Outlier Ventures:Web3项目如何设计代币归属方案?

Original author: Achim Struve

Original compilation: Luffy, Foresight News

What is token vesting?

Many early Web3 companies started with a big idea to revolutionize the decentralized technology world. But even the best ideas will need some form of funding to launch and build the intended flywheel economy. These self-running ecosystems are often built on fungible cryptocurrencies, with token economies used to aid user adoption, behavioral incentives, and the product itself. Therefore, in addition to raising funds on equity businesses, raising funds on future tokens is also a common strategy, especially if overall crypto market sentiment picks up.

Token vesting refers to the supply of tokens released to the market within a certain period of time. In fundraising, token vesting refers to the release of an allocated token supply to early investors and contributors. Since they play a crucial role in the building phase of Web3 startups, they receive discounts or even “free” tokens, meaning they have a lower entry point than later investors and market participants. Determining the token distribution of these privileged entities through a supply release schedule will align their long-term benefits to Web3 startups while being more equitable to later entrants.

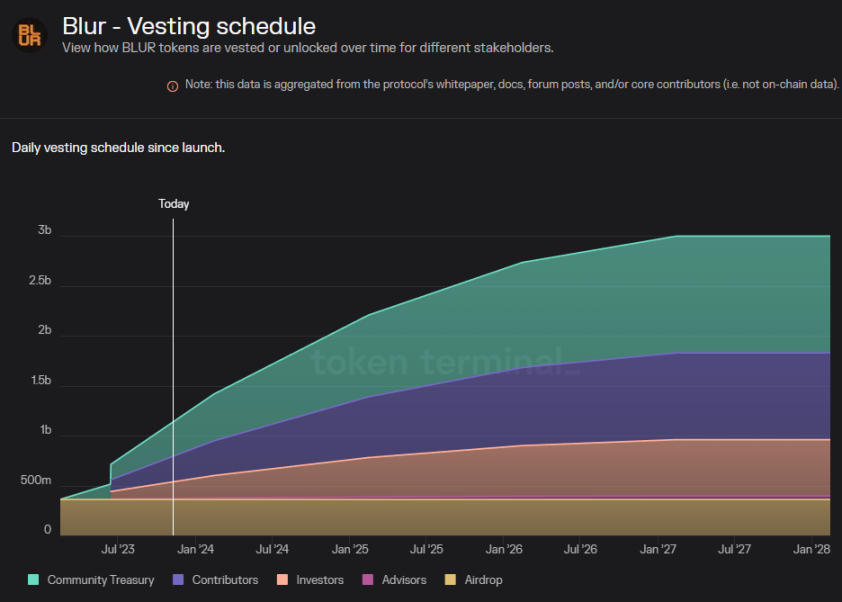

Figure 1: Blur token ownership, source: Token Terminal

Figure 1 shows the $BLUR token vesting schedule. In addition to airdrops, most of the supply will be gradually released over 4 years after a 6-month lock-up. These numbers are fairly common in the latest market narratives. In the 2021 bull cycle, typical vesting periods range from 12 to 18 months. Getting into the formal topic of this article, how do we design the right vesting terms for our early investors and contributors?

Short-term, or long-term vesting?

The above indicates the range of possible vesting schedules we are seeing in the market. These scopes are largely narrative driven and based on what others are doing rather than on what is best for the Web3 initiative as a whole. When designing a vesting schedule, besides “what is best,” other factors should be considered, such as:

Early investors and contributors

Recognizing early investors and contributors in the vesting schedule recognizes and rewards the risk taken by stakeholders who have supported the project from its inception. These individuals and entities often provide the necessary capital and resources for the initial development and growth of the project. They want to receive liquid tokens as early as possible, but also want the long-term health of the startups they invest in.

fair

Market participants consider vesting conditions when conducting due diligence on Web3 projects, and if they believe vesting terms are unfair, it could trigger bad sentiment toward the project and hinder future adoption. Equity refers to the fair distribution of benefits among all parties involved. Fairness ensures that no party is disproportionately advantaged or disadvantaged as a result of the vesting provision. This is to create a level playing field where long-term players are rewarded for their commitment, while still enabling new entrants to participate and benefit. In most cases, this means that the lower an investors entry point, the longer their vesting period.

Maintain investability

Token valuation tables and corresponding vesting schedule design play an important role in future investability and are in tension with startups’ requirements for rapid funding. Compared to a public offering with a short vesting period but a higher valuation, a sale at a lower valuation may attract more capital in the early stages but reduce investability in future rounds as later investors view themselves relative to The initial investors are at a disadvantage.

Ecosystem sustainability and stability

The design of vesting schedules should take into account the needs for sustainable development of the project ecosystem. This requires establishing a schedule to avoid flooding the market with tokens and causing value dilution, thus maintaining stability. A well-thought-out vesting schedule prevents wild price swings and ensures that token issuance matches the project’s stage of growth and development, thereby supporting the ecosystem. A more advanced approach to maintaining sustainability and stability is to adopt an adjustable attribution approach.

time and interval

The timing factor relates to the specific time interval during which tokens are released to stakeholders. It is important to align the timing of token releases with strategic milestones and the overall progress of the project. Proper timing helps maintain momentum, signal project maturity and manage market supply. By timing vesting based on the project roadmap and development stage, participants can rest assured that vesting is part of the strategic plan and not part of a short-term incentive plan. Keep in mind that the actual release of tokens should not be a one-time event, but gradual. When a large amount of supply hits the market at once, it can cause significant volatility. A better approach is to release smoothly over time to reduce market manipulation and volatility.

community belonging

Community incentives are also typically distributed over a specific time period. Some recent vesting schedule designs include individual address-based assignments to market contributors. It is critical to leverage these community incentives as effectively as possible. This means that every dollar issued in the form of tokens should help accumulate more than one dollar of value for the protocol. In many cases, this is achieved by incentivizing core ecosystem behavior and product adoption.

These aspects are not comprehensive and there are many different angles that need to be carefully weighed and considered when it comes to token release in an economic system. A fundamental pillar is creating the right demand to offset token releases. Imbalances between supply and demand can lead to volatility and disruption in the token ecosystem. Strong Web3 startups will pay attention to these dynamics and try to predict different scenarios.

Case Study: Simulating a Vesting Schedule

The following case study shows the impact of different term vesting schedules on token valuation. It was conducted using the Outlier Ventures open source quantified token model (QTM) radCAD under standard settings and medium adoption assumptions. Figure 2 shows the general structure of QTM, which has evolved since its initial release.

Figure 2: Quantitative token model structure abstraction

Please remember that no model can predict any token valuation and they should not be considered financial advice, especially advice derived from static and simplified models. However, with QTM we can assume that given some kind of adoption scenario, and then apply different vesting schedules to test what would happen if they changed. In the study below, the exact same conditions are applied in the model, except for vesting periods of different lengths, to understand the impact of vesting periods on token valuation stability.

Figure 3: Slow (top) and fast (bottom) vesting schedules in the Quantified Token Model (QTM) case study

Figure 3 shows hypothetical vesting schedules for two test scenarios. The image above depicts slow vesting and the image below depicts fast vesting. As can be seen, there are many different stakeholders involved, such as different funding stages, early investor groups, teams, advisors, partners, reserves, incentives and staking vesting, airdrops, and liquidity pools. These ecosystem players are common to a variety of different protocols. In this case study, no product or token utility was specified other than general staking and transfer utility that could represent a variety of different mechanisms such as store purchases or ecosystem transaction fees. The exact use case is not relevant to this study.

In the case of slow vesting, it will take 8 years to fully release all tokens into the economic system; in the case of fast vesting, it will take 4 years. This includes the time period from the token issuance, including staking, where most investors will complete vesting early.

Figure 4: Token valuation resulting from slow (top) and fast (bottom) vesting schedules

Figure 4 shows the token and liquidity pool valuations derived from QTM simulations under the two different vesting plans given in Figure 3. It is worth noting that the vertical axis is on a logarithmic scale. In both cases, the fully diluted valuation (FDV) market capitalization (MC) at launch is $40 million. Both cases show a similar curve shape, where the FDV MC decreases at the beginning of the simulation and starts to increase after some time. The circulating MCs only decreased in the fast vesting scenario but also started to increase after 8 months. Declining valuations in the first 2 to 3 years can be observed in many Web3 token issuances and are caused by the large amount of token supply released to the market while startups are still in the building phase. Subsequently, assuming the business model, token design and GTM approach are successful, valuations may rise again due to increased demand.

An interesting point is the range of valuations in both cases. Compared to launch valuations, FDV MC in the slow vesting scenario declines by approximately 58% 16 months after launch and peaks at a 74% gain at the end of the 10-year simulation. In the fast-vesting scenario, FDV MC valuations decline by approximately 87% after 18 months, but peak at a 145% gain by the end of the simulation. Although QTM cannot predict these results in an absolute manner, it can provide insight into the impact of initial parameter changes given the same boundary conditions and underlying assumptions. Notably, slower vesting results in a final valuation that is less different from the launch valuation and therefore less volatile than the fast vesting case. Slower vesting results in smaller valuation declines, but at the cost of potentially less long-term upside potential.

Here we need to discuss two questions: (1) What is the root cause of this phenomenon? (2) What does this mean for the design of our own vesting schedules?

The reason for the larger valuation decline in the fast vesting scenario is that more token supply is released into the economy in a shorter period of time. When more supply meets the same demand, it leads to a more severe decline in valuations. At the same time, releasing more supply into the economy faster will lead to smaller releases later on. In both cases, it is assumed that the Web3 business and token demand side continue to grow healthily as well. Therefore, compared to the slower vesting scenario, fewer tokens are issued in the later period with the same demand, resulting in higher valuations in the later period.

Considering the previous reasoning, we can conclude that a faster vesting schedule is beneficial to the long-term valuation of the token. This is true in the given situation, but there are actually more factors to consider, such as community sentiment. A large token devaluation is rarely associated with good market perception and therefore may even lead to long-term damage to the protocols image and ultimately a decrease in adoption. Although the protocol cannot control market conditions and the actual demand for tokens, there are some factors that can be controlled, such as vesting schedule design.

in conclusion

The above discussion and case studies demonstrate that there is no perfect static vesting schedule that takes into account all influencing factors such as early investor and contributor interests, market participant interests, fairness, investability, sustainability, token stability and appropriate incentives. Every vesting schedule is a compromise.

QTM simulations show the difference in token valuation and volatility between slow and fast vesting plans. We acknowledge that this is not an accurate prediction of the future due to the static and deterministic nature of the model, but it supports the conclusion that slower vesting tends to result in less volatility compared to faster vesting. Although simulations show higher long-term token valuations in a fast-vesting scenario, early market investors and token holders would suffer significant losses, damaging the potential reputation of the protocol.

Another aspect of vesting plan design that cannot be underestimated is the complexity and sophistication of vesting plan implementation. In the author’s opinion, the most beneficial vesting occurs when it aligns with actual demand and protocol adoption, as it benefits all participants, even early investors. However, this approach requires careful engineering and on-chain execution, which may be difficult to achieve for all early-stage, especially smaller, Web3 startups.

If a protocol does not have the capabilities to adopt more advanced approaches, good practices can still be applied to traditional static vesting plans to be more conducive to the design of the token economy:

The vesting schedule is designed to correspond to each node of the protocol growth roadmap.

If there is no utility and basic demand, dont release the token to the market.

Web3 businesses go through three phases: build, scale, and saturate. Most coins should start distributing tokens during the scaling phase, not the building phase. Matching lock-up and vesting periods accordingly is key.

Delayed vesting through lock-ups and longer terms needs to be fully explained to early investors. Ultimately, they will benefit from a conservative vesting schedule as this provides breathing room for better product adoption and thus more counterparties for their profit realization.

A perfect vesting schedule does not exist, and more engineering resources should be allocated to advanced token vesting designs only if the Web3 business is capable. Therefore, it is important to find an appropriate compromise between the aspects discussed above.