Weekly Editors Picks (1104-1110)

Weekly Editors Picks is a functional column of Odaily. In addition to covering a large amount of real-time information every week, it also publishes a lot of high-quality in-depth analysis content, but they may be hidden in the information flow and hot news and pass you by.

Therefore, our editorial department will select some high-quality articles worth spending time to read and collect from the content published in the past 7 days every Saturday. From the perspectives of data analysis, industry judgment, opinion output, etc., we will provide those in the encryption world with You bring new inspiration.

Next, come and read with us:

Investment and Entrepreneurship

Glassnode: Data reveals the logic behind the rise of BTC and ETH

In 2023, BTC appreciated 93% compared to gold, while ETH gained 39%. BTC and ETH returns have been closely correlated throughout 2023. Both assets have experienced declines of similar magnitude, but Bitcoin has been stronger during its upswings.

Bitcoin’s dominance continues to rise. Investor support and positive capital inflows are happening.

For the first time since the peak of the last cycle, the altcoin industry’s market valuation has increased significantly. However, it is important to note that this performance is relative to fiat currency (i.e. the US dollar).

Conversation with Galaxy: The potential impact of Bitcoin spot ETFs on the market

It is estimated that spot Bitcoin ETFs could bring in $1.44 billion in inflows in the first year, based on analysis of the wealth management industry. With increased market access, inflows could increase to $2.65 billion in the second year. Wealth management advisors may not trade as frequently as individual investors, preferring long-term planning over short-term market reactions. Inflows into ETFs do not happen immediately but gradually. A year from the launch of the ETF, the price of Bitcoin is likely to increase by approximately 75%.

After the approval of gold ETFs, the gold market experienced a long and significant bull market over the next decade. The same amount invested in Bitcoin would have an impact on the price of Bitcoin that is 8 times greater than the price of gold.

The approval and launch of the Bitcoin ETF may cause a buy the rumor, sell the fact reaction in the market. Some investors may buy Bitcoin in advance in anticipation of the ETF approval and sell after the actual launch, thus Affects fund inflows into ETFs. Once the Bitcoin ETF is approved, approval of the Ethereum ETF may be accelerated. If there were an Ethereum ETF in the future and included staking functionality, this could provide investors with additional returns, increasing its appeal.

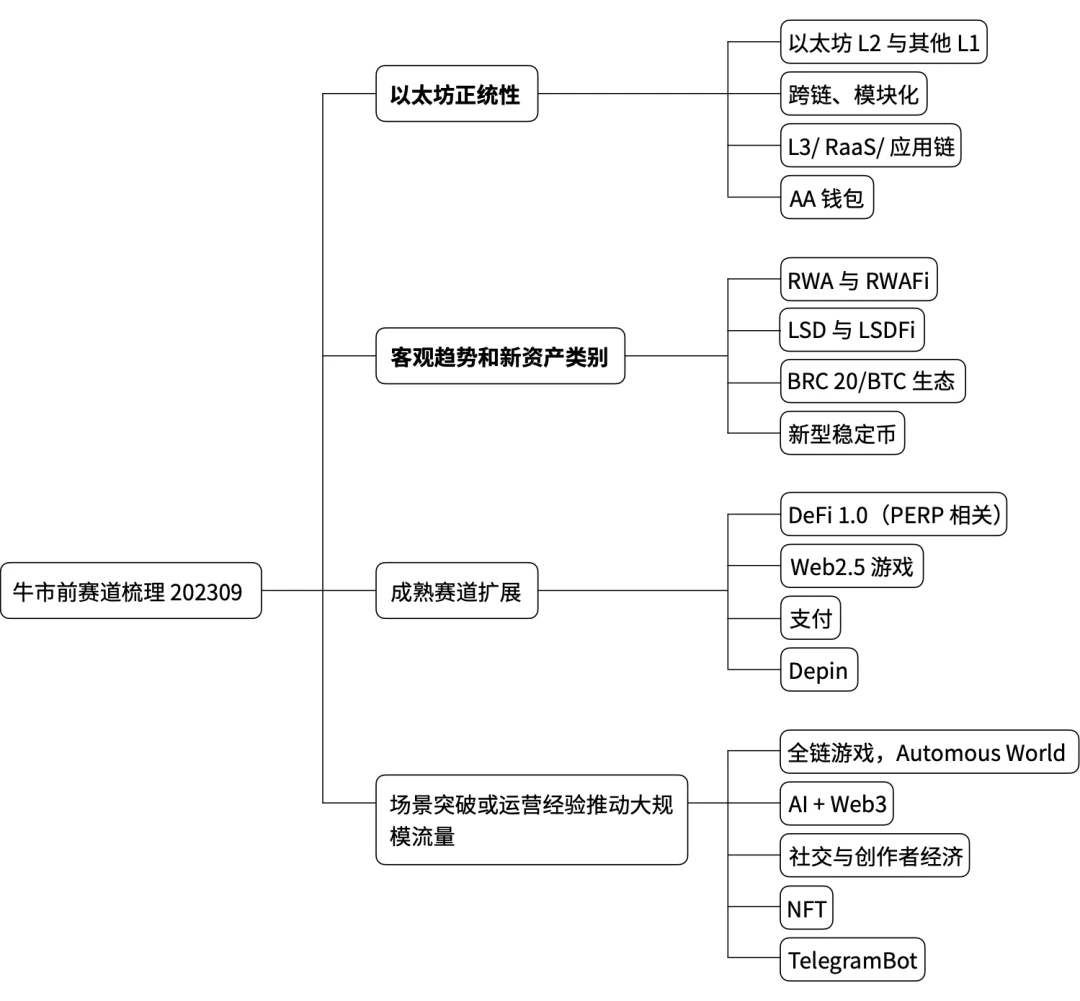

Zonff Partners: 2023 Q3 Web3 primary market review and track analysis

As of Q3 2023, the potential core tracks in the next bull market cycle have basically emerged in the market.

Based on past market experience and summary, we divide the existing main tracks into four categories based on factors such as the priority of occurrence, the reasons for the growth outbreak, the scale of the overall supply:

Foresight Ventures: WASM—Engine of the Big Era

There are some relationships and application scenarios between WASM and blockchain: smart contracts, cross-chain interaction, off-chain computing, and data privacy.

WASM brings not only high efficiency, interoperability and a wide range of application scenarios to the blockchain, but also the key to liberating developers and lowering the entry threshold for developers to enter the blockchain.

DeFi

PSE Trading: The Dilemma and Future of LSDFi

The growth bonus period of the LSDFi track has expired, the development of the track has stagnated, and the decline in yields has led to the flight of funds from the track; the homogeneity of projects is serious, involution but insufficient innovation; the yield rate of token subsidies is unsustainable, and the liquidity of stable coins is sluggish.

The project development ecology represented by Pendle and Lybra V2 makes up for the shortcomings of the economic model and establishes pricing power; CruiseFi (no liquidation) and Origin Ether (combination yield) use micro-innovation to improve differentiated user experience; with Eigenlayer as Basic LRTFi and others choose to continue to do nesting dolls; projects represented by Prisma have the support of capital power, bundle other mature projects, and enjoy other ecological dividends.

Mint Ventures: Is the rapidly growing Morpho a potential rival of Aave?

In the decentralized lending market, organic demand has become the mainstream of the market, and the Ponzi color has faded - leading projects represented by Aave are gradually getting rid of their reliance on high subsidies to maintain operating income and returning to a healthy business model; moat (Brand power in security = long history of security operations + more abundant security budget) Obviously, the market concentration is high.

Morphos current online business is a peer-to-peer lending protocol (or interest rate optimizer) built on Aave and Compound. Its function is to improve the funds that are not completely matched in peer-to-peer pool lending protocols such as Aave. Inefficiency problem.

Ingenious design and clear value proposition allowed Morpho to obtain nearly US$1 billion in deposits just over a year after its launch, ranking second only to Aave and Compound from the data.

Although Morpho tokens have been issued and used in voting decisions and project incentives, they are in a non-transferable state. Therefore, it does not have a secondary market price. Users and investors who receive tokens can participate in voting governance, but cannot sell them. Unlike projects such as Curve, which hard-code the future output and incentives of tokens, Morphos token incentives are determined in batches, quarterly or monthly, which allows the governance team to flexibly adjust the intensity and incentives of incentives according to market changes. specific strategies. Morphos PMF is relatively sufficient, and users needs are becoming more and more organic. The community token share is 51%, and currently there is nearly 48% left, which leaves ample budget space for business incentives in new sections in the future.

However, Morpho does not currently charge for the service. Morpho Blue adopts a product idea similar to Uni V4, that is, it only makes the basic layer of a large type of financial services, and opens up the modules above the basic layer to allow different people to come in and provide services.

NFT, GameFi and the Metaverse

The coming of the Ox? What changes have occurred in the competitive landscape of NFT exchanges?

Opensea was demolished and rebuilt, Blur is more calm, and the transaction mining of LooksRare and Zonic has a similar idea. Under the background of one-click chaining, it caters to the development of emerging L2 with the shortest online time and competes for hair-raising users.

Bitcoin Ecology

A review of BTC derivatives protocols: legitimacy and potential

The Segregated Witness upgrade in 2017 and the Taproot upgrade at the end of 2021 have made BTC make huge progress in programmability and scalability, and some protocols containing complex logic have begun to emerge.

The implementation of Ordinals uses the most basic functions of BTC, and NFT transfers are completely processed by the BTC network, so it is very consistent with the philosophy of the BTC fundamental community.

The output script of BRC 20 only stores data and cannot actually run Token functions such as transfer and minting. Therefore, we must use a third-party sequencer to record the ledger under the BTC chain and engrave new status data into the script.

Atomics Protocol is another derivative protocol that engraves data on UTXO to implement tokens. It rethinks how to issue tokens on BTC in a centralized, non-tamperable and fair manner from the bottom up. ARC 20 and $ATOM are still in their early stages and still need to wait for wallets and markets to improve, but they already have a high level of legitimacy. At the level of possibility, there is also an opportunity to achieve true BTC native DeFi.

Rune writes the number of Tokens in the script data, which gives it higher accuracy than ARC 20. But at the same time, the complexity has become higher, making it difficult to directly utilize the composability of BTC UTXO like ARC 20.

However, the use cases of the Lightning Network are very limited. It can only be used for BTC payments, cannot issue Tokens, and has no smart contract function, making it almost insulated from speculation.

RGB converts the state of a smart contract into a short proof and engraves the proof into the BTC UTXO output script. Users can check the status of the smart contract by verifying this UTXO. RGB is similar to BTCs L2. The advantage of this design is that it uses the security of BTC to guarantee smart contracts. However, as the number of smart contracts increases, the demand for UTXO encapsulated data will also increase, and eventually it will inevitably give BTC Blockchain creates a lot of redundancy.

RSK does not write anything in the BTC network at all, so its operation and security do not depend on the BTC network. RSK just links the main network BTC to its own chain through hash locks for network gas. RSK has little to do with BTC.

Stacks can be regarded as the smart contract side chain of BTC.

BitVM is currently the most BTC-native, most potential, and most technically hard-core smart contract expansion solution.

Although it seems that these protocols are primitive, old, troublesome and difficult to use, this is still a historic development opportunity. BTCs technology has accumulated enough to go further, and the community is gradually opening up and beginning to accept derivative innovations.

The foundation of BTC’s complex ecosystem, is the RGB protocol undervalued?

An important reason for ETHs take-off is the introduction of smart contracts, and subsequently a large and diverse ecosystem has been gradually built. Various assets, financial models, etc. are introduced through contracts, and can even be linked to the real world (currently RWA).

The RGB protocol takes advantage of the security of Bitcoin mainnet UTXO to endorse the security of its off-chain asset issuance or contract logic. Its advantages include security, confidentiality, and scalability. The author recommends paying attention to and experiencing the RGB ecological project, and you can also follow Taproot (Taro).

What do you think of Taproot Assets and Ordinals’ multi-asset narrative?

Ordinals are assets that are easy to distribute but difficult to grab. Taproot Assets are assets that don’t need to be grabbed but are difficult to distribute. For short-term speculation, it may be better to go to BRC 20. For long-term value discovery, don’t miss Taproot Assets.

Does Bitcoin need sidechains? An article exploring Bitcoin’s DeFi future

BIP-300 allows trustless transfers of BTC between the mainnet and these Drivechains with a two-way peg (2 WP).

Implementing a two-way peg between the Bitcoin mainnet and sidechains could completely undermine the economics and assumptions of Bitcoin; because each sidechain has its own version of BTC, Drivechain could lead to a surge in Bitcoin-based scams, directly driving Regulatory Crackdown; Technically, BIP-300 would also require a soft fork on the Bitcoin blockchain, which would add another layer of complexity and potential points of failure.

The Bitcoin community needs a system that complements Bitcoin rather than competing with it by trying to create new alternatives. One of the solutions is to build a blockchain to perform joint mining with the Bitcoin network. Federated mining enables miners to work on multiple blockchains simultaneously without incurring additional energy costs.

We also recommend a practical guide: The Bitcoin ecosystem is booming, how to solve the problem of on-chain transaction congestion?》

Hot Topics of the Week

Over the past week, analysts:If the SEC intends to approve 12 spot Bitcoin ETFs this year, the window will end on November 17,Gary Gensler:Restarting FTX “within the law” is possible,The SEC has begun conversations with Grayscale Investments regarding a spot Bitcoin ETF conversion, analyst:If Bitcoin ETF is approved, ETF launch will still have to wait a month,Nasdaq files application for BlackRock spot Ethereum ETF with SEC,The market fluctuated violently on November 9,FTX seeks court approval to sell $744 million of Grayscale and Bitwise trust assets,Three companies bid to restart FTX,FTX and Alameda continue to move assets to exchanges,The Ordinals track recovers, and the popularity of the Bitcoin ecosystem increases,Poloniex had hundreds of millions of dollars stolen;

In addition, in terms of policy and macro market, the U.S. SEC:There is limited case law regarding the application of securities laws to crypto-assets, and coordination is ongoing to oversee this area.,U.S. House of Representatives proposes ban on the use of Chinese blockchain in the United States, Liang Fengyi:Hong Kong will consider allowing retail investors to invest in spot cryptocurrency ETFs if regulatory issues are resolved;

In terms of opinions and voices, Charlie Munger:Digital currency is a destabilizing and unproductive financial invention,Arthur Hayes:ETFs could “kill” Bitcoin,Michael Saylor:Bitcoin provides businesses with innovative strategies to protect capital and create shareholder value, jointly created by DWF Labs:A bull market is coming and the current situation is very healthy and sustainable, JP Morgan analyst:Cryptocurrency rally appears overdone, caution on outlook, former advisor to Ethereum:Vitalik and Joseph Lubins alleged fraud is far more serious than SBFs problems, NEAR Foundation:Wintermute wants to arbitrage the USN it purchased from Alameda, so it denies its redemption request;

In terms of institutions, large companies and leading projects, people familiar with the matter:Circle is considering an IPO in early 2024,Standard Chartered’s investment arm partners with SBI Holdings to invest $100 million in crypto startups,Kraken layout L2,Binance’s built-in Web3 wallet starts grayscale testing,Binance Messenger launches ios store,Binance Lists Ordinals (ORDI),The founder of Ordinals emphasized that ORDI has nothing to do with Ordinals and asked Binance to remove related links to the token interface,Binance has cleared the ORDI “Currency Information” interface content, including the link to the Ordinals protocol,Aave community initiates on-chain voting on proposal to “disable stable lending rates”,Aave’s undisclosed vulnerabilities may be reproduced in these 30+ projects,Arbitrum will launch three grant programs, providing a total of 500,000 ARB rewards,LayerZero airdrop showing signs,Evmos plans to stop supporting Cosmos transactions and focus on EVM-based transactions;

NFT and GameFi fields,Coatue slashes the value of its OpenSea stake by 90%, suggesting OpenSea valuation has dropped to $1.4 billion,OpenSea cuts 50% of its workforce and will reposition the team around OpenSea 2.0,Gucci arrives at The Sandbox,Introducing the Gucci Cosmos Land experience...Well, it’s been another week of ups and downs.

Attached is the Weekly Editors Picks seriesportal。

See you next time~