SignalPlus Volatility Column (20231115): Digital currency ignores macro trends and falls with collapse IV

announced on tuesdayU.S. overall CPI and core CPI data were weaker than expected, boosting market expectations that the Federal Reserve will pause on raising interest rates, while also expecting a first rate cut as early as May. influenced by,U.S. Treasury yields plummet, the overall decline was about 20 basis points, the two-year short-term yield fell sharply below 5.0%, and is now at 4.84%, and the ten-year yield is now at 4.46%.The three major U.S. stock indexes soared as a result, the Dow/SP 500/Nasdaq closed up 1.43%/1.9%/2.37% respectively.

Source: SignalPlus, Economic Calendar

Source: Binance & TradingView

However,Digital currencies are failing to keep pace with rising risk sentiment, the prices of mainstream currencies have retraced from their highs. Among them, BTC once fell below 35,000 and then rebounded back to the pivot point (pivot point) to fluctuate around 35,300. After the Asian market opened, it gradually returned to around 35,800. ETH weak linkage,Falling below the $2,000 markThen the whole plate is placed below it.

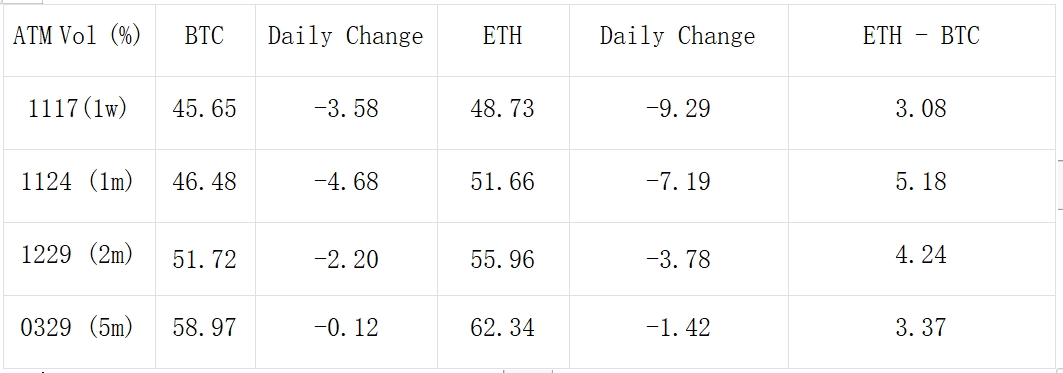

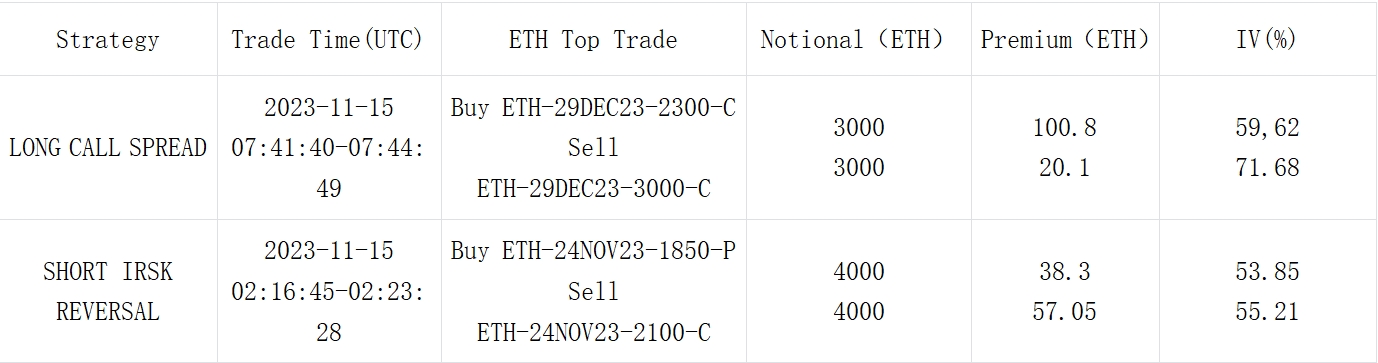

In terms of options, this decline also collapsed the implied volatility, causing the ETH front-end IV to fall by 7 to 9%, and BTC also fell by 3 to 5%. But in terms of trading, since this week is a critical window for BTC ETF approval,The pullback in price successfully attracted traders to open positions on the recent Call Spread, of which BTC 17 Nov 37000 vs 38500 Call Spread trading volume reached 2458 BTC, and ETH also had a 2300 vs 3000 Call Spread buy of 3000 ETH per leg at the end of the year.

Source: Deribit (as of 15 NOV 16:00 UTC+8)

Source: SignalPlus

Source: Deribit Block Trade

Source: Deribit Block Trade

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: xdengalin), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website:https://www.signalplus.com