An in-depth interpretation of 5 potential projects on the DePIN track

Original author: Biteye core contributor LouisWang

Original editor: Biteye core contributor Crush

DePIN (Decentralized Physical Infrastructure Networks), a decentralized physical infrastructure network, uses blockchain technology to allow participants to deploy hardware devices without permission and trust to provide real-world services or digital resources. Its core is that users obtain returns by leasing the services provided by the hardware. According to Messrai, the current valuation of the entire track is approximately US$9 billion, and is expected to grow to US$3.5 trillion by 2028.

(Source: Messari)

DePIN covers a very wide range of areas, and according to Messaris classification, it can be divided into two categories: physical resources (PRN) and digital resources (DRN). Physical resources include wireless networks, geospatial networks, mobile networks and energy networks; digital resources include data storage, computing power, and network bandwidth, and each small area has more detailed classifications.

(Source: Messari)

The basic flywheel logic of the DePIN track is to encourage more supply-side participation through the token economy. With sufficient resource supply, price competition will occur. Sufficient resources and good prices will promote demand. When demand arises, tokens will With value capture, coins can better promote price increases and attract more resource suppliers.

This article briefly introduces the projects of the DePIN track:

Render Network

Render Network is a distributed GPU rendering network platform based on blockchain. It was launched by OTOY in 2017. It aims to connect more creators and idle GPUs, so that idle computing power can provide assistance for film and animation art rendering. Compared with centralized cloud rendering, Render is an unlimited decentralized network that solves the problem of supply and demand, breaks the limitations of centralized storage, gathers spare GPUs, and connects creators who need additional GPU computing power to maximize resource utilization. .

Render Networks business is simply to match computing power and artistic rendering needs. The computing power supply role is called a node operator. This number has remained stable. There are currently 326 Render node operators providing computing power.

(Source: https://twitter.com/ejwallach)

As rendering demand grew, and RNDR prices increased, node operators received $958,000 in November, an increase of 82% month-over-month and an increase of 898% year-over-year. However, OTOYs payments to GPU nodes are often significantly delayed, so the spike may reflect catch-up payments from previous months.

(Source: https://twitter.com/ejwallach)

Render Network was originally deployed on the Polygon network. In March this year, the community passed a proposal and decided to migrate from Polygon to Solana and build a BME (Burn and Mint Equilibrium) model on Solana. The BME model describes a relative balance between burned tokens and minted tokens in an ideal process and specific consumer market. It is already a mature token model and is used in projects such as Helium.

(https://medium.com/render-token/behind-the-network-btn-july-29th-2022-7477064c5cd7)

In this model, users use RNDR tokens when purchasing GPU rendering services. The tokens used will be destroyed after the task is completed, and the service providers rewards are issued using newly issued tokens. The basis for the rewards is not only based on the task The completed indicators also include other comprehensive factors such as customer satisfaction. As a result, RNDR tokens have more consumption scenarios in the entire economy. At the same time, the supply and demand relationship of tokens can be balanced and adjusted according to the algorithm between destroying and minting tokens. The entire business model is also continuously driven by simple C2C Evolve into a more managed B2C model.

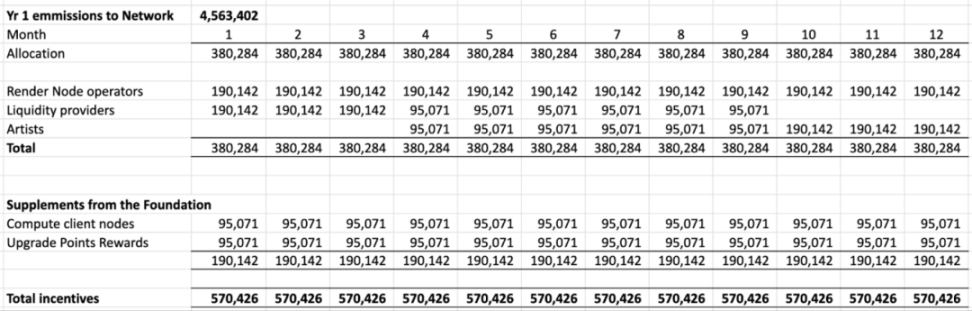

The specific initial distribution of token release is as follows:

(https://github.com/rendernetwork/RNPs/blob/main/RNP-006.md)

Regarding the destination of network migration, more than half of the users in the community vote chose to migrate to Solana. Since Render Network has reached a processing capacity of millions of frames per year, and this demand will gradually increase with the development of AI, there are higher requirements for on-chain synchronization efficiency, throughput, network latency, and cost. Solanas transaction volume per second TPS (4000) is about 137 times that of Polygon (29), and its cost is about 1/5000 of Polygon. At the same time, it has a large number of mature developers, making it an ideal choice.

(Source: https://github.com/rendernetwork/RNPs/blob/main/RNP-002.md)

On November 2, the Render Foundation announced that Render Network had successfully upgraded its core infrastructure from Ethereum to Solana and launchedIncentive planTo encourage users to upgrade $RNDR on Ethereum to a new token on Solana, $RENDER.

(Source: https://coinmarketcap.com/currencies/render/)

Since this year, $RNDR has increased by 800%. Currently, MC and FDV are at $1.5B and $2.2B respectively, ranking 51st in market capitalization. Since tokens have real application scenarios, we can see that the trends of token prices and business volume are relatively similar. Render has strong business resources. This year, it cooperated with Stable Diffusion on AI image rendering. It has also appeared in a promotional video for Apple Computer and has provided services for companies such as HBO and Netflix. The rapid development of AI has also greatly increased the project limit.

Helium

Helium is one of the oldest and most famous DePIN projects. It is a decentralized wireless network protocol that encourages users to deploy gateways and promotes global networks based on LoRaWan technology. Initially, we built our own Layer 1 network, but its adoption was hindered. In April this year, we completed the migration to the Solana network. We hope to take this opportunity to reach a larger user base and liquidity, and fully utilize the efficiency of the Solana network to complete further expansion. .

Helium has more than 350,000 active IOT nodes, and the Long-Fi signal generated by the Helium gateway can only be used for devices that support LoRaWAN. Currently, all gateways in the Helium network are full gateways, which will be gradually replaced by light gateways.

(Source: https://explorer.helium.com/stats)

To build a global, decentralized wireless network with supporting hardware is a very ambitious vision, and it is also very difficult. The following figure shows the distribution of Helium’s active nodes around the world, mainly concentrated in the United States and Europe. Therefore, Helium’s future prospects in the next few years The challenge is to drive rapid growth on the demand side.

(Source: https://explorer.helium.com/)

Heliums 5G business, Helium Mobile, recently announced that it will provide local residents with a $5 monthly unlimited voice/data mobile phone access package for a pilot project in Miami. This pilot project reflects Heliums commitment to open 5G networks in the future. Vision: Provide low-cost and reliable wireless network access services to the public. At the same time, Helium Mobile also announced next-generation 5G hotspots, developer tools, and application-based network coverage suggestions and incentive mechanisms, aiming to strategically encourage key areas and regions with lower costs and richer access scenarios. Rapid growth in location network coverage.

(Source: https://coinmarketcap.com/currencies/helium/)

$HNT is the main economic asset in the Helium ecosystem, and the only way to pay for network data transmission is to burn $HNT. The current market value is 1.29 billion US dollars, and the spot trading pair was delisted by Binance in October last year.

This year Helium issued two new tokens, $Mobile and $IOT, which are two subDAO governance tokens, Helium Mobile and Helium IOT respectively, with the purpose of achieving the separation of governance. Helium Mobiles 5G hotspot business earns $Mobile; while $IOT is used to reward nodes focused on running the Internet of Things. $HNT remains the primary asset in the Helium ecosystem, serving as the only token capable of paying for network data transfers.

Mobiles role is similar to that of a telecom operator, its services are low-priced, and it can be mined using eSIM. The business model is very simple and effective, and does not require complicated physical equipment. It is very attractive to low-income people and has strong scalability, thus achieving mass adoption.

Austin Federa, director of strategy at Solana Foundation, recently revealed that all employees of Solana Foundation/Labs/Eco have begun using eSIM and network services provided by Mobile. $Mobile has been online for 2 weeks, and its current market value is $541M. If it develops smoothly, there is still a lot of room for growth.

(Source: https://coinmarketcap.com/currencies/helium-mobile/)

Livepeer

Livepeer is a decentralized video transcoding network that aims to provide a decentralized, highly scalable real-time streaming protocol to significantly reduce the cost of video streaming applications. Founded in 2017, its business has now migrated from Ethereum to Arbitrum.

(Source: https://explorer.livepeer.org/)

Livepeers overall transcoding business volume has remained stable at an average of more than 2 million minutes per week. In November, Livepeer successfully transmitted 11.3 million minutes of video. Despite rising minutes of streaming, open price competition on the web has made video encoding 48% less cost-effective than it was two months ago (November vs September) ($42,100 vs $82,700) , This is consistent with the DePIN flywheel theory, that is, competition between idle computing will reduce user costs.

(Source: https://www.livepeer.tools/payout/report)

In addition to inflationary LPT rewards, node operators can earn ETH for video transcoding work on the network. This 30-day payout chart highlights the top 25 nodes, each receiving rewards ranging from 0.12 to 1.84 ETH.

(Source: https://tokenterminal.com/terminal/projects/livepeer)

The current market value of LPT is $217M. In August, there was a rapid rise from the bottom. The trading volume increased thirty times a day and the price doubled within a week. However, the overall price was still at a loss compared to the price at the beginning of the year. The annual revenue of the agreement is estimated at US$290,000, and there is no strong business cash flow.

(Source: https://coinmarketcap.com/currencies/livepeer/)

What is interesting is that in the past two weeks, whales have completed opening positions, purchasing a total of about 800,000 tokens (~$4.8 M) from the exchange and mentioning them to the wallet.

(Source: https://dune.com/sixdegree/liverpeer-lpt-ownership-and-governance)

Arweave

Arweave is a decentralized protocol that implements permanent data storage and uses a PoA (Proof of Access) mechanism to reach consensus and produce blocks. Compared with IPFS, the biggest feature is one-time payment and permanent storage. When people spend tokens to store data, a small portion of the AR payment is paid directly to the miners (nodes) responsible for storing the content, and a large portion is stored in an endowment that can technically be unlimited. Rewards are slowly released over time. Through this mechanism, Arweave guarantees unlimited permanent storage.

Arweave has many partners and a rich ecosystem. Solana and Nervos use Arweave as the default data storage layer, and also provides data storage services for multiple public chains such as Avalanche and Near through its middleware project KYVE. As of November 2023, Arweaves monthly transaction volume has reached 321 million times. The monthly transaction volume in November increased by more than 159% year-on-year and approximately 9.4 times month-on-month.

(Source: https://viewblock.io/arweave/stat/tx?time=month)

Arweave is currently capable of adding approximately 170 pieces of data to the network per second. While transaction volume continues to grow on a monthly basis, Arweaves fee market remains stable at 0.858 AR/GiB, proving Arweaves scalability.

(Source: https://viewblock.io/arweave/stat/tx?time=month)

Since its establishment, Arweave has completed a total of 1.84 billion transactions, and its business has grown rapidly this year, with approximately 1.2 billion transactions occurring this year.

(Source: https://viewblock.io/arweave/stats?tab=tx)

$AR is basically in full circulation at present, MC is currently $583M, the business volume is equivalent to Filecoin, the market value is 1/4 of it, the business growth is obvious, and the token increase is not much.

(Source: https://coinmarketcap.com/currencies/arweave/)

Irys is the storage solution for the AR ecosystem and handles about 95% of Arweave transactions. It is considering forking Arweave, no longer maintaining the data set, and resetting the token supply, which may result in the inability to achieve permanent storage of data on AR. This One event may have a greater impact on the price of AR currency.

Hivemapper

Hivemapper is a map network based on the blockchain. By installing Hivemappers driving recorder, contributors can collect data and earn tokens $HONEY as rewards. The issuance and settlement of tokens are all on the Solana network. The driving recorder in Hivemapper is similar to a mining machine. It is connected with the Hivemapper application and uploads street view images as data.

(Source: https://hivemapper.com/explorer)

In just one year since its establishment, Hivemapper has mapped approximately 91 million kilometers of roads, covering 10% of the worlds total road mileage, of which more than 6 million kilometers are unique. With more than 8,000 dash cams delivered worldwide, every day drivers are helping to create the worlds freshest maps.

(Source: https://hivemapper.com/explorer)

Hivemappers map artificial intelligence training has been put into operation, which can independently generate map features based on road images. More than 2,000 artificial intelligence trainers are responsible for verifying the systems output results every month. In September, there were an average of 500,000 training results per week, which increased rapidly after entering November, with the number exceeding 4.2 million per week.

(Source: https://coinmarketcap.com/currencies/hivemapper/#Chart)

Hivemappers revenue comes from two parts, selling driving recorders and selling map data API. The price of each recorder is $300 ($649 for the high-end model), and the annual revenue alone is conservatively estimated to be more than $2 million. The price of $Honey tokens cannot be too low, otherwise driving recorders will lose demand, maps cannot be effectively expanded, and the entire business will reach a deadlock. The tokens have not yet been listed on mainstream exchanges, and are basically traded on Orca. The FDV is very high, currently at $2.4 B, but the circulation is only 2.6%. Projects with high FDV and low circulation used to be a major feature of SBF tokens, and the price Very easy to pull and smash.

Summary and discussion

DePIN is a track that is perfectly adapted to crypto. It is a combination of decentralized infrastructure, blockchain technology, and token economy. Blockchain technology can solve problems such as rights confirmation and verification, while token economy encourages more participation. , the source of building network effects.

As mentioned at the beginning, DePIN can be discussed simply by classifying physical resources and digital resources into two categories. Physical resource projects, such as Helium and Hivemapper, are currently mainly concentrated in the United States and radiate to Europe. They have relatively strong geographical restrictions. How to deal with supervision while expanding the market is an important challenge faced by such projects. Although digital resource projects also have physical equipment requirements (such as GPUs, hard drives, etc.), fortunately, they can break through geographical restrictions and provide point-to-point services. With the rapid development of AI and the popularization of large models, ordinary people can also use AI to create. The demand for computing power will only increase, and the reachable market size allocated to DePIN will also increase. How to effectively collect demand and expand business cooperation is a difficulty in the growth of digital resource DePIN.

The DePIN track is still in a very early stage. Although it has great potential to break the circle, the threshold for non-Web3 users to access, understand and use it is actually relatively high, and it lacks complete infrastructure and unified standards. , resulting in mediocre development and usage experience and insufficient network availability. The moats of each project are not deep. For example, after Pollen entered the 5G track, Heliums miners also began to deploy Pollens nodes. Competition in the same segmented track is fierce, so it is important for projects to develop their own moats. At the same time, how to prevent cheating and how to face regulatory restrictions are all obstacles that will be faced on the road to development.

From an investment perspective, DePIN is a business with upper and lower limits. Unlike most meme projects that have no practical application, the DePIN project has real demand, supply and income, and the quality of the target can be analyzed from these perspectives. Compared with mature centralized services, DePIN services are cheaper, more flexible in configuration, and more suitable for the needs of small-scale users. From individuals to start-up teams, they are DePINs ideal customers.

Token economy is an important part of DePIN. Without incentives, participants will lose the motivation to become distributed nodes. Like BT seeds, the vision is good but eventually disappears. The token economy complements this link very well. A good example is filecoin as the incentive layer of IPFS. At the same time, the physical equipment of some projects is also an important source of income, such as Livemappers driving recorder. If the token price is not attractive enough or cannot even cover the cost, users will have no incentive to purchase hardware equipment, and the physical network will not be able to further Expansion will not create a network effect, and the project will reach a deadlock. Therefore, the DePIN track token has a certain lower limit, just like the shutdown price of miners.

In turn, this will also become a condition that limits the ceiling of the DePIN project. DePIN projects generally use project tokens for settlement, such as RNDR, LPT, and AR. Therefore, as tokens rise, the burden of cash expenditures will increase for users. When the price advantage is insufficient, users will inevitably be lost, leading to a decline in token prices. Therefore, even if the DePIN project is very successful, there is an invisible ceiling on the token price. The more important point is that the DePIN project is too solid, lacking the imagination of Memecoin, and there is no Ponzi mechanism of left foot stepping on the right foot. It is difficult to be fomoed, so DePIN is an investment track with a lower limit and an upper limit, looking for early low market value , Projects with applications are a safer way.

With the maturity of Ethereum Layer 2, high-performance public chains Solana, Aptos, Sui, etc. are all good choices for DePIN to take root in the future. It is much more cost-effective than early projects to build a blockchain by themselves. Blockchain network The performance improvement also laid a solid foundation for the development of DePIN. A recent new concept in Solana is called OPOS (Only Possible On Solana), which claims that many applications will only be implemented on Solana, and DePIN is one of their main tracks. It can be found that many DePIN projects have either migrated to Solana or used Solana for settlement. Solanas high throughput and low handling fees are very suitable for the needs of DePIN projects. Solana may become the rising Beta of the DePIN track.