LD Capital Track Weekly Report (2023/11/6)

Summary

Lending: The asset size of MakerDAO RWA has been reduced to US$2.975 billion, and the size of DSR has been reduced to US$1.626 billion, showing a turning trend; the Aave community initiated a temperature check vote to increase the GHO borrowing interest rate.

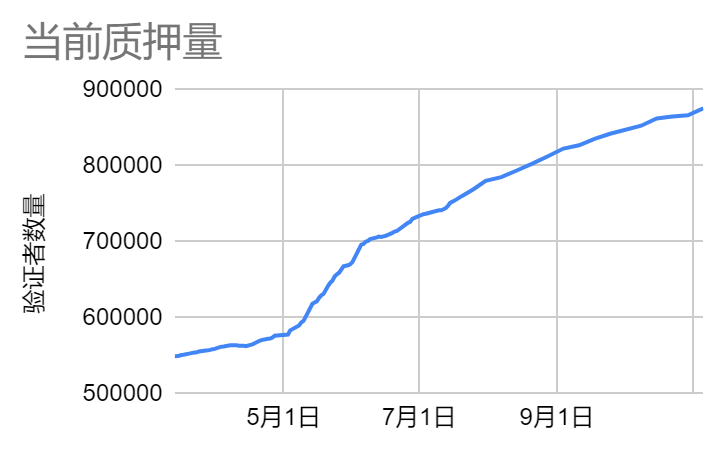

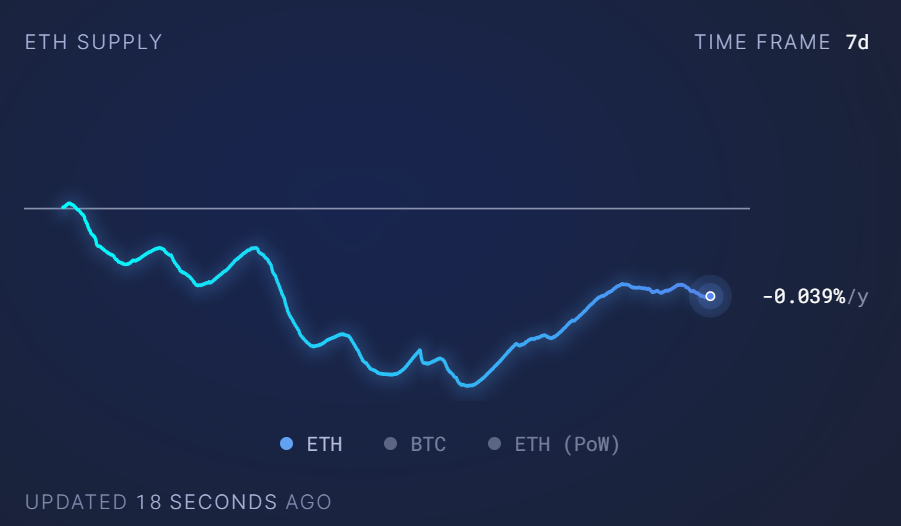

LSD: The ETH pledge rate rose to 23.55% last week, a month-on-month increase of 1.13%. Last week, 28.32 million ETH were locked in the beacon chain, corresponding to a pledge rate of 23.55%, a month-on-month increase of 1.13%; of which there were 875,600 active verification nodes, a month-on-month increase of 1.06%. This week, the ETH staking yield remained at 3.60%; ETH turned to deflation, with annualized inflation falling to -0.039%.

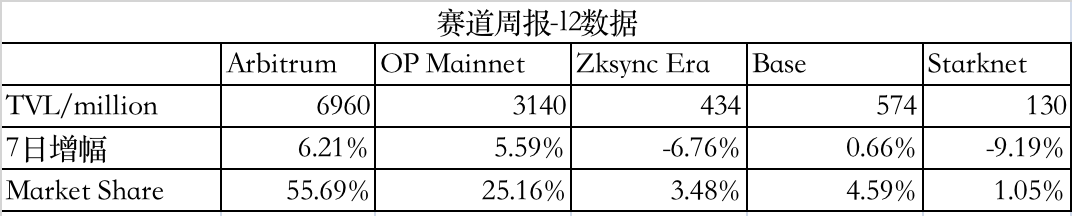

Ethereum L2: The total amount of Layer 2 TVL is US$12.51 billion, and the overall TVL has increased by 5.16% in the past 7 days. With further updates on the upgrade schedule at Ethereum’s 121st ACDC conference, Devnet 12 may launch sometime in early December, or start upgrading the public Ethereum testnet after the first quarter holiday of 2024.

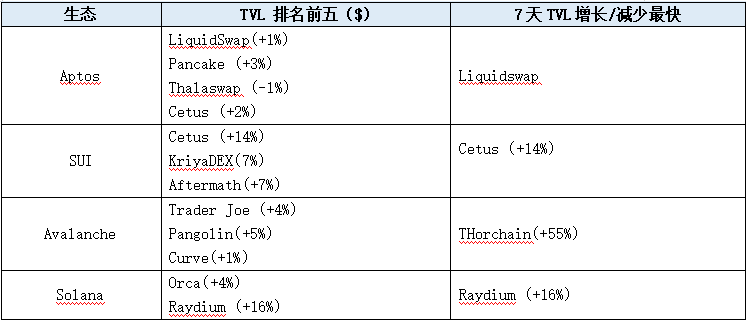

DEX:Dex combined TVL 11.95 billion,An increase of 500 mln from last week. Dex’s 24-hour trading volume was 2.65 billion, and its 7-day trading volume was 18.35 billion, a decrease of 0.7 billion from last week.

Derivatives DEX: Altcoins have entered an active period in the past week. Compared with other tracks, the performance of related projects in the POW track is average. Whether it is a veteran project or a recent rookie, the performance is relatively ordinary. The top seven-day performer is KAS , up 22%. The remaining items’ 7-day increase was within 5%. BCH is even in a downward trend.

loan

MakerDAO

The asset size of MakerDAO RWA dropped to US$2.975 billion, and the size of DSR dropped to US$1.626 billion, showing a turning trend. At present, market risk appetite has increased, and there is a high willingness to exchange stablecoins such as dai/usdt for btc/eth/alts. In order to prevent the market from withdrawing Dai on a large scale due to liquidity shortages and Dai de-anchoring, RWA’s scale business has shrunk, and the current estimated annual income is still to US$120 million.

Aave

Aaves native stablecoin GHO has been launched on the Ethereum main network since July 15. The current circulation has exceeded 30 million. The Aave community initiated a temperature check vote to increase the GHO borrowing interest rate. The proposal proposes to increase the GHO borrowing rate from 3% to 4.72%. The voting period ended on November 8, and the current voting approval rate is 99.99%. The purpose of this proposal is to further enhance GHO anchoring and increase revenue from the stablecoin sector. However, GHO currently remains below $1 for a long time and lacks practical application value.

In addition, the Aave community’s proposal to “Activate Aave V3 on Gnosis” has been implemented on the chain. According to the proposal, based on recommendations from service providers ACI, Gauntlet, and Chaos Labs, assets supported by the Aave V3 Gnosis pool include WETH, wstETH, GNO, USDC, wXDAI, EURe, and sDAI.

LSD

Last week, the ETH pledge rate rose to 23.55%, a month-on-month increase of 1.13%. Last week, 28.32 million ETH were locked in the beacon chain, corresponding to a pledge rate of 23.55%, a month-on-month increase of 1.13%; of which there were 875,600 active verification nodes, a month-on-month increase of 1.06%. This week, the ETH staking yield remained at 3.60%; ETH turned to deflation, with annualized inflation falling to -0.039%.

ETH staking increased by 1.13% month-on-month this week

ETH staking yield remained at 3.6% this week

ETH annualized inflation this week -0.039%

Among the three major LSD protocols, in terms of price performance, LDO rose by 10.1% in a week, RPL rose by 5.6%, and FXS rose by 6.4%; from the perspective of ETH pledge volume, Lido rose by 1.38% in a week, Rocket Pool rose by 1.34%, and Frax rose by 1.38%. 1.03%. Last week, the price of ETH increased by 4.5%, and LSD-related targets generally followed the rise of ETH; Lido deployed the DVT module proposal, and the potential forfeiture losses were provided by the Lido cover fund; it should be noted that Brevan Howard Digital continued to sell LDO, and last week it sold 500,000 LDOs were transferred to Binance and Coinbase exchanges, and there are still about 5 million LDOs left in the on-chain wallet; the current Rocket Pool deposit pool balance is 19,537 ETH, and the RPL pledge rate is 50.62%, which is a decrease from last week, and the effective pledge rate is 92%.

Ethereum L2

TVL

The total amount of Layer 2 TVL is US$12.51 billion, and the overall TVL has increased by 5.16% in the past 7 days.

Source: L 2b eat, LD Captial

Cancun Upgrade - 121 ACDC meetings:

1. Update Cancun/Deneb testnet schedule: Devnet 12 may be launched sometime in early December, and developers believe that a possible time is to start upgrading the public Ethereum testnet after the first quarter holiday of 2024.

2. Make significant changes to the Cancun/Deneb specification (blob sidecar contains proof) to reduce the complexity of Blob implementation

3. Another upgrade specification change that allows honest validators to reorganize late blocks

Optimism

Fraud proof development progress: OP Goerli and OP Sepolia’s Canyon network upgrade is scheduled to be carried out at 17:00 UTC on November 14 this year (1 o’clock on November 15, Beijing time)

Arbitrum

1. Arbitrum DAO Security Council election ended, 6 members were elected

2. Arbitrum’s L3 Rollup Orbit is ready for the mainnet and will be launched in the near future

Zksync

Wallet service provider Argent said in an open letter to users that after six months of alpha phase testing and careful consideration of user feedback, it has decided to stop supporting the zksync Era and focus on the Starknet network.

Starknet

1. The Starknet Foundation will distribute 50 million unissued STRK tokens to early ecosystem contributors. According to a blog post, the project, called the Early Community Membership Program, will reward individual contributors who encourage technical discussions, organize Starknet-related events and regularly publish Starknet-branded content.

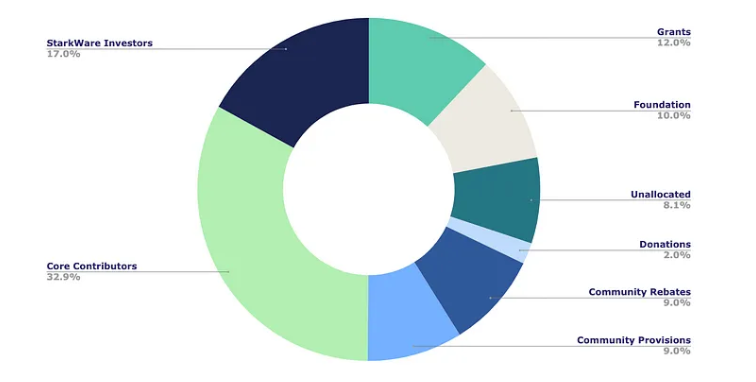

2. Ten billion Starknet tokens have been minted but have not yet been provided to token holders. The tokens are expected to be available on April 15, 2024. The majority of tokens are allocated to the Starknet Foundation, with 32.9% allocated to core contributors and 17% allocated to investors.

On-chain activity

DEX

Dex combined TVL 11.95 billion,An increase of 500 mln from last week. Dex’s 24-hour trading volume was 2.65 billion, and its 7-day trading volume was 18.35 billion, a decrease of 0.7 billion from last week.

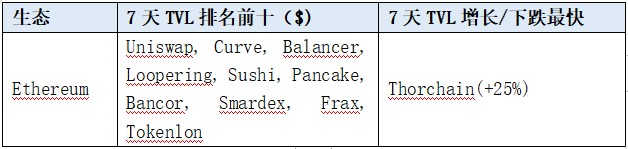

Ethereum

RUNE has the fastest TVL growth this week among the top protocols in the Ethereum ecosystem. Due to RUNEs own arbitrage mechanism, arbitrageurs have brought a large amount of transaction fees to BTC-RUNE and ETH-RUNE, and APY and TVL have increased. RUNE uses an incentive mechanism to ensure that there are 3 US dollars of RUNE for every 1 US dollar of non-RUNE assets on the network. is locked, so the growth leverage of TVL amplifies the demand for RUNE, increasing the buying pressure.

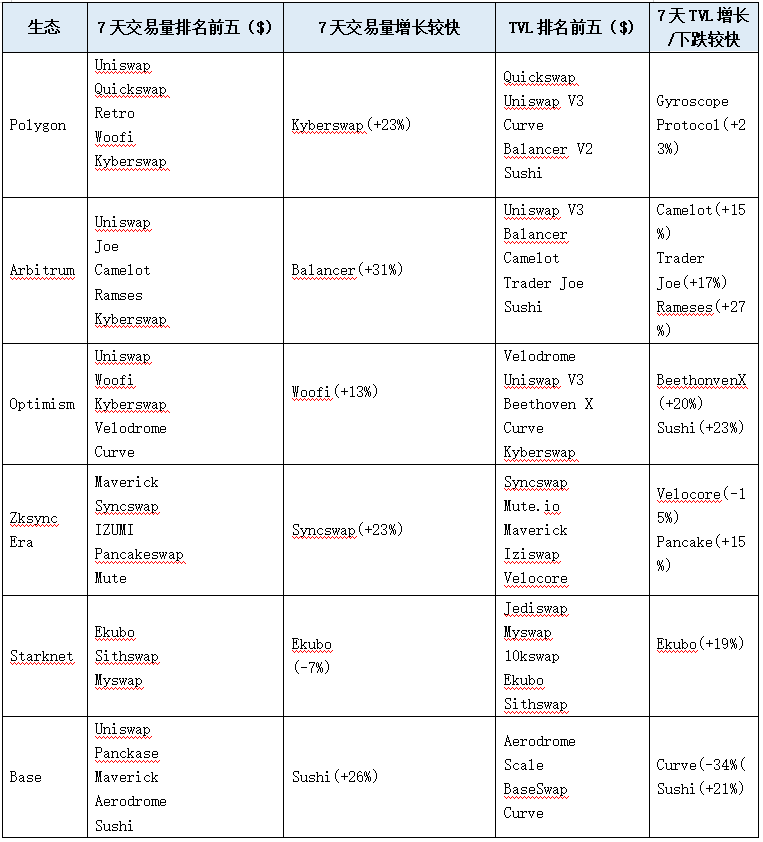

ETH L2/sidechain

BTC L2/Sidechain

Alt L1

Derivatives DEX

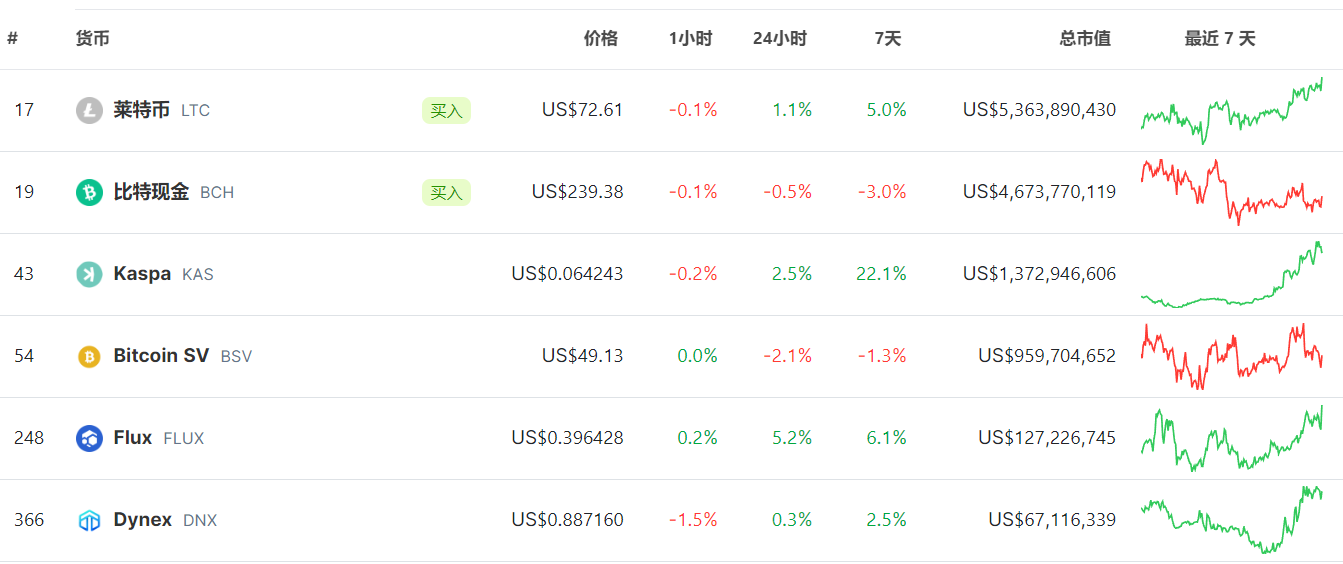

BTC has been trading between $33,000 – $35,500 over the past week. BTC’s share of the total market capitalization decreased, from 54% to 53%; the ETH/BTC exchange rate increased, from the lowest 0.051 to 0.052. As a result, altcoins have also entered an active period. Compared with other tracks, the performance of related projects on the POW track is average. Whether it is a veteran project or a recent rookie, the performance is relatively ordinary. The top seven-day performer is KAS , up 22%. The remaining items’ 7-day increase was within 5%. BCH is even in a downward trend.

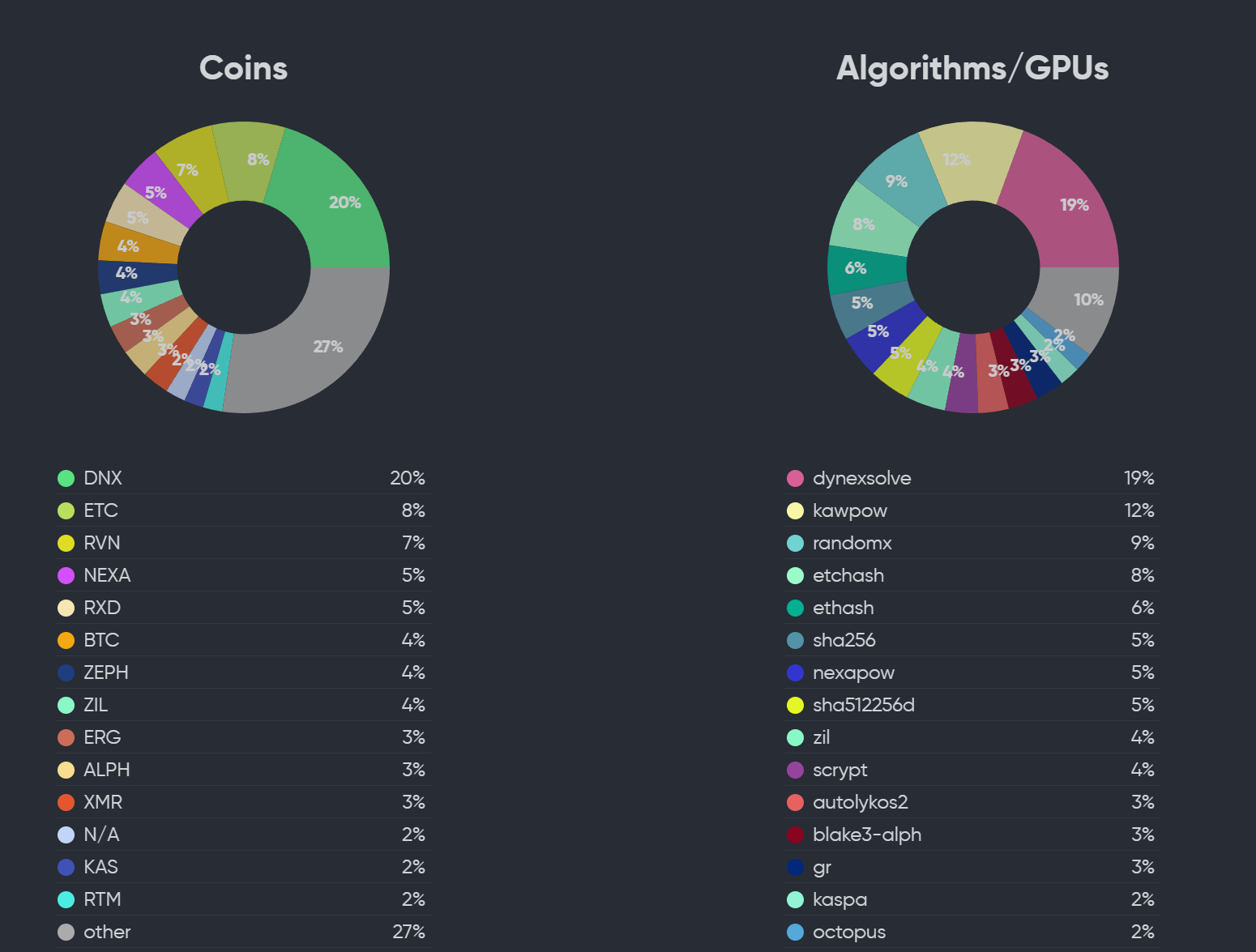

24-hour output and computing power

Judging from the 24-hour product rankings, the rankings are basically unchanged. KAS has been stable in the top three for a long time, and its output level is already higher than projects such as LTC/BCH, but its market value is far lower than these projects. DNX’s ranking dropped to 8th place from 7th place previously.

DNX’s share of computing power in GPUs is currently entering a period of adjustment, with its share falling from a peak of 24% to the current 20%. Comparing the computing power and market value of other projects, DNX should be relatively undervalued at this stage. With the inflow of market funds, there should be better realization.