SignalPlus Volatility Column (20231130): Bullish strategies remain popular

Yesterday (29 Nov), the GDP data released by the United States exceeded expectations. The U.S. dollar index rebounded and exceeded the 130 mark, while U.S. bond yields continued to decline. The two-year/ten-year yield is now at 4.649%/4.279%. U.S. stock indexes opened higher and closed lower, with the Dow closing up 0.04%, the SP 500 and the Nasdaq falling 0.09%/0.19% respectively. Regarding the future trend of interest rates, Fed Mester said that the current monetary policy is in a good position to flexibly evaluate future data, and whether to raise interest rates further depends on the data. Tonight (30 Nov 21: 30 UTC+ 8) the PCE data to be released in the United States will further show the market the trajectory of inflation.

Source: SignalPlus, Economic Calendar

Source: Binance & TradingView

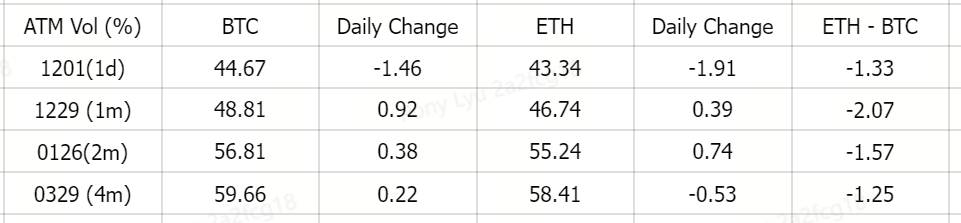

In terms of digital currencies, BTC/ETH fluctuated around 38000/2050 respectively, closing slightly down to 37815.36 (-0.803%) / 2034.97 (-1.16%). In terms of implied volatility, except for a slight decrease of about 1.5% Vol in the late option IV, there are no significant changes in the other tenors.

From a trading perspective, BTC bullish strategy trading was still hot at the end of December, with representative examples including the ratio of Buy 40,000 vs Sell 45,000, and the 36,000-40,000-44,000 Sell Fly. ETH is also dominated by bullish strategies, but the distribution of transactions has shifted to forwards. Among them, the call spread/triangular spread in March vs. June has become a trading hot spot; in addition, there are many Call Spread strategies betting on the SEC in January. To a certain extent, this flow also causes Januarys forward IV to continue to maintain a steeper slope relative to the end of the year, reflecting the markets expectations for a further return of volatility after the start of the year.

Source: Deribit (as of 30 NOV 16:00 UTC+8)

Source: SignalPlus, option IV fell at the end of January, and IV premium was higher at the end of January

Source: Laevitas, ETH bullish strategy’s transaction distribution shifts to forwards

Source: Deribit Block Trade

Source: Deribit Block Trade

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: xdengalin), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website:https://www.signalplus.com