Blockworks:L1将是未来十年最好的风险交易

原文来源:Blockworks

原文编译:深潮 TechFlow

“大多数技术倾向于让工人执行琐碎的任务。然而,区块链的不同之处在于它的自动化是去中心化的。区块链没有让出租车司机失业,而是让 Uber 失业,让出租车司机直接与客户合作。”

– Vitalik

如何解释加密货币的一切

如果你在加密领域工作足够了长的时间,你就会理解尝试向新手讲述加密是什么是很痛苦的。

在全职从事加密领域六年后,当我的父母让我描述它是什么时,我仍然会感到心慌意乱。

通常,我默认回答以比特币为中心的答案。

我首先描述问题:中央银行印制了太多钱,因此比特币作为一种不能被中央实体贬值的数字货币被创造出来。

但我开始发现这个答案不令人满意,尽管这是客观事实,但今天的加密货币实际上比这个回答要更广泛。

如今,加密货币行业中有很多人不与比特币互动,也不关心解决与金钱相关的问题。

加密货币的发展非常快,以至于很难用一个总体理论来描述这个行业是什么以及它为何如此重要。

我已经为此苦苦挣扎了一段时间,现在我终于认为我有一个理论,这个理论可以统一回答加密货币是什么的问题。

加密货币的创新:创造一种新商品

加密货币的根本创新在于创造了一种新商品:区块空间。

为了过于简化的定义,区块空间是在存在于网络空间中的存储,任何开发者都可以在其中运行代码或存储数据。

使区块空间作为软件独特的是,它不从属于硬件的中心化所有者。

中心化是我们当下所有软件的现状。谷歌这样的公司创造了我们都在使用的极其有价值的软件:谷歌搜索、Gmail、Chrome 等。

但如果谷歌想要的话,他们可以单方面改变任何事情。不过事实证明,这种组织有许多优势。

作为一个中心化组织,谷歌可以快速修补漏洞。他们可以雇佣优秀的人才并利用规模经济。

然而,有些软件的应用不适用于可能被单一方占用的软件,这些往往是对社会信任度和重要性极高的应用软件。

例如,尽管我们信任谷歌,但我们不会信任他们来管理我们的货币。为什么?因为他们可以没有监督地随时更改金额。无论我们多么信任谷歌,我们都心知肚明,作弊的动机太强烈了。

这些传统软件不适用的高信任应用正是区块空间非常有用的地方。因为它是由全球大量独立参与者独立验证的,所以它实际上颠覆了现有的规则,使硬件运营商从属于软件。这就是为什么我认为许多硅谷人不懂加密。它本质上与他们的商业模式相反。

不同风格的区块空间

事实证明,就像任何商品一样,有许多不同的方式来完善区块空间。例如,比特币的区块空间具有许多独特特性,使其适用于金钱用途。具有讽刺意味的是,比特币区块空间的属性使其特别适合金钱用途,但其性能却受到限制。

比特币网络大约每 10 分钟产生一个区块,最大容量为 4 兆字节,这些限制(以及其他许多限制)使比特币无法进入许多用例——高频交易、游戏等。然而,对于金钱用途来说,这些限制实际上是一种优势,因为它迫使网络回避适应这些应用程序所需的复杂性。

其他区块空间生产者(例如以太坊)选择了一套不同的权衡。以太坊的区块空间是通用的,更适合于更广泛的应用。这一决定使以太坊面对其生产的区块空间的消费者群体更广泛。但它作为一个网络所必须应对的复杂性降低了它的货币属性。

我可以用多个段落来讨论不同风格的块空间(专用应用程序与通用、从属于另一个区块链序列的区块空间,例如 Rollup 等)。

这里要记住的关键点是,我们正处于试验和完善区块空间的早期阶段。在未来,我的期望是,将有一个大型且多样化的区块空间生产者和消费者市场,适合不同的用例。

为什么我们关心区块空间是一种商品?

如果你正在考虑与其相关代币的投资,了解区块空间的性质很重要。

这是了解商品的重要一点。虽然商品投资者很多,但几乎都是交易者。没有人会购买并持有大宗商品 20 年,因为大宗商品是由社会设计的,以保持平稳,或更理想的情况是下跌。(注:当我说“下降”时,我的意思是实际购买力会下降)

原因很明显——我们日常要使用商品!如果石油价格上涨太多,政策制定者最终会竭尽全力使其回落。其他重要的商品如钢铁、食品等也是如此。

这与股票基本相反,股票是被设计用来上涨的。如果股市长时间下跌,政策制定者将开始寻找方法让它再次上涨。

当然,这个说法是简化的,还有其他原因导致股票上涨(复利等),但这是高层次的原因。

但我被告知要持有加密货币

这意味着几乎每个时事通讯的读者都非常不喜欢这一点。

如果L1区块空间是一种商品的话,那么我们在 Blockworks 谈论的所有资产(比特币、以太坊、Solana、Atom 等)都不是长期投资。从我们刚才阐述的角度看,这些都是短期交易而不是长期投资。

但等一下,你可能会说,数据并不支持这个理论!

我认可Fat Protocol(胖协议理论)。

比特币和其他L1代币(如以太坊)是加密货币中表现最好的资产,远远超过了像 Coinbase 这样最成功公司的股权。但我不认为这种情况会永远持续下去,原因很简单:区块空间的激励与商品类似。如果比特币要成为成功的货币,它就不能继续每年增长 100% 。同样地,对于生产区块空间以供应用程序消费的区块链(比如以太坊、Solana 等),长期激励是价格在某个时刻达到最高。

有些人会指出,区块空间市场和代币市场并不是 1: 1 。我理解这一点,但它们是相关的,因为区块空间以代币计价,因此它们具有内在的联系。

我认为过去十年的加密货币最好的类比是一次传统的商品繁荣。

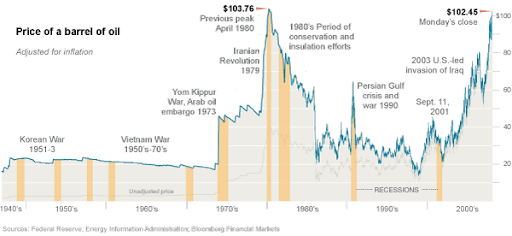

你可以看看近代史上的一些例子,但我认为最相关的是 1970 年代的大宗商品繁荣。

由于相似的经济和地缘政治气候,我觉得 1970 年代的比较最合适。大宗商品的繁荣最初是由阿以冲突引发的,但潜在的通货膨胀气候使情况加剧。

在同一时期,尼克松暂停了黄金兑换窗口,导致货币基础快速扩张和黄金价格暴涨。

现在,我想表达的重点并不是 1970 年代和今天完全一样,货币贬值和通胀是推动加密货币价格上涨的因素(尽管这是其中的一部分)。

我的观点是,历史上有各种时期误导了投资者,使他们相信商品可以在很长一段时间内维持类似股票的回报。

一个有趣的比较,会让加密货币 OG 发笑,那就是在 1970 年代和 2000 年代,人们也开始说我们正在经历一次商品超级周期(向 Su Zhu 致敬)。

我对当前时期的看法是,这是世界上数字商品繁荣的第一阶段。区块空间是一种新颖的商品,可以用于极其广泛的应用,这就是为什么它如此迅速扩张的原因。

但是,就像在此之前的所有商品繁荣一样,金融引力最终会生效。随着时间的推移,你最喜欢的L1将开始像玉米、钢铁或大豆一样交易。

1970 年代商品繁荣和 2010 年代数字商品繁荣之间的最后一个比较是它们对市场参与者的心理影响。

金本位者和今天加密货币主义者之间有一个非常有趣的比较。

对我来说,金本位者有趣的地方在于,经历了 70 年代惊人的价格上涨后,黄金的表现基本上落后于世界上所有其他资产。但 40 年后,这个社区比以往任何时候都更狂热。如果你真的认真思考一下,这相当令人难以置信。

我认为加密货币中存在相同的情况。当你拥有的一个资产涨了 10 倍或 100 倍时,大多数人的大脑化学反应会发生变化,这很难忘记。

在加密货币领域,我认为还有另外两个未被充分认识的动力助长了盛行的部落主义。

网络时代的孤独。年轻人越来越多地在孤立的世界中寻找社区,而大型的加密货币社区(例如比特币、Solana、以太坊)可以提供这种服务。

Layer-1 需要大型社区聚集在一起制定路线图,这些路线图具有非常有意义的技术权衡,但只有一小部分工程师真正理解。因此,策略是围绕这些权衡制造叙事以争取大众支持(以区块大小战争为例)。

所以,我对可预见的未来的预测是,在这次加密货币商品繁荣期间,部落主义会增加,而不是减少。

总结

对一些人来说,这种预测可能听起来很悲观。对我来说不是。

我认为我们还处于L1区块链的实验和扩张的早期阶段。所以好消息是,我认为我们离这次区块空间商品繁荣的尽头还很远。我预计,还有 5 到 10 年的时间。

所以如果你仍然喜欢以太坊、Solana、Celestia 或其他,留给你的时间仍然很多,我猜已有和新的L1,将是十年来最好的风险交易(这不是投资建议)。但最终,我预计市场将根据其所需的区块空间风格进行调整,并将变得商品化。

对一些人来说,我会理解这听起来是看跌的,但我不同意。我认为这是一件好事。我对加密货币的长期看法是,它是一个使以前不可能的新用例和业务成为可能的底层基础。为了建立一代又一代的企业浪潮,我们需要丰富、廉价、有用的区块空间。而这正是今天所建立的。

如果您已经阅读到这里,那么这里是本文的简要总结:

加密货币的根本创新是一种新商品的创新:区块空间;

过去十年的加密货币是一个区块空间商品热潮,这种热潮可能会在未来的 5-10 年继续;

但最终,区块空间将变得商品化,并且 Layer-1 将开始横向交易;

这将为在区块空间上建立的第一代企业铺平道路,这些企业将跨越鸿沟进入主流;

这些支持区块空间的企业的权益将开始超越底层的 Layer-1 ;

这一理论的一个例外可能是像比特币这样的区块链,其用例不是在其上建立业务,而是充当货币。

我认为这是一个有效的例外,尽管如我之前指出的,如果比特币要作为货币,其波动性和回报将随时间降低。

因此,我最终认为结果将非常相似。(旁注:我认为这个例外被加密社区理解,这就是以太坊试图将自己重新命名为“超声波货币”的原因。)

总而言之,这对我来说是非常令人兴奋的。在下一个十年里,我期待看到区块空间的寒武纪大爆发将会继续下去。投资者和用户都会做得很好(非金融建议)。就我个人而言,我对接下来会发生的事情感到兴奋,那就是在这个区块空间之上建立的一代企业浪潮。

我认为当我们在十年后回顾时,我们会对发生的巨大变化和我们所建立的一切感到惊讶。

正如比尔·盖茨曾经著名地说过:“我们高估了我们一年能做的事情,但低估了我们十年能做的事情。”