Lessons from $34 million in blood and tears: RWA is not that easy to do

Original - Odaily

Author - Azuma

RWA (Real World Assets) is undoubtedly one of the hottest concepts in the Crypto industry at the moment.

As a pioneer representative, Maker reaped the dividends of the high-interest cycle by opening up the income window for U.S. bonds, thereby amplifying the market demand for DAI, and ultimately pushed up its own market value in reverse when the market fell. Since then, projects such as Canto and Frax Finance have also achieved certain success through similar strategies. The former has doubled its currency price within the month, and the latters sFRAX, which has just been launched with the V3 version, is also growing at an alarming rate.

So, is the RWA concept really so simple and easy to use that it can always improve project fundamentals stably and quickly? Two recent lessons from the market tell us that the situation may not be that simple.

Goldfinch bad debt incident

One was Goldfinch’s bad debt affair.

Goldfinch is positioned as a decentralized lending protocol. Since 2021, Goldfinch has completed three rounds of financing totaling US$37 million (US$1 million, US$11 million, US$25 million), the latter two rounds of which were led by a16z.

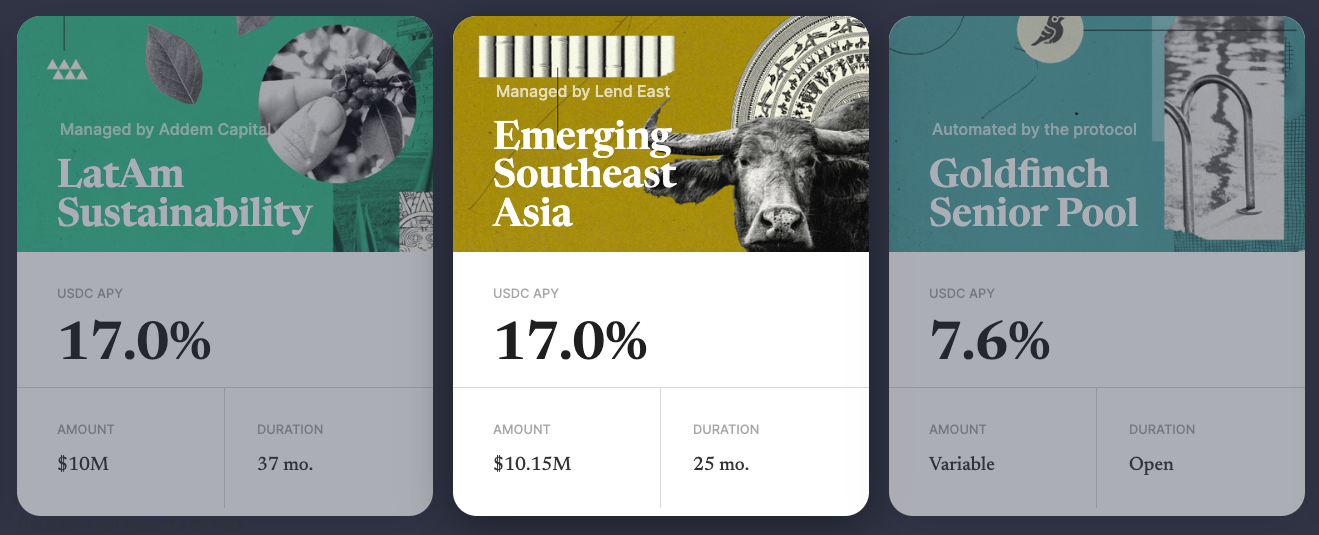

Unlike traditional lending protocols such as Aave and Compound, Goldfinch mainly serves real-world commercial credit needs.Its general operation mode can be divided into three levels.

Users, as investors, can inject funds (usually USDC) into different themed liquidity pools managed by different borrowers, and then earn interest income (the income comes from real commercial profits, which are generally higher than the conventional level of DeFi);

Borrowers are generally professional financial institutions from around the world. They can allocate funds in the liquidity pool they manage to real-world enterprises with needs based on their own business experience;

After obtaining the funds, the enterprise will invest in developing its own business and regularly use part of the income to repay the loan interest to the user.

Throughout the entire process, Goldfinch will review the qualifications of the borrower and constrain the details of all lending terms to guarantee (somewhat ironically now) the safety of funds.

However, the accident happened.On October 7, Goldfinch disclosed through the governance forum that an unexpected situation occurred in the liquidity pool managed by the borrower Stratos. The total size of the pool was US$20 million, and the expected loss was as high as US$7 million.。

Stratos is a financial institution with more than ten years of experience in the credit business. It is also one of Goldfinchs investors. It seems to be quite reliable in terms of qualifications, but it is obvious that Goldfinch still underestimated the risks involved.

According to the disclosure,Stratos allocated $5 million of the $20 million to a U.S. real estate leasing company called REZI, and another $2 million to a company called POKT (the business is unknown, and Goldfinch said he had no knowledge of the money being used). What did you do with it...), both companies have stopped paying interest, so Goldfinch has written down these two head deposits to 0.

In fact, this is not the first time Goldfinch has had bad debt problems.In August this year, Goldfinch disclosed that the US$5 million lent to the African motorcycle rental company Tugenden may not be able to recover the principal because Tugenden concealed the flow of funds between internal subsidiaries and blindly expanded its business, resulting in large losses.

The successive bad debt issues have dealt a serious blow to the confidence of the Goldfinch community. At the bottom of the disclosure page about the Stratos incident, many community members have questioned the transparency and review capabilities of the agreement.

USDR Unanchoring Event

On October 11, the stablecoin USDR, which is backed by real estate (emmm, this wave is a double kill...), began to experience serious de-anchoring. The current discount has not been alleviated and is only quoted at US$0.515.Based on its circulation scale of 45 million, the total loss of position users is close to US$22 million.

USDR is developed by Tangible on the Polygon chain.Can be minted by staking DAI and Tangible’s native token TNGBL, DAI’s mortgage casting ratio is 1:1, while due to risk considerations, TNGBL’s mortgage size is limited to no more than 10%.

The reason for emphasizing physical real estate support is that Tangible will use most of the mortgage assets (50% - 80%) to invest in physical real estate in the UK (corresponding ERC-721 certificates will be minted after purchase), and Provide additional income to USDR holders through house rental, thereby increasing the market demand for USDR and thereby connecting the extremely large real estate market to the Crypto world.

Taking into account the potential redemption needs of users, Tangible will also reserve a certain amount of DAI and TNGBL in the mortgage assets., the reserved scale of DAI is 10% - 50%, and the reserved scale of TNGBL is 10%.

However, Tangible clearly underestimated the magnitude of redemption demand in a run situation. In the early morning of October 11, 11.87 million DAI was still reserved in the USDR treasury, but within 24 hours, users redeemed tens of millions of USDR and exchanged them for more liquid assets such as DAI and TNGBL. The sell-off also caused the price of TNGBL to halve, which indirectly led to the shrinkage of this part of the mortgage assets, further exacerbating the unanchoring situation.

Afterwards, Tangible has announced a three-step resolution plan:

First, it is emphasized that USDR still has a mortgage rate of 84%;

The second is to tokenize the real estate it owns (if there is no demand, it will consider liquidating the real estate directly);

The third is to redeem USDR in the form of stable currency + real estate token + lock-up TNGBL.

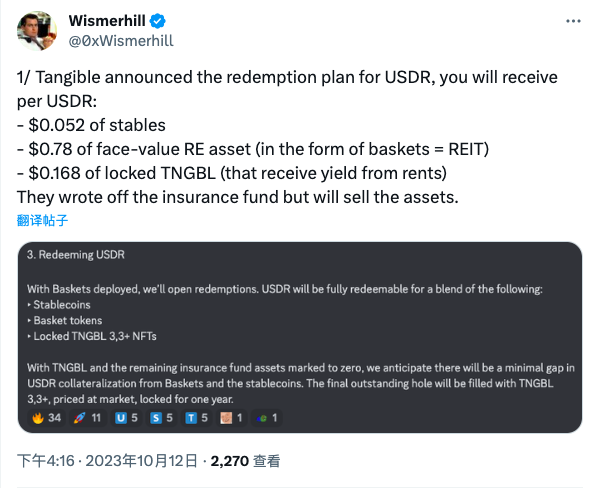

According to estimates by overseas KOL Wismerhill, USDR holders are expected to be returned:

Stablecoin worth $0.052;

Property tokens worth $0.78;

TNGBL worth $0.168 locked.

All in all, compensation may be able to return blood to holders, but USDR is destined to become history, and this RWA attempt with real estate as the main body ultimately ended in failure.

Experience and lessons

From the success of protocols such as Maker and the failures of Goldfinch and USDR, we may be able to roughly draw the following lessons.

The first is about the selection of off-chain asset classes.Taking into account factors such as risk level, pricing clarity, and liquidity conditions, U.S. debt is still the only asset class that has been fully verified at the moment. The various relative disadvantages of non-standard assets such as real estate and corporate loans will bring consequences to the entire business process. Additional friction, in turn, prevents mass adoption.

The second is about the liquidity unbundling of off-chain assets and on-chain tokens.Analyst Tom Wan mentioned the reason for USDR’s de-anchoring and said that Tangible could have minted the on-chain certificate representing real estate in the form of ERC-20, but chose to cast it in the relatively “solidified” ERC-721 form, which made DAI pre- After the reserve was depleted, the mortgaged property in the agreement could no longer be repaid. Real estate is illiquid, but Tangible could have improved this on-chain through additional design.

The third is the review and supervision of off-chain assets.Goldfinchs two consecutive bad debt incidents have exposed its inability to manage the actual execution status of the off-chain. Even though it has activated a special review role within the agreement, it has also chosen relatively credible in-house financing for borrower management. , but ultimately failed to avoid the misuse of funds.

The fourth is the issue of off-chain bad debt collection.The borderless nature of Crypto gives on-chain protocols the freedom to conduct business regardless of geography (except for regulatory factors), but when problems arise, it also means that it is difficult for the protocol to implement bad debt collection specific to local areas, especially under those laws. In areas where laws and regulations are not yet complete, the difficulty of practical operation will only increase infinitely. Take Goldfinch’s earliest bad debt incident as an example. Can you imagine a few New York white-collar workers going to Uganda to ask for money from people who rent motorcycles...

All in all, RWA has brought Crypto imagination about the incremental market, but as of now, it seems that only the brainless stud path of US debt is feasible. However, the attractiveness of U.S. debt is closely related to macroeconomic policy. If the yield of the former begins to fall as the latter turns, whether this path can continue to remain smooth will be questioned.

By then, expectations surrounding RWA may shift to other asset classes, which will require practitioners to face challenges head-on and forge new paths.