LUCIDA: Sector perspective analysis of the crypto market

Original source: Lucida Falcon

The tools used in this tweet are: Falcon

https://falcon.lucida.fund/en/multi_factor_category_selector

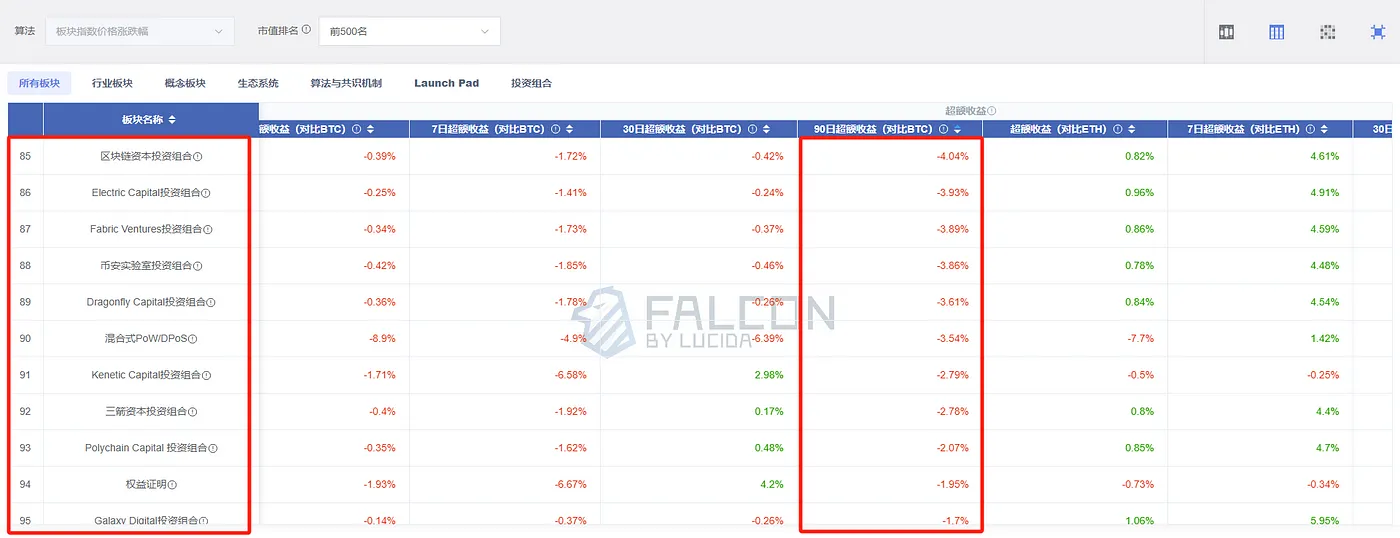

1. If you are not good at analyzing and selecting sectors with higher potential returns, you might as well simply hold Bitcoin

By analyzing sector data on Falcon, we found that nearly 50% of sectors had lower returns than Bitcoin over the past 90 days.

This phenomenon is completely contrary to peoples inherent impression: that is, the return rate of most currencies in the bull market is higher than that of Bitcoin, and investors can easily make profits in the bull market, but this is not the case.

In my impression, the market differentiation in the past few years is not so common. This obviously increases the difficulty of making a profit.

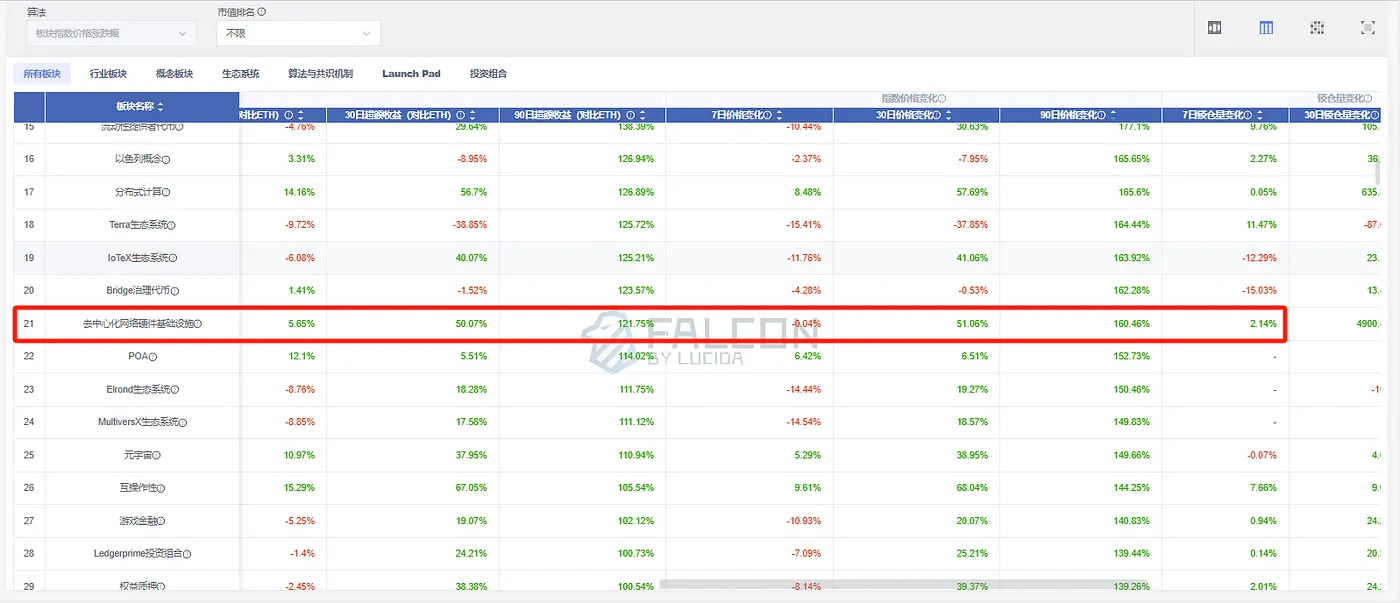

2. Popularity does not equal actual high returns

People are used to focusing on popular sectors consisting of blue-chip assets or well-known cryptocurrencies or highly valued coins, such as DePin and DeSci, but popularity does not equal actual high returns.

Falcon shows that DePin and DeSci have fairly low category price changes over the past 90 days, ranking 21st and 45th respectively

Some unpopular sectors, such as artificial intelligence big data, storage wallets, etc., are ranked high and have considerable returns.

So don’t invest in popularity, just believe in real data.

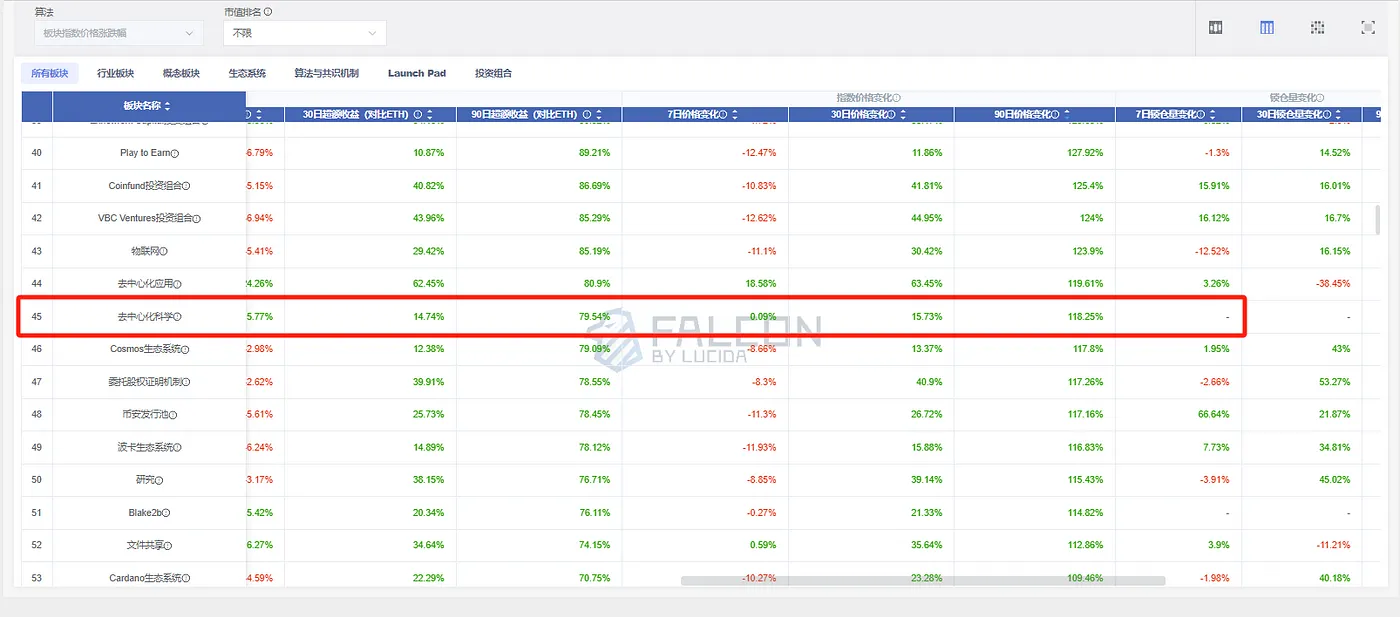

3. Several sectors that have performed well in the past 90 days have experienced stagflation for several consecutive days.

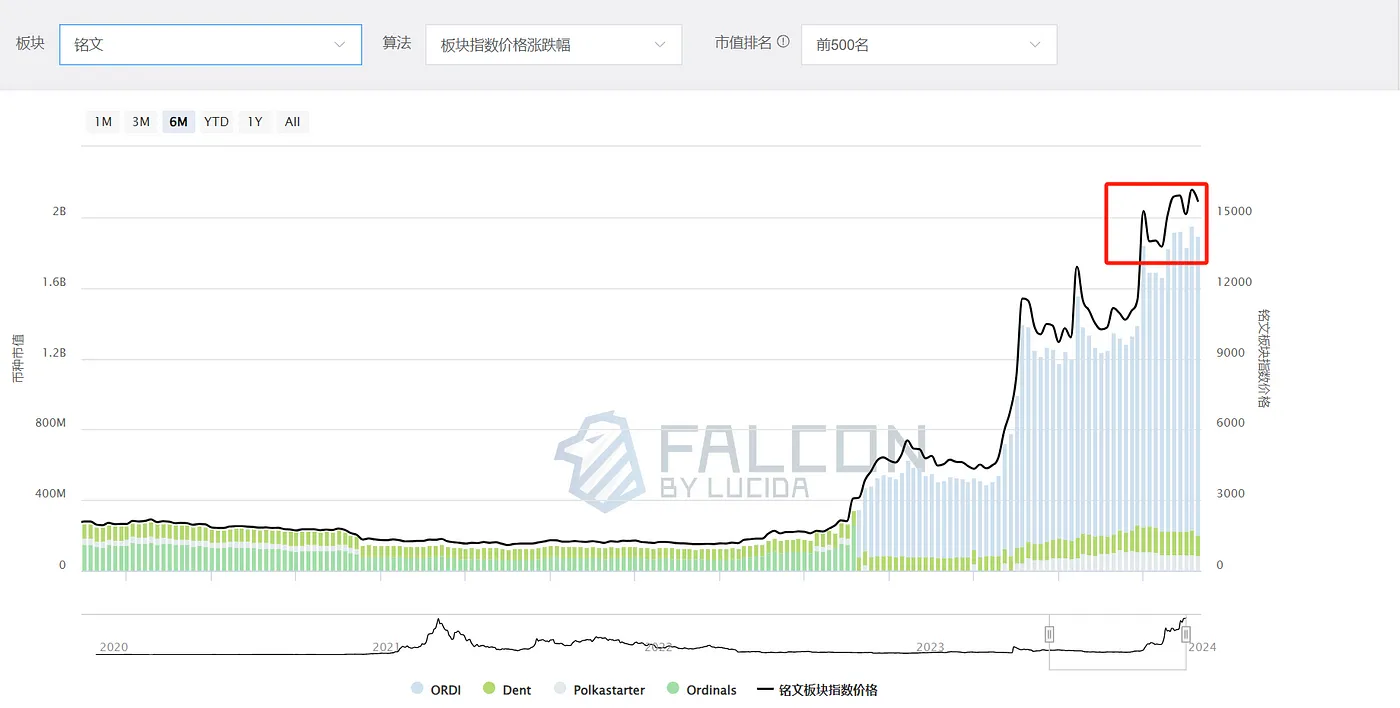

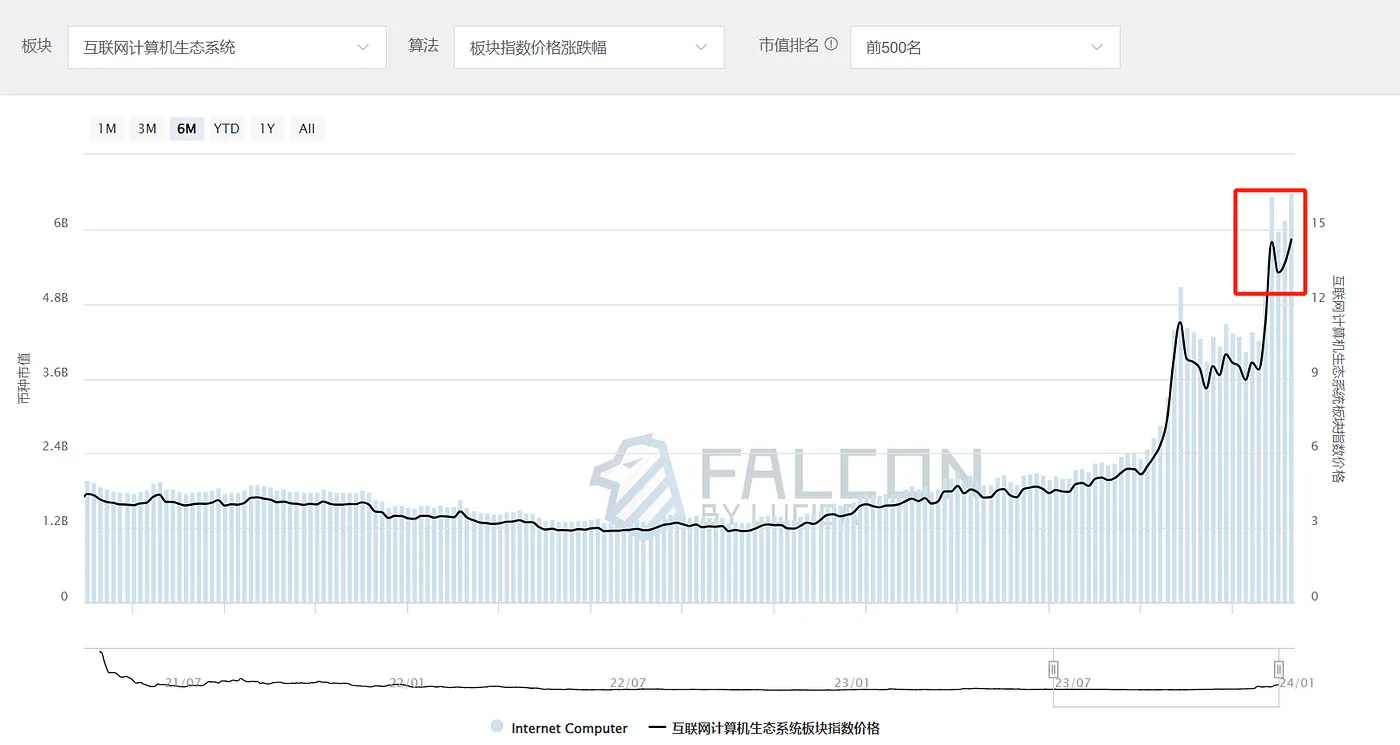

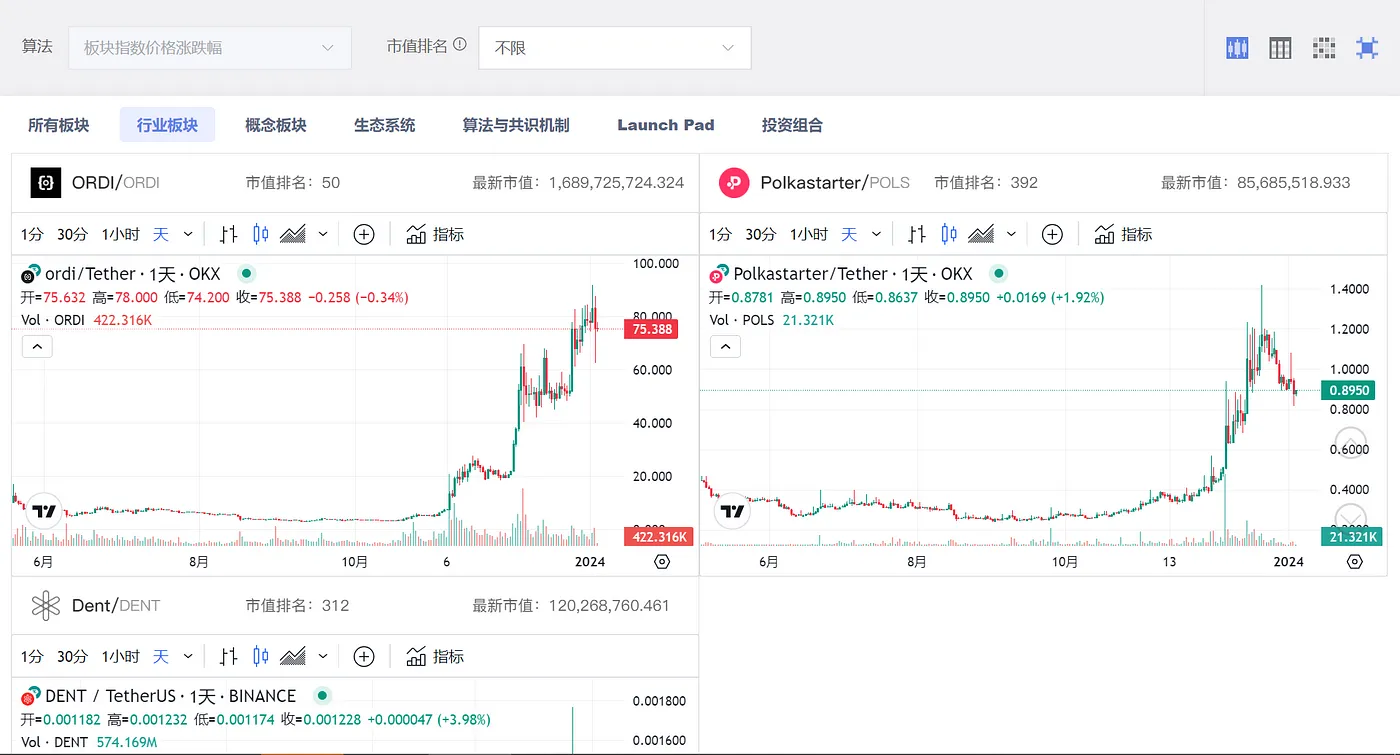

Falcon shows that some sectors that have performed well in the past 90 days, such as Inscription, ICP Ecosystem, etc., have experienced stagflation for several consecutive days.

In addition, the leading currencies in these sectors have also been stagnant.

All this evidence points to potential risks going forward.