Gryphsis Cryptocurrency Weekly Report: SEC Delays Bitcoin Spot ETF Application

Welcome, dear reader, to Gryphsis Academy’s weekly cryptocurrency digest. We bring you key market trends, in-depth insights on emerging protocols, and new industry dynamics, all designed to enhance your expertise on cryptocurrency and Web3. Happy reading! Follow ourTwitterandMediumGet deeper research and insights.

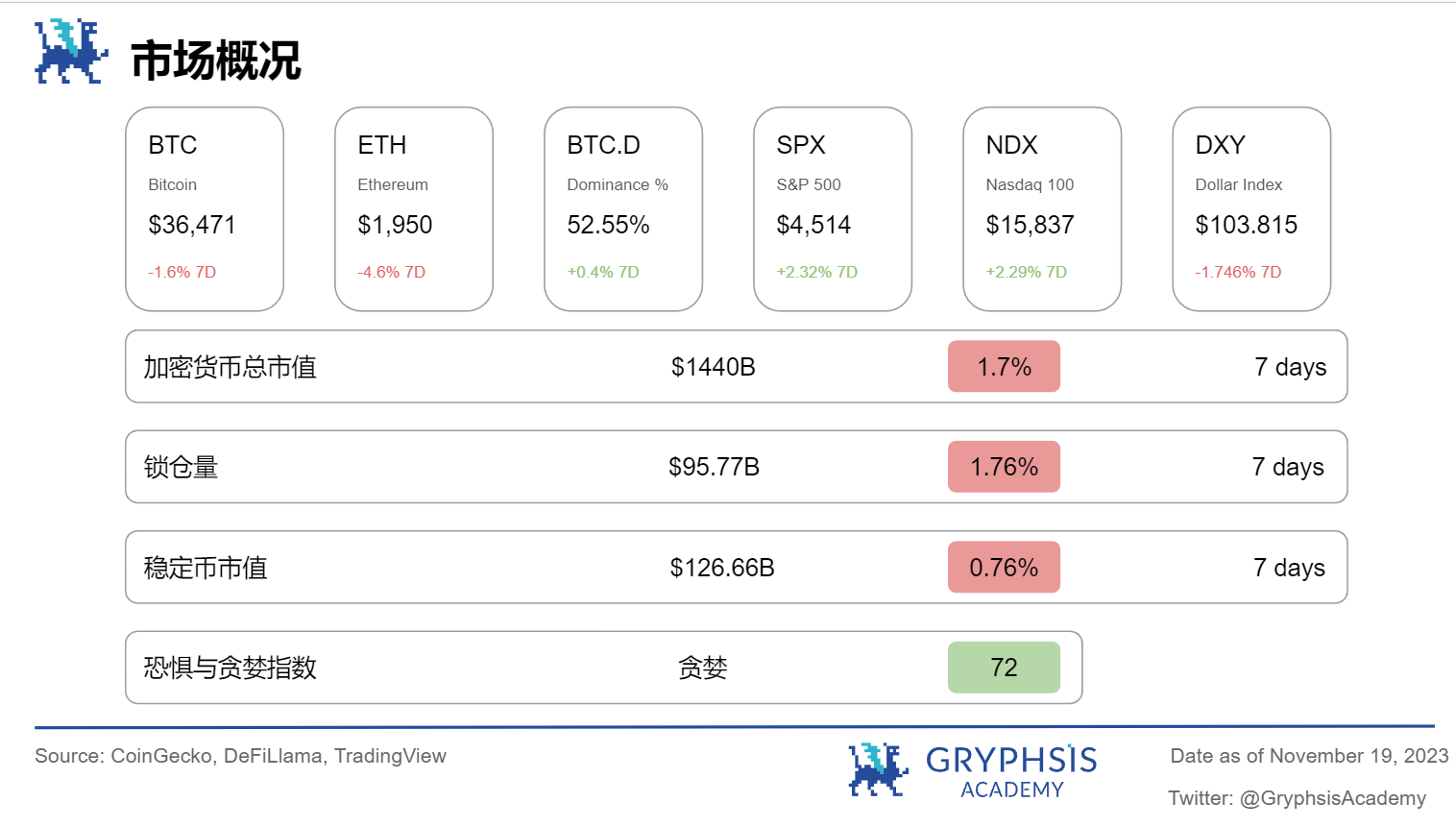

Market and Industry Snapshot:

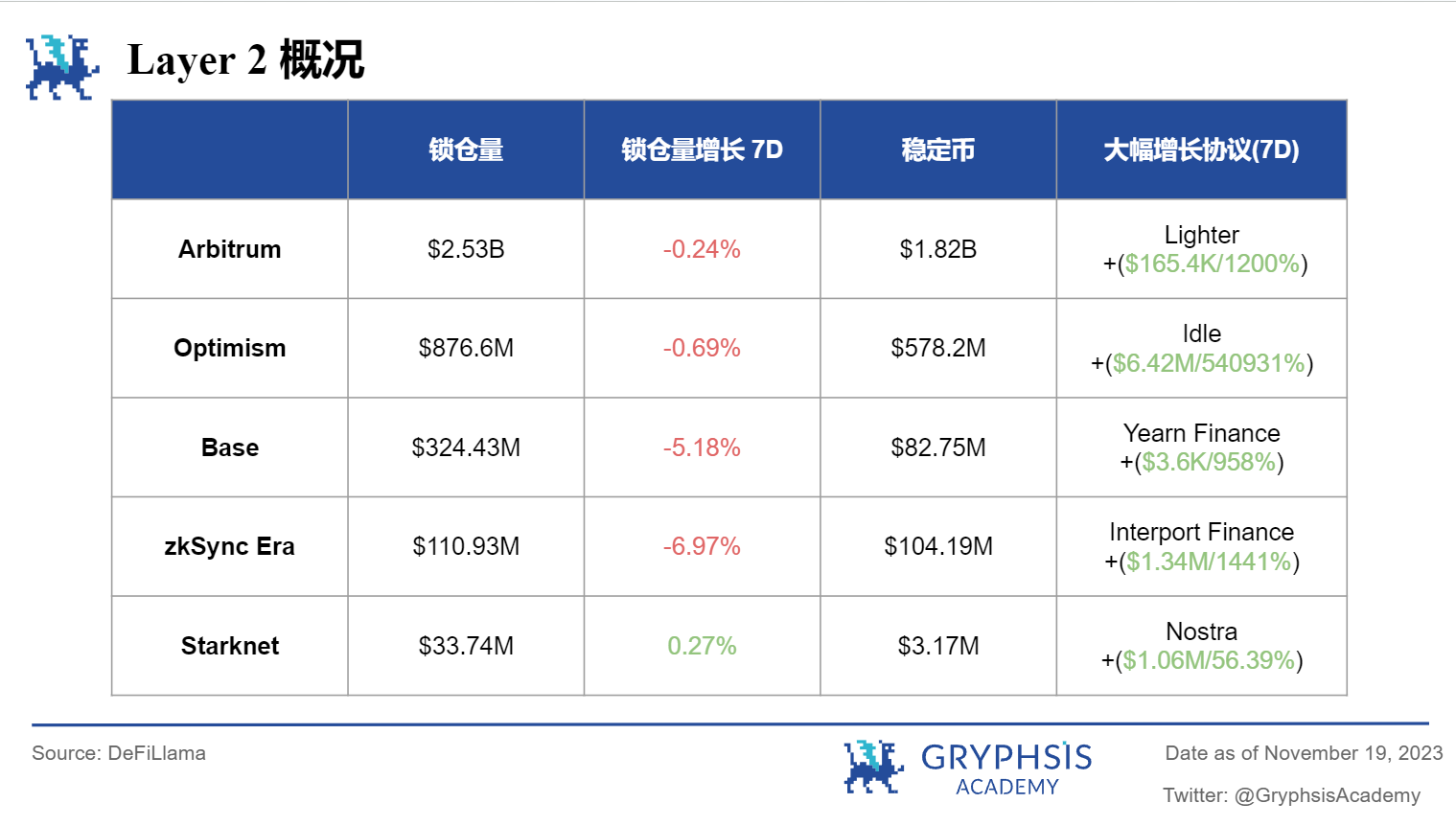

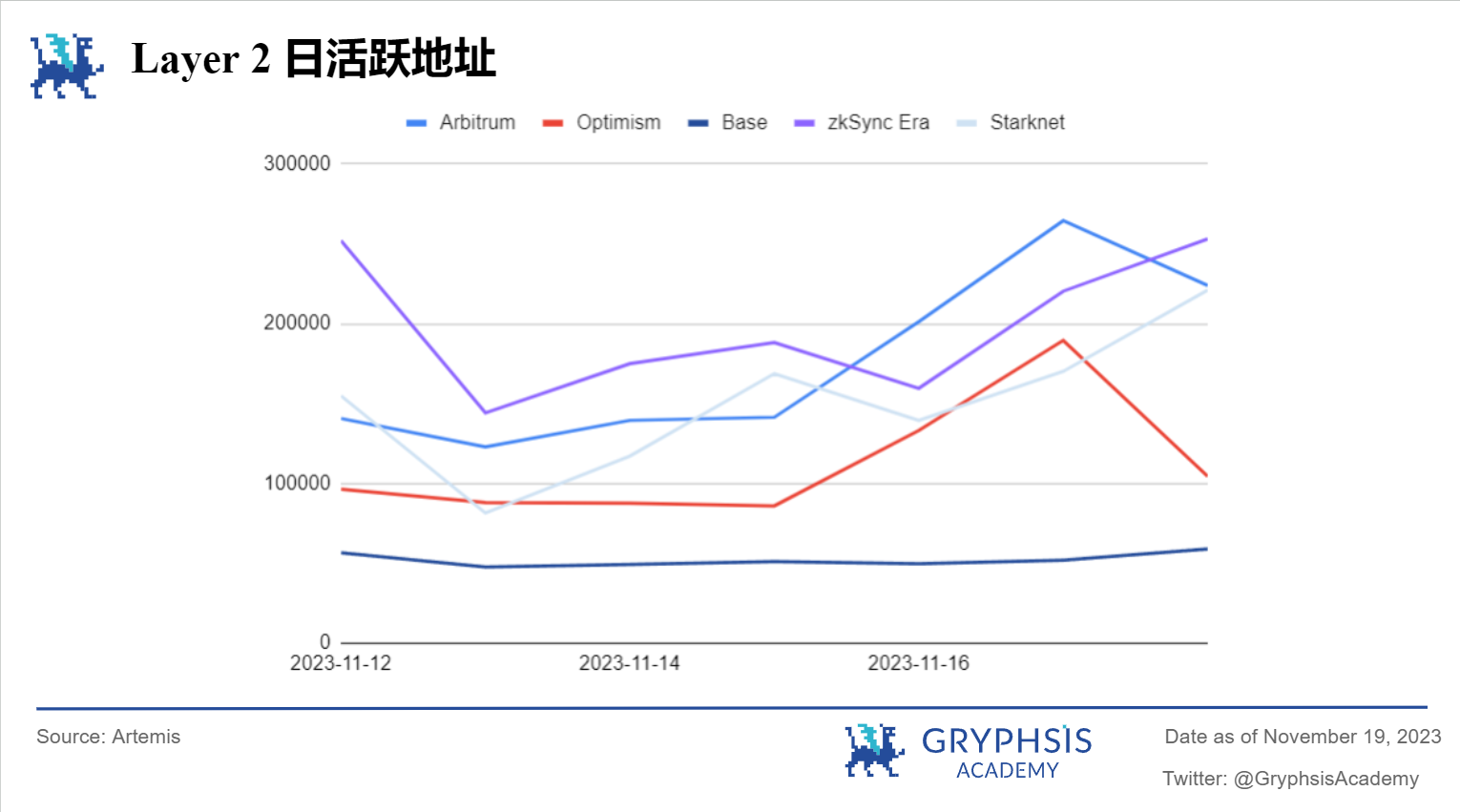

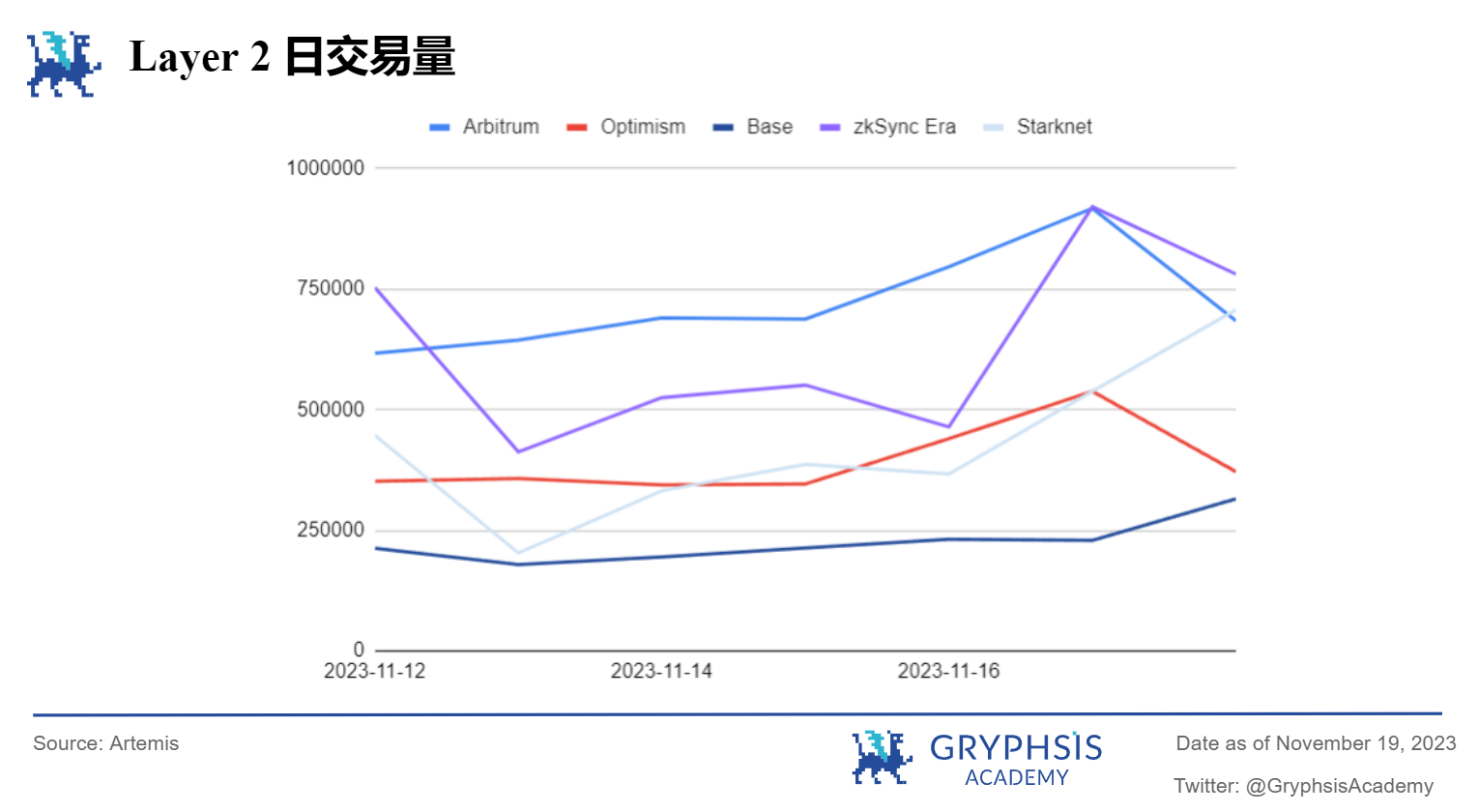

Layer 2 Overview:

Last week, most Layer 2s were in a downward trend except for Starknet. Among them, Base and zkSync dropped more obviously, falling by 5.18% and 6.97% respectively. Starknet, the only Layer 2 to grow, rose slightly by 0.27%. Protocols like Lighter, Idle, and Yearn Finance have demonstrated noteworthy TVL growth rates.

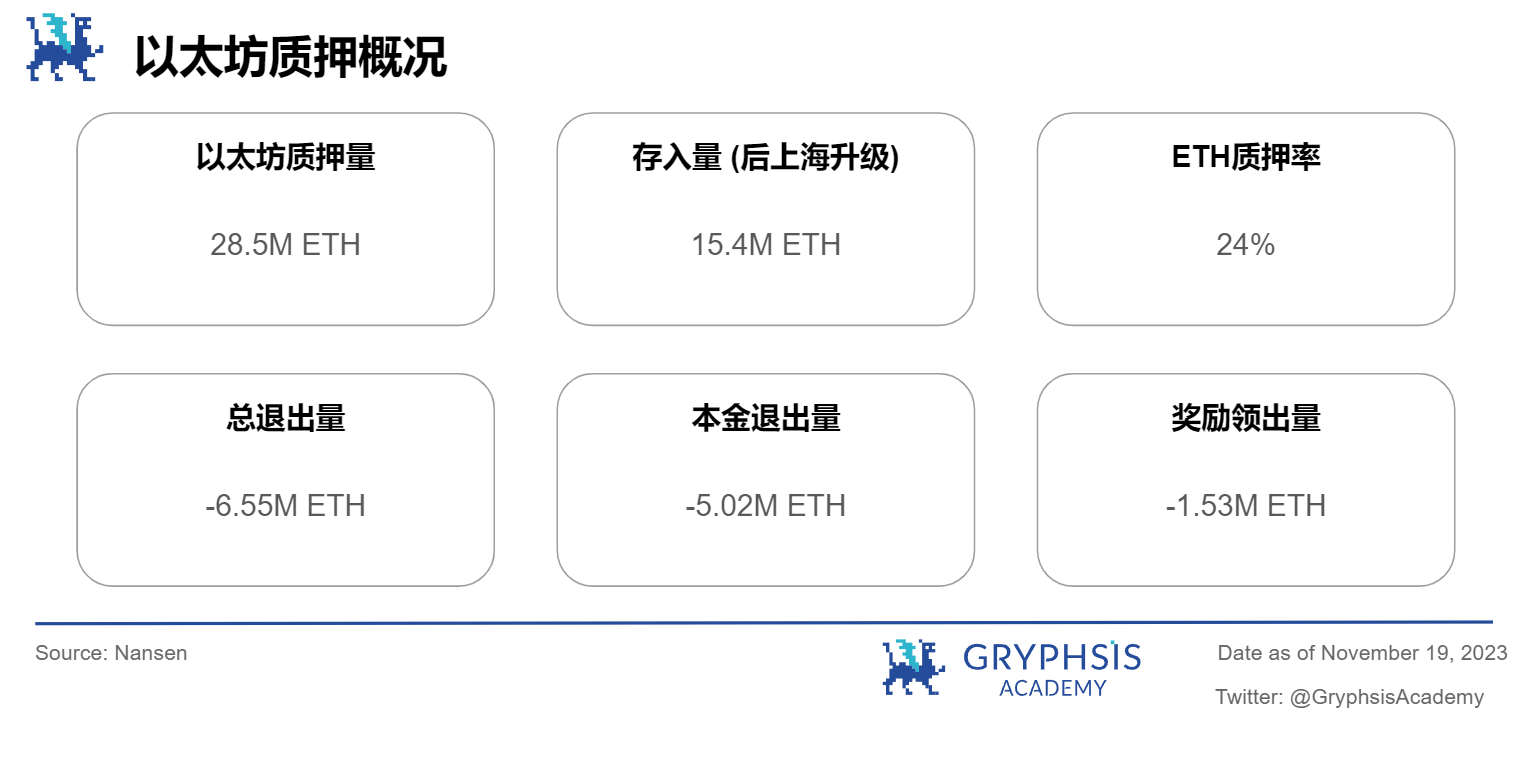

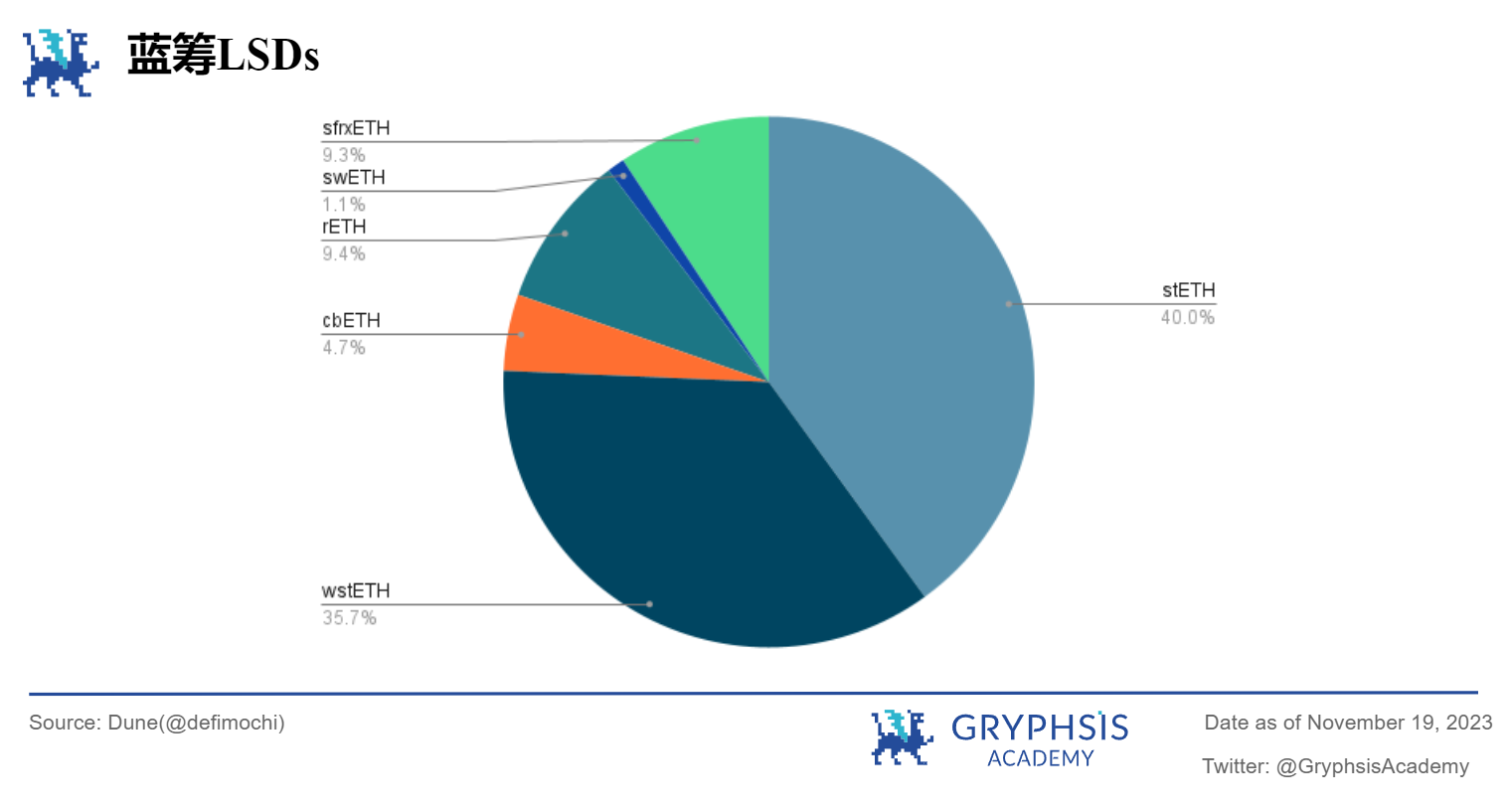

LSD Sector Overview:

In the LSD field, Ethereum pledges maintained a slight increase, but the magnitude was not large and there was no obvious indicator change. In terms of market share, wstETH has grown while the rest have remained stable.

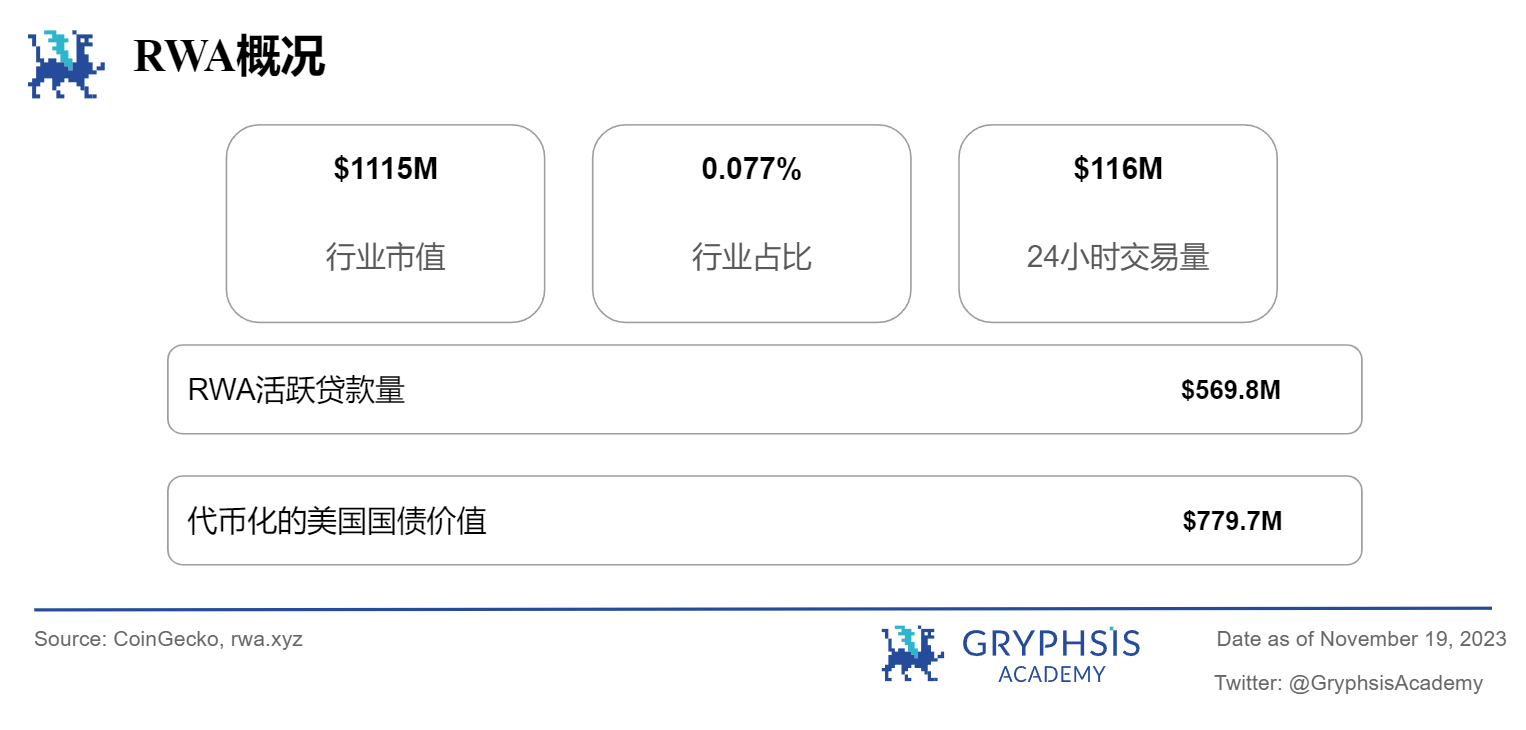

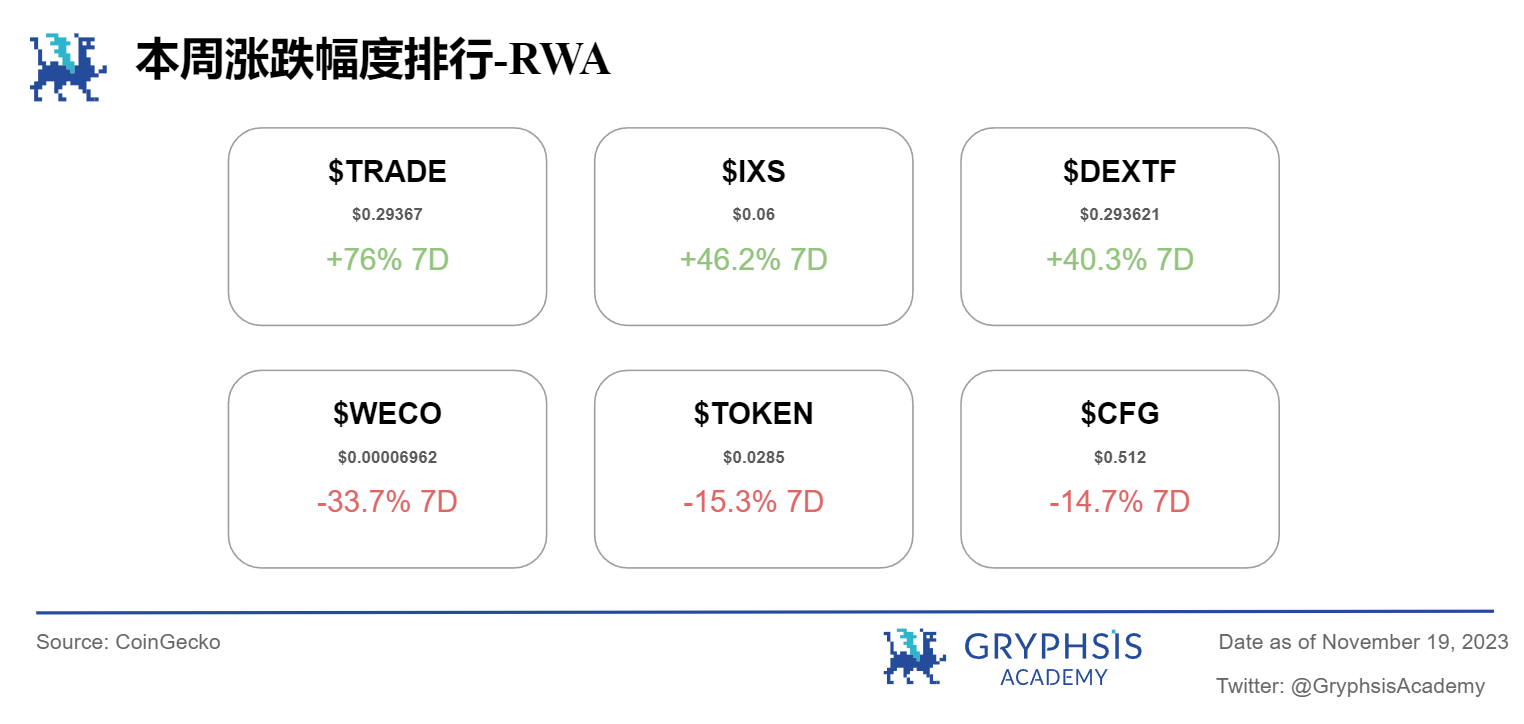

RWA Sector Overview:

Last week, the total market value of the world’s real assets remained above 10 billion, still showing a growth trend. In addition, RWA’s active private credit value and tokenized treasury have both increased. Notable growth tokens include $TRADE, $IXS, and $DEXTF. Tokens like $WECO, $TOKEN, and $CFG experienced larger losses.

Main Topics

Macro overview:

US Stock V.S. Crypto

Big news this week:

SEC Delayed Bitcoin Spot ETF Application

Weekly Agreement Recommendations:

Match Finance

Weekly VC Investment Focus

Blockchain.com ($ 110 M)

Civitai($ 5.1 M)

Twitter Alpha:

@defiinfant on smart contract wallet

@milesdeutscher on potential airdrop

@poopmandefi on Celestia

@zerokn 0 wledge_ on intent-centric

Macro overview

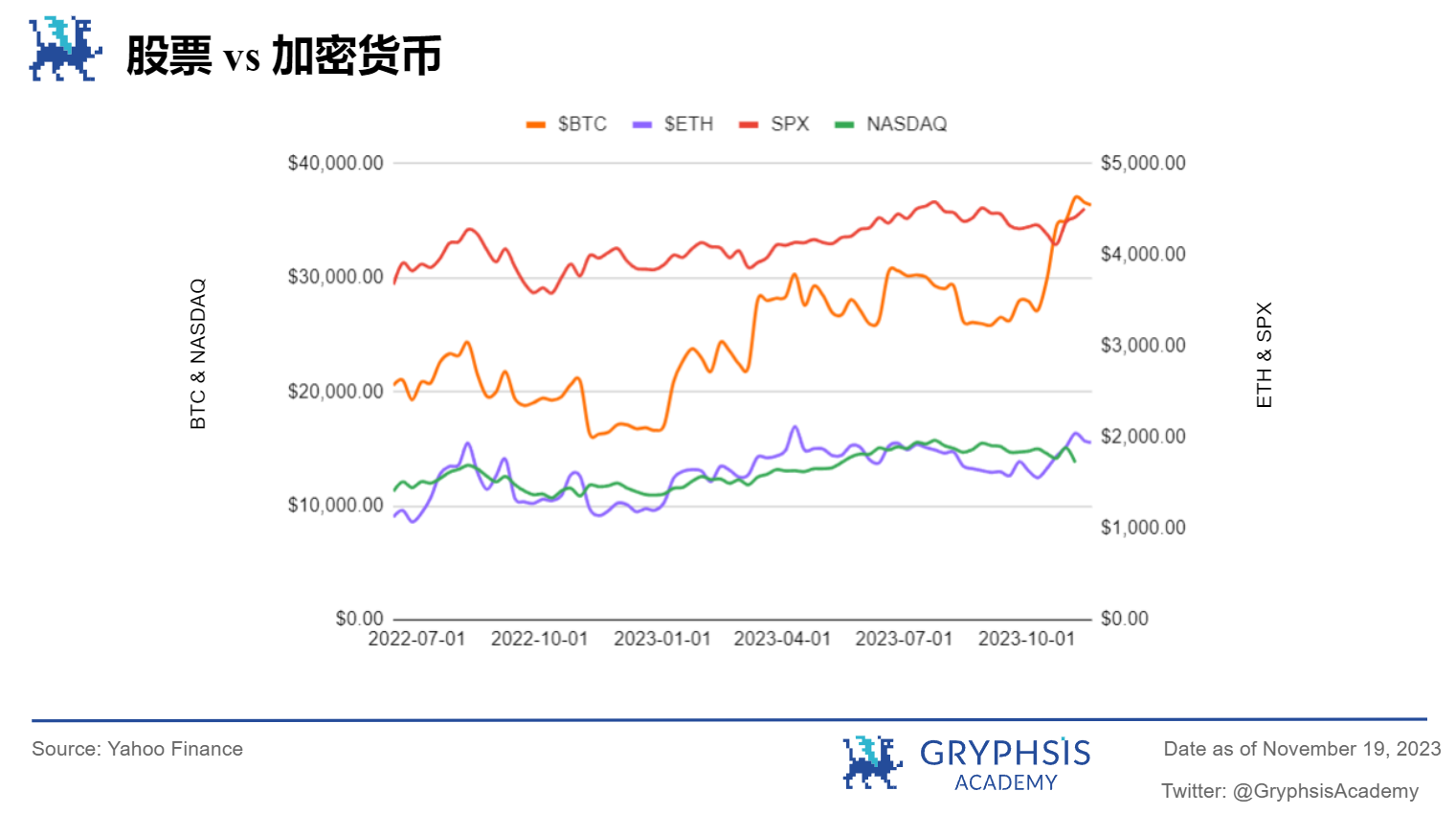

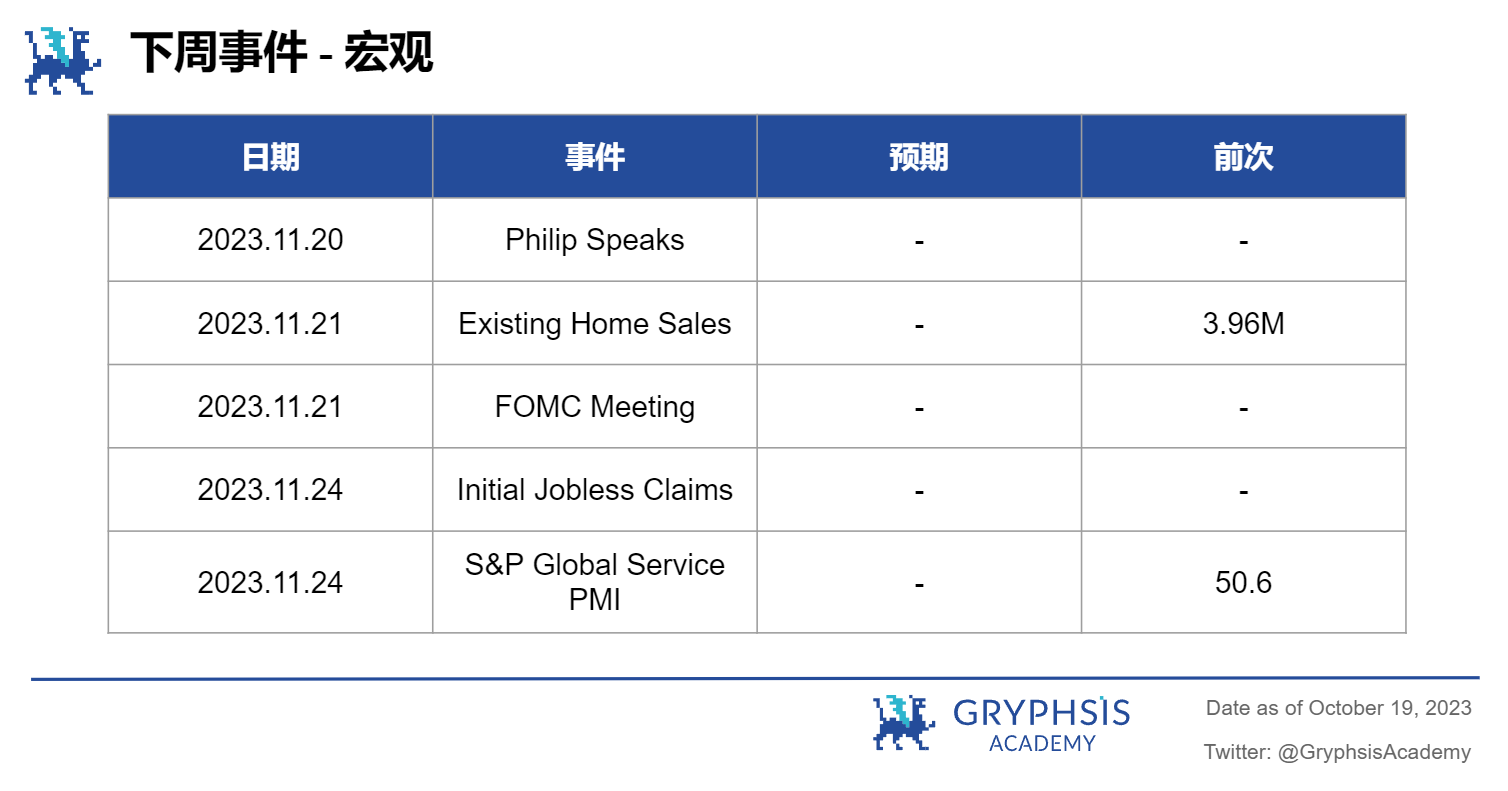

This week, both stock and crypto markets have seen opposite trends. The SP 500 and Nasdaq are up 2.2%, while $BTC and $ETH are trending lower, down 1.6% and 4.6% respectively. In the coming week, pay attention to major events such as FOMC, initial unemployment claims, and PMI.

Big news this week

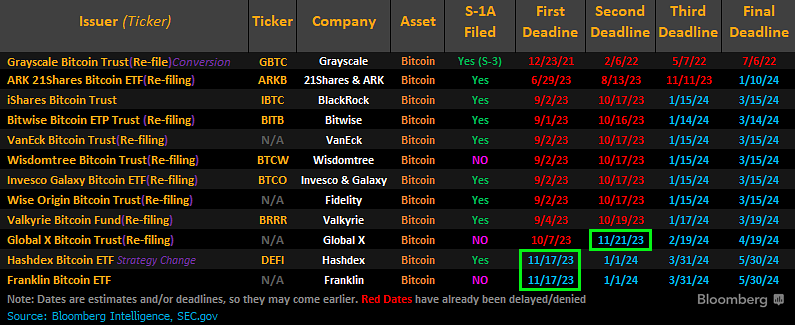

SEC delays spot BTC ETF application

The U.S. Securities and Exchange Commission (SEC) has delayed a decision on Hashdex’s application to convert its existing Bitcoin futures ETF into a spot ETF and delayed Grayscale’s move to launch a new futures-based Ethereum ETF. The two each applied for a Bitcoin ETF and an Ethereum ETF in the same month, but both suffered delays.

The delay comes amid high expectations for federal regulators to approve a spot Bitcoin ETF. So far, regulators have rejected every attempt to list blockchain assets among the general investing public. There are many companies on the market that have applied or even been developing, but have all been rejected.

However, this rejection did not dampen market enthusiasm at all. The price of BTC rose by more than 5% on the afternoon of the 16th, reaching $37,500.

Although the SEC has once again delayed its application for spot ETFs, the market expects that a number of spot Bitcoin ETFs will still be approved by January next year, making it easier for institutional and retail investors to have access to Bitcoin. With the continued popularity of the crypto industry, Emotions were running high. The price of Bitcoin has risen by 129% year to date.

One question facing investors, however, is whether the approval of a spot Bitcoin ETF has been factored into this year’s sharp rise in Bitcoin prices. Sui Chung, CEO of digital asset index provider CF Benchmarks, said the approval of a spot Bitcoin ETF may have been priced in, but the question is how much inflows the spot Bitcoin ETF will attract. He said the benefits of diversification are driving discussions about Bitcoin investing, given its lack of correlation with assets like stocks over longer periods of time.

One question facing investors, however, is whether the approval of a spot Bitcoin ETF has been factored into this year’s sharp rise in Bitcoin prices. Sui Chung, CEO of digital asset index provider CF Benchmarks, said the approval of a spot Bitcoin ETF may have been priced in, but the question is how much inflows the spot Bitcoin ETF will attract. He said the benefits of diversification are driving discussions about Bitcoin investing, given its lack of correlation with assets like stocks over longer periods of time.

https://x.com/crypto/status/1724871377981747653?s=20

Weekly Agreement Recommendations

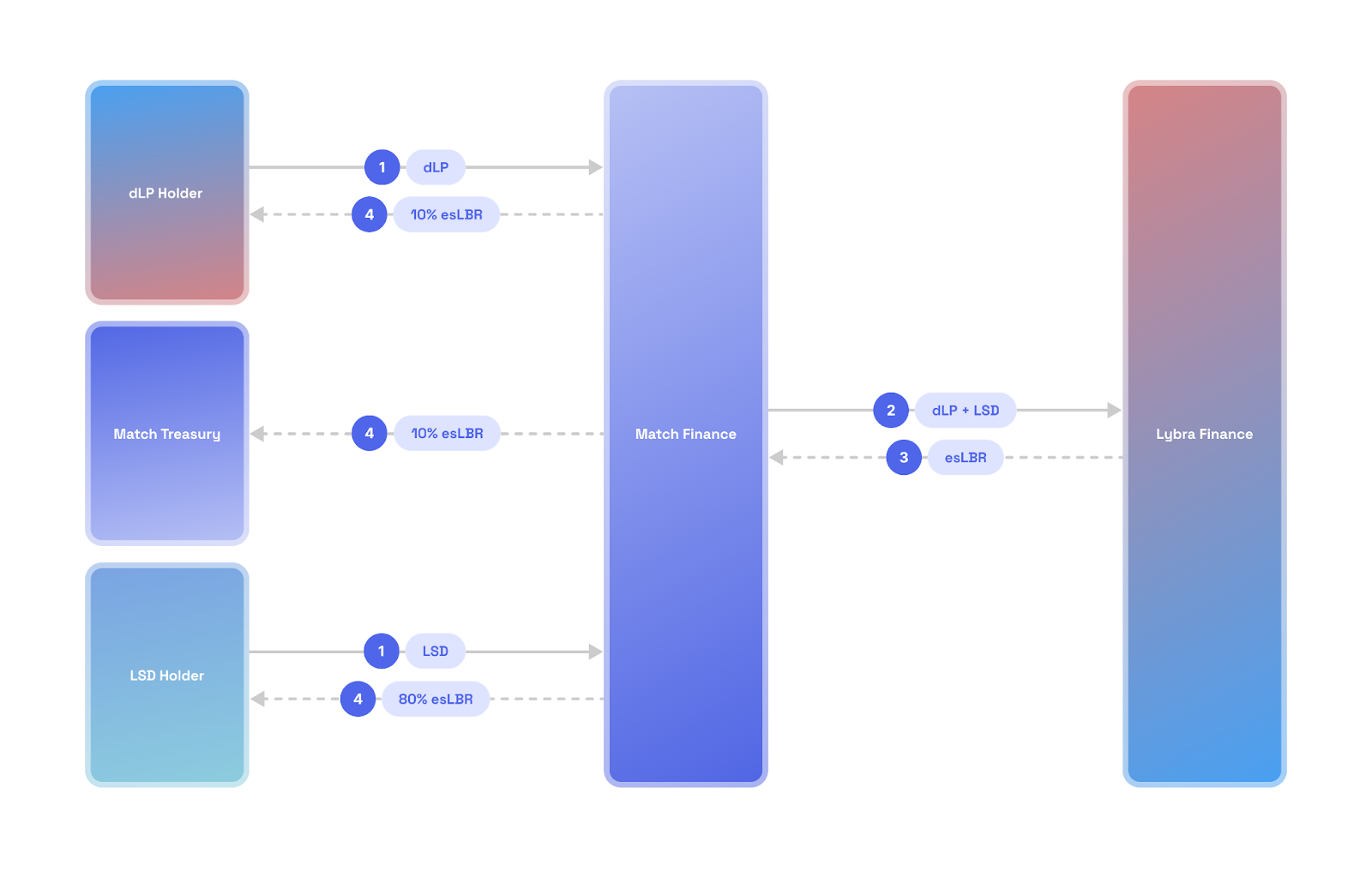

Welcome to our Protocols of the Week segment – where we spotlight protocols making waves in the crypto space. This week, we chose Match Finance, an aggregator built on Lybra Finance.

Match Finance was launched in October this year and has been audited by Beosin. To understand its product mechanism, you can first have a general understanding of its service agreement, Lybra Finance. Lybra Finance is an LSDfi stablecoin protocol where users obtain eUSD (stablecoin) by over-collateralizing stETH.

In addition, LBR is used as a governance token to incentivize LPs holding eUSD or giving eUSD-USDC/LBR-ETH. esLBR is a third-party escrow token that is exchanged with LBR at a ratio of 1:1. All mining rewards in the agreement are issued in this form and are non-tradable and non-transferable. However, esLBR holders enjoy the income source and governance rights of the agreement. You can also exchange the esLBR you hold for LBR through linear unlocking.

Match Finance workflow overview:

As a Yield platform, what incentives does Match Finance provide to attract users to participate?

As a Yield platform, what incentives does Match Finance provide to attract users to participate?

1. Lower the threshold for obtaining esLBR

In Lybra Finance, users must maintain 5% of the LBR/ETH liquidity of the total value of eUSC in order to obtain esLBR rewards normally. If they cannot maintain it, the esLBR originally obtained will become a bounty. But in Match Finance, users only need to deposit eUSD or dLP (LBR/ETH pool) to obtain esLBR. This greatly reduces the threshold for users to obtain esLBR and reduces risks.

2. Increase dLP rewards

1) Get 100% of transaction fees

2) Obtain 100% of the esLBR reward as an LBR/ETH liquidity provider

3) Get an additional 10% esLBR reward from Mint Pool

4) Get an additional 10% esLBR reward from the Treasury

5) All those who are dLP in Match Finance are eligible to receive the airdrop of $MATCH

3. The mesLBR/esLBR pool receives instant rewards.

4. Serving as a vote-buying platform for Lybra War

In short, Match Finance uses these mechanisms to attract users to participate in dLP or pledge eUSDC, so as to obtain esLBR as incentives with high returns.

our insights

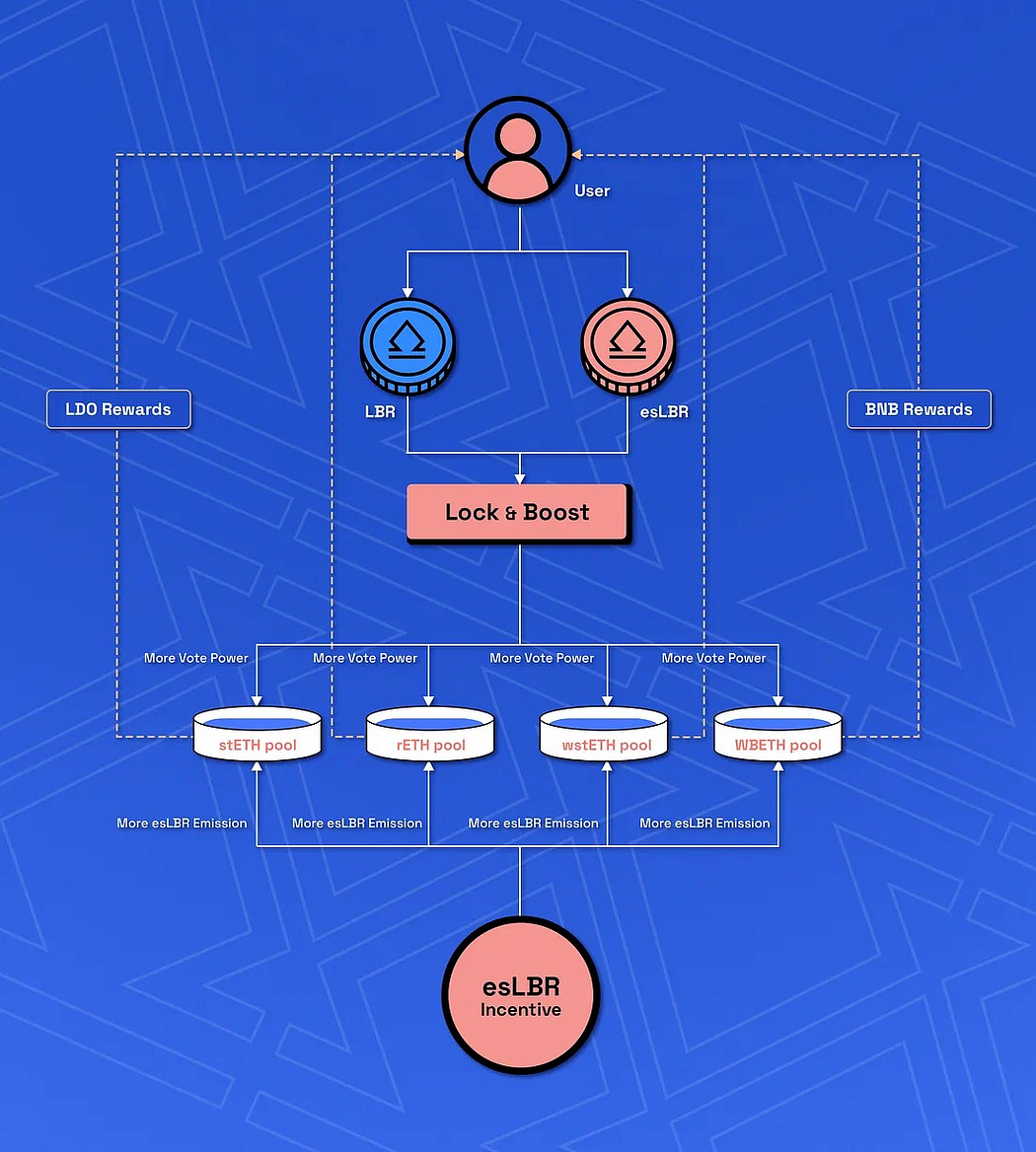

Why is using esLBR so attractive that all the incentives for Match are based on it? This is the Lybar War caused by the governance rights it possesses.

Lybar Finance launched the DAO organization in October this year, and all esLBR and LBR holders can participate in Lybras decision-making by submitting governance proposals for voting. However, you must have 10,000 esLBR to initiate a proposal. Those who hold LBR/esLBR have voting rights, but LBR will be automatically converted into esLBR when voting.

In this way, esLBR has both proposal rights and governance rights, and can also enjoy the revenue sources of the agreement. Holders can decide the emission amount of esLBR in LST Vault. Therefore, in order to attract users to use their issued tokens as collateral to mine stablecoins (eUSDC peUDC) and additional esLBR income, these LSTs will have the bribery value of governance tokens. .

Lybra allows using Lidos stETH as collateral to mint eUSDC, and this Lybra War is also supported by Lido. As the first platform to support vote-buying, Match is the leader in the LSDfi track, and its value expectations are relatively optimistic.

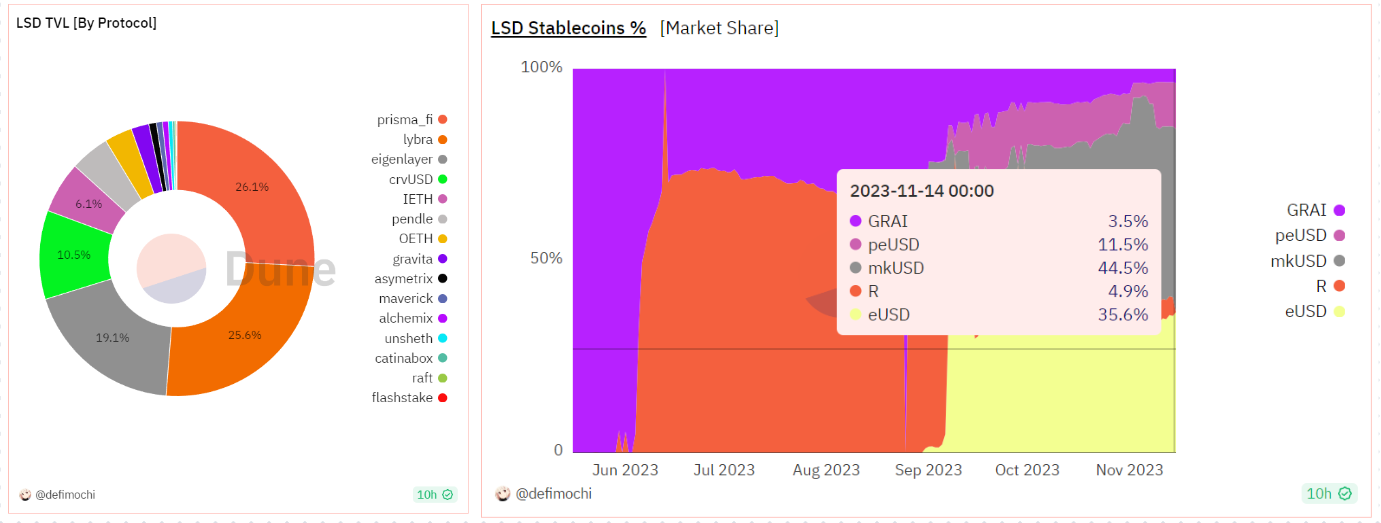

Judging from the data, Lybra currently occupies 25.6% of the LSDfi track, and its ecological stablecoin eUSD occupies 35.6% of the total track, both ranking among the top three.

Since the pledged liquidity value is over-anchored to the stablecoin eUSD, and the agreement will process a service fee of 1.5% of the total annual circulation of eUSDC as the main source of income, esLBR will enjoy both agreement income and governance rights, which will bring benefits to its holders. To increase the feedback value.

esLBR is non-transferable and non-tradable, and can only be obtained by mining as LP in Lybra a. Compared with Lybra, which has a higher threshold, perhaps Match will be the most efficient portal for ordinary users in this war.

Weekly VC Investment Focus

Welcome to our weekly Investing Spotlight, where we reveal the biggest venture capital developments in the crypto space. Each week, we’ll spotlight the protocols that received the most funding.

Blockchain.com

Cryptocurrency exchange Blockchain.com completed a $110 million Series E round of financing, led by British investment management company Kingsway Capital, with Baillie Gifford, Lakestar, Lightspeed Venture Partners, Coinbase Ventures and other institutions also participating. According to Bloomberg, Blockchain.com’s valuation is “less than half” of its Series D valuation that year (less than $7 Billion).

https://www.theblock.co/post/263079/blockchain-com-raises-110-million-in-series-e-funding

Civitai

Content creation platform Civitai has completed $5.1M in financing, led by a16z. With a current total valuation of $20M, Civital is a generative AI content marketplace that has surpassed 1 million registered users within three months of its founding. Today, there are approximately 3 million registered users and between 12 million and 13 million unique visitors per month. In the future, the startup aims to expand to other modalities besides AI image models.

https://www.cointime.ai/flash-news/content-platform-civitai-completed-us-14038

protocol event

OKX launches new ZK Layer 2 network 'X 1 ' with Polygon CDK

dydx chain trading goes live beta mainnet stage

Reddit admins reduce moons supply then token surges

Cboe launches margined bitcoin and ether futures

Aave launches social graph Lens V2 on Polygon

Bithumb eyes IPO in second half of 2025

Industry updates

Crypto fund inflows break $ 1 billion for 2023, led by Bitcoin, Ether and Solana

South Korea’s national pension fund buys $ 19.9 million worth of Coinbase shares

Bitcoin ETP exposure hits all-time highs as approval window for spot ETFs nears end

XREX obtains in-principle approval for Major Payment Institution license in Singapore

Monetary Authority of Singapore to start 'live' wholesale CBDC pilot

New York financial watchdog releases guidance to strengthen crypto listing, delisting

Twitter Alpha

Theres a lot of alpha in crypto Twitter, but navigating thousands of Twitter threads can be difficult. Each week, we spend hours doing research, curating threads full of insight, and curating your weekly picks list. Let’s dive in!

https://x.com/defiinfant/status/1725420547763249564?s=20

https://x.com/hmalviya9/status/1725043901957111898?s=20

https://x.com/milesdeutscher/status/1725268373184086523?s=20

https://x.com/poopmandefi/status/1725094175979548991?s=20

https://x.com/zerokn0wledge_/status/1725070163752649059?s=20

next week events

news source:

https://www.coindesk.com/policy/2023/11/15/sec-delays-decision-on-hashdex-bitcoin-spot-etf-application-grayscale-ether-futures-filing/

https://m.techflowpost.com/article/detail_12616.html

https://match-finance.gitbook.io/whitepaper/

https://www.theblock.co/post/263243/new-york-financial-watchdog-releases-guidance-to-strengthen-crypto-listing-delisting

That’s all for this week. Thank you for reading this weeks newsletter. We hope you benefit from our insights and observations.

Follow us on Twitter and Medium for instant updates. See you next time!

This weekly report is provided for informational purposes only. It should not be relied upon as investment advice. You should conduct your own research and consult independent financial, tax or legal advisors before making any investment decisions. And the past performance of any asset is not indicative of future results.