Weekly Editors Picks (1223-1229)

Weekly Editors Picks is a functional column of Odaily. In addition to covering a large amount of real-time information every week, it also publishes a lot of high-quality in-depth analysis content, but they may be hidden in the information flow and hot news and pass you by.

Therefore, our editorial department will select some high-quality articles worth spending time to read and collect from the content published in the past 7 days every Saturday. From the perspectives of data analysis, industry judgment, opinion output, etc., we will provide those in the encryption world with You bring new inspiration.

Next, come and read with us:

Investment and Entrepreneurship

MT Capital Research Report: Fair Launch, a profound change in the way tokens are issued

In project experiments such as #BRC 20, #Blast, #ZERO, #ZKFair, etc., we have witnessed a great way to innovate - fair distribution for all. They do not rely on platform coins or investors. The earliest participants complete the investment, distribution, marketing and evangelism of the project. This is similar to liquidity mining in DeFi Summer, where the projects own liquidity incentives create prosperity for the entire chain. Fair distribution has greatly enhanced the enthusiasm of community participants and reached unprecedented heights.

The article provides an in-depth analysis of several key projects, from Inscriptions retail-driven model, to Blasts incentive innovation, to ZKFairs emphasis on fairness, to Analysoors innovation in distribution methods, to Binances use of Fair Mode to redefine the token economy.

As long as projects released on the leading Launchpad platform gain shares, they will definitely have a good rate of return. Among them, TurtSat has an astonishing return rate due to the released projects that are more closely related to the Bitcoin Inscription sector. At present, the popularity of the Launchpad sector continues to rise, and it is still a good opportunity to make money by gaining new shares.

DeFi

Re-staking (Eigenlayer) will be the fastest growing area in the staking protocol in 2024. Most DEXs, especially derivatives, would benefit from having their own execution environment. ATM, Pendle, Notional (fixed rate loans) and IPOR are sustainable interest rate derivatives protocols. Interest rate derivatives may become one of the more compelling narratives in cryptocurrencies in the coming years.

An evolutionary dead end? An article discusses flatcoin supported by the founder of Coinbase

One of the key features that makes money so popular is that it integrates directly into the primary business language we use in our daily economic lives. Normalization is a convenient feature. And flatcoin is not compatible with the U.S. dollar that we use in spoken language. Flatcoins will be less liquid than a standardized 1:1 USD, and this lack of liquidity will make them less useful for payments. Another issue with flatcoin is taxes.

GameFi

Quick Facts Delphi Digital Web3 Game Annual Report 20 Key Points

AAA chain games worth looking forward to in 2024 include Midnight Society Deadrop, Shrapnel, Gunzilla Games Off The Grid, Big Time, Star Atlas, Illuvium, and Parallel.

BGA 2023 Web3 Game Report: Acquiring new users is the biggest challenge

Compared with the peak of the bull market in 2021, the activity of all Web3 games has dropped significantly, but projects have shifted their focus to improving occupancy and player retention rates. After asset ownership, new revenue models and player reward models were considered the second and third largest advantages of blockchain games respectively in the survey.

Acquiring new users remains the biggest challenge facing the industry. Poor gameplay is another important issue. Regulation is once again a key concern for the industry.

70.0% of respondents believe blockchain games are scams or Ponzi schemes.

In addition to earning money through play, new methods for user acquisition include on-chain positioning, on-chain reputation, and Web3 activation.

2024 will be the end of predatory revenue models.

Bitcoin Ecology

Bitcoin Renaissance: Changing and Unchanged Value and Consensus

Macro trend: Bitcoin is the totem of the crypto world, and value storage is its core function. With Bitcoin gaining wider social acceptance, the consensus has strengthened, institutional admissions, ETF expectations, Bitcoin halving, interest rate cut expectations and many other factors have combined to push up the price, and the narrative subject is quietly shifting; it is predicted that the price will not rise in the long term. There has been a sharp decline, which is a market manifestation of the currencys store-of-value function being more widely recognized.

Technology Ecology: The explosion of Ordinals has attracted people’s attention to the Bitcoin ecosystem, which is a new narrative for individual retail investors to participate in Bitcoin investment. However, speculation is still the main focus at present. It is undeniable that speculation is one of the driving forces for the development of the industry. However, emotional speculation cannot last long, and the wealth creation effect brings too much bubbles and noise.

The Bitcoin Ecosystem IDO Platform Riding the Wind: Bounce Finance

Bounces auction mechanism combines liquidity mining, decentralized governance and staking mechanisms. Bounces goal is to improve the speed and efficiency of auctions in the DeFi ecosystem, allowing users to build, design, collect and trade various assets, tokens and NFTs on different chains. Bounce provides a fair place for the projects initial token issuance (IDO) through a powerful auction mechanism; it brings new opportunities for the development of Bitcoin ecological projects; Bounce also provides customized options, allowing the project team to customize the Set up as required. Bounce Finance’s popular ecological tokens include MUBI, BSSB, and BDID.

Metrics Ventures research report: Alex Lab, unlocking the huge potential of Bitcoin DeFi and BRC-20

Alex Lab is a DeFi infrastructure built on the second layer of Bitcoin Stacks. The functions that have been launched and are being developed include Bitcoin Oracle, Bitcoin Bridge, AMM, order book, pledge, Launchpad and a series of functions, building a complete DeFi Basic kit.

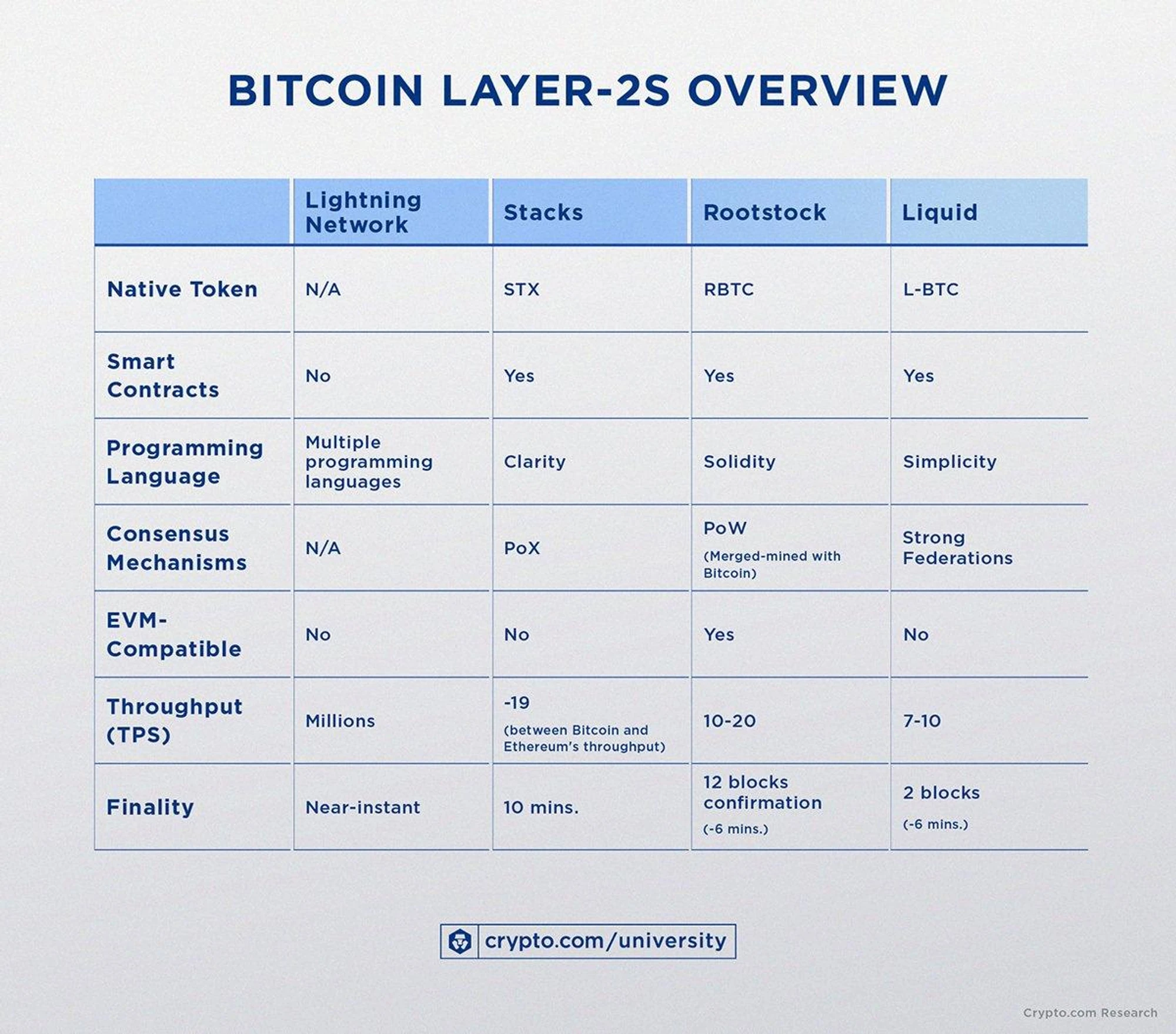

From a competitive perspective, Alex Lab is the absolute leader on Stacks. Compared with other expansion solutions, Stacks is currently the second-layer expansion solution with the healthiest ecological and data growth, and is comparable to Rootst.

The Nakamoto upgrade and the issuance of sBTC are expected to be launched in the first quarter of 2024. The Nakamoto upgrade will bring comprehensive improvements to the performance of Stacks, and sBTC will unlock new opportunities for Bitcoin DeFi. Alex Lab will be the best target for laying out this upgrade.

Based on ALEXs valuation and TVL, ALEX can be used as a leverage target to lay out the STX ecosystem. ALEX is currently not listed on large CEX and has a certain liquidity discount. Future listing may bring about an increase in currency prices.

Playing with the Atomics ecosystem: an overview of common assets and tools

1. Wizz Wallet (formerly ATOM Wallet) Wallet;

2.Foundry production platform;

5.Atomic Market trading market;

6.Wizz Cash wallet dashboard, asset transfer tool dashboard;

7.mempool block generation query on Bitcoin chain;

8.Atomics vs. Ordinals data comparison;

Ethereum and Scaling

Ethereum on-chain data, technology progress and what to watch in 2024

The changing trends in the Ethereum market in terms of institutional interest are worth noting.

The upcoming EIP-4844 upgrade (Proto-dank sharding) is a potential catalyst for its performance. This upgrade will improve Ethereums network efficiency and scalability, thereby gaining an advantage in the market, and L2s handling fees will be more competitive. . The current L2 is mainly EVM compatible, such as Arb, OP, Metis, etc. In addition, non-EVM L2s such as Eclipse and Flyent are being launched, which will bring new types of applications and developers.

Crypto games will be mainly based on the L2 ecosystem, and wallet user experience will continue to improve, allowing the Ethereum ecosystem to absorb more new users.

Additionally, the tokenization of real-world assets has been gaining momentum, bringing more “old world” financial products to the Ethereum blockchain.

Multiple ecology and cross-chain

Why can Solana be reborn from nirvana, and how can we participate?

Analysoor( 0,1): A new battlefield for 100-fold profits, reshaping Fair Launch’s innovation journey

Analysoor is the first Meta Protocol on the Solana chain, adopting a unique approach to creating and distributing NFTs and tokens. It provides users with the casting mechanism of Fair Launch by using the block hash value as a random number generator and selecting a winner on each block. This mechanism has currently proven to be successful, effectively eliminating the impact of Bots in the minting of $ZERO and Index ONE NFTs.

Fairness and liquidity guidance are the core value supports of Fair Launch. The fees generated by minting will not flow to the wallets of the project parties or miners, but will all be used to create liquidity, feed back the ecology and community, and form a positive flywheel.

Analysoor is forming a strong community consensus, and its value and potential are being realized and recognized by more and more people. At the same time, its developers are constantly using more innovative methods to further combat potential Bot behaviors so that fairness can be maintained and guaranteed in the long term. Among them, the application of AI algorithms and machine learning will be what we are most likely to see next.

Compared with the market value of mainstream Lanchpad projects on other public chains such as Auction, Turt, and Bake, Analysoors current market value may be seriously underestimated. Considering that there is currently no leading Launchpad protocol in the Solana ecosystem, Analysoor is very likely to play this role and has huge room for value growth in the future.

Its risk points include technical security, degree of decentralization, and being sucked by imitators.

Starknet is about to be airdropped. What ecological projects are worth paying attention to?

Except for RabbitX and Realms.Wrold, most of the ecological protocols of the Starknet network are still in a state of unissued coins.

The increase exceeded 190% in the 7th day, a glance at Metis ecological potential projects

On December 18, the MetisDAO development organization MetisDAO Foundation announced the creation of a fund of approximately US$100 million to accelerate the growth of its ecosystem and will allocate 4.6 million METIS tokens for serializer mining, retroactive funds, new project deployment and other efforts. Based on current token prices, the fund is already worth $322 million.

In addition, according to the official blog post, Metis is expected to become the first Optimistic Rollup of the decentralized sorter early next year, and the distribution of the Metis Ecological Development Fund will take place one week after the Metis decentralized sorter goes online. Metis marketing director Jose Fabrega said in an interview that the initial incentive for the sequencing pool came from the Metis Ecological Development Fund.

Projects worthy of attention in this ecosystem include DeFi (Hermes, Netswap, Hummus) and Meme (VMUM, BARSIK).

Safety

The latest fraud routines and risk prevention of currency circles

Beware of phishing website routines, fake well-known inscription routines, false claims in the east and attacks in the west, and steal wallet private key routines.

Hot Topics of the Week

In the past week,Some users reported that they have received compensation in Japanese yen from Mt.Gox,ETH market returns;

In addition, in terms of policy and macro market,Hong Kong announces opening of Bitcoin spot ETF, Hong Kong Monetary Authority consultation document:It is a criminal offense to issue and promote stablecoins without a license in Hong Kong;

In terms of opinions and voices, Arthur Hayes:If Bitcoin ETF is too successful, it will destroy Bitcoin,Cathie Wood:GBTC has tax and regulatory uncertainties, Delphi Digital year-end summary:A multi-chain world is inevitable, Blur reshapes NFT liquidity,Blockworks:L1 will be the best venture deal of the next decade, OKX CEO Star respondedRequests for more BRC-20 tokens to be launched will be listed following the five major currency listing principles,Jupiter Lianchuang:JUP will not be given more functions other than governance for the purpose of pulling the market;

In terms of institutions, large companies and leading projects,Paxos Receives NYDFS Approval to Expand Stablecoin Issuance to Solana, posted by Tether CEOOutlook 2024: Plans to launch multiple new products and consolidate existing business,Starknet has added bridging related files to the Github repository,Unibot:Trading Bot for Solana to be launched,Avalanche Foundation will invest in Avalanche ecological meme currency through creator fund Culture Catalyst,Nostr Assets Protocol was slapped for donating to Damus,Bounce Brand:Bitcoin staking chain BounceBit is being developed;

NFT and GameFi fields,Elon Musk tweets a video with the word NFT...Well, it’s been another week of ups and downs.

Attached is the Weekly Editors Picks seriesportal。

Happy New Year in advance to all my readers! See you next time~