Coinbase 2024 Crypto Market Outlook: Bitcoin’s Dominance Further Strengthens

Original author:Coinbase Research

Original compilation: Deep Chao TechFlow

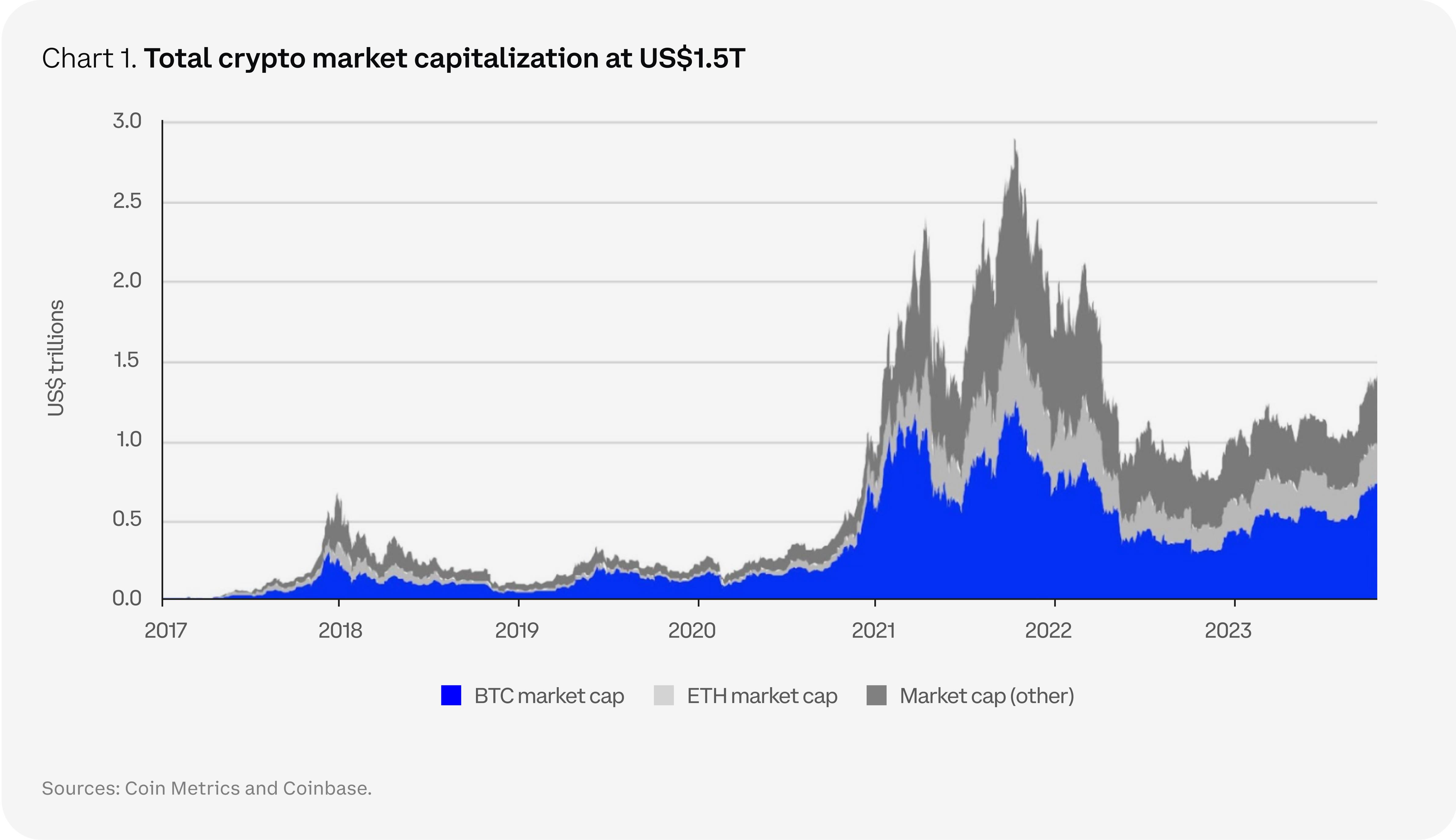

The total market capitalization of the cryptocurrency market has doubled in 2023, indicating that cryptocurrencies have survived the bear market and are now in the process of turning from bear to bull. Coinbase wrote a long article, mainly introducing the narrative that it expects to dominate cryptocurrency in 2024, as well as an in-depth discussion of Bitcoin, Ethereum, stablecoins, etc.

The main points

Coinbase believes that the main focus of institutional investment will continue to be on Bitcoin through at least the first half of 2024, driven in part by strong demand from traditional investors to enter this market.

2024 will provide a favorable macro environment for risk assets, and more importantly, crypto regulations will continue to be promoted to promote the long-term adoption of cryptocurrencies.

Web3 developers will continue to work on building real-world use cases, and the technical foundation is already evident.

The foundations for a better crypto user experience are being established that will help the industry bridge the gap from early adopters to mainstream users.

Authors Note

The total market capitalization of the crypto market will double in 2023, indicating that this asset class has ended its hard winter and is now in transition. Still, we believe it’s too early to label this, or that the upturn in the market is evidence to refute those who are bad-mouthing cryptocurrencies. What is clear is that despite the difficulties faced by the cryptocurrency community, the developments we have seen over the past year have exceeded expectations. This proves that cryptocurrencies are here to stay and the challenge now is to seize the moment and build a better future.

The catalyst for cryptocurrency’s resurgence in 2023 has nothing to do with the innovation that characterizes its value. The rise in regional U.S. banking crises and geopolitical conflicts, among other factors, has strengthened Bitcoin’s status as a safe haven. In addition, spot Bitcoin ETF applications from some of the top U.S. financial institutions have implicitly acknowledged the disruptive potential of cryptocurrencies, which may be a precursor to clearer regulations that help remove friction that prevents capital inflows.

Progress is rarely smooth sailing, and to create a more resilient market, Web3 developers need to continue building real-world use cases that help us bridge the gap from early adopters to mainstream users.

The foundations of what this could bring are already clear – from web2 products like payments, gaming and social media, to cryptocurrency-specific advancements like decentralized identity and decentralized physical infrastructure networks. The former is easier for investors to understand, but these projects face tough competition from established web2 giants. The latter may change the technology landscape, but development times are longer and large-scale user adoption is further away. However, blockchain infrastructure has come a long way over the past two years, creating the necessary conditions for these applied experiments and innovations, and we are now approaching a tipping point.

Asset tokenization is another important use case that is currently attracting traditional financial players into this space. Full implementation may still take 1-2 years, but the resurgence of the tokenization theme reflects the economic reality: the current opportunity cost is higher than when the epidemic was first released. This makes capital efficiency for immediate settlement of repos, bonds and other capital market instruments even more important.

Against this backdrop, we believe the long-term trend of institutional adoption of cryptocurrencies will accelerate. In fact, Bitcoins late 2023 rally is rumored to have begun to attract a wider range of institutional clients into the cryptocurrency space, whether traditional macro funds or ultra-high net worth individuals. We expect the launch of a US spot Bitcoin ETF to accelerate this trend, potentially leading to the creation of more complex derivatives products that rely on compliance-friendly spot ETFs as a basis. Ultimately, this will improve liquidity and price discovery for all market participants.

We believe that what has been mentioned above represents some of the fundamental themes of the cryptocurrency market in 2024, which we will discuss in this article.

Topic 1: The next cycle

Bitcoin supremacy

Market conditions in 2023 are largely developing as we expected in our 2023 Crypto Market Outlook. The shift in digital asset selection towards higher-quality underlyings has led to Bitcoin’s dominance rising steadily above 50% for the first time since April 2021. This is largely due to multiple well-known and established financial giants filing for spot Bitcoin ETFs in the United States, as their participation in the space helps validate and enhance the cryptocurrency’s prospects as an emerging asset class. While there may be some capital movement toward riskier targets in cryptocurrencies next year, we believe institutional flows will remain firmly anchored in Bitcoin through at least the first half of 2024. In addition, the strong demand from traditional investors to enter this market will make it difficult for Bitcoin’s hegemony to be shaken in the short term.

Bitcoin’s unique narrative helped it outperform traditional assets in the second half of 2023, and we expect this to continue next year. Unless a broad risk-off environment triggers liquidity needs, we believe Bitcoin is likely to perform well even against a more challenging macroeconomic backdrop. For example, fiscal advantages in the United States and other countries may limit restrictive monetary policies that keep capital stagnant. The U.S. commercial real estate sector looks fragile, potentially putting new pressure on regional U.S. banks. These two developments should continue Bitcoin’s long-term trend as an alternative to the traditional financial system. All of this could reinforce the deflationary narrative associated with the Bitcoin halving in April 2024.

new trading system

The last cryptocurrency bear market (2018-19) ended with the emergence of decentralized finance (DeFi) and the rise of multiple L1 networks, ostensibly built to meet the anticipated demand for on-chain block space . Development activity on these platforms pushed cryptocurrencies further into the mainstream before overall activity came to a standstill in late 2021. Therefore, it turns out that more block space is not necessarily needed. In anticipation of the downturn that followed, developers decided to take advantage of the cryptocurrency bear market to build. They work to solve technical barriers that hinder the development of new blockchain use cases.

The first stage of this progress is to build the infrastructure needed to realize the future of web3, such as scaling solutions (L2), security services (re-staking) and hardware (zero-knowledge proofs), etc. These are still important investment opportunities in the cryptocurrency space, but it can be said that a lot of infrastructure has been built over the past two years. As this enables the emergence of more decentralized applications (dapps), we believe that the cryptocurrency trading regime will transform with these efforts. That said, we expect more market players to focus on finding potential web3 applications to help cryptocurrencies bridge the gap between early adoption and mainstream usage.

Many market participants rely on web2 analogies to derive investment ideas for Web3 areas such as payments, gaming and social media. There are also use cases emerging in the industry with more unique crypto-native flavors, including decentralized identity, decentralized physical infrastructure networks, and decentralized computing. We believe the challenge is not just to identify sectors but also to pick winners. Achieving dominance in any given industry is not just about first-mover advantage (although it helps), but also about realizing and monetizing the right network effects. Before early 2004, there were at least a half-dozen other social media platforms, including Friendster and MySpace, that had achieved some success but had not achieved the same network size or popularity as Facebook. Given the nascent nature of the digital asset class, we expect many market participants to rely more heavily on brokers and platforms to capture the opportunities we see in the next cycle.

L1 balanced

In our view, the easing of on-chain activity over the past two years has reduced demand for L1. Ethereum’s dominance among smart contract platforms remains solid, leaving only a tiny space for direct competition. Approximately 57% of the total value locked in the crypto ecosystem is on Ethereum, and Ethereum’s dominance of 18% of the entire crypto market capitalization is second only to BTC. As market players become increasingly application-focused, we expect more alternative L1s to reposition their networks to better align with the shifting narrative. For example, more industry-specific platforms have spread across the ecosystem. Some focus on games or NFTs (e.g. Beam, Blast, Immutable X, etc.), while others focus on DeFi (e.g. dYdX, Osmosis) or institutional players (e.g. Avalanche’s Evergreen subnet, Kinto).

At the same time, the concept of modular blockchains is gaining more traction in the crypto community, and many L1s are stepping in to meet the needs of one or more core blockchain components, including data availability, consensus, settlement, and execution. In particular, Celestias mainnet launch in late 2023 has reinvigorated the discussion around modular blockchain design by providing a pluggable data availability layer that is always available. That is, other networks and rollups can use Celestia to publish transaction data and ensure that the data is on-chain for anyone to inspect. Other Ethereum Virtual Machine (EVM)-compatible L1 options focused on smart contract execution transitioned to Ethereum L2, such as Celo.

That being said, integrated chains like Solana still have an important place in the crypto ecosystem, which means the modularity vs. integration debate is likely to continue. We believe the trend of increasing chain differentiation - both by industry and function - will continue into 2024. However, the value of these blockchains ultimately still depends on which projects are being built on them and how much usage they attract.

The evolution of L2

The rapid growth of L2 scaling solutions has been driven by the emergence of new rollup stacks such as OP Stack, Polygon CDK and Arbitrum Orbit and the abstraction of functionality into specialized layers. Therefore, developers can more easily build and customize their own rollups. However, despite the growing number of L2s, they are diverting almost no activity from the Ethereum mainnet and are instead undermining L1 activity.

For example, if we compare connecting Ethereum L2 to alternative L1, we see that the share of ETH locked on Rollup connecting bridges has grown from 25% of all bridged ETH in early 2022 to 85% by the end of November 2023. Meanwhile, despite the growth in Rollup usage, the number of transactions on Ethereum remains relatively stable, averaging around 1 million per day. By comparison, the combined activity of Arbitrum, Base, Optimism and zkSync currently averages over 2 million transactions per day.

Furthermore, modularity theory is being reflected in the L2 domain in completely unique ways. Eclipse has attracted significant attention in 2023 for challenging existing conventions, being a universal extension solution that relies on a modular architecture. It is worth noting that Eclipse relies on

(1) Solana Virtual Machine (SVM) to execute transactions

(2) Celestia provides data availability

(3) Ethereum is used for settlement (security)

(4) RISC Zero is used for zero-knowledge fraud proof.

This is just one example of how we are starting to do some experimentation with different (non-EVM) virtual machines on the execution layer, although the impact this will have on the ecosystem remains to be seen. With the Cancun (Dencun) fork also approaching in Q1 2024, we may also see transaction fees for L2 settlement to Ethereum drop.

Topic 2: Resetting the Macro Framework

The long road to de-dollarization

De-dollarization will likely continue to be a long-term topic in 2024, especially in an election year. However, the reality is that the U.S. dollar does not face any threat of losing its global supremacy in the short term. What is clear is that the U.S. dollar is at an inflection point. Although de-dollarization may take many, many generations to unfold, the global monetary system has begun to move away from the dominance of the U.S. dollar. Macroeconomic imbalances in the United States are increasing. The Congressional Budget Office (CBO) predicts that the service cost of the U.S. debt burden will rise to US$1 trillion by 2028, accounting for 3.1% of GDP. CBO projects that the federal deficit will expand from 3.5% of average GDP to 6.1% over the next decade.

On the other hand, the subject of moving away from dollarization has been a topic of discussion since the early 1980s, and despite this, the US dollar remains the worlds reserve currency. In fact, the dollars outsized role in global finance and trade means that the dollars share of all international transactions has remained around 85-90% over the past four decades. What has changed is that as the United States imposes more sanctions on Russia over the war in Ukraine, the weaponization of global finance has begun. This has accelerated interest in developing new cross-border payment solutions, as more and more countries are entering into bilateral agreements to reduce dependence on the U.S. dollar. For example, France and Brazil (among other countries) have begun using Chinese yuan to settle merchandise trade. Additionally, more trials are underway with central bank digital currencies to avoid today’s cumbersome agent banking system.

Cryptocurrency advocates believe that Bitcoin and other digital stores of value play an important role in this emerging trend of shifting from a unipolar to a multipolar world. The value of owning a supranational asset that is not owned or controlled by any single country. Monetary transformations often occur during periods of socioeconomic upheaval that are often understood only in hindsight, like paper money in 11th-century China, promissory notes in 13th-century Europe, or credit cards in the United States in the mid-20th century.

On the other hand, while digital cash and distributed ledgers are likely to form a major part of the next transformation, replacing the U.S. dollar in the global financial system will not be easy. First, the entire crypto market is worth a fraction of the $13 trillion in denominated bonds held by non-banks outside the United States. The U.S. dollars share of foreign exchange reserves has declined over the past 30 years, but still accounts for the overall majority at 58%. But Bitcoin doesn’t necessarily need to replace the U.S. dollar to fulfill its valuable function as an attractive alternative in volatile environments, which could help it find a place among more countries’ reserve assets. Structural adoption of Bitcoin and cryptocurrencies is also not dependent on a collapse of the US dollar, which explains why we see Bitcoin strengthening in tandem with the US dollar in the first half of 2023. In the long term, the changes taking place in the monetary system and the role of cryptocurrencies in it are likely to be significant, even if we may not be able to witness the collapse of the old order.

Economic Outlook 2024

The odds that the U.S. will avoid a recession in 2024 have increased sharply in recent months, although the likelihood of a recession is not zero — as highlighted by the fact that the U.S. Treasury yield curve remains deeply inverted. The United States unique economic resilience this year has been driven by high levels of government spending and efforts to bolster nearshoring of domestic manufacturing. However, we expect these effects to fade in the first quarter of 2024, leading to a weaker economy amid relatively tighter financial conditions. But we dont think this will necessarily lead to a recession. Instead, a recession will depend on endogenous factors, such as the likelihood of renewed weakness in the U.S. banking system or the overall pace of deflation.

Regarding the latter, we have argued since March 2023 that inflation has peaked, and that slowing aggregate demand should cyclically support a stronger deflationary trend going forward. To a large extent, this is already happening, and structural forces, such as artificial intelligence, can lead to greater automation and lower input costs. However, demographic changes - such as the exit of baby boomers from the labor market - may counterbalance this. Taken together, we believe the economic slowdown and easing price pressures should pave the way for the Fed to cut interest rates in mid-2024 (or sooner).

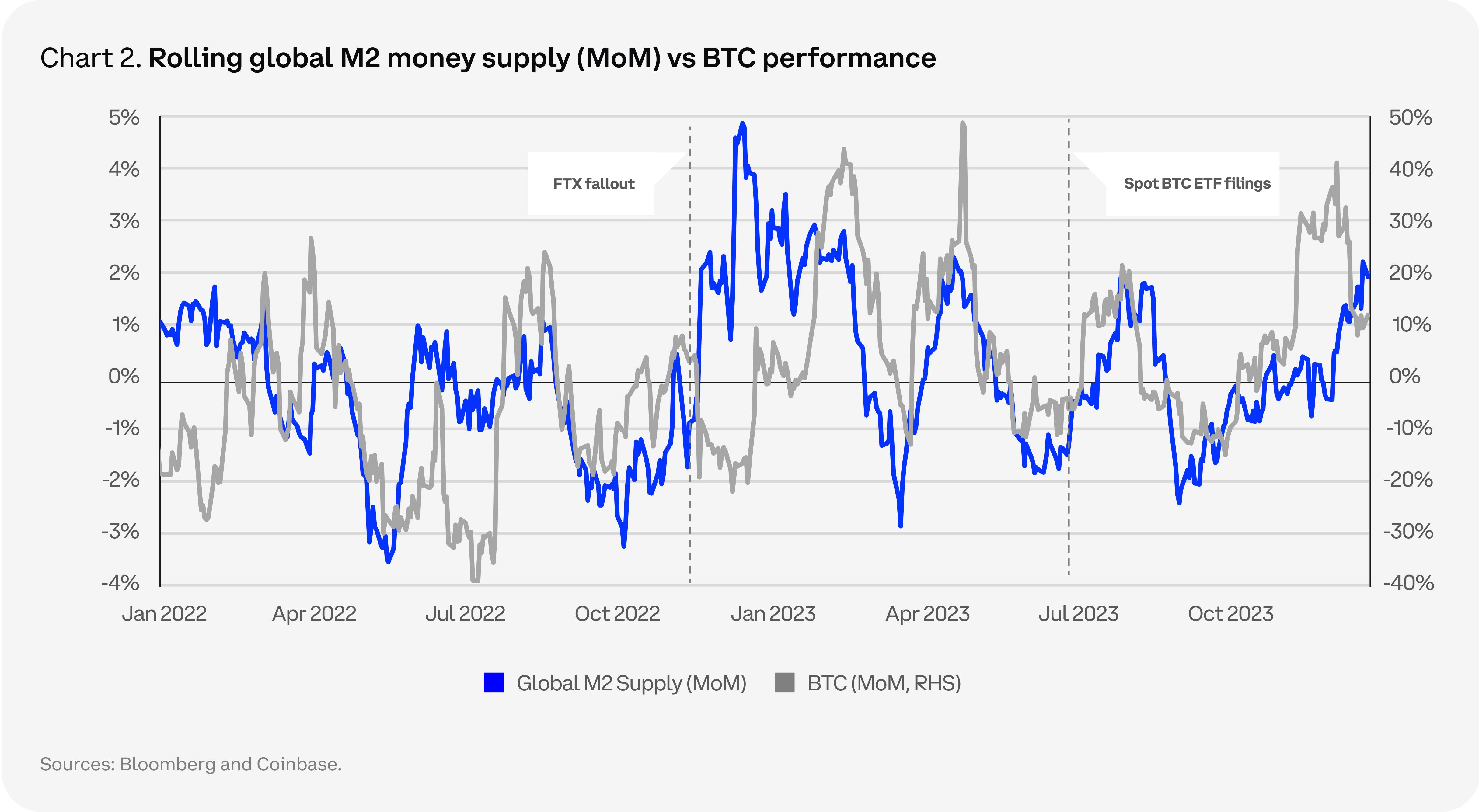

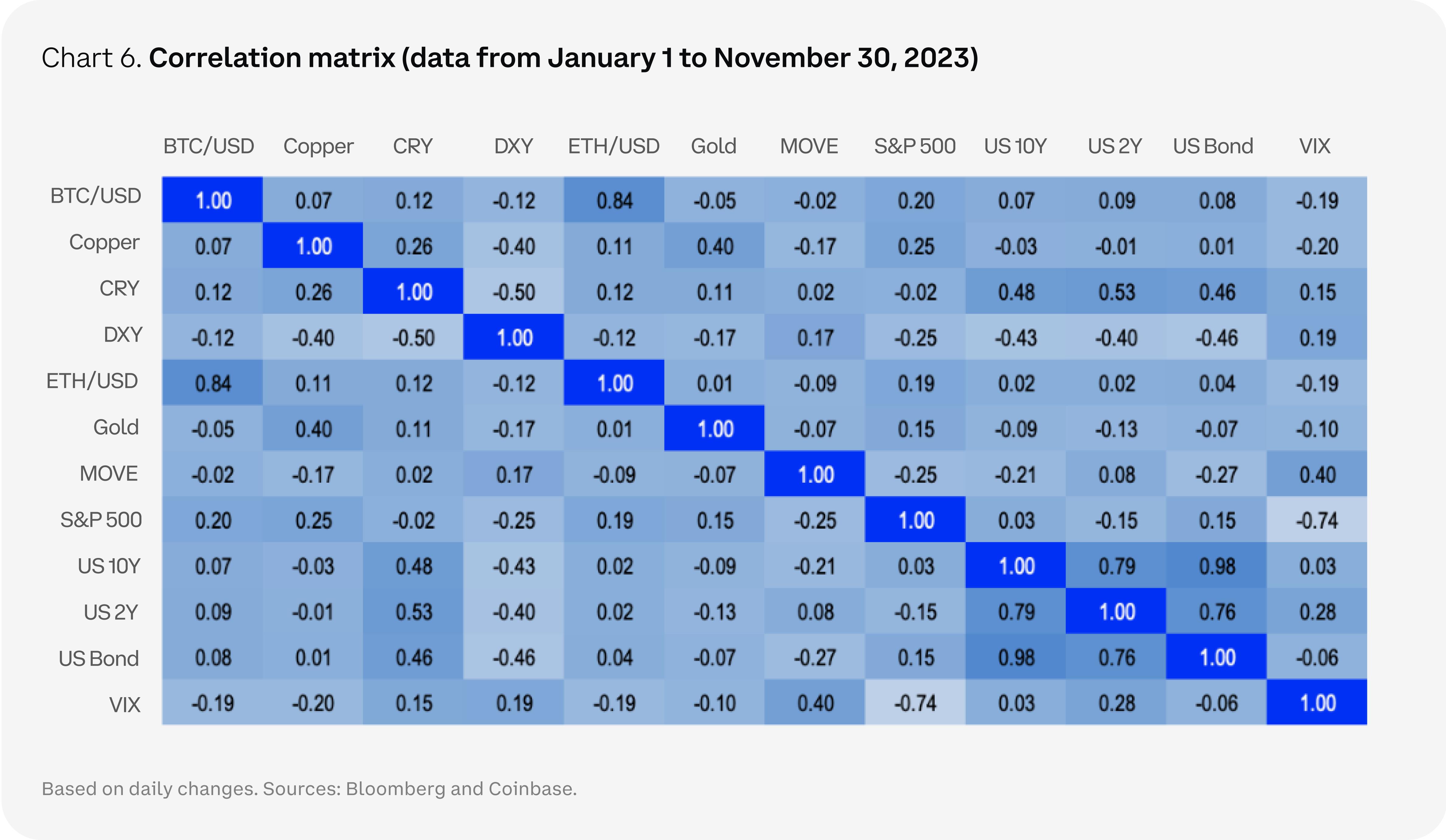

In our view, lower capital costs are likely to support risk assets in Q2 2024, but Q1 2024 could present some challenges depending on how entrenched the Feds stance becomes. Cryptocurrencies may not be completely immune to this scenario. But our economic outlook also points to a weaker U.S. dollar next year, which will be an opportunity for cryptocurrencies since these assets tend to be priced in U.S. dollars. Although the correlation between changes in many macro variables and Bitcoin (and Ethereum) returns has declined over the past year, the loose macro backdrop still forms a core part of our overall constructive market thesis for 2024.

Interpret supervision

In a recent institutional investor survey commissioned by Coinbase, some 59% of participants said they expected their firm’s proportion of investments in the digital asset class to increase over the next three years, while a third said they were The investment ratio has increased over the past 12 months. This proves that cryptocurrencies remain an important asset class with broad business and investment appeal globally. However, while many jurisdictions around the world are taking decisive action on cryptocurrency regulations, uncertainty in the United States is leading to missed opportunities and enforcement-focused market restrictions. In fact, 76% of survey respondents believe that the lack of sound and clearly defined cryptocurrency regulations in the United States threatens the country’s position as a leader in financial services.

Furthermore, regardless of the specific language used in the 2023 regulatory guidance and other public statements, the market perception is that the attitude of U.S. bank regulators towards the digital asset ecosystem is at least unfavorable, and some consider it downright hostile . The result is that all but the largest and most reputable cryptocurrency companies may have difficulty establishing banking relationships. Whether intentional or not, the regulatory gates the U.S. has established through non-objection letters and other requirements seeking licenses have cooled banks’ incentives to invest in digital asset technologies or take on customers who actively engage in these activities.

On the bright side, we think more U.S. lawmakers are aware of the Payments Stablecoin Clarity Act and the Financial Innovation and Technology for the 21st Century Act (FIT 21 Act) in 2023 as multiple U.S. House committees advance The risk of global regulatory arbitrage continues to rise.

Additionally, potential U.S. approval of a spot Bitcoin ETF could open the cryptocurrency to a new class of investors and reshape the market in unprecedented ways. Compliance-compliant ETFs could form the basis for a range of new financial instruments, such as lending and derivatives, that can be traded among institutional counterparties. We believe that 2024 will continue to establish the foundation for cryptocurrency regulations, leading to more progressive regulatory clarity and more institutional participation in this space in the future.

Theme 3: Connecting to the real world

Tokenization is an important use case for traditional financial institutions, and we expect it to be an important part of the new crypto market cycle as it is a key part of renewing the financial system. This primarily involves automating workflows and eliminating certain intermediaries that are no longer needed in the asset issuance, trading and record-keeping processes. Not only does tokenization have a product market that is well-suited for distributed ledger technology (DLT), but the current high-yield environment makes the capital efficiency that tokenization provides even more important than it was two years ago. In other words, the cost for institutions to tie up funds for even a few days in a higher interest rate environment is much higher than in a lower interest rate environment.

Over the course of 2023, we have witnessed many new entrants begin to offer tokenized access to on-chain U.S. Treasury exposure on public, permissionless networks. Total assets with on-chain U.S. Treasury exposure increased six-fold to more than $786 million as digitally native users sought to gain income uncorrelated to traditional cryptocurrency revenue sources. Given customer demand for higher yielding products and the need for diversified sources of returns, we may see tokenization expand to other market instruments by 2024, including equities, private market funds, insurance and carbon credits.

Over time, we believe that more areas of business and finance will incorporate aspects of tokenization, although regulatory ambiguity and the complexity of managing different jurisdictions continue to pose significant challenges for market participants – as well as integrating new Technology is integrated into traditional processes. This has forced most institutions to rely on private blockchains until now because of the risks associated with public networks such as smart contract vulnerabilities, oracle manipulation, and network outages. While private blockchains will likely continue to grow alongside public permissionless chains, this may fragment liquidity due to interoperability barriers, making it more difficult to realize the full benefits of tokenization.

An important theme to watch around tokenization is the regulatory progress being made in jurisdictions such as Singapore, the EU and the UK. The Monetary Authority of Singapore sponsors “Project Guardian,” which has developed dozens of proof-of-concept tokenization projects on public and private blockchains for Tier 1 financial institutions around the world. The EU DLT pilot regime sets out a framework that enables multilateral trading facilities to use blockchain for trade execution and settlement rather than through a central securities depository. The UK has also launched a pilot regime seeking a more advanced framework for issuing tokenized assets on public networks.

While many are now looking at “proofs of concept” for possible commercialization, we still expect full implementation to continue for many years as this topic requires regulatory coordination, progress on on-chain identity solutions, and key players within major institutions Large-scale operation of infrastructure.

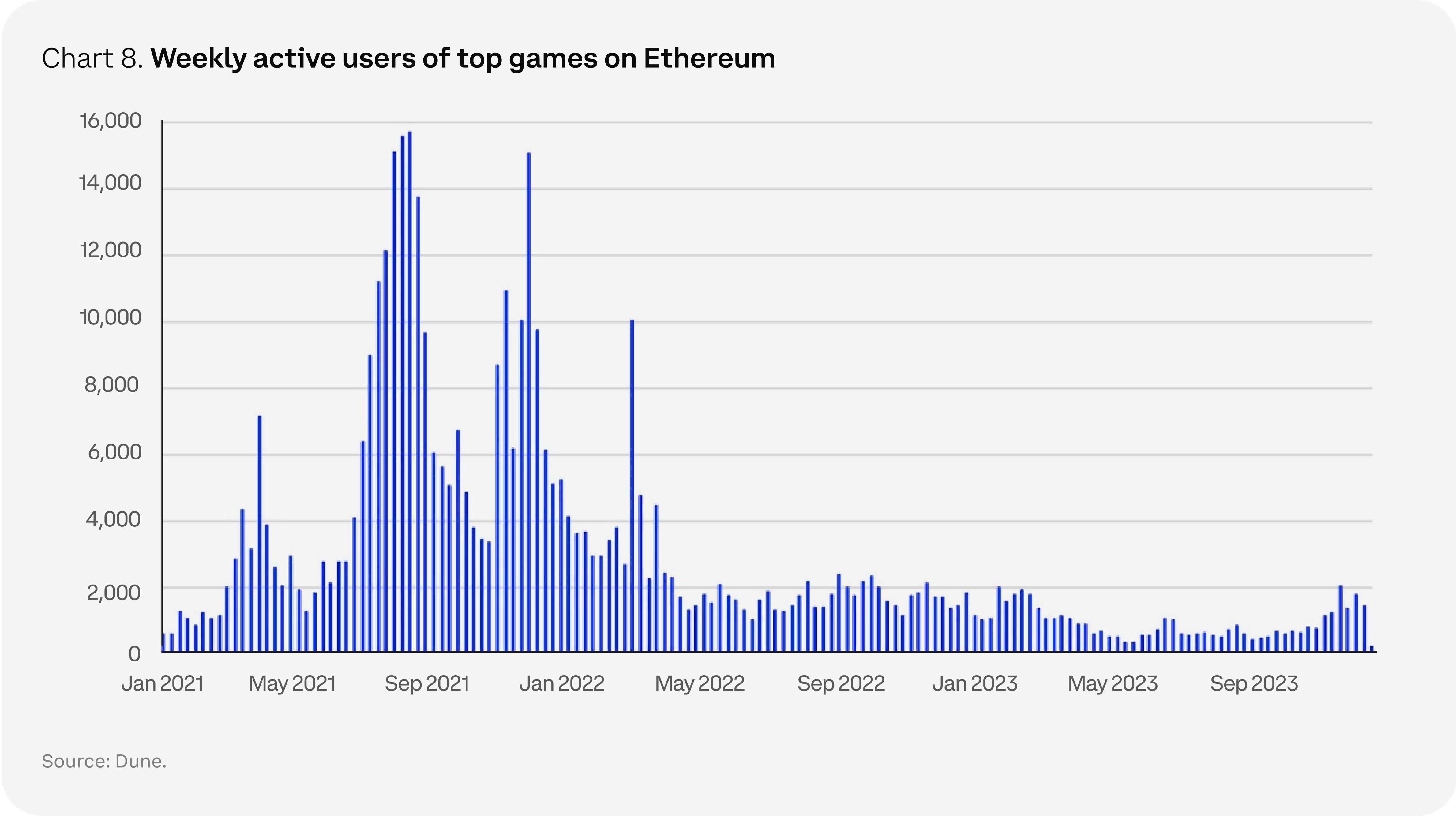

Thoughts on Web3 Games

Web3 gaming has seen a recent resurgence in popularity after trading activity plummeted during the early days of the cryptocurrency bear market. Currently, the field is focused on attracting the attention of mainstream gamers outside the many “crypto-first” communities. Overall, the gaming industry currently has a potential market share of approximately US$250 billion and is expected to grow to US$390 billion within the next five years. However, despite the huge investment opportunities, users have generally rejected the existing web3 play to earn model demonstrated by early projects such as Axie Infinity. In fact, this model may lead many mainstream gamers to become even more skeptical of web3 games.

This has led to more experimentation by developers who try to combine the network effects of high-quality AAA games with sustainable financialization mechanisms. For example, game studios consider using web3 narratives such as non-fungible tokens (NFTs) that can be used in games, transferred, or sold on designated markets. However, surveys show that most gamers don’t like NFTs, which broadly reflects their rejection of “Play to Earn.” For the gaming industry, the value-add of leveraging web3 architecture is that it promises to improve user acquisition and retention, but so far this remains an unproven argument. With game development processes hitting the 2-3 year mark for many projects (following the massive funding rounds in 2021-2022), we think some web3 games potentially releasing in 2024 may soon give us the data and statistics we need data to better assess this sector.

How to build a decentralized future

A big theme in 2024 (and likely longer, depending on development timeframe) is the decentralization of real-world resources. We pay particular attention to the related concepts of Decentralized Physical Infrastructure Networks (DePIN) and Decentralized Computing (DeComp). Both DePIN and DeComp leverage token incentives to drive resource creation and consumption of real-world constructs. In the case of DePIN, these projects rely on creating economic models that help incentivize participants to build physical infrastructure (from energy and telecommunications networks to data storage and mobile sensors) that are not controlled by large corporations or centralized entities. Specific examples include Akash, Helium, Hivemapper and Render.

DeComp is a specific extension of DePIN that relies on a distributed computer network to fulfill specific tasks. With the mainstream adoption of generative artificial intelligence (AI), the concept has seen a resurgence. Training AI models can be computationally expensive, and the industry is exploring opportunities to adopt decentralized solutions to alleviate this problem. It’s unclear whether combining blockchain with AI is feasible, but the field is growing. For example, a separate but related field of research called zero-knowledge machine learning (ZKML) focuses on privacy, promising to revolutionize the way AI systems handle sensitive information. ZKML potentially enables large language models to learn from a private set of data without requiring direct access to that data.

DePIN, as a powerful real-world application case of blockchain technology, has the potential to disrupt the existing paradigm, but it is still relatively immature and faces many challenges. These challenges include high initial investment, technical complexity, quality control, and economies of scale. In addition, many DePIN projects focus on how to incentivize participants to provide the necessary hardware, but only a few projects have begun to work on financialization models that drive demand. While demonstration of DePINs value may come early, realizing these benefits may still be years away. Therefore, we believe market participants still need to take a long-term view before investing in the sector.

Decentralized identity

Privacy is the new frontier for blockchain developers, who are leveraging innovations like zero-knowledge (ZK) fraud proofs and fully homomorphic encryption (FHE) to perform computations while keeping user data encrypted. The applications for this are widespread, especially regarding decentralized identity – the end state where users have complete control and ownership of their personal data. For example, this could enable medical research organizations to analyze patient data, helping them discover new trends or patterns in specific diseases without revealing any sensitive patient health information. However, for this to happen, we believe individuals need to have control over their identity data – unlike the current status quo where information is stored on many different centralized entity servers.

To be sure, we are still in the very early stages of solving this problem. But ZK systems and FHE, once viewed as purely theoretical concepts, have recently seen more experimental implementations within the crypto industry. In the next few years, we expect to see even greater advancements in this area, potentially allowing us to have end-to-end encryption in web3 applications and networks. If this is the case, then we believe decentralized identity could have strong product-market fit in the future.

Topic 4: The future of blockchain

Better user experience

One theme that has emerged during the recent bear market cycle is how to make crypto more user-friendly and accessible. The additional responsibility of managing cryptocurrency and everything involved (wallets, private keys, gas fees, etc.) is not applicable to everyone, making it difficult for the industry to mature unless it can overcome some key user experience related challenges. Progress in account abstraction appears to be achieving meaningful results in this regard. The concept of account abstraction dates back to at least 2016 and refers to treating externally owned accounts (such as wallets) and smart contract accounts in a similar manner to simplify the user experience. Ethereum advanced account abstraction in March 2023, opening up new opportunities for users through the introduction of the ERC-4337 standard.

For example, in the case of Ethereum, it could allow application owners to act as “payers” and pay users for gas, or enable users to fund transactions using non-ETH tokens. This feature is particularly important for institutional entities that do not want to hold Gas tokens on their balance sheets due to price fluctuations or other reasons. JP Morgans proof-of-concept report as part of Project Guardian highlights this, with all gas payments being processed through Biconomys Paymaster service.

Since the Dencun upgrade is likely to reduce Rollup transaction fees by 2-10x, we believe that more decentralized applications (dapps) may pursue the Gas-free transaction path, effectively allowing users to focus solely on high-level interactions. This may also facilitate the development of new non-financial use cases. Account abstraction can also facilitate robust wallet recovery mechanisms to create failsafes against simple human errors such as lost private keys. The goal of the crypto ecosystem is to attract new users and encourage existing users to become more active participants.

Validator middleware and customizability

Developments like restaking and distributed validator technology (DVT) are giving validators the ability to tailor key parameters in new ways—to better adapt to changing economic conditions, network needs, and other preferences over time . From an innovation perspective, the growth of validator middleware solutions is already a major theme in 2023, but we believe that their full potential to enhance customizability and unlock new business models has not yet been fully realized.

In terms of re-staking, currently led by EigenLayer, this could be a way for validators to secure data availability layers, oracles, orderers, consensus networks, and other services on Ethereum. The potential rewards gained through this process could represent a new revenue stream for validators in the form of “security as a service.” EigenLayer has officially launched its first phase on the Ethereum mainnet in June 2023 and will begin registering operators for the Active Verification Service (AVS) in 2024, after which stakers will be able to delegate their staking positions to these operators . We think these developments are worth watching to see how much of the staked ETH will be allocated for additional security measures when EigenLayer is fully open to the public.

At the same time, Distributed Validator Technology (DVT) for proof-of-stake networks can provide stakers with more design choices when it comes to setting up and managing validator operations. DVT limits single points of failure by distributing the responsibilities (and private keys) of a single validator to multiple node operators. This reduces the risk of slashing penalties and improves security, as a compromise of a single node operator does not compromise the entire validator. Additionally, for solo stakers, DVT gives participants the ability to run validators and earn rewards without staking too much (assuming they collaborate with others through platforms like Obol, the SSV Network, or the Diva Protocol to meet the staking threshold) , thereby lowering the barrier to entry and promoting greater decentralization. Therefore, we may see DVT enable validators to be geographically dispersed to mitigate activity and curtailment risk.