SignalPlus Volatility Column (20231129): Will the rate cut be relaxed? Bullish strategies return in popularity

Yesterday (28 Nov) Federal Reserve officialscut interest ratesThere has been a subtle change in attitude on this matter. Fed Governor Waller said that if inflation continues to fall, there may be reasons to cut interest rates in a few months, and this has nothing to do with economic pressure; New York Fed President Williams also said that recent concerns about the United States The news that inflation is stable in the long term is basically reassuring; as a dovish representative, Chicago Fed President Goolsby pointed out that keeping interest rates at high levels for too long is a worrying issue. The U.S. bond market responded similarly,Yields fell overall, in which the two-year/ten-year yield fell below the 4.7%/4.3% mark respectively, reporting at 4.683%/4.286%.The three major U.S. stock indexes rose slightly, SP 500/Dow/Nasdaq closed up 0.1%/0.24%/0.29% respectively.

Source: SignalPlus, Economic Calendar

Source: Binance & TradingView

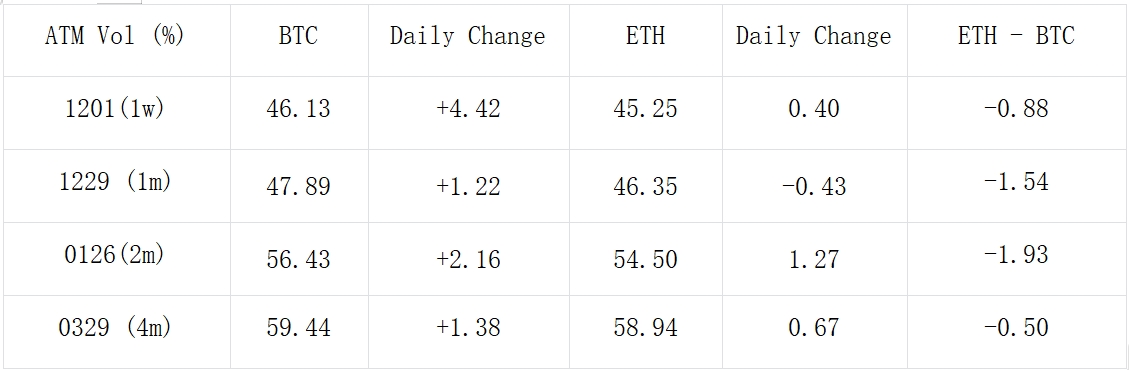

As macro market yields fall, digital currencies also usher in a wave of gains.BTC/ETH broke through the $38,000/2,050 mark respectively, closing at 38121.53(+ 2.85%) / 2058.88(+ 2.44%). In terms of options,BTC’s implied volatility level increased by about 2 to 3%,The term IV curve steepens and gradually begins to deviate from ETH. At the same time, the 25 dRR, which measures the slope of the curve, also rebounds by about 2.5% Vol.

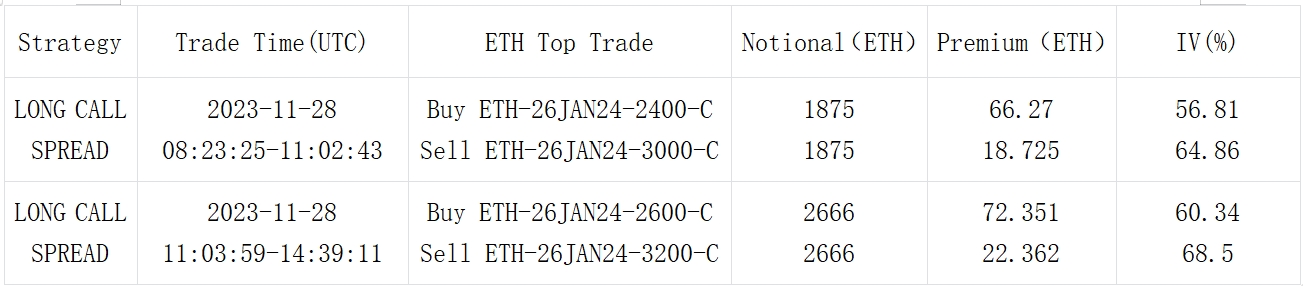

In options trading,The proportion of call option transactions increased significantlyThis reduces the P/C Ratio of BTC/ETH to 0.52 and 0.3 respectively. Among them, the transactions of the BTC bullish strategy were concentrated at the end of December, including45000 A total of 1350 photos have been uploadedLarge sales to close positions(OI reduced by 793 BTC), and38000-40000 within rangeBuy Call/Call Spread. The ETH bulk platform is represented by 26 JAN 24 2600 vs 3000 and 2400 vs 3000Bull Call SpreadIt was also a popular strategy yesterday, with total trading volume exceeding 30,000 ETH.

Source: Deribit (As of 29 NOV 16: 00 UTC+ 8) (As of 29 NOV 08: 00 UTC)

Source: SignalPlus, BTC IV moves higher

Source: SignalPlus, Vol Skew Bounce

Source: Laevitas, BTC call options were intensively traded at the end of December

Source: Deribit Block Trade

Source: Deribit Block Trade

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: xdengalin), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website:https://www.signalplus.com