Metrics Ventures研报:进军RaaS赛道,Gelato会迎来新的爆发吗?

Original author:Charlotte, Kevin, Metrics Ventures

TL;DR:

Founded in 2019, Gelato initially helped developers create smart contracts that are automated, gas-free and capable of off-chain computation, and is a leader in this field. In September 2023, Gelato completes its transformation to a RaaS platform, and the shift in narrative will open up new markets and upside for it.

Layer 2 maintains a rapid growth trend, especially in order to achieve expansion, customization and reduce value loss, more and more Dapps will turn to the construction of application chains. RaaS reduces development costs and provides professional consulting services, which will have high market demand. The RaaS platform will serve as a middleware distributor in the Web3 world, helping developers quickly complete infrastructure construction.

Gelato is not a pioneer in the RaaS track, but it is a team that has been developing Web3 infrastructure for more than four years. Gelatos years of development results and resources will directly translate into competitiveness in the RaaS field: (1) native Web3 middleware service integration, (2) mature account abstraction solution integration; (3) rich third-party Web3 middleware distribution resources .

The RaaS track is currently relatively early, and it is difficult to identify leading projects from the technical characteristics and ecological data of the projects. It is necessary to continue to pay attention to changes in the competitiveness of projects within the track.

From the perspective of narrative and timing, Gelato is a worthy target at the moment: the Cancun upgrade is one of the most concerning events in the market. The launch of ALT has begun to attract the attention of ordinary users to the RaaS track. The value of the RaaS track is at a critical stage. In the process of slow discovery.

1. Is RaaS a track worthy of deployment?

Before studying the Gelato project itself, it is necessary for us to first understand the overall importance and development prospects of the RaaS business.

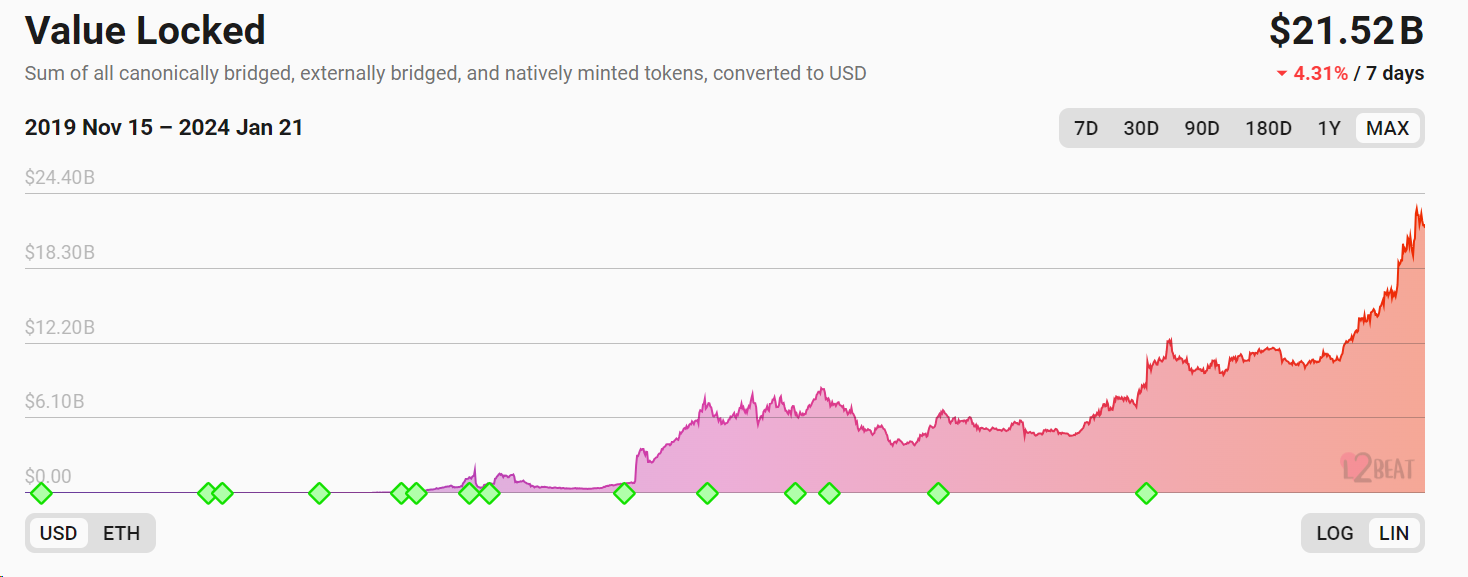

First of all, the demand for capacity expansion still exists, and capacity expansion is still a key technology to achieve Web3 Mass Adoption.Although the existing Layer 2 has initially solved the need for expansion, Dapps still have to compete for Blockspace, especially for Transaction-heavy use cases (especially games and socialfi). The significantly increased transaction fees and long waiting times still exist. Affect user experience. When trading volume increases significantly during a bull market, the need for expansion will also increase further. In fact, the growing TVL also reflects the market demand for L2, which has maintained rapid growth since 2023.

Secondly, Dapp’s demand for blockchain customization continues to grow.With the development of blockchain applications, even Dapps that have achieved good development on the existing chain have to deal with DA layer flexibility, MEV transaction income, block generation time, expansion, customer acquisition, token value capture, and economic systems. Under the multi-directional requirements such as ecological expansion and so on, we will also turn to building our own customizable Appchain, especially when Dapp does not have high requirements for composability.

Third, the shift from Dapp to Appchain will also lock in more revenue for the ecosystem(It reduces the value loss of gas fees, which can be locked by the project party or given back to users), attracting more Validators to pledge tokens, and binding more liquidity to the ecosystem. This will bring more empowerment to the original project tokens and greatly promote the economic flywheel.

Among the many public chain architectures available, Rollup will be one of the core choices.Rollup, as the expansion solution chosen by Ethereum, has a certain legitimacy., and will benefit from the prosperous ecosystem of Ethereum. At present, general-purpose rollup has been tested by the market. The technology of general-purpose rollup is also relatively mature, and its development framework can be used directly.

At present, more L2 demand may come from the conversion of Dapp to Appchain. Appchain focuses on, first, the customization of the chain to meet the needs of Dapps, and second, building an ecology to attract users and complete user migration. Therefore, if the application chain itself is not concerned with the technological innovation of the public chain, but the core business of the application itself, then it should not spend a lot of time to implement the development process from 0 to 1, but outsource the development and maintenance process. Focus on the development of core business; on the other hand, Appchain also needs a professional technical team to provide consulting services in numerous Rollup frameworks, DA layers and other solutions.

The core business model of the RaaS platform is to become the AWS and Google of the Web3 world, becoming a distributor of blockchain middleware and making profits from it. Therefore, the scale and quality of the middleware ecosystem that can be captured will become the primary competition of the RaaS platform. force. Additionally, as the operator of Rollup, the RaaS platform will also capture transaction fees and MEV revenue.

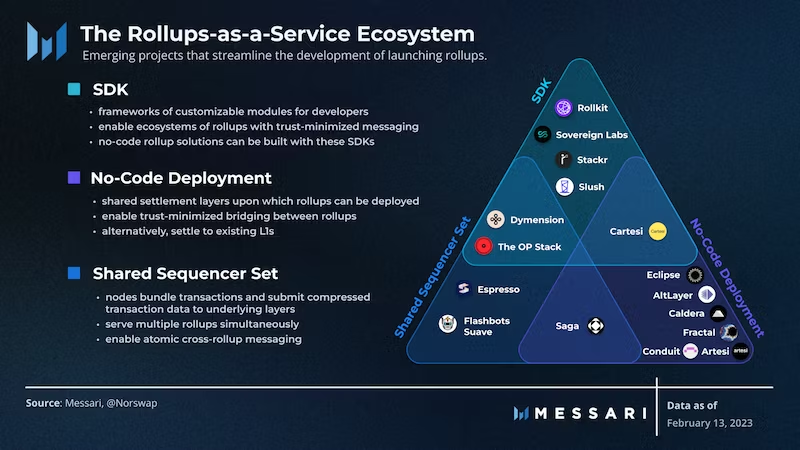

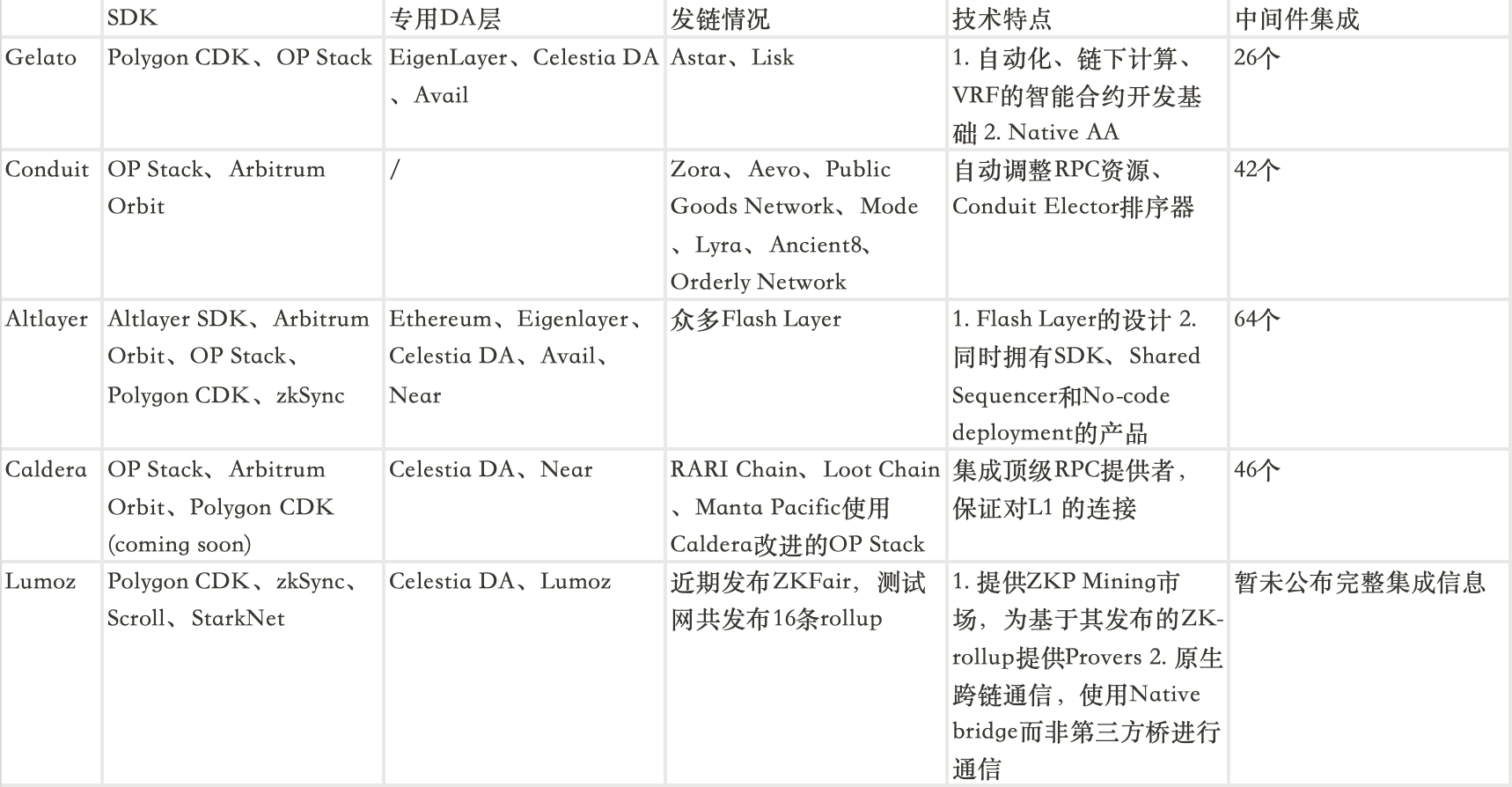

According to Messaris classification, the RaaS ecosystem currently mainly includes three types of projects: SDK, Shared Sequencer Set and No-code Deployment. Gelatos track is No-code Deployment, which provides one-stop services for developers by integrating SDK framework and infrastructure services. Projects that belong to the same track as Gelato include Lumoz, Altlayer, Caldera, Conduit, etc.

(Image source: Messari)

2. From smart contracts to Layer 2: Gelato completes RaaS platform transformation

Founded in 2019, Gelato initially helped developers create smart contracts that are automated, gas-free and capable of off-chain computation, and is a leader in this field. In September 2023, Gelato completed its transformation into a RaaS platform, inheriting its technology in smart contract development and its advantages accumulated in the infrastructure ecology, and its competitiveness in this track cannot be underestimated.

Gelato is currently in the early stages of business. The L2 framework it uses is initially based on Polygon. In December, it officially announced that it supports OP Stack and will use more frameworks in the future. On the DA layer, Ethereum, Celestia DA, Avail, Eigen Layer DA are currently supported.

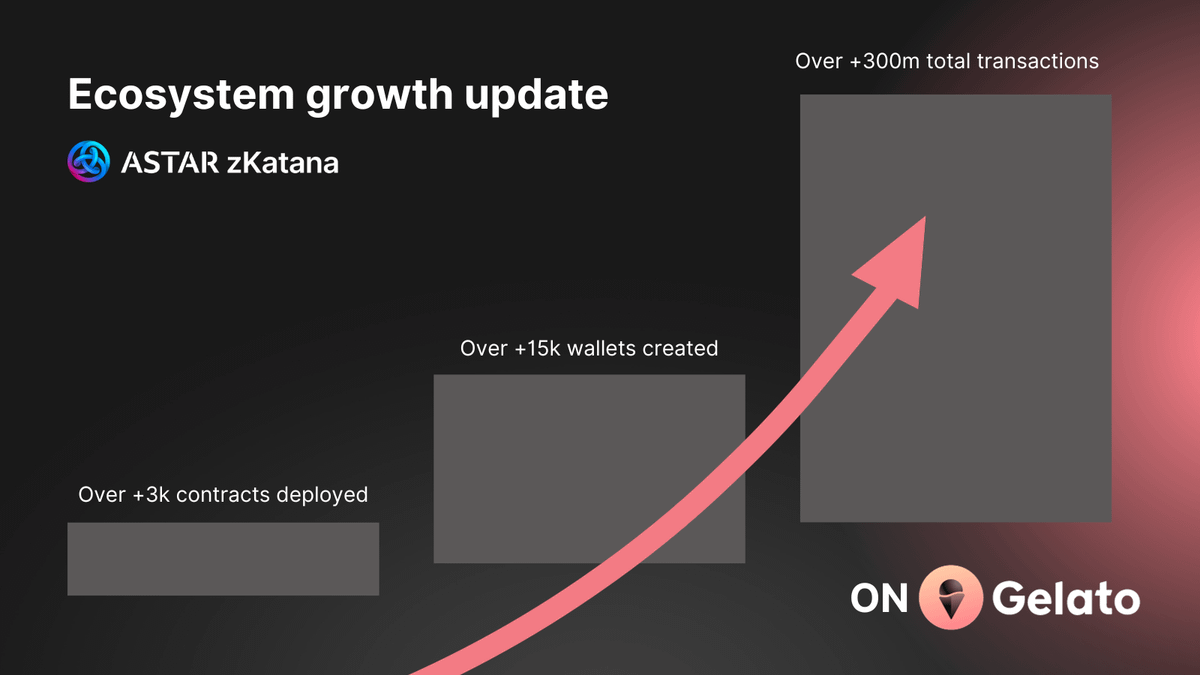

There are currently two projects that have chosen Gelato as their RaaS service provider: Astar and Lisk. Astar is the first L2 on Gelato to use Polygon CDK. As of December 26, 2023, more than 3,000 smart contracts have been deployed on Astar zkEVM, more than 15,000 wallets have been created, and a total of more than 300 M has been completed. trade. Lisk will be the first L2 released on Gelato using the OP Stack framework, focusing on the development of RWA and DePIN ecosystems.

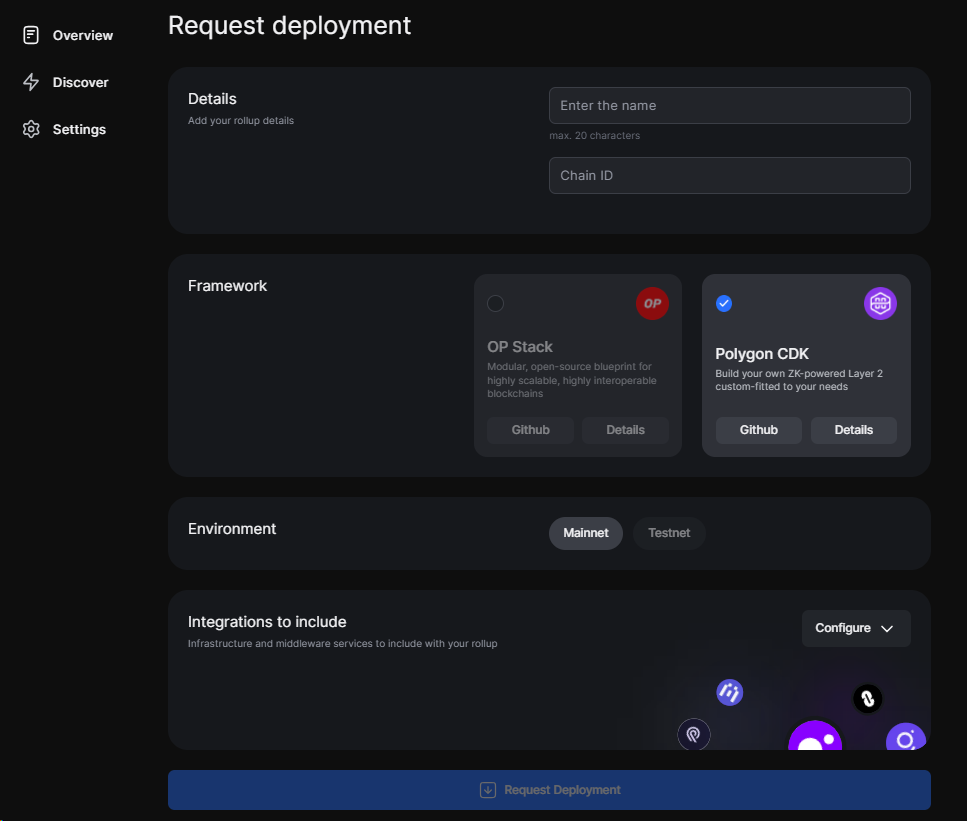

In order to reduce the difficulty of development, Gelato launched the Deployment Platform in December 2023. Developers can directly choose the Rollup framework, data availability layer and middleware integration, and create a Rollup with a few clicks.

Gelato is not a first mover in the RaaS field, so where is its current competitive advantage?

Gelato has been deeply involved in the field of smart contract development for four years and will directly empower RaaS business expansion. Specifically,Gelatos competitiveness is reflected in three points: (1) native Web3 middleware service integration, greatly optimizing L2s smart contract development experience; (2) integration of relatively mature account abstraction solutions; (3) a large number of third-party Web3 middleware Distribute resources to provide developers with a complete suite of development resources.

1. Native business integration: automation, no gas fees, off-chain sensing and VRF

Gelato was originally used as a decentralized development backend for Web3, aiming to optimize the development and use experience of smart contracts. Its core functions include four: contract automation, gasless transactions implemented by Relay, off-chain data sensing and calculation, and VRF.

Contract automation:

One thing that users often overlook is that the smart contract function cannot be automatically triggered. Instead, an on-chain transaction needs to be sent by the EOA account to execute the contract function. DEX limit orders, automatic compounding, and loan settlement all require contract automation. Automate is the core function of Gelato, which eliminates the cost of manual operations or running bots by contract developers. Gelato as a marketplace brings together two parties: developers who want to automate transactions, and infrastructure operators who run bots to find tasks that need to be completed in exchange for a fee for the service.

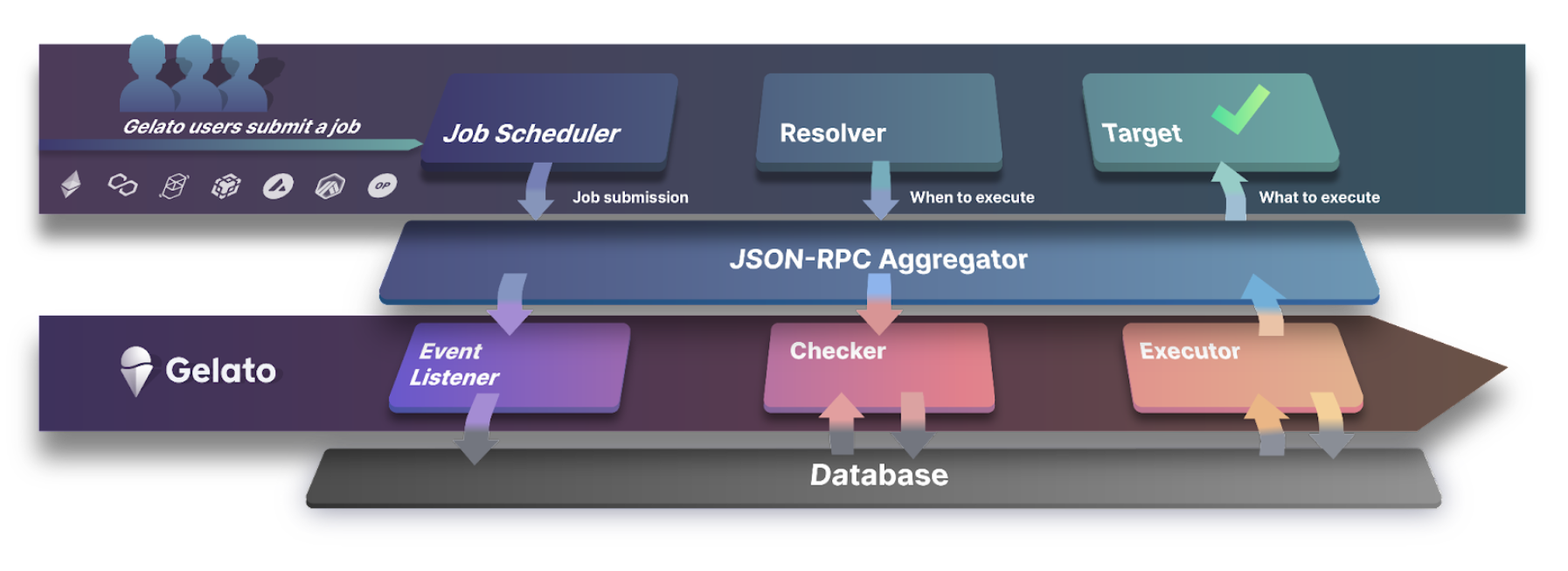

There are three roles in Gelatos network architecture, namely Event Listener, Checker and Executor. The Listener is responsible for monitoring events on the chain. When the trigger condition is found to be met, the user logic is submitted to the Checker. The Checker checks whether the automated task can be executed at a given moment based on the logic. When the trigger condition is deemed to have been correctly met, the Checker submits the transaction to the Executor. , Executor is a network of infrastructure operators, responsible for the final execution of on-chain transactions, also known as Bot or Keeper.

Relayer and gasless transactions:

In standard on-chain transactions, users need to first deposit native tokens in the EOA wallet as gas before they can carry out subsequent interactions, which creates a great obstacle to the user experience. The job of the Gelato Relayer is: the user will sign a message off-chain to interact with the Web3 app. The message is sent to the Gelato Relay through an API call. The Relayer verifies the signature on the chain. Afterwards, the EOA controlled by the Relayer sends a transaction to trigger the contract function, and Pay the gas fee. This results in a more flexible payment system, such as using a single balance to pay for all transactions on the EVM chain, developers sponsoring users gas, etc.

Off-chain data sensing and computing:

Gelato upgraded Automate to Web3 Functions. This upgrade will break through the limitation that smart contracts cannot connect to off-chain data, allowing developers to calculate and execute on-chain transactions based on any off-chain data. Functions written in Typescript, stored on IPFS and run by Gelato, enable seamless integration with off-chain data, enhanced computing power (avoiding complex calculations consuming large amounts of gas on-chain), and customizable logic execution.

VRF (verifiable random number generation):

The VRF function is widely used in games, NFT generation, random election Validators and other fields. The key is that the entity operating this function can generate random numbers and prove its randomness and correctness. The generated random numbers are required to have no preference and Unpredictable, others can prove that the randomness-generating process is not evil.

The core component of Gelato VRF is Drand. The Drand network consists of a group of decentralized nodes. Before generating random numbers, all nodes reach a consensus on the threshold parameter. Each node creates a signature and broadcasts it in the network. When the threshold parameter is reached, the last node will create the final BLS signature, and the authenticity of the signature can be verified by the entire network. The random number is the hash value of this signature. .

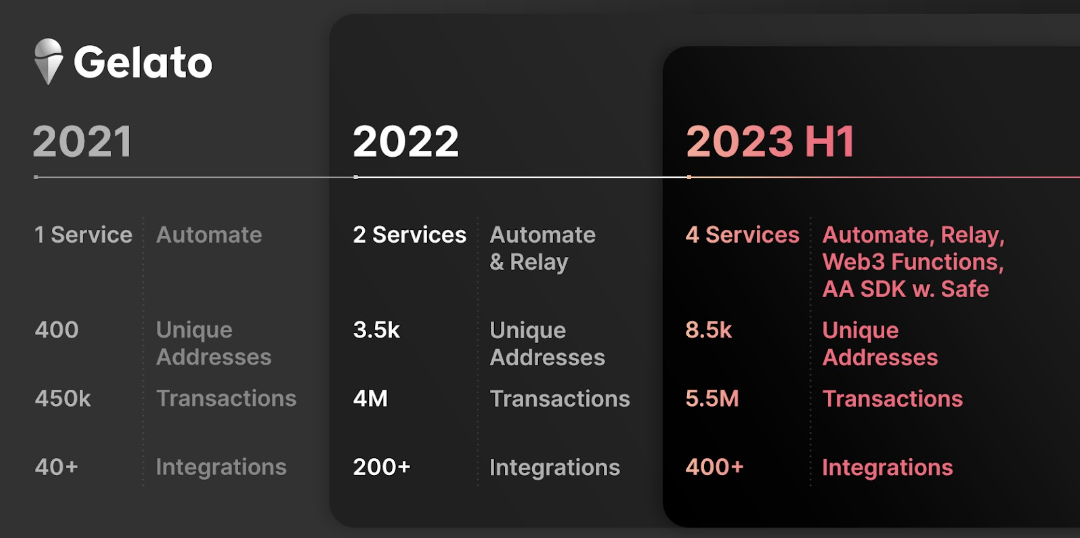

Gelato is extremely competitive in its native business. Gelato supports up to 15 blockchain networks. The first half of 2023 annual report disclosed that more than 400 applications have integrated Gelato and more than 5.5 million transactions have been performed using Gelato, including many leading projects such as MakerDAO, Gnosis Pay, and Pancake Swap. . The only one currently directly competitive with Gelato in this field is Chainlink.

2. Integration of mature account abstraction solutions

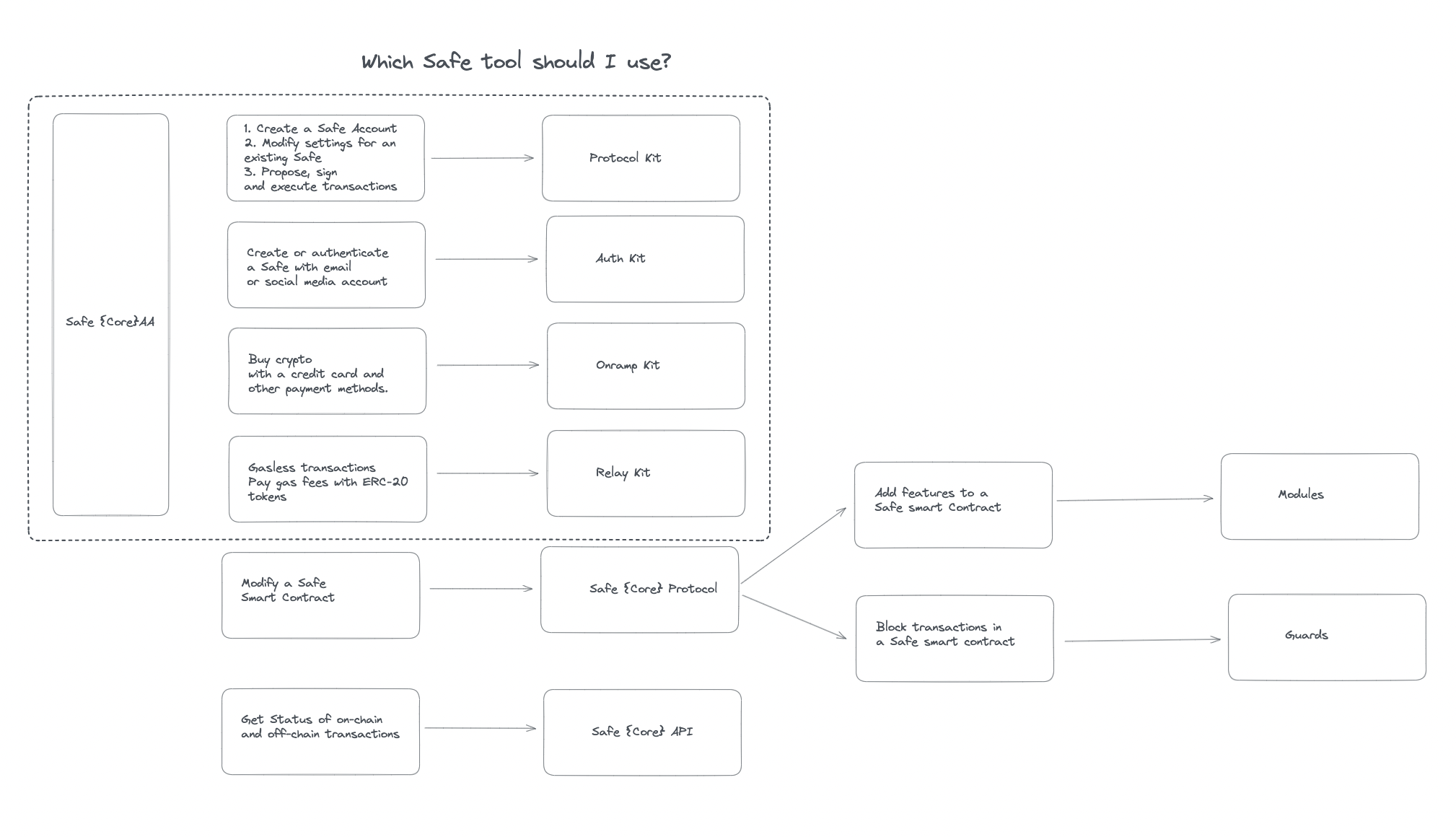

Based on the Relay service, Gelato developed Relay Kit and worked with Safe to create an account abstraction SDK. Safes account abstraction consists of multiple Kits, of which the core kit is developed by itself and some kits use third-party solutions. The Relay Kit provided by Gelato implements the function of Payment Abstraction, that is, users can directly use native tokens or ERC-20 tokens to pay transaction fees on Ethereum, not just ETH.

Account abstraction can be divided into two key steps: Signature Abstraction and Payment Abstraction. The former enables various contract accounts to use different signature verification schemes (such as EOAs single private key signature, multi-signature aggregation, etc.), while the latter mainly provides multiple There are various currency options for transaction fee payment or payment on behalf of others. We know that Layer 2 public chains such as zkSync and StarkNet have developed native account abstraction solutions. Compared with directly using the AA solution in the SDK, what are the advantages of the account abstraction provided by Gelato?

In short, the current ZK-Rollup basically implements the Signature Abstraction process well, but the Payment Abstraction has not yet been developed maturely. Gelato uses its own Relay and 1 Balance services and has proven its ability to complete flexible payments and Gasless transactions. It has a relatively mature solution for completing Payment Abstraction. Payment Abstraction is also the most direct way to improve user UX experience, and Gelato The AA SDK integrated with Safe can also be used directly to achieve social account login and helpless word memory experience.

3. Rich Web3 middleware distribution resources

In the analysis of the RaaS track pattern, we mentioned that middleware distribution resources will be one of the core competitiveness of the RaaS platform. Although the general-purpose Layer 2 provides an SDK, the development of a chain also requires the development of a series of functions such as block explorers, Indexers, oracles, and cross-chain bridges. Gelato has accumulated a large number of infrastructure and middleware partnerships in its four-year development business, and can be used directly as a development tool, providing an out-of-the-box kit for one-click chaining. Currently, Gelato RaaS Marketplace provides 27 middleware integration services, but it is worth noting that Gelato has integrated more than 400 applications in the Web3 Function business. These customers will be quickly converted into distribution resources, greatly promoting the development of the Gelato RaaS ecosystem.

3. Competitive landscape: The RaaS track is in its early stages

Projects in the RaaS track that also belong to the No-code Deployment segment include Conduit, Altlayer, Caldera, and Lumoz. The basic information of each project can be seen in the table below.

From the perspective of ecological expansion, the number of projects using RaaS services to issue chains is currently not large. Many first movers in the RaaS track do not have relatively ideal data. It is currently difficult for us to measure the competitiveness of projects based on the number of chains issued.

From the perspective of middleware resources, the number of integrations of Gelato RaaS Marketplace is not dominant, but Gelatos ecosystem of more than 400 applications will become the backup pool of the Marketplace. We need to pay close attention to the growth of the number of subsequent integrations of Gelato to judge its success in the RaaS field. changes in competitiveness.

Overall, the RaaS track is still in a very early stage, and many projects are still in the test network stage. It is difficult to judge the leading project from the existing data. Altlayer has just been launched on Binance Launchpad recently. Currently, only Altlayer and Gelato issue tokens in the RaaS track, which are the only secondary market targets for RaaS. Judging from the valuation comparison between the two, Altlayers current market value is $451,466,031 and its FDV is $4,104,236,647. Gelatos market value is $167,412,873 and its FDV is $287,476. 805, whether in terms of market capitalization or FDV, Gelatos valuation is more cost-effective.

4. Gelato Flywheel: Token Economics

GEL is the native token of Gelato. Currently, token economics is still focused on the Automate business and has not yet been empowered for the RaaS business.

The bot operator responsible for running Automate can only participate in the network by staking GEL. The source of revenue can include two aspects: 1) charging transaction fees on each transaction; 2) discovering arbitrage opportunities and completing back running transactions. Bots that do evil will face the risk of being fined.

In July 2023, Gelato updated the bot’s staking and task allocation mechanism to accelerate the Gelato flywheel. After the update, bots still need to pledge GEL to join the network. To become a node, they are required to pledge at least 150 k GEL and have a three-month cancellation period. However, Gelato adjusts the parallel task allocation algorithm. The frequency of task allocation to a bot is proportional to the amount of GEL pledged by the bot, prompting bot operators to continuously pledge more GEL. In addition, the gas cost consumed by the bot will be replenished in real time by Gelato ecological applications or handling fees paid by retail investors, further stimulating the staking flywheel effect of the bot.

Gelato’s token economics should be integrated with RaaS business in the future, which requires more observation in the future.

5. Conclusion: Gelato is in the early stages of value discovery

Gelatos expansion into RaaS will bring a more powerful narrative space. The transformation from back-end development services that cannot be directly perceived by users to a RaaS platform that is more easily seen by the market will bring a new round of growth space for Gelato. From a technical point of view, on the one hand, Gelatos native automation, account abstraction and other services will empower L2 development and provide L2 developers and users with a more convenient experience; on the other hand, automation and account abstraction will bring more Executing these functions on L2 will greatly optimize costs due to complex on-chain operations and higher gas costs, so the transformation to L2 also brings new ground for its native services. Gelatos middleware customer resources accumulated over the years can be quickly transformed into L2 development empowerment, so this transformation can achieve two-way mutual support between the two major businesses.

Judging from the performance of the token, after Gelato announced its transformation into a RaaS platform in September last year, it did not cause a significant increase in the token price. It was not until the past month that Gelatos RaaS transformation began to be gradually discovered by the market, with the price starting to increase from $0.3 More than doubled, this wave of increase mainly comes from the hype of Cancun upgrade and the heat brought by ALT listing on Binance to the RaaS track. In terms of narrative and market enthusiasm, the RaaS track has always lacked secondary hype targets, so it has not received enough market attention. At this point in time, the Cancun upgrade is one of the most concerning events in the market, and the launch of ALT It has begun to attract the attention of ordinary users to the RaaS track. The value of the RaaS track is in the process of being slowly discovered. There are not many secondary targets in the RaaS track. The hype funds for this track will currently focus on ALT and GEL. Gelato has a long development time, solid fundamentals and abundant ecological resources. Its current market value is still relatively underestimated. This is a critical period for its layout. However, it should be noted that Gelato does not currently occupy the leading position in the RaaS track, and it is still necessary to continue to pay attention to subsequent changes in competitiveness.

Subsequent attention to this project will include the adoption of RaaS services, token listings and possible changes in token economics. It currently occupies a leading position in automated services. If it can seize the leading position in the RaaS track, it will Further confirmation of its upside potential.

about Us

Metrics Ventures is a data and research-driven crypto asset secondary market liquidity fund led by a team of experienced crypto professionals. The team has expertise in primary market incubation and secondary market trading, and plays an active role in industry development through in-depth on-chain/off-chain data analysis. MVC cooperates with senior influential figures in the encryption community to provide long-term enabling capabilities for projects, such as media and KOL resources, ecological collaboration resources, project strategies, economic model consulting capabilities, etc.

Welcome everyone to DM to share and discuss insights and ideas about the market and investment of crypto assets.

Our research content will be published simultaneously on Twitter and Notion, please follow:

Twitter: https://twitter.com/MetricsVentures

Notion: https://www.notion.so/metricsventures/Metrics-Ventures- 475803 b 4407946 b 1 ae 6 e 0 eeaa 8708 fa 2 ?pvs=4

Recruiting! We are looking for traders with good salary and flexible working location.

If you have: bought sol below 40 ordi/ below 25 inj/ below 3.2 rndr/ below 10 tia if you meet any two of the above, please contact us at admin@metrics.ventures, ops@metrics.ventures