OKX Ventures Research Report: Understand the development pattern and future direction of stablecoins in one article

1. Core viewpoints

From the bull market in 2021 to the bear market in 2023, the cryptocurrency market has changed significantly. The total market capitalization fell from US$3 trillion to US$1 trillion, but the stablecoin market capitalization only decreased by 30%, which shows that the stablecoin market has shown strong resilience and proves its importance in the cryptocurrency ecosystem, and Its trend of rapid expansion continues.

As of December 2023, CoinGecko data shows that the total market value of the stablecoin market is approximately US$130 billion, of which Tether (USDT) accounts for approximately 70%, USDC accounts for approximately 20%, and the remaining market value is distributed among other centralized and decentralized stablecoins. between. Especially in the current high Treasury yield environment (>5%), Tether can easily earn $3 billion in profits per year, making the stablecoin market a very attractive space. In addition, governments of various countries are formulating virtual currency trading policies, and central banks have also begun to study their own stablecoins. These measures have further promoted the growth of the stablecoin market.

In addition to Tether and USDC, we have also seen the emergence of many on-chain stablecoins, which reflects the demand for different stablecoin types (staking, lending, nesting dolls) in the DeFi space. The innovations of these emerging stablecoins include diversified collaterals, collateral liquidation mechanisms, and revenue mechanisms that give back to the community. Their success depends on factors such as maintaining liquidity and attracting access to large DeFi protocols.

Although on-chain stablecoins continue to emerge, more than 90% of market capitalization is still concentrated in centralized stablecoins. With the strengthening of regulatory discourse and the trend of central bank digital currency issuance, centralized stablecoins have once again become the focus. Some startups are trying to take advantage of high U.S. bond yields to challenge the dominance of Tether and USDC, but the long-term development of centralized stablecoins requires more cooperation with traditional financial institutions and regulators. This includes a compliant custodian, capital injection and obtaining a virtual asset trading license.

To create the next super stablecoin like USDC and USDT, I believe that at least the following four key conditions need to be met to take full advantage of centralized and decentralized stablecoins:

1. US dollar-based stablecoins: The US dollar has wide global acceptance, and its supporting assets have broad applicability.

2. Global regulatory recognition and licenses: Super stablecoins need to be deployed in the global market from the beginning and obtain recognition and global licenses from major regional regulatory agencies.

3. Innovative financial attributes: Super stablecoins should have innovative financial attributes, such as revenue distribution mechanisms, to build community support and sustained growth.

4. Integration into the DeFi ecosystem: Super stablecoins need to become the default currency in DeFi protocols to ensure their widespread use in the DeFi field.

In conclusion, the stablecoin market plays a vital role in the cryptocurrency ecosystem and is expected to continue to develop and expand. To successfully create the next super stablecoin, you need to meet a series of DeFi gameplay advantages and establish cooperative relationships with traditional financial institutions and regulatory authorities.

2: Stablecoin classification

Decentralized Stablecoin

In order to solve the problems of centralized stablecoins, decentralized stablecoins have introduced innovative solutions. These new stablecoins are built on blockchain protocols, making them more secure and transparent. For example, Curves crvUSD, Aaves GHO, and Dopexs dpxUSDSD are all stablecoins based on on-chain protocols. They do not rely on a central agency, reducing the financial and management risks of the central agency itself. Decentralized stablecoins can be divided into two broad categories:

1. Overcollateralized Stablecoins:

Collateralized stablecoins are the most common type of decentralized stablecoins, and their asset backing usually comes from other cryptocurrencies, such as Ethereum or Bitcoin, to maintain their value stability. For example, MakerDAO’s DAI is backed by Ethereum as collateral. The latest trend is to change the collateral from traditional centralized stablecoins and large traditional digital currencies into a wider range of digital currencies, or to carry out multi-layer nesting to increase liquidity and provide more application scenarios. For example, the largest collateral in Curve’s crvUSD is steth, while Ethena’s stablecoin is also based on Ethereum and LST.

Advantages: Collateralized stablecoins make decentralized stablecoins not only payment tools, but also a broader digital asset management and investment tool, providing users with more choices and flexibility.

Disadvantages: The challenge with collateralized stablecoins is that too much collateral may reduce asset utilization, especially when the collateral is a currency with large price fluctuations such as Ethereum, which may trigger forced liquidation due to higher risks.

2. Algorithmic Stablecoins:

Algorithmic stablecoins are one of the most decentralized types of stablecoins, using market demand and supply to maintain their own fixed price without the need for actual collateral to back it up. These stablecoins use algorithms and smart contracts to automatically manage supply to keep prices stable. Ampleforth, for example, is an algorithm-based stablecoin designed to keep its price close to $1. It uses an approach called an elastic supply mechanism that automatically adjusts supply to balance prices based on market demand. When the price is above $1, supply increases, and when the price is below $1, supply decreases.

Additionally, there are hybrid algorithmic stablecoins that combine algorithmic and fiat reserves. For example, Frax is an algorithm-based stablecoin designed to keep the price close to $1. It uses a hybrid stablecoin mechanism, part of which is backed by fiat currency reserves, and the other part manages the supply algorithmically to maintain price stability.

Pros: The decentralization of algorithmic stablecoins themselves offers the best prospects. Stablecoins have the fundamental advantage of scalability compared to other solutions. Algorithm-based stablecoins use transparent and verifiable code, which makes them attractive for building trust.

Disadvantages: Sensitive to the market. When the market demand for algorithmic stablecoins drops, its price will be lower than the target value, eventually leading to the risk of market collapse. At the same time, because the operation of algorithmic stablecoins relies on smart contracts and community consensus, there may be Governance risks, such as code flaws, hacking, manipulation, or conflicts of interest.

Centralized Stablecoin

Centralized stablecoins are usually collateralized by legal currency, which is mortgaged in off-chain bank accounts as a reserve for on-chain tokens. It solves the value anchoring problem of virtual assets, linking digital assets with physical assets (such as U.S. dollars or gold) to stabilize their value. At the same time, it solves the access problem of virtual assets in a regulatory environment and provides users with a more reliable way to store and trade digital assets. The centralized stablecoin market still accounts for more than 90% of the market share.

Currently, in addition to the U.S. dollar and British pound, the collateral assets of many centralized stablecoin projects are U.S. Treasury bonds. This means that users holding on-chain tokens are equivalent to holding U.S. Treasury bonds at the bottom of the traditional market. U.S. Treasuries are typically held in institutional custody, ensuring redemption, and tokenizing them increases the liquidity of the underlying financial asset. Additionally, it provides interactive opportunities for DeFi components, such as leveraged trading and lending. This enables projects to obtain USD funding from crypto users at zero cost to purchase U.S. Treasury bonds and directly benefit from Treasury yields.

However, centralized stablecoins also have some drawbacks

1. Financial and regulatory risks: Centralized stablecoins usually rely on central institutions for issuance and management, so there are financial and regulatory risks for the issuer. If the issuer faces financial problems or is subject to regulatory sanctions, the value and availability of stablecoins may be affected.

2. Limited application areas: The main application areas of centralized stablecoins are mainly limited to the payment field, lacking diversity and innovation.

Three: Reasons for the recent boom in the stablecoin market

1. U.S. bond yields are higher and higher than the yields of DeFi protocols

Treasury interest rates have soared, causing TradFi returns to far exceed DeFi returns. Stablecoins currently have a total market capitalization of $130 billion, equivalent to the 16th largest holder of U.S. Treasuries, with annualized returns of 5% or more. However, in the DeFi ecosystem, such as lending platforms such as Aave and Compound, users lend stablecoins to other users to obtain interest. The loan yield is about 3%, while the automatic market makers of decentralized trading platforms such as Uniswap ( AMM) provides a yield of approximately 2%. This situation reflects the fact that falling Treasury bond prices and rising interest rates have led some investors to seek higher yields in traditional financial markets, while potentially facing lower yields in DeFi.

2. New stablecoin-type projects are emerging in the market, increasing their market share by giving ecological participants a certain profit share

Currently, the profits from most centralized stablecoins mainly flow to their issuers and related investors. For example, USDC distributes a portion of its profits to its investor Coinbase, which allows users who store USDC on Coinbase to earn up to 5% annualized interest, thereby attracting more users. There are already some innovative projects on the market, that is, income distribution is not limited to investors, but also extends to ecological participants.

3. Payment companies are gradually entering the stablecoin market

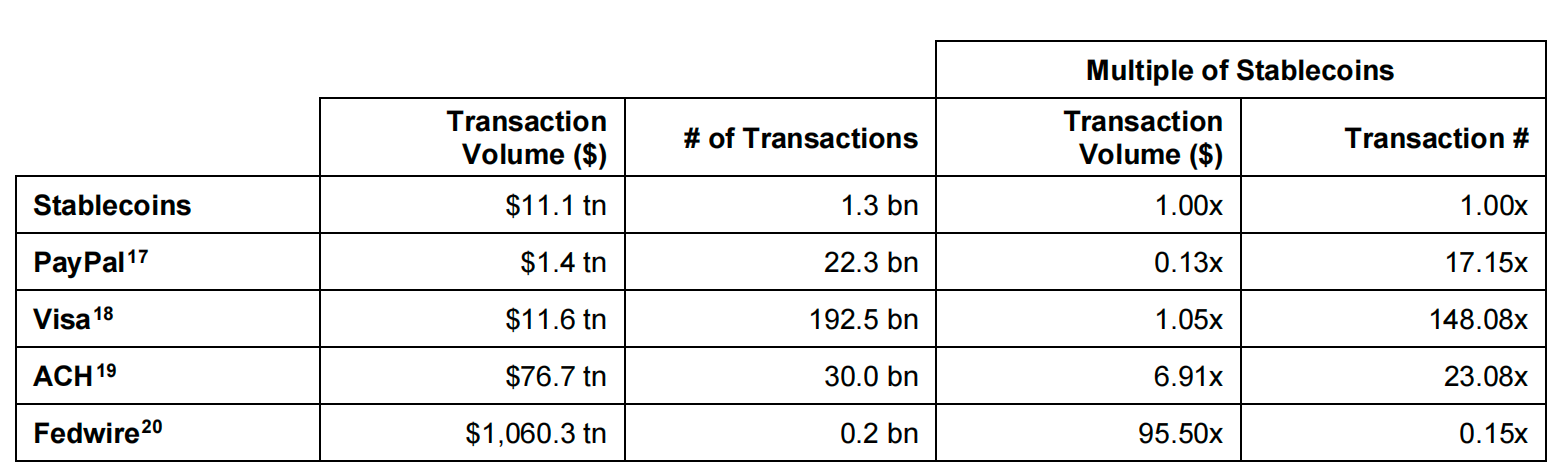

According to a research report by Brevan Howard, the amount of on-chain settlement funds for stablecoins will reach US$11.1 trillion in 2022. This number far exceeds PayPals US$1.4 trillion and is equivalent to Visas US$11.6 trillion. This highlights the huge potential of stablecoins in the payments sector, especially in providing efficient on-chain settlement systems. The application of stable coins can help project parties hedge the revenue risks caused by the decline in U.S. bond yields. In addition, in developing countries with imperfect payment and banking systems, the application of stablecoins is particularly important to meet the needs of these regions for efficient and low-cost payment solutions. As a result, stablecoins play an increasingly important role in the global financial ecosystem, especially in promoting financial inclusion and economic growth.

Source:The Relentless Rise of Stablecoins, Brevan Howard Digital 2023

Several companies focused on money movement rails are entering the stablecoin market, including big names like PayPal and Visa. PYUSD is a stablecoin launched by PayPal in partnership with Paxos that is backed by U.S. dollar deposits, short-term Treasury bills, and cash-like equivalents. The stablecoin can be exchanged within PayPal’s app and interoperates with other cryptocurrencies as well as Venmo, the most popular payment app in the United States.

PYUSD is designed to be redeemable through PayPal at any time, giving PayPal’s 431 million users a solid foundation to enter the Web3 world. As of now, PYUSD’s circulation has reached approximately $114.46 million, ranking 14th, accounting for 0.1% of the total stablecoin market circulation. This number is relatively low, well below other centralized stablecoins on the market and those minted by trust custodians Paxos and First Digital, such as USDP and FDUSD.

The launch of PYUSD is potentially important for the mass adoption of Web3. As a stablecoin launched by a well-known fintech company, it has the potential to attract millions of users into the cryptocurrency space, which is a big step in driving the popularity and acceptance of cryptocurrencies. PYUSD combines the convenience of traditional financial services with the innovation of cryptocurrency and may become a key product in the future of digital currencies and payments.

Four: The impact of ecological participants on stable currency projects

1. Exchange

In the current high government bond yield environment (>5%), according to the financial report for the first half of 2023, USDC contributed nearly half of Coinbase’s revenue in the first half of the year, which was approximately US$399 million. Tether can easily make $3 billion in profits every year.

A. Close cooperation between exchanges and stablecoin issuers brings revenue

Coinbase’s financial report for the first half of 2023 showed that a significant portion of its revenue came from a revenue sharing agreement with Circle. By the end of the third quarter of 2023, the balance of USDC on the Coinbase platform reached $2.5 billion, up from $1.8 billion at the end of the second quarter. Circle and Coinbase jointly manage USDC through the Center Consortium and distribute revenue based on USDC holdings. In August 2023, Coinbase Ventures purchased a minority stake in Circle, deepening the partnership.

In addition, Circle is also actively expanding its Web2 business, using USDC as a key medium for cross-border settlement. In September 2023, Visa announced that it had extended Circles USDC stablecoin settlement function to the Solana chain to increase the speed of cross-border payments. Visa became one of the first companies to use Solana for settlement on a large scale, which also promoted the Solana proxy. A short-term increase in currency prices.

Market observation shows that USDT is mainly used for derivatives trading on centralized exchanges, while USDC is used more frequently in Web3 DApps, and multiple stablecoin/RWA protocols support USDC as a settlement tool. It is very important for exchanges to choose a trustworthy stablecoin issuer. Traditional institutions such as BNY Mellon have greater credibility. At the same time, top crypto-native stablecoin issuers like Tether and Circle have relatively low incentives to default due to very high default costs and large impact areas.

B. The potential of stablecoin payments to bring traffic to exchanges and issuers

In the long run, the most promising application scenario for stablecoins lies in the field of payments, especially cross-border payments. Stablecoin issuers can integrate stablecoins into users’ payment processes by cooperating with Web2 payment companies, especially in cross-border payment applications.

PayPals influence in the Web2 space is obvious. As of the fourth quarter of 2023, there were 4.33 million active retail accounts and 35 million active merchant accounts using PayPal globally. PayPal supports settlement using PYUSD, and merchants can also buy, hold, and send PYUSD. Users of the PayPal, Venmo and Xoom platforms can buy, receive and send PYUSD within the app, with Venmo having approximately 80 million users in the United States and PayPal having approximately 320 million users worldwide. Currently, PYUSD only supports US accounts with PayPal, as PayPal has a money transmission license. Considering its strong Web2 user base and usage scenarios, PYUSD still has growth potential in the future. However, it should be noted that the risk of PYUSD is that its issuer Paxos may stop issuance or freeze PYUSD assets due to regulatory pressure.

For Web3 users, PYUSD has limited influence. PYUSD has been listed on multiple exchanges. As of mid-November 2023, the cumulative circulation reached approximately US$158.9 million, ranking 13th among global stablecoin projects, with a market share of approximately 0.15%. Given its centralized nature and the risks of issuer Paxos, users may lack the incentive to switch to PYUSD without additional incentives. Unless PYUSD establishes some kind of interest relationship with exchanges in the ecosystem, its use will be expanded among Web3 users through the support of exchanges.

2. Public chain:

Table: TVL ranking of leading stablecoin projects in mainstream public chains

Source:DefiLlama, 2023 November

A. Impact of BUSD on BSC TVL

BUSD supports 6 public chains, mainly circulated in Ethereum and BSC, and its cumulative market value has dropped to 2B. The decline in the market value of stablecoins on the BSC chain mainly comes from the decline in the market value of BUSD stablecoins. As of the release of this report, Binance published on November 29, 2023announcementIndicates that BUSD will be removed and fully exchanged for FDUSD.

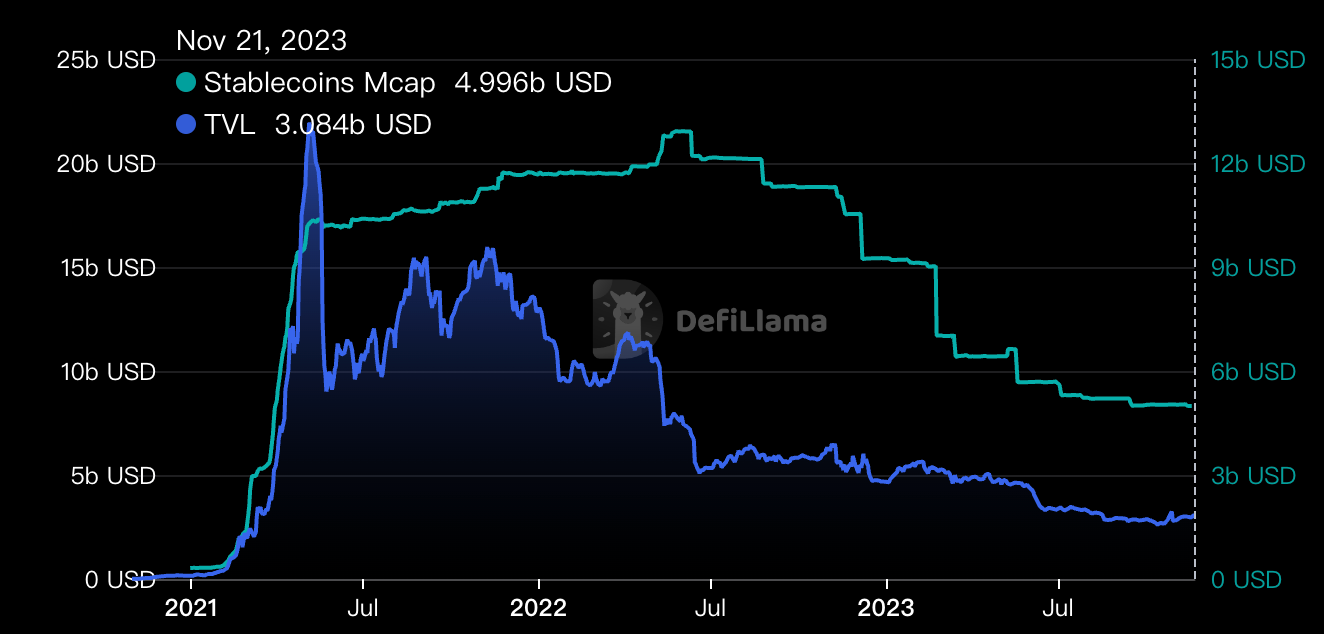

Public chain native stablecoins have an important impact on the TVL and ecological development of the public chain ecosystem. The stablecoin fell by 44%, and the corresponding TVL lock-up in the protocol fell by 66%. It can be seen that the decline in the market value of stablecoins has a certain impact on the ecological construction of BSC.

As BUSD withdraws from the stablecoin basket of the Binance exchange, Binance is also increasing its support for the FDUSD ecosystem. It occupies a large proportion in its Launchpool and Earn businesses.

Source:DefiLlama, 2023 November

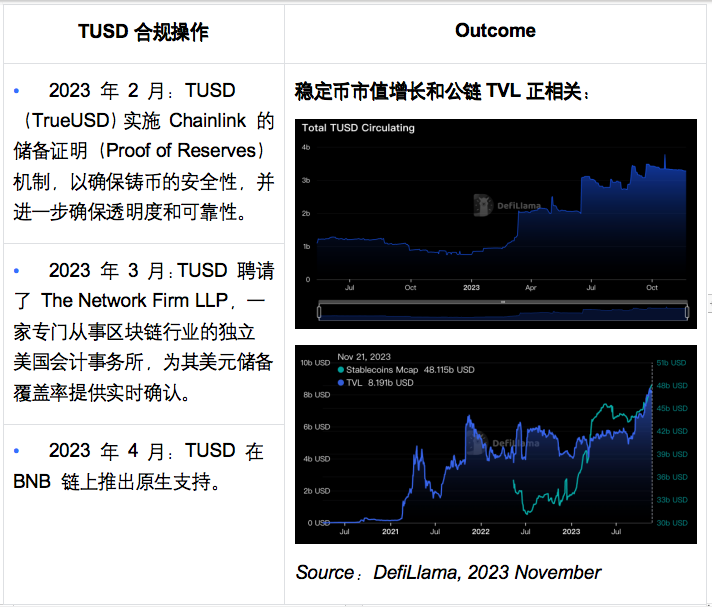

B. Impact of TUSD on Tron Ecology

After February 2023, TUSD’s market value increased from about 1B to 2-3B after a series of operations.

Table: TUSD series of compliance operations

C. USDC and public chains

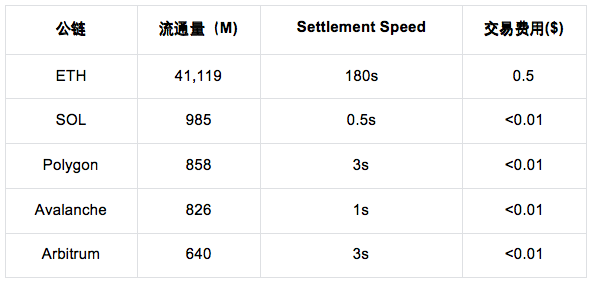

USDC has been issued on a total of 15+ public chains, and the top three TVLs are ETH, Solana and Polygon. USDC is seeking to expand its application scenarios, mainly for payment, especially cross-border payment scenarios.

Table: TVL distribution of USDC in different public chains

Source:State of the USDC Economy, Circle Annual Report, 2023

USDC<> Solana:Recently, Visa announced plans to use Circle’s USDC as an on-chain settlement tool on the Solana blockchain, in partnership with Circle. This collaboration is an important step in the integration of traditional financial services and cryptocurrency technology, aiming to provide faster and lower-cost cross-border payment solutions. The Solana blockchain was chosen because of its high throughput and low transaction costs, making it suitable for processing large numbers of small payments. This innovative payment method is expected to have a significant impact on the global payments landscape, especially in accelerating cross-border transaction processing.

USDC <> Polygon:In October 2023, Circle announced that it would support native USDC issuance on the polygon Pos main network; Polygon ecological mainstream protocols AAVE, Compound, Curve, QuickSwap and Uniswap said they would invest in developers to support native USDC; in addition, Circle said it expected to implement CCTP for Polygon by the end of 2023 The integration of PoS Bridge enables cross-chain interoperability.

USDC<> Sei:In mid-November 2023, Circle strategically invested in Sei Network to support native USDC on the chain. The official announcement stated that Seis performance is better than Sui, Solana, and Aptos, with a TTF of0.25 s。

D. Dapp issues stablecoins and public chains

The influence of stablecoins issued by leading DeFi protocols on the public chain is an area worth observing. Taking Curve and AAVE as examples, their actions in the stablecoin field are of great significance to the entire cryptocurrency market and the application of blockchain technology.

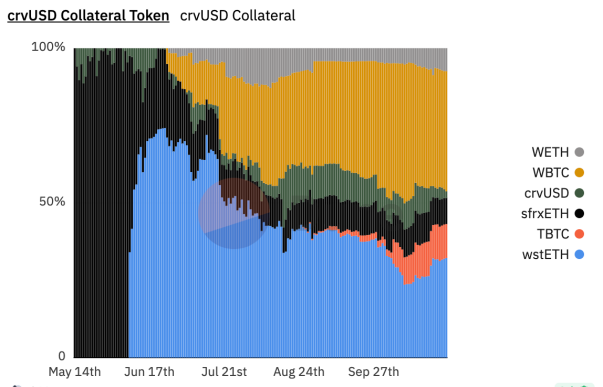

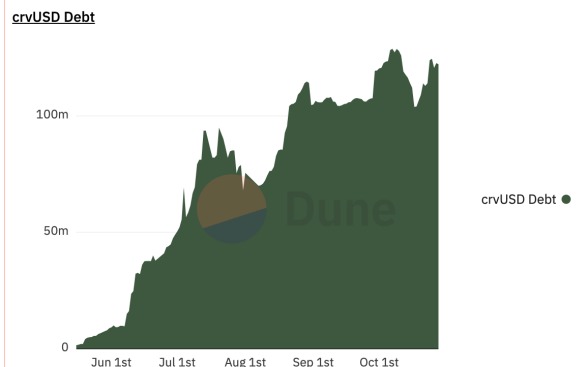

The crvUSD stablecoin issued by Curve in May 2023 is a protocol that uses stablecoins as a medium to realize asset mortgage lending on the chain. The protocol enables users to mint crvUSD using a range of crypto assets (such as ETH, WETH, wstETH, WBTC, etc.) as collateral. Especially after June 2023, supporting WBTC as collateral has significantly boosted the growth of crvUSD. As of November 2023, the size of the collateral exceeded $100 million.

In May 2023, the majority of Curves collateral was FRAXs sfrxETH, but it subsequently supported Lidos wstETH as well as BitGos issuance of WBTC, and these newly supported collaterals quickly captured a large portion of the market. This shows that Curve has huge influence over which tokens are supported as collateral. This strategy of Curve not only expands its influence in the DeFi field, but may also have a profound impact on the liquidity of assets on the public chain and the way stablecoins are used.

Such initiatives by leading DeFi protocols demonstrate the innovative and dynamic nature of the DeFi field, while also highlighting the important role these protocols play in the cryptocurrency ecosystem. As more DeFi protocols participate in the issuance and management of stablecoins, we can expect that this will bring new changes and challenges to the use of public chains, the liquidity of cryptocurrencies, and the stability of the entire market.

crvUSD Collateral

crvUSD TVL

Source:https://dune.com/Marcov/crvusd, 2023 November

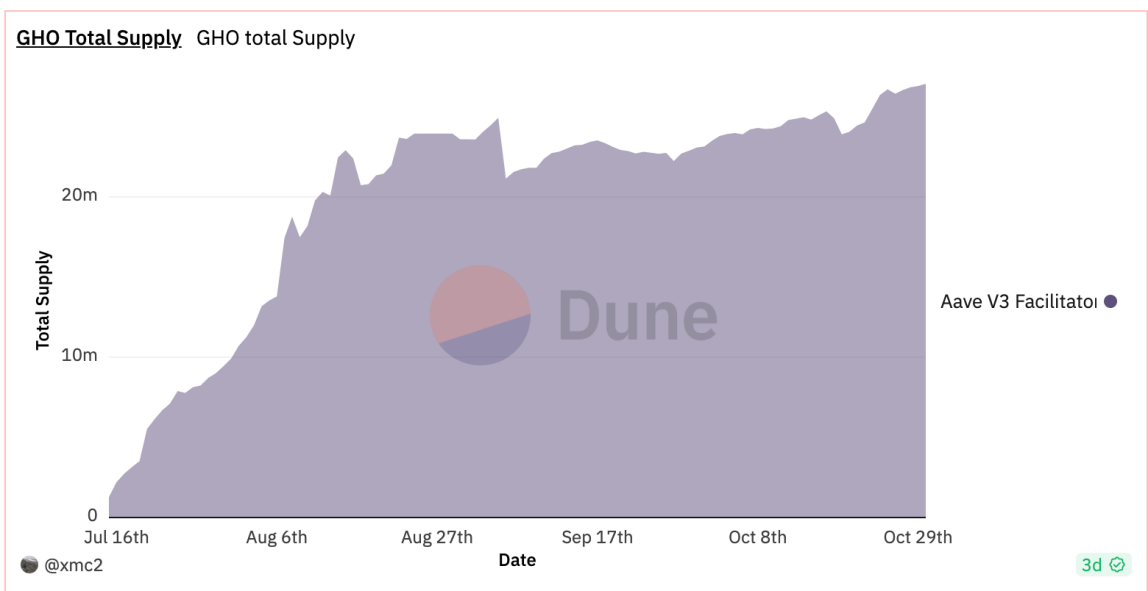

As the largest lending protocol, Aave has a TVL of 5.64 b. The launched GHO is an over-collateralized stable currency, so tokens supported by the Aave v3 protocol can be used as collateral, and the collateral will continue to generate revenue in the lending agreement. The cumulative TVL since its launch in July is 20 m+.

Source:Dune Analytics, 2023 November

3. Stablecoin issuers

At present, the underlying assets of most stablecoin projects are mainly liquid short-term assets such as US dollars and T-bills, and the default risk of the underlying assets is almost 0. Stablecoin issuers, a centralized institution, need to ensure smooth channels for users to purchase and exit. The biggest risk is that if the issuer fails to pay during the user exit process, the ecosystem will tend to collapse.

Finding a trustworthy stablecoin issuer is an important topic for ecological participants. Looking at the cryptocurrency ecosystem and traditional financial market systems, crypto-native custodian service providers and Tradfi custodian service providers, banks, asset management platforms and other financial institutions have absolute credibility, such as Fireblocks, Bitgo, BNY Mellon, BlackRock and more. Suitable as a stablecoin issuer.

We can learn from the management method of ETF assets. Multiple parties can use the monitoring sharing agreement to ensure the openness and transparency of fund storage and flow withdrawals, which will also enhance a certain degree of credibility. In addition, we cooperate with third-party on-chain audits and on-chain data tracking platforms such as OKLink to jointly monitor the safety of funds.

4. Regulatory agencies:

The regulatory framework for cryptocurrencies in the United States has not yet been officially introduced. Prior to this, according toU.S. federal securities laws, a digital asset is considered a “security” if it is an “investment contract” under the four-part test set forth in the Securities Act of 1933 and the Securities Exchange Act of 1934. The U.S. Securities and Exchange Commission (SEC) first applied the Howey test (the legal test used to determine whether a particular transaction is a security) to digital assets in 2017, although the 2019 framework outlines how the SEC may determine whether a digital asset is a security. There are many non-determinative factors considered, but SEC Chairman Gary Gensler said in April 2022 that he considered almost all digital assets to be securities.

Some senators in the U.S. Congress are creating a broad regulatory framework for digital assets and plan to give the Commodity Futures Trading Commission (CFTC) most of the oversight responsibilities. In April 2023, the first regulatory bill on payment stablecoins was introduced, which was revised in July 2023. This shows that there is currently no specific stablecoin regulatory framework in place. However, stablecoin issuers must comply with existing regulatory and legal requirements, such as having to meet the anti-money laundering and customer identity verification (KYC) requirements of the Financial Crimes Enforcement Network (FinCEN), and need to obtain currency exchange licenses from each state. But the bill does not specify who is the federal payments stablecoin regulator.

The U.S. Securities and Exchange Commission’s (SEC) regulatory approach to centralized stablecoin projects has caused some discussion in the industry. The “regulation through enforcement” strategy adopted by the SEC is considered questionable by some insiders. For example, in June 2023, the SEC directed Paxos to suspend the issuance of BUSD and classify it as a security. In response to this approach, Circle defended the use of its stablecoin USDC, emphasizing that USDC is mainly used for payments, not as an investment tool, and therefore should not fall within the scope of SEC supervision. In addition, in November 2023, the stable currency PYUSD issued by PayPal also attracted the attention of the SEC. SEC Chairman Gary Gensler mentioned in an April 2023 interview with New York Magazine that most cryptocurrencies may be considered securities and thus subject to corresponding regulations. The regulatory outlook for the U.S. stablecoin market remains unclear, and the industry continues to pay attention to this.

Stablecoin issuers do face a range of challenges and opportunities in the current regulatory environment. Following best practices, including working to obtain cryptocurrency licenses from state governments, especially the Money Transmitter License and New York State’s BitLicense, is critical for stablecoin issuers.

Paxos has obtained the BitLicense of New York State and the Money Transmitter License of other states, which provides it with the basis for compliant operations. These licenses not only ensure that the company operates within a strict legal framework, but also enhance customer trust in its business. For the future development of stablecoins, if the focus is on interoperability with traditional financial systems, Real World Assets (RWA) support, and long-term sustainable development, then companies that can quickly obtain these licenses and regulatory approvals will have the advantage Competitive Advantage. This strategy could give emerging companies a chance to challenge companies like Circle that dominate the market.

Additionally, the U.S. Internal Revenue Service (IRS) defines digital assets as property and brings them into the tax system, which is an important consideration for stablecoin issuers and the cryptocurrency industry as a whole. Tax compliance for cryptocurrency transactions is a critical area, and one that is likely to continue to change and evolve as the market develops and regulation increases.

Therefore, stablecoin issuers need to not only pay attention to existing regulatory requirements, but also pay close attention to new regulations and changes that may appear in the future to ensure that their businesses can adapt to market and regulatory changes.

Outside the United States, the Mica (Market in Crypto-Assets) Act, specifically targeted at EU member states, proposes a series of clear regulations on stablecoins and related crypto-assets, which has had an important impact on the cryptocurrency industry. The bill does not support algorithmic-based stablecoins and prohibits stablecoins from generating income, arguing that income-generating tokens should be classified as securities. This poses a challenge to the regulation of centralized stablecoins, as the underlying assets behind such stablecoins may generate returns. Stablecoins are similar to money market funds and are more likely to be considered securities if the returns are attributed to users. Therefore, newly issued tokenization-based projects are often considered security-type assets. In order to comply with these regulations, the industry usually cooperates with exchanges, payment service processors, wallets and various DeFi protocols to provide incentive programs to users through indirect methods. At the same time, other regions such as Singapore and Hong Kong are also developing their own stablecoin regulatory frameworks. For example, the Hong Kong Monetary Authority is expected to introduce a stablecoin regulatory framework in the first quarter of 2024. The purpose of these regulatory measures is to provide more transparency and security to the crypto asset market, while also posing new challenges to how stablecoins are defined and operated. As regulatory frameworks in different countries and regions gradually become clearer, stablecoin issuers and users need to pay close attention to these changes to ensure compliance with their activities.

5. Hosting service provider:

The brief de-anchoring of USDC due to the bankruptcy of SVP in 2023 shows that the proposition of safe management of underlying assets is very important.

Some stablecoin projects such as PYUSD hand over the management of underlying assets to Paxos, a compliant and licensed custodian service provider. Paxos holds a New York State BitLicense crypto asset operation license and is regulated by the New York State Department of Financial Services (NYDFS). Supervision, isolating certain risks by handing assets over to third-party compliant custody service providers.

In addition, Circle has established a partnership with BlackRock, the worlds largest asset management company, to jointly create the Circle Reserve Fund, which is registered and regulated by the SEC. Its main purpose is to manage the reserves of USDC. Currently, about 94% of the reserves are held in institutions. middle.

6. Traditional trust companies:

According to the authors research on multiple stablecoin issuers, the underlying assets of most stablecoin issuers are stored in trust-type companies, and most use SPV structures in designing company structures to achieve legal protection and protection of users underlying assets. isolation. It is an effective risk management strategy to achieve complete isolation of users underlying assets and company assets by establishing a special purpose vehicle (SPV). This arrangement ensures that at the legal level, the ownership of the users underlying assets belongs to the SPV. Therefore, in the event of the groups bankruptcy, even if the SPV is its subsidiary, it will not be implicated in any way, achieving bankruptcy remoteness. .

Delaware, as the seat of incorporation, is favored for its bankruptcy courts’ extensive experience in handling cases related to the Corporations Act. Delaware courts provide extensive guidance on these types of cases to help ensure legal safety.

For centralized stablecoins, since the underlying assets they are anchored to are usually off-chain assets, human participation in the operation process should be minimized and automated. Doing so can reduce losses due to human error and increase the transparency and efficiency of the system. Automated processes not only increase the consistency and reliability of operations, but also help reduce the possibility of manipulation and fraud, thereby providing a higher level of protection for users and investors. In summary, by setting up an SPV in Delaware, achieving asset segregation and automating operational processes, the security and stability of centralized stablecoins can be greatly improved, which is crucial for the healthy development of the cryptocurrency industry.

7. On-chain infrastructure:

A prominent example is the on-chain infrastructure provided by M^ZERO Labs, which focuses on building decentralized infrastructure that allows institutional participants to allocate and manage assets on-chain. The platform operates in a fully transparent, open source and composable manner, connecting certified financial institutions and other decentralized applications that comply with local regulatory requirements to enable on-chain value transfer and collaboration among participants.

5. Summary

As the cryptocurrency market transitions from its peak in 2021 to a bear market in 2023, stablecoins serve as a unique and important category that has not only shown remarkable resilience amidst market turmoil, but also highlighted its importance across the entire crypto ecosystem. central role in. The market has shrunk from a peak of $3 trillion to $1 trillion, but in the process, the relative stability of stablecoin market caps has revealed their potential as a “safe haven” within the cryptocurrency ecosystem. In particular, dominant stablecoins such as USDT and USDC have become an integral part of the crypto market due to their stability and high liquidity in the market.

At the same time, the rapid development and diversification of the stablecoin market reflects continued innovation in the cryptocurrency space. From over-collateralized to algorithmic stablecoins, the diversity of the market shows adaptability and response to various financial needs. The innovations of these emerging stablecoins, such as diversified collateral, liquidation mechanisms, and income distribution strategies, not only enhance the robustness of the DeFi ecosystem, but also provide experiments for possible future market changes.

Rapid changes in the regulatory environment are also a key factor affecting the future of stablecoins. As governments and regulatory agencies gradually step in to formulate policies and regulations on cryptocurrencies and stablecoins, the development of stablecoins will inevitably be affected by these external factors. Increased regulation may lead to a more centralized market, but it also brings new cooperation opportunities for stablecoins, especially with traditional financial institutions and regulators.

Going forward, the role of stablecoins in the cryptocurrency ecosystem is expected to continue to expand. As technology develops and the regulatory environment matures, we may witness wider application of stablecoins in financial services, especially cross-border payments and clearing. However, achieving this will require further industry efforts in terms of transparency, security, and compatibility with existing financial systems.

To sum up, stablecoins are not just a branch of the crypto market, they play a vital bridging role between the traditional finance and digital currency worlds. Its development will be an ongoing process that requires constant innovation, adaptation and cooperation to find its position in the dynamic market and regulatory environment. Along the way, for market participants, understanding and adapting to these changes will be key to long-term success. (The starting point for the content described in this article is only industry ecological research. Business, policies, etc. are all public information. The article does not endorse or guide any project.)

Appendix: Summary list of stablecoins

Source: https://messari.io/assets/stablecoins, 2023 November

Disclaimer: The starting point of the content described in this article is only industry ecological research. Business, policies, etc. are all public information. The article does not endorse or guide any project.