HashKey Capital: Thailand Blockchain Ecology Report 2023

Original source: HashKey Capital

1. Overview of Thailand’s blockchain and encryption ecosystem

1.1 The number of visitors to the cryptocurrency data analysis platform is booming

The average monthly visits to the CoinMarketCap website in 2023 were 648,000, accounting for 0.94% of the countrys total population. Thailands per capita visits were 0.21% higher than the United States.

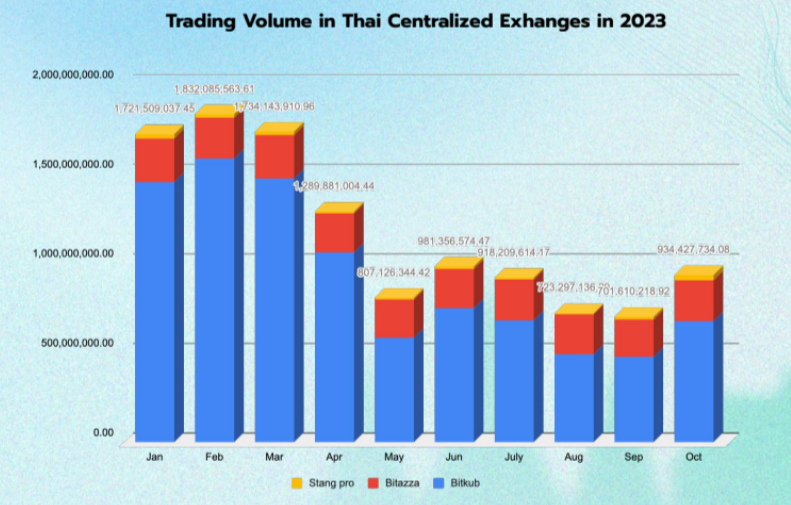

1.2 The trading volume of crypto assets in Thailand is considerable

According to trading volume data on Thailand’s leading digital asset exchanges such as Bitkub, Bitazza (broker) and Satang on CoinGecko, from January to October 2023, the total trading volume reached 116, 436, 471, 138.81 USD, approx. A total of 410 billion baht. In 2023, Bitkub occupied the largest market share, accounting for 77.04% of the total trading volume that year; the market shares of Bitazza and Satang were 21.60% and 1.36% respectively. Among them, Satang was acquired by Kasikornbank (KBANK) in 2023 and was later renamed Orbix.

Source: cryptomind, CoinGecko

1.3 Thai users’ interest in digital asset trading is rising

On Chainalysis’s Crypto Adoption Index, Thailand is rankedtenth place, Chainalysis’ evaluation criteria consider user activities on centralized exchanges, P2P trading, and DeFi protocols.

Exchange:Thailand Digital Asset Exchange currently has more than 2.94 million user accounts, accounting for 4.27% of the country’s total population, more than half of the 5.5 million accounts in the stock market, indicating that Thailand’s encryption industry is growing rapidly.

Binance:From January to November 2023, Thai users visited Binance an average of 116,877 times per month, with visits peaking at 303,057 times in January 2023.

Metamask: From September 2020 to August 2023, the Metamask wallet was downloaded more than 797,931 times in Thailand. The month with the most downloads was November 2021, reaching 88,539 times, which is likely to be affected by GameFi and Metaverse. Popular influence.

Dex: During the bull market in 2021, Thai users visited DEXs like PancakeSwap an average of 35,000 times per month. The number of visits dropped after the bear market arrived.

Opensea: During the NFT craze in 2022, Opensea averaged 48,000 monthly visits in Thailand, with a peak of 65,000 visits in July, and traffic declined after the bear market.

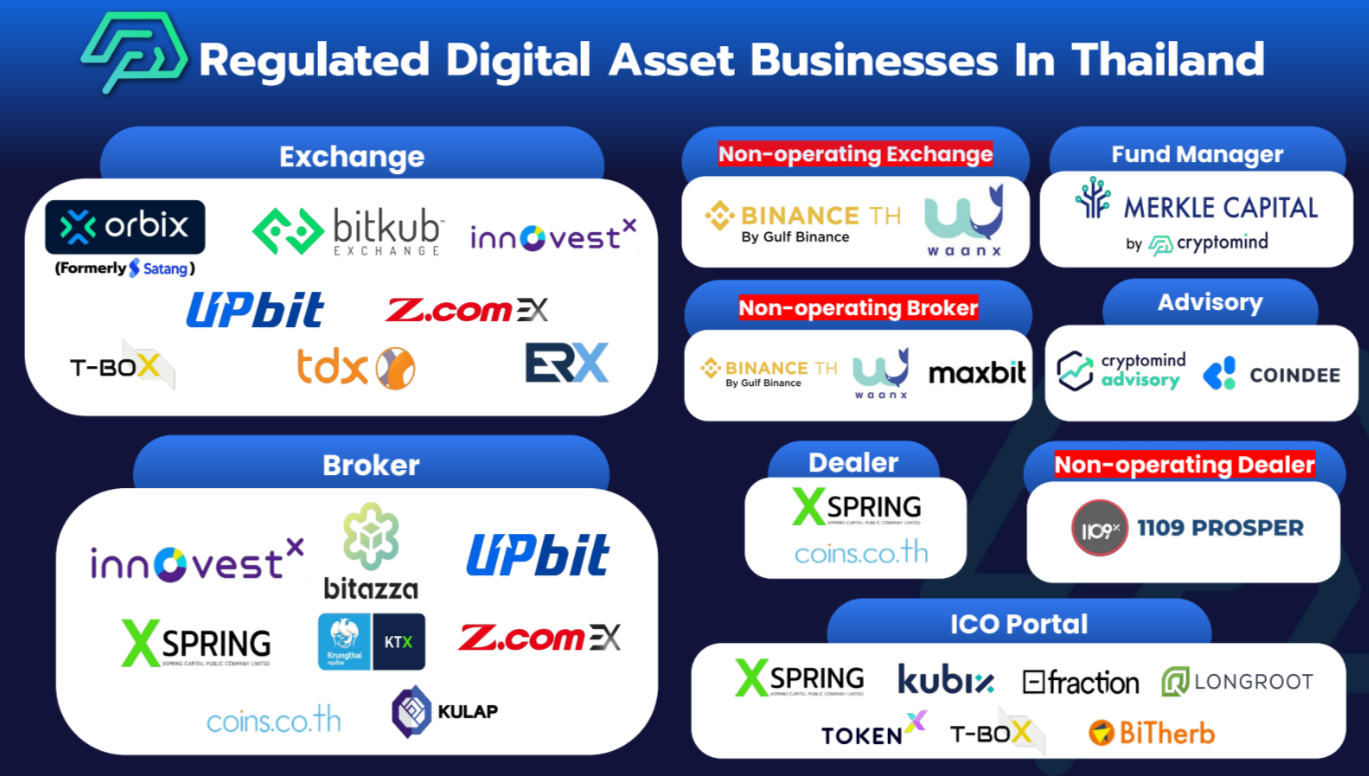

2. Seven licenses, Thailand’s encryption regulatory framework is clear

Thailands financial industry is highly regulated, and the regulatory framework in the field of digital assets is relatively clear. The Thailand Securities and Exchange Commission (SEC) adopts a follow-up strategy and follows the example of the United States, Japan, Hong Kong, Singapore and other places. The main bills areEmergency Decree on Digital Asset Businesses, B.E. 2561 . Thailand’s financial industry institutions, such as banks and asset managers, must report to the SEC for their investment and business activities.

Assets and activities regulated under the regulations:

Regulated assets:coins、tokens

ICO:It includes two businesses: ICO issuer and ICO portal.

Operating digital asset business:Including exchanges, brokers, dealers, funds and advisory businesses.

Digital asset relatedSeven license plates:

Digital Asset Exchange

Digital Asset Broker

Digital Asset Dealer

Digital Asset Fund Manager

Digital Asset Advisory Service

Digital Asset Custodial Wallet Provider

ICO Portal

Crypto is temporarily listed ascommodity, charging a 7% transaction tax, and various circles are working hard to classify crypto as an investment product like stocks.

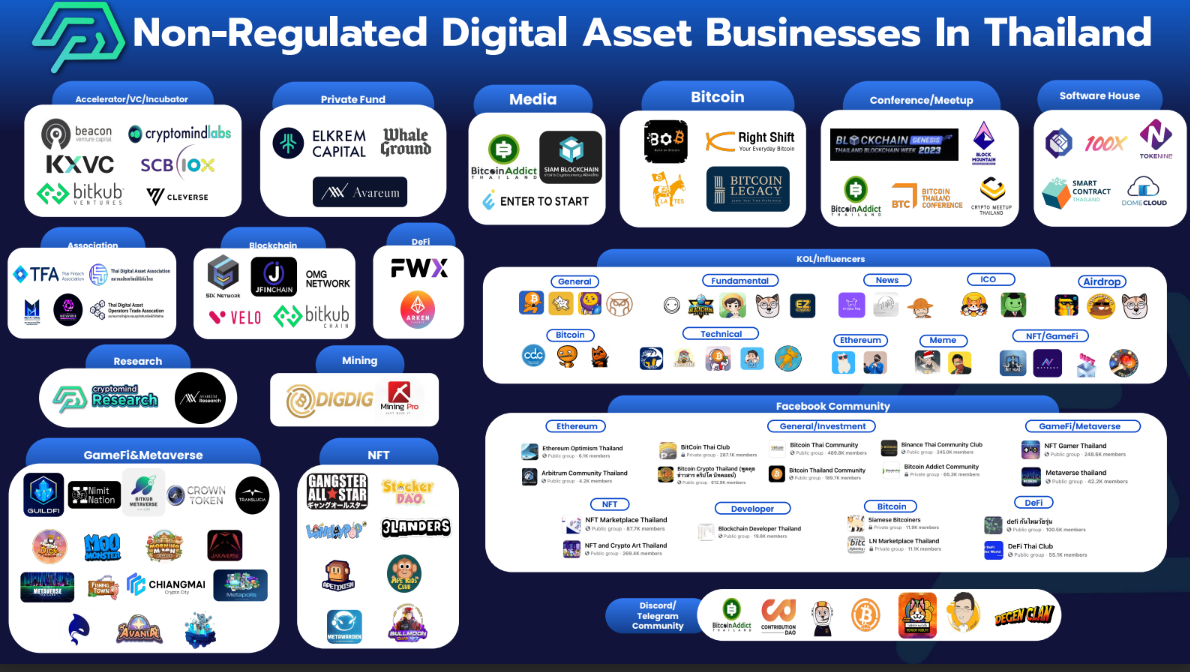

3. Thailand’s encryption ecosystem is active and the goose effect is significant

Digital asset activities in Thailand are mostly focused on trading, broker/dealer and tokenisation, and are dominated by core players. Many traditional large-scale enterprises have entered the digital currency market in recent years, such as Thailands two major banks, Siam Commercial Bank (SCB) and the above-mentioned KBANK, Thailands leading energy companies GULF, PTG Energy, etc.

Source: cryptomind

Source: cryptomind

Exchange:In addition to the large-traffic exchanges bitkub, orbix, etc. mentioned above, the Thai clean energy power company Gulf and Binance jointly established a joint venture, Gulf Binance Co., Ltd., which has now obtained a license allowing it to create a crypto asset platform. It has not started operation yet. Innovest X is an investment app launched by SCB that allows investors to invest in Thai stocks, foreign stocks, bonds, digital assets and funds.

ICO Portal:Thailands two major banks, SCB and KBANK, have already participated in the ICO portal business. SCBs ICO portal is TokenX, and KBANKs ICO portal is Kubix. In addition, XSpring also participated in the ICO, providing sales channels for Sirihub Token, an investment token used to invest in Sansiri real estate projects. Sansiri is one of Thailands largest real estate developers, and Thailands Prime Minister-elect Srettha Thavisin once served as its CEO.

Broker/Dealer:The business of digital asset brokers and dealers in Thailand is a regulated activity, and licensed brokers include Bitazza mentioned above, and InnovestX launched by SCB. In addition, XSpring also launched a fully integrated cryptocurrency trading platform in 2022, with broker and dealer operations. PTG Energy and Unit jointly established Maxbit and have obtained a Broker license from the SEC. As of now, they have not started business operations.

consult:Cryptomind Advisory, a subsidiary of Cryptomind, is the first company in Thailand to have a digital asset advisory service license. Its products include Cryptomind Research, which covers in-depth research articles, industry reports, weekly reports, Cointalk, and news about cryptocurrency. At the same time, Cryptomind is also one of HashKey Capital’s representative investee companies in Thailand.

VC:SCB 1 0x is a venture capital company under SCB, and KX is a venture capital company launched by KBTG, a subsidiary of KBank.

Web3:Thailands local Web 3 projects are mainly concentrated in the gamefi/metaverse sector. The main projects include the game guild GuildFi, etc. GuildFis investors include Coinbase Venture, Animoca Brands, Pantera, etc., and it is one of the most influential game guilds in Southeast Asia. At the same time, some NFT projects are also popular in the community: including 3 Landers and LonelyPop.