Excellent traders who make profits in the highly volatile crypto market must be better than ordinary people in one or more dimensions such as market insight, professional knowledge, data analysis and risk control capabilities, and can complete the accumulation of original capital more quickly. Increase the gap between novice traders and ordinary traders.

Those who try to find excellent traders through K-line charts or on-chain data cannot fully recover their operating methods from clues, nor can they accurately control their trading variables, and the possibility of following and making profits is extremely slim. With the continuous evolution of the cryptocurrency market and the innovation of crypto exchange tools, products that can bridge the needs of users to follow - copy trading (Copy Trading) have begun to appear on the market.

On November 13, OKX, the world’s leading crypto exchange, announced that it has officially launched “spot copying”.OKX has previously launched contract copying and strategy copying. Through the OKX copy trading platform, users with different needs can automatically follow the operations of leading high-quality traders to increase profit opportunities. Leading high-quality traders can also use anytime, anywhere and shared operation strategies to gain more profits.

However, the current copy trading platforms on the market are of mixed quality, and users do not know much about them. For example, why can there be two results of making money and losing money when following the same trader? This is because copy trading is copying the trading strategies of other excellent traders, but excellent traders are not 100% accurate. A more appropriate approach is that after the user selects the target to follow, he needs to adjust parameters and other parameters according to his own situation.

This article will take OKX spot copying as an example, and provide an in-depth analysis of how to use the OKX copying trading platform correctly from multiple dimensions such as a detailed explanation of the copying products, how to select traders, and how to use the platform.

Understand OKX spot ordering

The spot copying model is similar to the contract copying model and is a new social investment method.

OKX selects high-quality spot traders. Users can automatically copy the traders spot trading points to follow orders, and can easily grasp the trading timing without having to watch the market. At the same time, spot order operators can earn up to 13% of profits by sharing trading points and other operations.That is, users pay to buy trading opportunities, and agents charge to analyze trading opportunities, so as to meet the needs of both parties.

Through OKX spot copy products, users can enjoy better market depth, multi-dimensional trader data, and guaranteed fund security, making it easier to capture trading opportunities in the ever-changing crypto market.OKX spot copying is not only suitable for novice users, but even experienced traders can establish their own transactions by comparing the trading points of different traders.

The method of using OKX spot follow-up is very simple. Follow the orderUsers open the OKX App, click Trade or Discover, select Copy - Spot, and select or filter their favorite spot traders in the Copy Plaza. Then click Follow Order or the traders avatar to view the traders detailed information, such as order performance, historical returns, etc. Finally, click Follow Order Now to complete the setting of spot copy order. After confirmation, you can wait patiently for the trader to open a position.

For high-quality traders, you can apply through the copy trading banner and submit your application.

Currently, OKX orders follow the order mode, which covers two types: following orders based on a fixed amount and following orders based on proportion. Users can choose according to their own needs.Copying by amount means that when a trader opens a position, the copying user invests a fixed amount to follow the order. For example, if a user sets a single investment of 10 USDT, when a trader opens a position, no matter how much the trader invests, the users order amount will be 10 USDT.

Proportional copying means that when a trader opens a position, the copying user follows the order based on the traders order value and the set fixed order multiple. For example, if a traders order is worth 1,000 USDT, and the user sets a single copy order of 0.1 times, then the value of a single copy order is 10,000 USDT* 0.1 = 100 USDT.

It is worth noting that copy trading is not 100% profitable.

No trader with orders can always make the right judgment in the long-term trading process. In addition, sometimes the problem does not lie with the trader who leads the order, but with the user who follows the order, such as over-reliance on the order leader, neglect of risk management, expectation of immediate profit, etc.Follow-up is also a kind of ability, which is mainly reflected in two levels: how to select and evaluate order leaders, and how to set follow-up parameters. According to an OKX copying user, he selected 3 order leaders from more than 4,000 order leaders based on multiple factors such as winning rate and position opening amount, with a winning rate of 100%, and ranked TOP 1 in terms of income in the copying list.

Different order leaders have different styles, trading experience, trading concepts, and targets of attention. If you like short-term small position games and follow an order leader who likes long-term, it is easy for your mentality to fluctuate, thus affecting your operations. and income, so you need to work hard to compare and select among thousands of order operators. It is important to choose the one that suits you. The other is to reasonably set the order amount/position, etc., and do a good job in risk management.

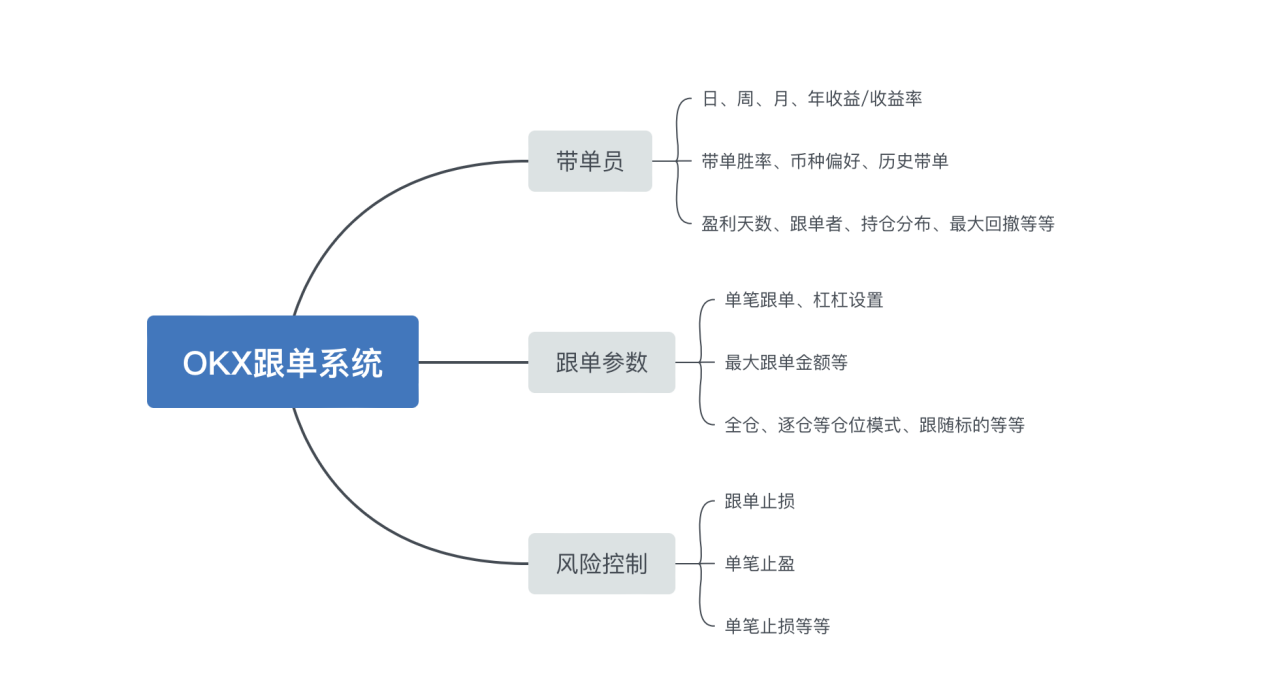

To this end, the OKX ordering system has designed a very diverse and valuable parameter system in these aspects.For example, OKX has set up a strict review system for order brokers and publicly displays the actual trading data of their orders, covering core data such as order winning rate, profitable days, position distribution, maximum drawdown, etc., which is very transparent.I won’t go into detail here. Users who need to follow orders can do in-depth research, so that the probability of making profits from following orders will be greater.

Quick overview of OKX copying system

In addition to the selection of order guides, order tracking parameters, etc. discussed above, the stability and security of the platforms order tracking system are also very important.As a leading crypto exchange, OKX provides better trading depth, security system, etc. It can follow orders in a timely manner even in high-frequency trading, and it is not easy to cause slippage even in a large number of orders.OKX is committed to improving POR transparency to traditional financial audit standards, thereby continuing to lead the industry in security and transparency. It is one of the few mainstream crypto exchanges in the industry that releases reserve certificates on a monthly basis. The POR system has been upgraded through innovative technologies such as zk-STARK, and users can independently verify the solvency of OKX at any time. Since OKX first launched POR from the end of 2022, hundreds of thousands of users have participated in visiting the POR page and completing self-verification.

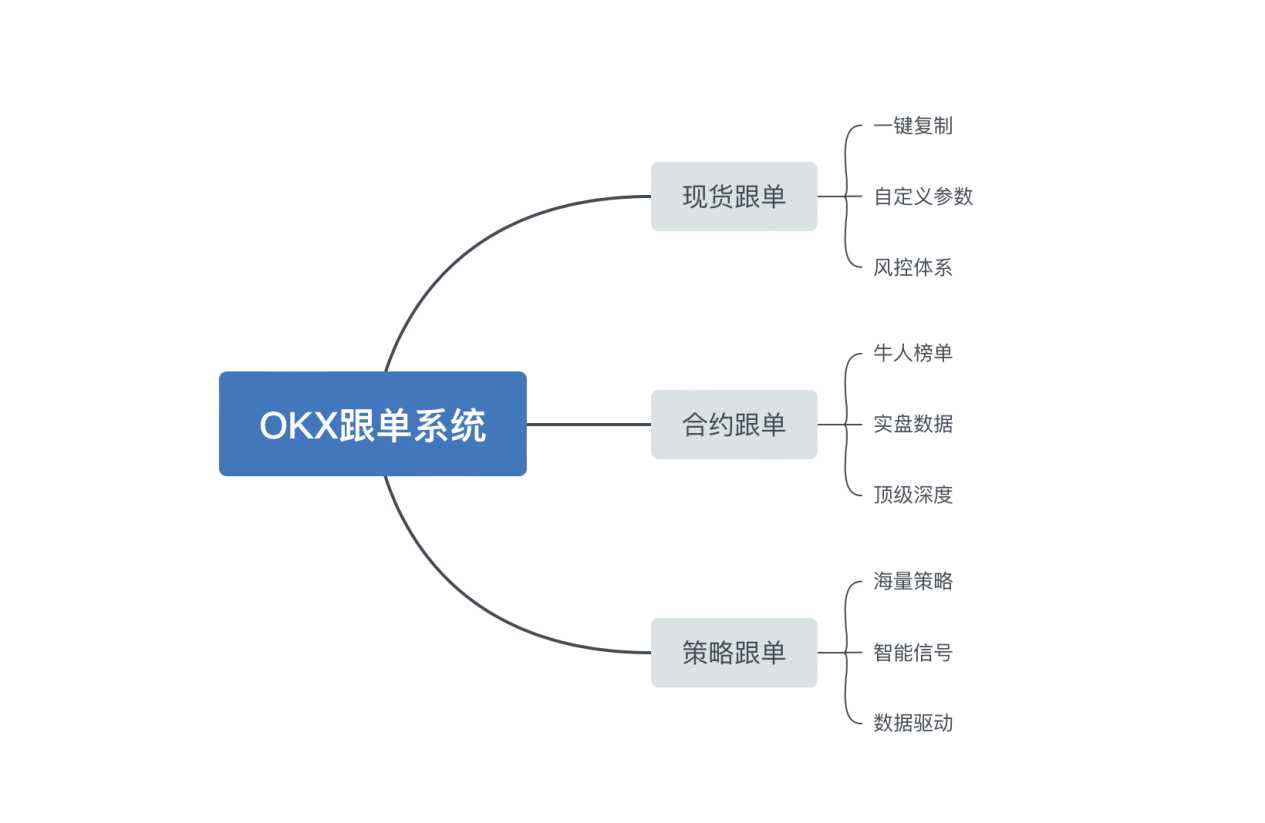

The OKX copying system finds a balance between the order leader and the follower. In addition to the above spot follow-up orders, OKX also provides powerful contract follow-up orders and strategic follow-up orders.

to some extent,OKX contract copying can be understood as leveraged spot copying. It is worth noting that OKX contract copy has launched a ranking list of trading experts. It is convenient for users to more intuitively view the historical data, current position status and other information of high-yield orders, and subscribe, so that they can get real-time reminders of their position changes and follow orders with one click.

Different from spot follow-up and contract follow-up,OKX strategy copying is to meet users growing needs for advanced trading tools and strategies.Strategy Copying OKX has established a strategy copying trading system in the Strategy Square. The platform selects top strategy copying staff. Users can follow the strategy with one click and automatically follow the trigger/stop, making it easy to grasp the best opportunity. On the strategy copying page, users can click on any leaders avatar to enter the leaders homepage and view information such as the leaders comprehensive performance, current strategies, and historical strategies.

OKX strategy copying provides a large number of high-quality strategies, allowing users to conduct ultra-low-latency transactions through professional intelligent signals, thereby turning emotion-driven decisions into data-driven decisions, gaining real-time insights into the market and accurately capturing trading opportunities.In addition, based on the different trading preferences and strategies of different users, OKXs signal strategy platform allows users to have complete freedom and flexibly customize their trading signals on the TradingView platform to meet their specific needs, truly liberalizing the trading experience.

OKX strategy copying marks the upgrade of Strategy Square to the 2.0 era. It builds a user-friendly one-click strategy copying system to reduce user operating costs, capture trading opportunities, and at the same time help order managers obtain profit sharing. The user opens the OKX App, clicks Trade, selects Strategy, selects Strategy Copying in the Strategy Square, then selects the preferred leader strategy, clicks Follow, and after understanding the detailed parameters of the leader and strategy, Click Use Strategy, select the leverage multiple and investment amount, click Confirm to start following the strategy.

The OKX copy trading system, relying on advanced innovative technology, powerful trading engine, secure POR, etc., has gradually grown into the safest, most transparent, most advanced, and most comprehensive copying platform on the market.

Learn to use the power of tools

OKX contract copying is a promising tool that lowers the trading threshold for crypto users while providing more opportunities. With the continuous development of the crypto market and the iteration of OKXs follow-up products, it will continue to attract more investors and traders, forming a more active cryptocurrency ecosystem.

However, although the follow-up model reduces the burden on investors, they cannot completely rely on this method. They still need to try their best to understand its working principle, and constantly improve their investment system based on their own risk tolerance and return expectations.Because following is also a kind of ability. Even if you follow the same trader, there will be two results: making money and losing money.

Whether it is an experienced trader or a novice trader, only by learning to use the power of cryptographic tools can you achieve half the result with half the effort.As the worlds leading crypto exchange, OKX provides the industrys top trading tools and is becoming an important force in changing the future of finance and user participation, as well as a shaper of the digital financial era.

Crypto trading tools emphasize security and privacy. They have not only spawned many financial innovations such as DeFi, NFT, and DAO, but also established a powerful decentralized financial market, bringing greater transparency and lower transaction costs. They are also constantly Improve financial inclusion, especially those who do not have traditional financial accounts can also access cryptocurrency through smartphones and the Internet, and can equally enjoy financial services. Additionally, investors can drive the globalization of financial markets through crypto emerging markets and diverse asset classes. As encryption supervision and security issues gradually improve, in the future, encryption trading tools represented by OKX may become an indispensable part of the new financial landscape.

What users have to learn is to use the power of tools.