Original source:Filecoin Network

The main points

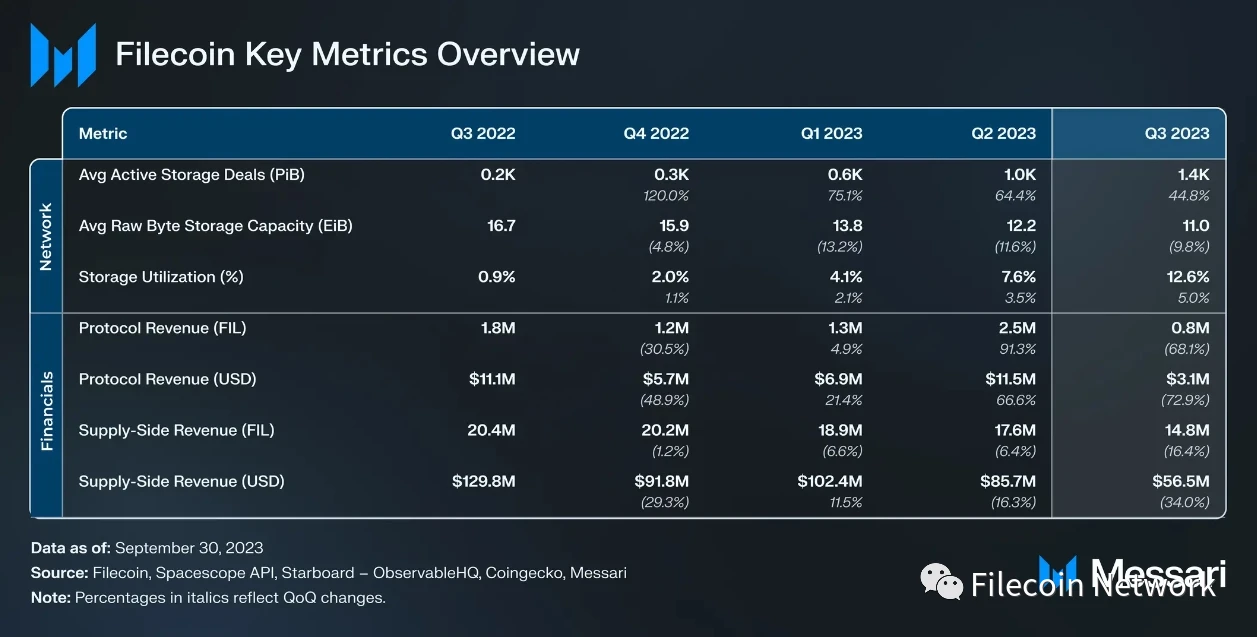

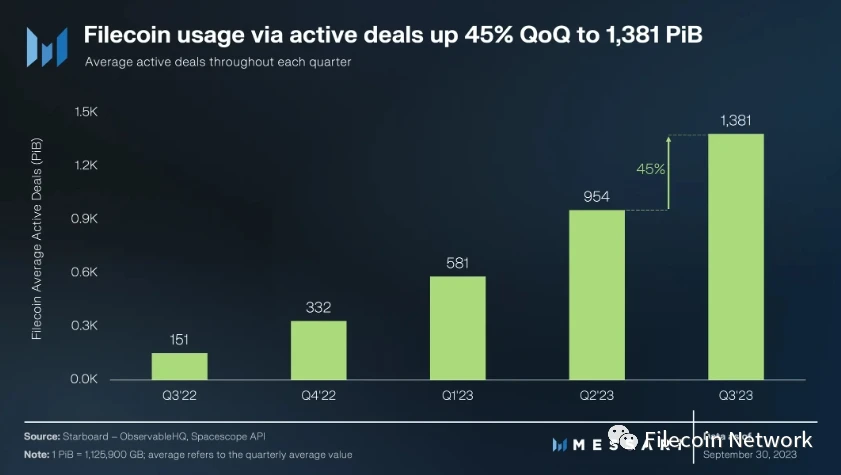

The Filecoin storage market continues to grow in the third quarter of 2023,Active transactions increased 45% month-on-month, a year-on-year increase of nearly10 times. At the same time, storage utilization increased from nearly 8% in the second quarter of 2023 toNearly 13% in Q3 2023。

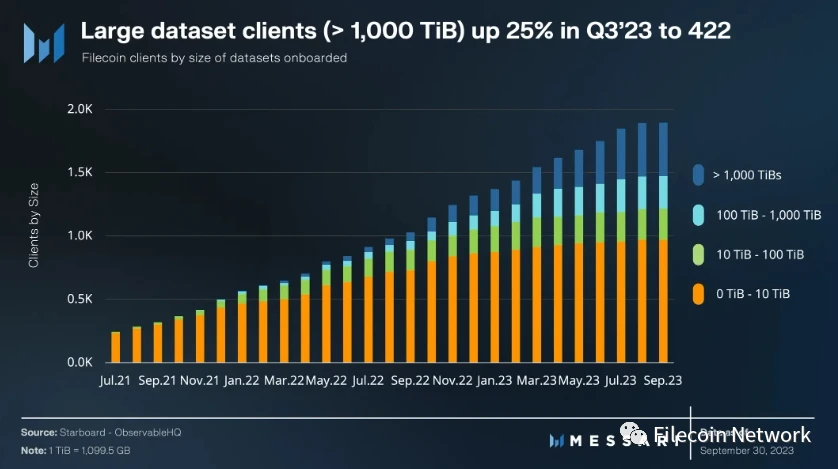

By the end of the third quarter of 2023, nearly 1,900 users had stored data sets on Filecoin, of which422Users introduced large datasets (over 1,000 TiB), growing quarter over quarter25% 。

Storage fee agreement revenue calculated in FIL in the third quarter of 2023decline68%(a 73% decrease in U.S. dollar terms), which is consistent with the overall decline in demand-side revenue for distributed cloud storage space.

The Filecoin Virtual Machine (FVM) release introduces Ethereum-style smart contracts to Filecoin, which will promote new use cases in areas including liquidity staking, permanent storage, and distributed computing. In the third quarter of 2023, both net deposits and net borrowings continued to grow.

Deploying Uniswap contracts on FVM may usher in a new stage of DeFi applications based on the Filecoin network.

Filecoin basic information

There is a serious problem with relying on centralized data storage: it is difficult to systematically verify the integrity of stored data. Today, the Filecoin storage network is Amazon S3Peer-to-peer version, which is built on the InterPlanetary File System (IPFS) above. IPFS is the distributed data storage and sharing layer of the Filecoin network. Filecoin regularly verifies the validity of data storage and dynamically updates data based on supply and demand.Store transactionImplement pricing rather than a fixed pricing strategy.

A storage deal comes with a service level agreement (SLA) contracts - users pay a storage provider to store data for a specified period. To ensure data security, Filecoin uses a cryptoeconomics incentive model.Zero knowledge proofRegular verificationstorage. In order to motivate storage providers to participate in storage transactions, Filecoin will use the networks native token FIL as a reward. There are also penalties if the storage provider fails to provide reliable online times or behaves maliciously against the network (slashed)。

To retrieve data, Filecoin users pay a retrieval provider to obtain the data. Unlike on-chain transactions where transaction proposals are stored, retrieving transaction proposals incurs off-chain settlement fees, making retrieval faster.

The Filecoin Virtual Machine, released in March 2023, will introduce Ethereum-style smart contracts to Filecoin and will facilitate new use cases in areas including liquidity staking, permanent storage, and distributed computing.

Key indicators

performance analysis

The Filecoin blockchain is used to store data distributedly in the following ways:

The demand side is the storage user who needs data storage.

The supply side, that is, the storage provider with excess network capacity.

use

Data stored in active storage exchanges between storage users and storage providers measures Filecoin storage demand from Web2 and Web3 users.

Store transaction

In the third quarter of 2023, Filecoin continued to adopt distributed storage through active transaction growth. With active trading during the quarter, nearly1400 PiBStorage in the Filecoin network represents a 45% quarter-on-quarter increase from 945 PiB in the second quarter of 2023, and a nearly 10-fold year-over-year increase from the 151 PiB in the third quarter of 2022.

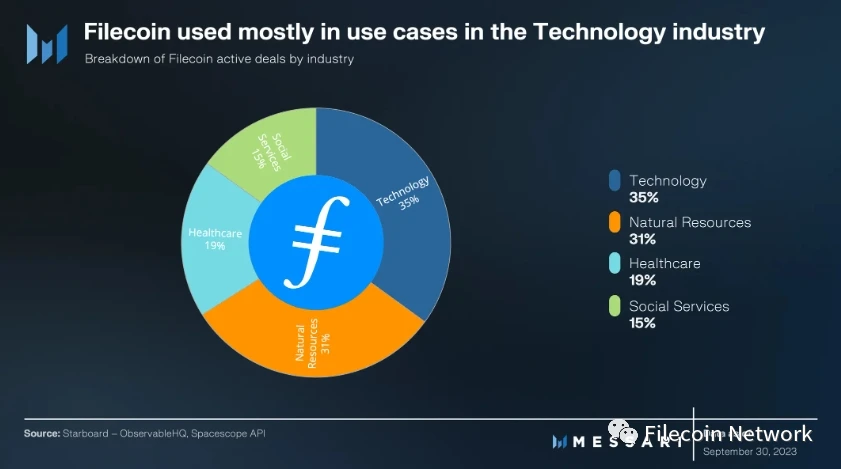

Active storage transactions based on industry use casesSegmentationdisplay, useFilecoin PlusThe most common industries areTechnology (41%) and natural resources (31%). To encourage further usage, Filecoin offers a comprehensive suite of services, includingSingularity.Storage、NFT.StorageandWeb3.Storage。

Meanwhile, daily new transactions increased 6% sequentially, a slowdown from the 47% acceleration in the second quarter of 2023. On the one hand, the slowdown in the growth of new transactions corresponds to a reduction in the overall return of storage providers (which will be elaborated on in the Supply-side Revenue section later); on the other hand, the increase in new transactions corresponds to an increase in Filecoin network utilization.

Storage Utilization and Capacity

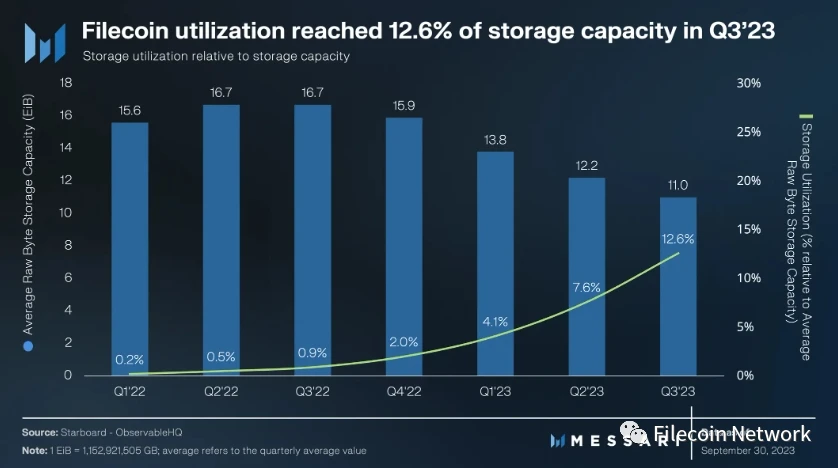

Filecoin storage utilization relative to total available storage capacity increased from 7.6% in the second quarter of 2023 to 12.6% in the third quarter of 2023. While this growth is a positive sign for Filecoin’s adoption through active storage transactions, it must be placed within the context of network capacity.

In the third quarter of 2023, Filecoin’s average raw byte storage capacity fell by 12% quarter-on-quarter to approximately 11 EiB. The metric has been gradually declining since about a year ago, after average raw byte storage capacity reached an all-time high of nearly 17 EiB in the third quarter of 2022.

The decline in storage capacity is further reflected in the decline in the total number of storage providers. After reaching an all-time high of more than 4,100 companies in the third quarter of 2022, the indicator continued to decline to more than 3,400 companies at the end of the third quarter of 2023. To accommodate the decline in average storage capacity and simplify the process for storage providers to join the platform, FilecoinPartner with servers.comData centers available on demand. The partnership aims to reduce time to market for new storage providers from 6-12 months to 6-8 weeks, a reduction of up to 75%.

Store user

Messari on distributed storage networksguideIt shows that Filecoin is currently suitable for providing cold storage solutions (such as archiving and recovery) to enterprises and developers. Its competitive pricing and ease of access make it an attractive option for Web2 users looking for a cost-effective alternative to bulk archive data storage.

As of the end of the third quarter of 2023, there were1, 891 usersIntroducing datasets to Filecoin, with 422 users introducing large datasets (datasets over 1,000 TiB), a 25% increase from 338 in Q2 2023. Meanwhile, the percentage of users with total uploads exceeding 100 TiB increased 17% month-on-month, from 570 in June to 666 in September.

according toFilecoin User ExplorerStatistics, the main users range fromNew York CityandUSC Shoah FoundationarriveOpenSeaorLayer-1 Network SolanaWaiting for Web3 platform. Other noteworthy organizations using the Filecoin network include:

Victor Chang Heart InstituteMaintain and share research data

Democracy’s LibraryStores data sets collected by the Internet Archive at the end of its administration

SETI InstituteUsing Filecoin to store astronomical research data

UC Berkeley partners with Seal StorageConduct storage physics research.

GenRAIT uses EstuaryStoring critical genomic data on Filecoin.

Research Center Starling LabStoring sensitive digital records of human history.

Ewesion (China’s fastest growing graphics file host)Use Filecoin for data storage.

An overview of featured users of the Filecoin network can be found athereObtain.

Search

To meet storage and retrieval needs, Filecoin and IPFS’ Content Delivery Network (CDN), also known asSaturn Project. The Saturn project aims to serve the Filecoin retrieval market with fast and low-cost content delivery, and its node operators fulfill retrieval requests by earning FIL from a pool of approximately 30,000 FIL per month.

In terms of performance, the Saturn project aims to be on par with or even surpass IPFS Gateway. Its focus is on improving retrieval speed and performance, and most of the data is mirrored from IPFS.hereGet an in-depth look at Saturns distributed CDN, its traction so far, and its roadmap.

At the end of the third quarter of 2023,The number of global nodes exceeds 1800,geographical distributionas follows:

Europe: 766 nodes (42%).

North America: 531 nodes (29%).

Asia: 409 nodes (22%).

The remainder: 120 nodes (7%) are located in South America, Africa and Oceania.

A performance overview of the Saturn node can be found atSaturn instrument panelobtained from.

FVM usage

The Filecoin Virtual Machine (FVM) was launched at the end of the first quarter of 2023, bringing Ethereum-style smart contracts to Filecoin. Leasing and staking applications give storage providers better access to FIL, allowing for more efficient data loading. As of September 30, 2023, FVM has deployed2000+ contracts, and byUsed by over 560,000 unique users, a total ofOver 1.6 million transactions。

according toFVM Explorer Statistics, since the launch of FVM, as of September 30, more than 2,900 stakers have totaled DeFi net deposits of nearly 9 million FIL (approximately $30 million). Meanwhile, net borrowings reached FIL 6.8 million (nearly $23 million). In the third quarter of 2023, both net deposits and borrowings continued to grow. On a monthly basis, monthly net deposits and borrowings both hit record highs in September at 3.6 million FIL (over $12 million) and 2.4 million FIL (over $8 million) respectively.

FVM DeFi RankingThe distribution of net deposits is shown as follows:

GLIF5.9 million FIL (approximately 57%).

STFILThere are 2.4 million FILs (approximately 23%).

HashKingThere are 1.9 million FILs (about 13%).

Deployment on FVM following an increase in FIL staking volume since its launchUniswap Contractproposal was successful. The deployment of Uniswap contracts on the main network is expected to usher in a new stage of DeFi applications based on the Filecoin network. As Filecoin continues to acquire new users and valuable data sets, it may become the basis for developing monetizable FVM data use cases.

income

Filecoin’s revenue framework is similar to Ethereum in that its transaction fees are designed similar toEIP-1559 mechanism. This gas system consists of network fees that are burned to compensate for the resources used. Both storage users and storage providers generate protocol revenue.

Agreement income

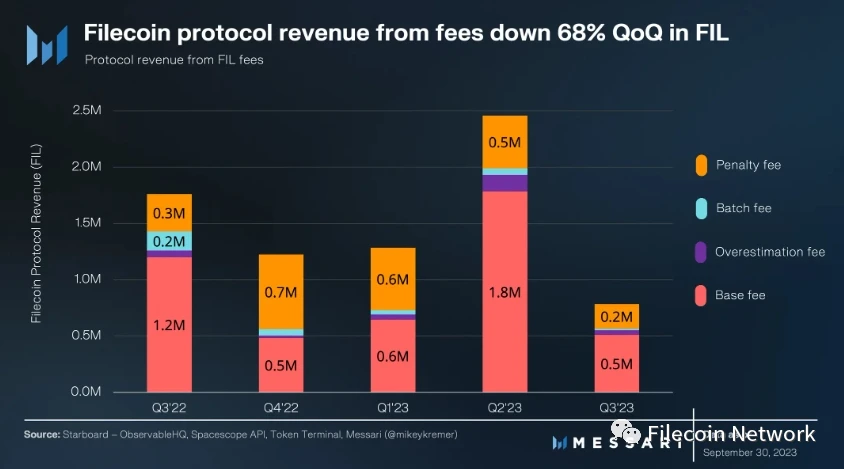

according toMessari Revenue Analysis, Filecoin protocol revenue includes the sum of the following four items:

Base fees - required for any proof of storage, depending on message congestion.

Batch fees - used when packaging and storing proofs in batches.

Overestimation fees - used to optimize gas usage.

Penalty fees - Penalty fees when a storage provider fails.

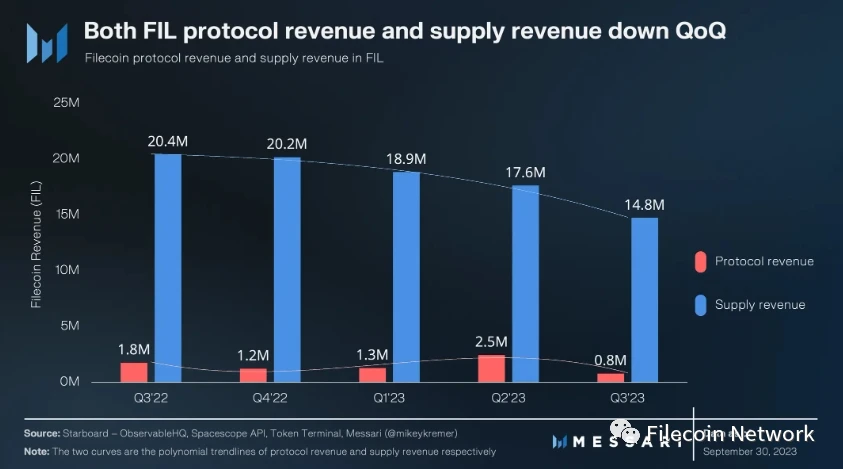

While demand for FIlecoin storage rises, protocol revenue from FIL fees fell 69% in the third quarter of 2023 to 800,000 FIL (down 73% in U.S. dollars to $3.1 million). Protocol revenue decline and distributed cloud storage spaceOverall demand-side revenue declineThe amplitude is consistent.

The main reason for the decline in Filecoin protocol revenue is demand-side basic fees, which fell 72% month-on-month in FIL terms. Filecoin is actively reducing the cost of data import into the network, for example, through the Distributed Storage Alliance (DSA) initiative plans to reduce the cost of distributed storage40% lower. Along with the decline in base fees, all other FIL fees generated from protocol revenue (penalties, volume fees, and overage fees) decreased sequentially. The only part of the FIL fee that is not consumed by the protocol is the “tip” fee charged by the block storage provider, a mechanism used to speed up transactions on the supply side of the network. Therefore, tip fees can be considered supply-side revenue.

supply side revenue

Filecoin supply-side revenue includes:

Block rewards distributed by the network to storage providers.

Payments are made via contract-anchored storage deals.

A tips fee used to speed up transactions.

In the second quarter of 2023, block rewards constituted more than 99.9% of supply-side revenue, while “tips” accounted for only a small part.New FIL token minting mechanismDepends on the following two items:

Exponential decay mode (30% total): To encourage participation, block rewards are highest in the early stages. Decays exponentially over time.

Baseline mode (70% total): Block rewards are distributed as storage capacity increases.

The combination of these two models helps maintain participation beyond the early block reward distribution phase of the network (see Exponential Decay Model), and also helps to continue to reward the additional value brought to the network by increasing the networks storage capacity. (See Baseline Mode).

FIL supply-side revenue fell 16% to 14.8 million FIL in the second quarter of 2013 (a 34% decline in U.S. dollar terms). Such a decrease is related to the reduction in the overall FIL reward issuance brought about by the exponential decay mode and the baseline casting mode. The reduction in FIL award issuance is likely to continue in the coming quarters. For an in-depth discussion and various simulations of future FIL issuance, please refer to Messari’s recent analysis of FIL’s circulating supplyResearch。

Ecological Overview

Filecoin EcologyAlways actively engaging developers and builders, it regularly participates in events such as hackathons, accelerators, sponsorship programs, mentorship programs, and growth support. These programs are designed to help early-stage projects and teams grow and hopefully receive financial support from Protocol Labs or its affiliated entities. The ecosystem is dedicated to introducing diverse use cases ranging from data infrastructure, streaming media, metaverse to games.

Example

As of September 2023, there are 115 known projects developing in the Filecoin ecosystem, with most projects using Filecoin’s applications and protocols to provide data services:

Banyan: Storage function similar to web2.

Ocean Protocol: Data marketplace developer tools and platform.

Numbers Protocol: Maintain data authenticity.

Berty: Secure messaging and social media application.

Dether: Cash deposit and withdrawal and diversified financial transaction mechanisms.

Tableland: Distributed cloud database.

Media and entertainment-focused contracts include:

Mona: A 3D art gallery in the Metaverse.

NFTwitch: NFT minting platform for Twich content.

Huddle 01 : Distributed video conferencing.

OPGames: Game-related NFT minting.

FileMarket:Web3 store builder and marketplace.

Xone: A metaverse solution that connects artists and fans.

The following use cases are designed to leverage Filecoin infrastructure to drive domain-specific data needs:

Koios: Codeless data DAO platform.

Cryptosat: Use mini satellites to prevent side-channel attacks and enable secure verification.

Bela Supernova: Store patient health data.

Slate: Search engines that process and share personal data.

ZKsig NFT: Market access control.

DataMarket: Data purchase and settlement functions.

Startups actively building FVM include:

STFIL: Filecoin liquidity staking and leverage farming protocol.

Lighthouse: Permanent data storage service with one-time payment pricing model.

GLIF: Builder of applications and tools for the Filecoin network.

MineFi: Storage provider revenue platform.

ZKAmoeba: Use zk-tech to extend Filecoin’s Layer-2 protocol.

An overview of projects built in the Filecoin ecosystem can be found athereObtain.

Accelerators and Hackathons

LonghashX, the Web3 accelerator arm of Longhash Ventures, and Protocol Labscooperaterelease"FVM Genesis Cohort", to provide support for developers focusing on FVM distributed applications.

Distributed Storage Provider Accelerator (DSPA) is a 6-month Asian project that provides training and support to storage providers looking to scale distributed data services on the Filecoin network.

Enterprise Storage Provider Accelerator (ESPA) provides a 7-month training opportunity, including technical and business courses, for individuals interested in entering the world of distributed storage providers.

HackFSis a hackathon project for building Web3 infrastructure and applications in the Ethereum ecosystem.StartupsOffering $150,000bonus。

Open Data Hackis a 3-week online hackathon featuring technical workshops and rewards for building projects within the Filecoin community.

Qualitative analysis

release version

V21 network upgrade

Filecoin Core DeveloperproposalThe schedule and scope of the upcoming V2 1 network upgrade Watermelon has been announced. The mainnet upgrade is tentatively scheduled for November 7, 2023. The upgrade scope includes the following Filecoin improvement proposals (FIP):

FIP 0052 : Increases maximum sector commitment to 3.5 years.

FIP 0057 Update: Add batch balancer parameter recalibration.

FIP 0059 : Synthetic Proof of Replication (PoRep).

FIP 0063 : Switch to the new drand mainnet network.

FIP 0065 : Ignore built-in market locked balances in circulating supply calculations.

FIP 0070 : Allows the storage provider to move partitions between deadlines.

Venus V1.13 Series

Venus v1.13.0 Published on August 30, 2023. This release updates the minimum required Go version to 1.19, updates the issue template enhancement.yml, and adds query parameters for messages and transactions. For a complete list of changes, seeRelease Notes。

Filscan UI and metric adjustments

FilscanSeveral updates and enhancements will be rolled out, including:

Comprehensively upgrade the user interface to provide users with a better product experience.

Adjusted data indicators, including adding new storage provider (SP) and Filecoin Virtual Machine (FEVM) data.

key events

Works with Brave and ECC

Brave, Electric Coin Co. (ECC) and Filecoin FoundationJoin forcesEnhanced privacy features in the Brave browser, plans to integrate the Zcash protocol into Brave’s crypto wallet, allowing users to securely manage ZEC and other cryptocurrencies. In addition, they are developing a privacy-focused feature using the Zcash protocol for private messaging and media transfer, as well as providing secure storage for encrypted content via the InterPlanetary File System (IPFS).

Consensys Scale Project

Protocol Labs and ConsensysLaunched in partnershipThe Consensys Scale project was launched to help blockchain companies transition from the seed stage to the Series A financing stage. This program is suitable for higher-level projects with a well-established team, institutional funding, and a certain degree of product-market fit.

Filecoin storage provision and staking services

Encrypted storage provider manufacturerBitmainareMarch intoIn the field of Filecoin storage provision, a new model with a unit price of nearly US$40,000 has been launched. Users can choose to host these machines on Bitmain’s Antpool platform to earn Filecoin rewards. In addition, Bitmain also launched a delegated staking service for Filecoin, charging a monthly fee of 0.5%, allowing users to delegate their tokens to third parties such as Antpool. In this context, storage providers on Filecoin can receive storage provision rewards based on their storage capacity, while token holders can stake FIL tokens to obtain consensus and governance rewards.

Summarize

Filecoin storage usage accelerated in the third quarter of 2023. Active storage transactions increased by 45%, a nearly 10-fold year-on-year increase, and the number of users introducing large data sets also increased by 25% month-on-month. Although storage capacity fell by 10% quarter-on-quarter, storage utilization increased from 7.6% in the second quarter of 2023 to 12.6% in the third quarter of 2023. Storage fee revenue in the third quarter of 2023 fell 68% on a FIL basis (73% on a dollar basis), consistent with the overall decline in demand-side revenue across the distributed cloud storage space.

The Filecoin Virtual Machine (FVM) brings Ethereum-style smart contracts and will support new use cases such as liquidity staking, permanent storage and distributed computing. Both net deposits and borrowings achieved continued growth in the third quarter. Deploying on-chain voting for Uniswap contracts on FVM could usher in a new phase of DeFi applications built on the Filecoin network.

As Filecoin continues to acquire new users and valuable data sets, it may become the basis for developing monetizable FVM use cases around the data. Prominent examples include persistent storage (similar to Arweave), mortgage lending to storage providers, and distributed computing. If Filecoin can continue to meet demand, it has the opportunity to become a major provider of distributed storage and cloud services for Web3 and traditional applications.

If youd like us to know what you like about this report, whats missing, and other thoughts, please fill out this briefsheet, all feedback content is subject to ourPrivacy PolicyandTerms of Serviceconstraint.

This report was commissioned by the Filecoin Foundation. All content is produced independently by the authors and does not necessarily represent the opinions of Messari, Inc. or the agency that commissioned the report. The client has no influence on editorial decisions or content. The authors may hold cryptoassets mentioned in this report. This report is for reference purposes only and is not investment advice. You should conduct your own research and consult independent financial, tax or legal advisors before making any investment decisions. The past performance of any asset is not indicative of its future performance. Please review our terms of useTerms of Serviceto know more information.

No part of this report may be copied, photocopied, reproduced or distributed in any way without the written consent of Messari®.