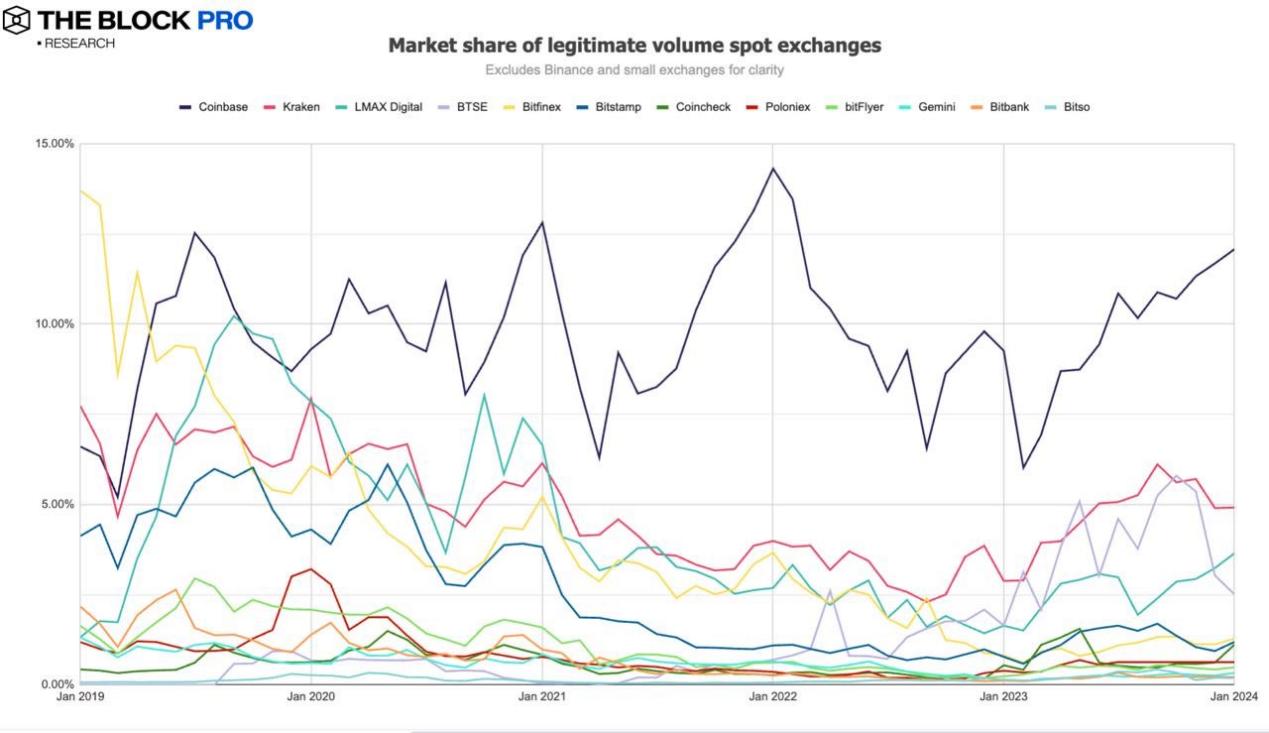

7. The spot market share rankings of major cryptocurrency exchanges in January are as follows: Binance was 71% (a decrease from December), Coinbase was 12.1%, Kraken was 4.9%, and LMAX Digital was 3.7%.

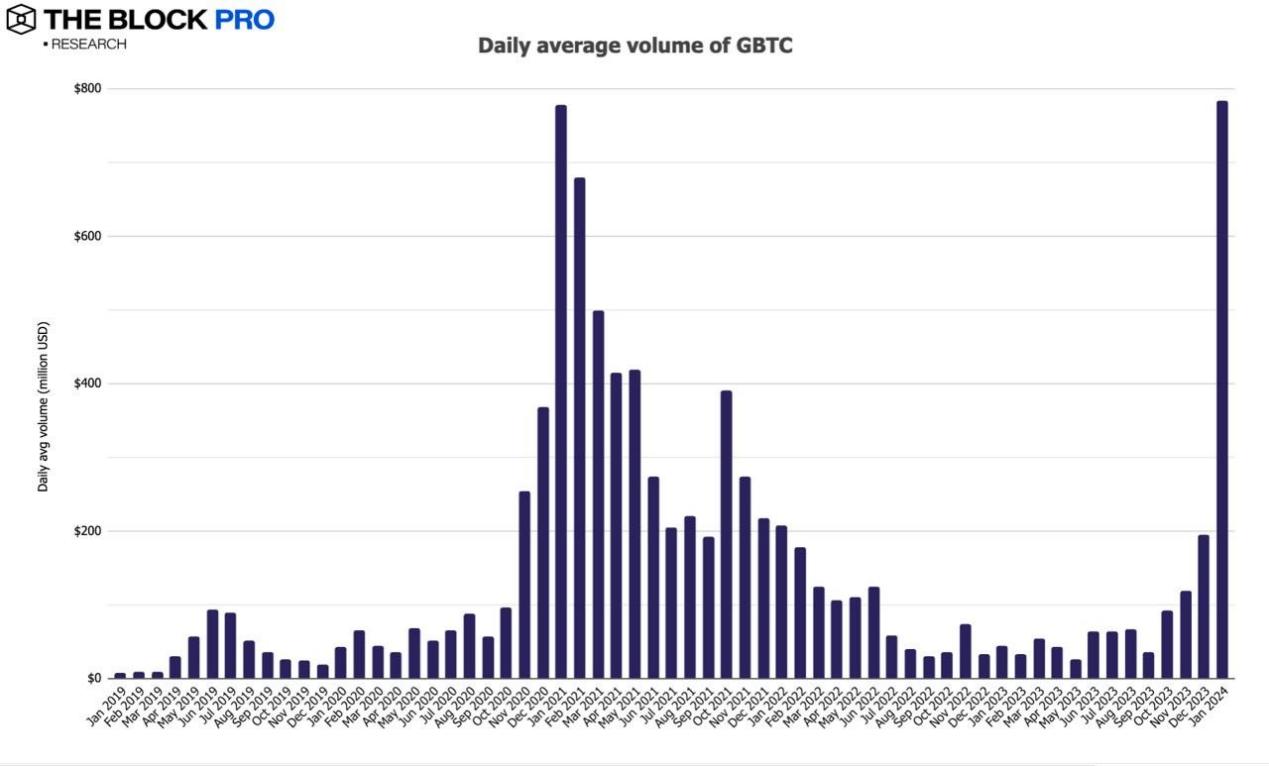

8. The average daily trading volume of Grayscale’s Bitcoin Trust Fund GBTC rose significantly in January, reaching 302.7%, rising to US$784 million. This situation is due to the fact that the fund has successfully converted to a spot Bitcoin ETF. .

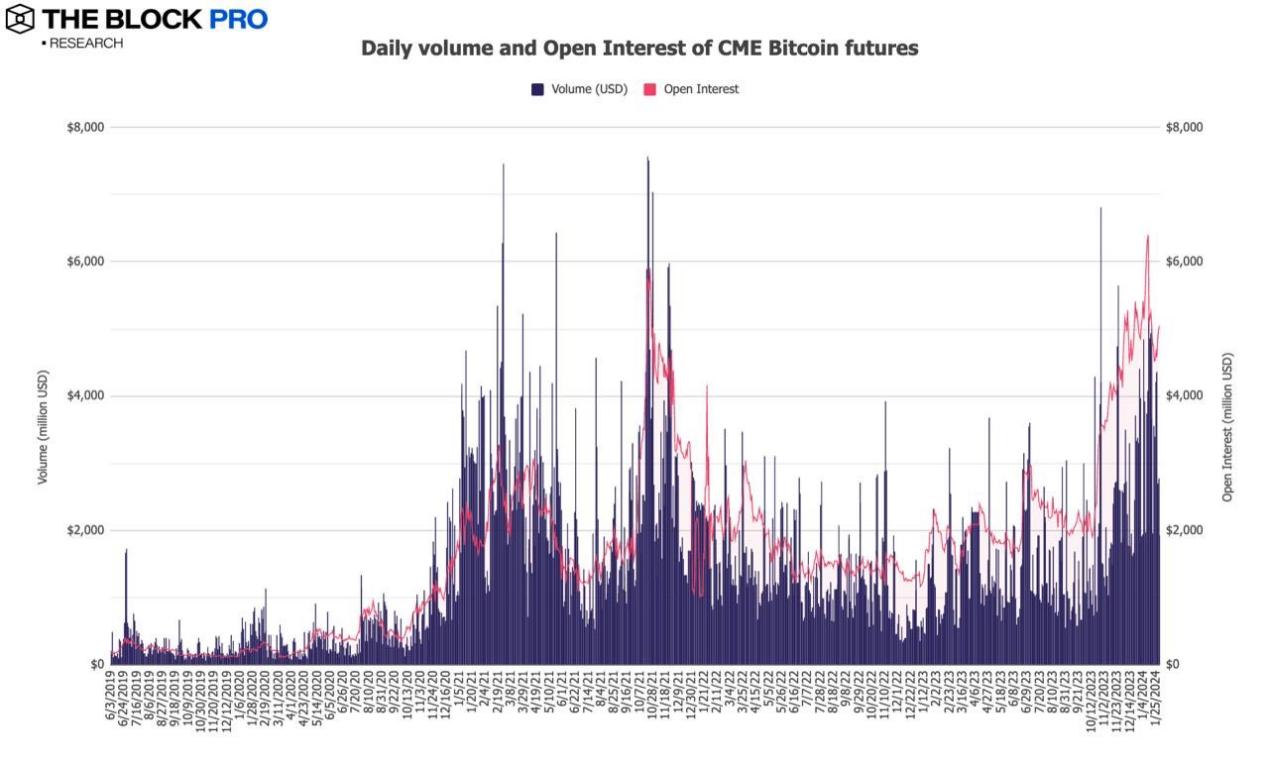

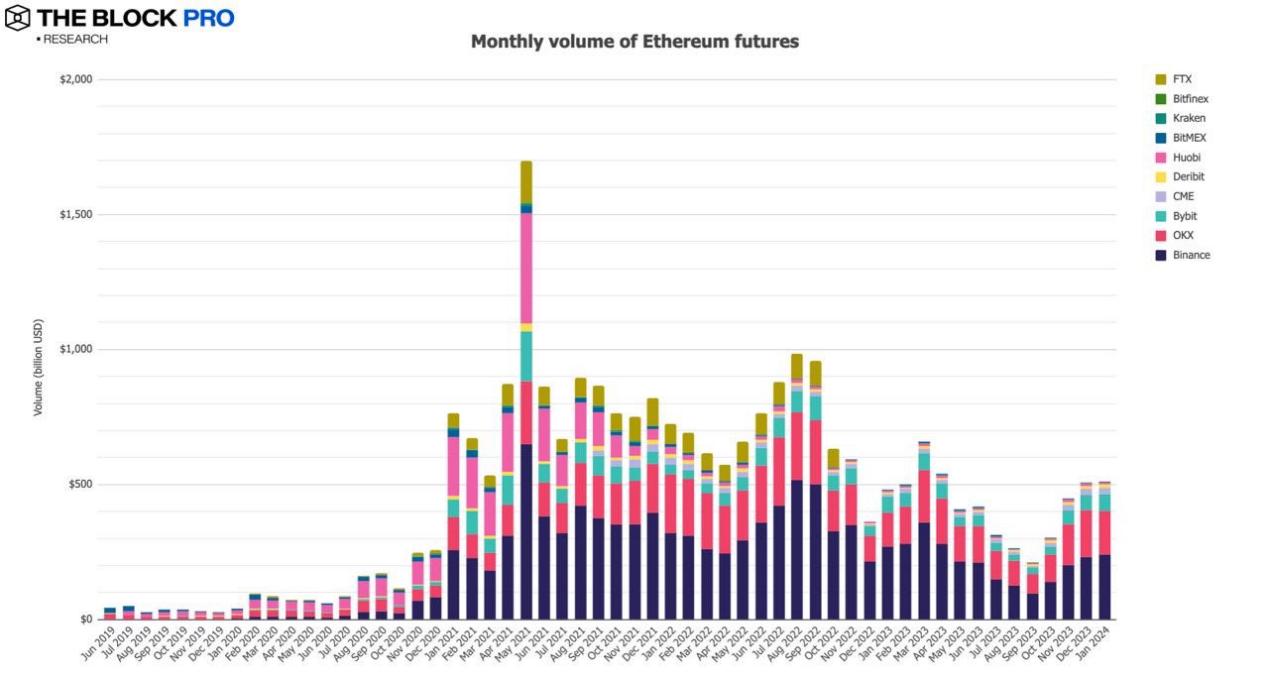

9. In terms of crypto futures, the open interest volume of Bitcoin futures in January fell by 5.9%, and the open interest volume of Ethereum futures fell by 1.5%. In terms of futures trading volume, the trading volume of Bitcoin futures in January increased by 14.1%, rising by 14.1%. to $1.1 trillion.

10. In January, open interest in CME Group’s Bitcoin futures increased by 3.1% to US$5 billion, and daily avg volume increased by 29.2% to approximately US$3.44 billion.

11. The average monthly trading volume of Ethereum futures in January rose to US$511 billion, an increase of 0.9%.

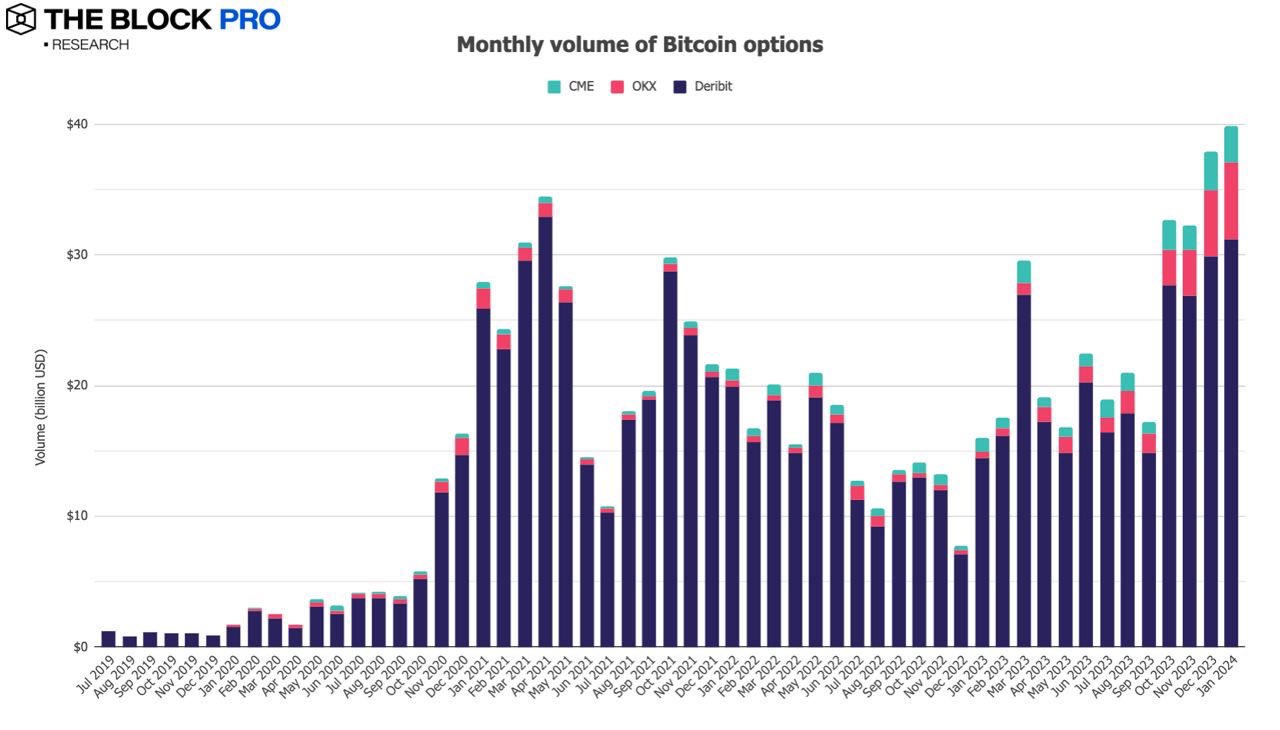

12. In terms of cryptocurrency options, Bitcoin positions fell by 6.4% in January, while Ethereum positions increased by 6.5%. In addition, in terms of Bitcoin and Ethereum options trading volume, Bitcoin options trading volume increased by 5.2% in January to US$39.9 billion, continuing to hit a record high; Ethereum options trading volume increased by 17.3% to US$17.9 billion. , also reached a record high.