An article explaining the investment potential of CEX platform currency in detail

The crypto market is rapidly emerging from a two-year bear market as Bitcoin breaks through the $38,000 USD mark. Bitcoin’s halving is coming, and a Bitcoin spot ETF is expected to be approved. These factors indicate that the crypto industry may be about to usher in an unprecedented bull market. So, how can we more firmly seize the wealth opportunities in the crypto industry?

Currently, one of the most profitable areas in the crypto industry is the trading platform, and platform coins have also become one of the important tracks in crypto assets. During the last bull run, Bitcoin rose from $5,021 to an all-time high of $67,000, a gain of approximately 1,200%. The growth rate of platform currencies on major exchanges far exceeds the growth rate of Bitcoin. Taking the leading trading platform Binance as an example, its platform currency has increased by about 60 times, while the platform currencies of many other trading platforms such as OKB, GT, KCS, etc. have increased by more than 20 times. Therefore, it may be a wise choice to lay out the platform currency track in the early stages of the bull market. This not only has higher certainty, relatively small risks, but also huge potential for future appreciation.

So, how to choose a platform currency? Which type of platform currency has greater room for appreciation? Below we will conduct a comprehensive comparative analysis from the fundamentals of the trading platform, the price trend of the platform currency, and the added value of the platform currency. By having an in-depth understanding of the operating conditions, market share and other fundamental factors of each trading platform, as well as the historical price trends and added value of platform coins, we can better evaluate the appreciation space and potential of each platform coin. At the same time, we can also pay attention to some new platforms and platform coins with innovation and development potential. Ultimately, through comprehensive analysis and comprehensive consideration, we can choose platform coins with greater appreciation space and potential.

The growth rate of leading exchanges slowed down, and the growth of second-tier platforms increased significantly.

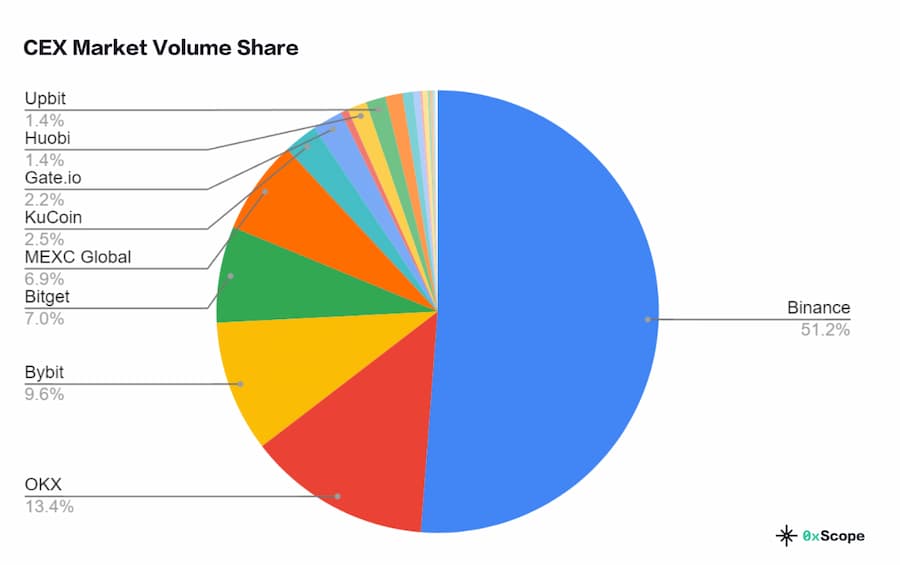

As the saying goes, you can enjoy the shade by leaning against a big tree. This statement holds true in the cryptocurrency space as well. The value of a platform currency is largely determined by the fundamentals of the trading platform behind it. During the nearly two-year bear market, the landscape of crypto platforms has changed quite a bit. Take Binance as an example. At the beginning of 2023, its trading volume and market share once reached 60%, showing a clear leading advantage. However, according to a recent CEX report released by 0x Scope, Binance’s market share dropped to 51%.

At the same time, some second-tier exchanges such as Bitget and Bybit have suddenly emerged and ushered in rapid development. Take Bitget as an example. At the beginning of 2023, its market share was only 2%, but now it has risen to 7%, becoming one of the fastest-expanding trading platforms in 2023, and firmly ranking among the top four trading platforms in the world.

Through comparison, we can find that rapidly developing trading platforms such as Bitget and Bybit are rising against the trend in the bear market through more active currency listing strategies and high-quality products and services, capturing more value for platform coins.

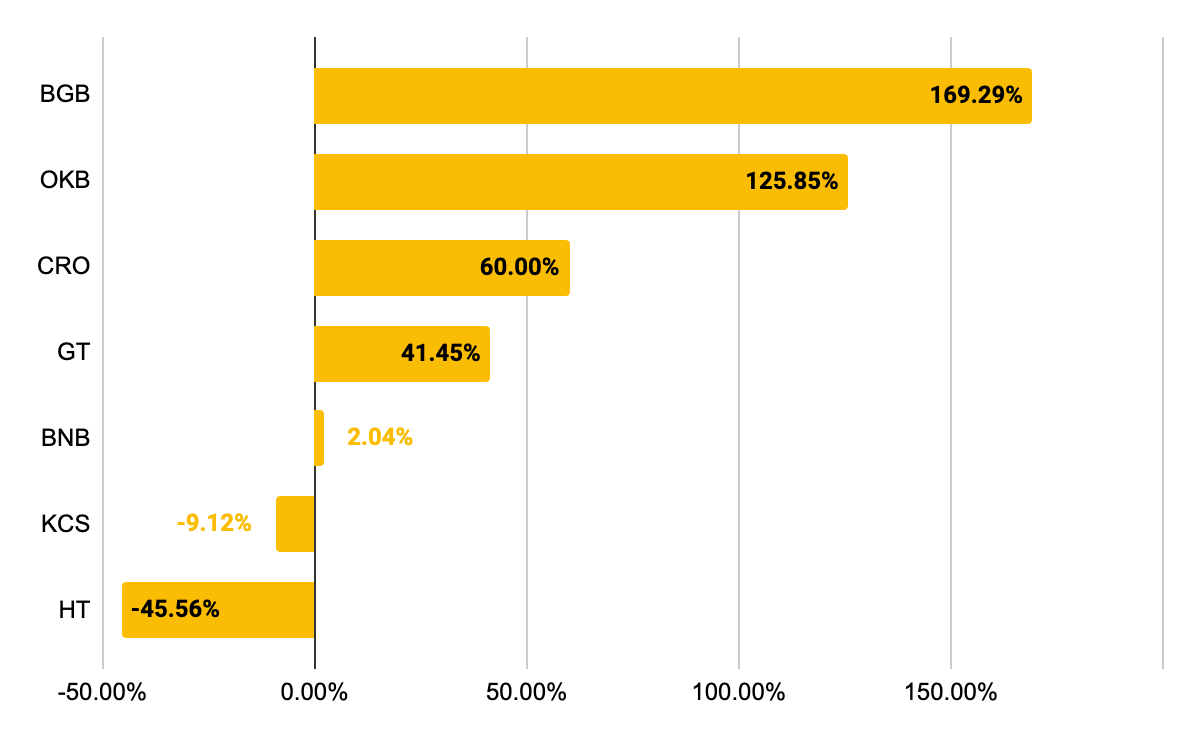

The performance of major platform coins in 2023

The price trend of platform coins is the most intuitive indicator reflecting its investment potential. It can be clearly seen from the chart below that BNB, as the industry leader, has achieved a 2% increase this year, and the operating conditions of the platform directly affect the price of the platform currency. Similarly, we can also see this view being verified among the outstanding performing currencies. The Bitget platform, which has emerged rapidly in 2023, is an example. Its platform currency BGB has risen by 168% since the beginning of this year. This increase has even exceeded Bitcoin (BTC has increased by 107% from the beginning of the year). BGB has become one of the best-performing platform coins this year, and it is also one of the few platform coins that can surpass Bitcoin in terms of growth.

It is worth noting that currencies that can rise against the trend in a bear market tend to show stronger appreciation potential when a bull market comes. BGB, which is currently on the rise, has strong momentum. Once a bull market comes, its upward trend will be multiplied and its momentum will be more abundant.

The power of compound interest: the added value of platform coins

High-quality assets not only need to have appreciation potential, but also need to be able to generate additional income.Compared with other cryptocurrencies, the unique advantage of platform currency is that it creates additional value for holders. People who hold the platform currency can participate in the LaunchPad of major trading platforms, which is the main manifestation of the added value of the platform currency. So, which platform currency generates greater additional value? We can look at it from the following two aspects.

First, the profitability of the LaunchPad project. According to data from CryptoRank, the LaunchPad projects of leading exchanges have performed well since their launch in 2023, with average maximum returns of more than 10 times. Taking Bitget as an example, the average historical highest return rate of all its LaunchPad projects is 41.9 times, ranking first; OKX and Bybit follow closely, with the average historical highest return rates of 35.6 times and 33.3 times respectively.

Second, the number of new projects in LaunchPad. Since entering 2023, Bitget’s LaunchPad has launched 6 projects, with new ones added every 1.5 months on average. Binance followed closely behind and launched 3 LaunchPads, with an average of one new launch per quarter. Other trading platforms are more conservative. LaunchPad has a small number of new listings, so the additional revenue its platform currency can bring is limited.

To sum up, Bitget’s LaunchPad not only has a higher yield, but also provides more new projects, so holding BGB can create more additional value. In addition, people who hold BGB can also participate in Bitget’s Launchpool, pledge, receive airdrops for new projects, etc. to earn income. Although these benefits are currently limited, once the bull market comes and the snowball effect occurs, it will create huge profit margins for holders.

Conclusion

In summary, holding platform coins in a bull market can bring higher returns and additional income opportunities. Recently, the platform coins of some rapidly developing second-tier platforms such as Bitget and Bybit deserve attention. Compared with the leading platform coins, the platform coins of these second-tier platforms have greater room for imagination.Taking Bitget as an example, its market share is 7%, which is about 1/7 of Binance (51%), while BGB’s market value is only US$600 million, which is about 1/70 of BNB’s market value (US$38 billion). From this point of view, BGB may be undervalued.

Therefore, when choosing a platform currency, investors should pay attention to the platform fundamentals behind it as well as the historical price trend and added value of the platform currency for comprehensive consideration and comprehensive evaluation.

This article does not constitute investment advice, investors are advised to DYOR.