Data: What is the crypto market like outside of the US?

Original author -Mitchell Hammer

Compile - Odaily 0xAyA

Editors note: Crypto VC Electric Capital analyst Mitchell Hammer shared the current situation of the non-US encryption market on Twitter, expressed optimism about its future, and expressed dissatisfaction with the implementation and legislation of US domestic encryption policies. Odaily will The highlights are compiled below.

The United States remains on the sidelines on cryptocurrencies. But the rest of the world can no longer stand by and watch. Non-US policymakers are embracing cryptocurrencies and non-US consumers are using cryptocurrencies, let’s dig deeper:

Over the past six months, policymakers around the world have embraced the existence of cryptocurrencies:

EU approves MiCA

UK passes new encryption law

Hong Kong is approving cryptocurrency exchange licenses

Dubai creates cryptocurrency regulator

Brazil creates virtual service provider license

Japan wants to become a cryptocurrency hub

Combined, these six jurisdictions alone have more than 850 million consumers. Their combined GDP exceeds $23 trillion, and these countries view cryptocurrencies as a major potential economic driver, and they want to share in the millions of jobs and trillions of dollars in value created by cryptocurrencies.

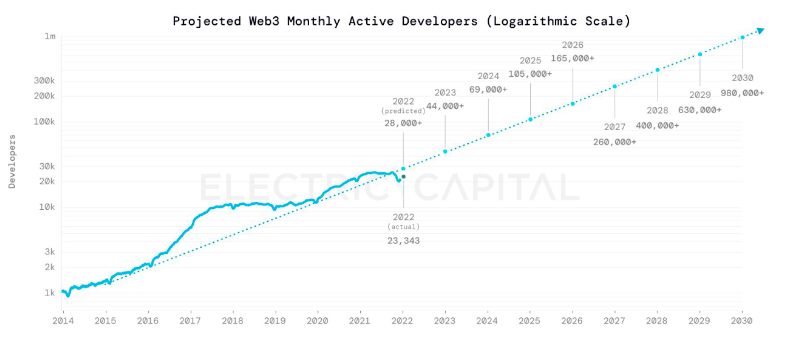

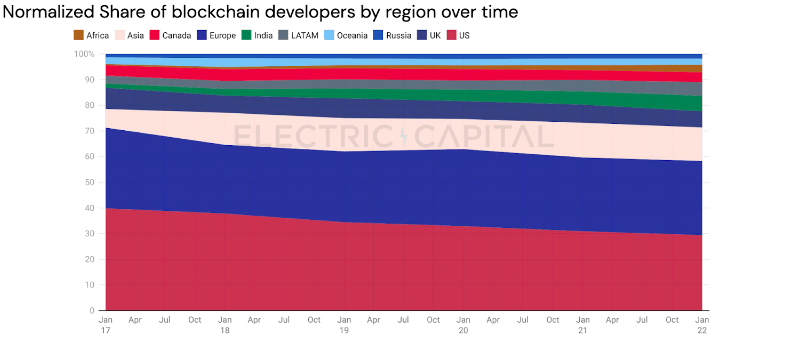

Cryptocurrency-friendly policies outside the United States have taken effect, and non-U.S. regions are grabbing U.S. crypto development market share.Over the past five years, the United States has lost approximately 30% of its development market share to Asia, Africa, and Latin America.

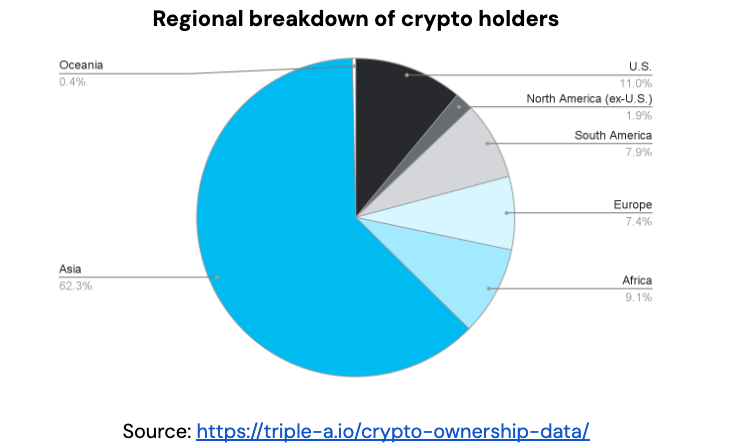

I can’t help but wonder, could the crypto industry really develop so big without the US market? However the fact is,The United States already accounts for only a small portion of the cryptocurrency user base:

90% of cryptocurrency’s 420 million users live outside the United States

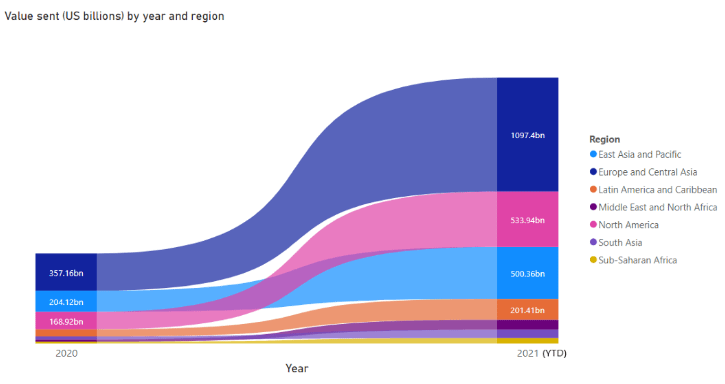

80% of cryptocurrency volume comes from outside the United States

Binance is the world’s largest CEX and has almost no US customers.

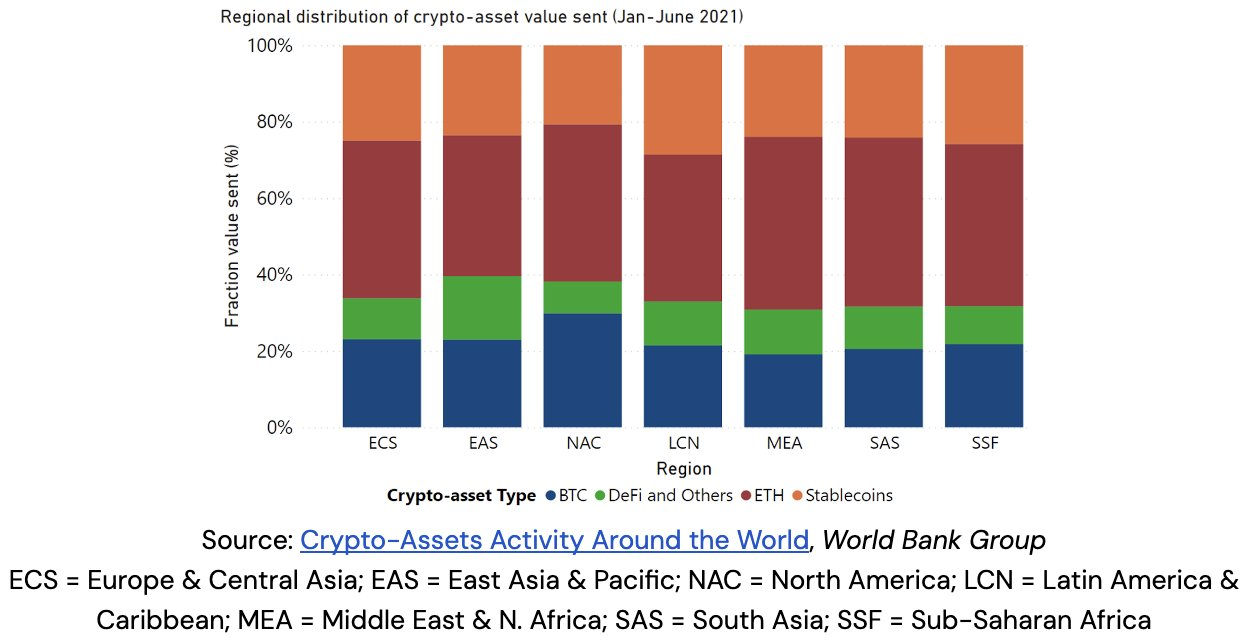

Crypto already has a product market that caters to non-U.S. consumers.Many of them don’t have access to stable fiat currencies, they don’t have access to basic and affordable financial services, they use stablecoins to get USD, and they use DeFi to trade, lend, and earn income.

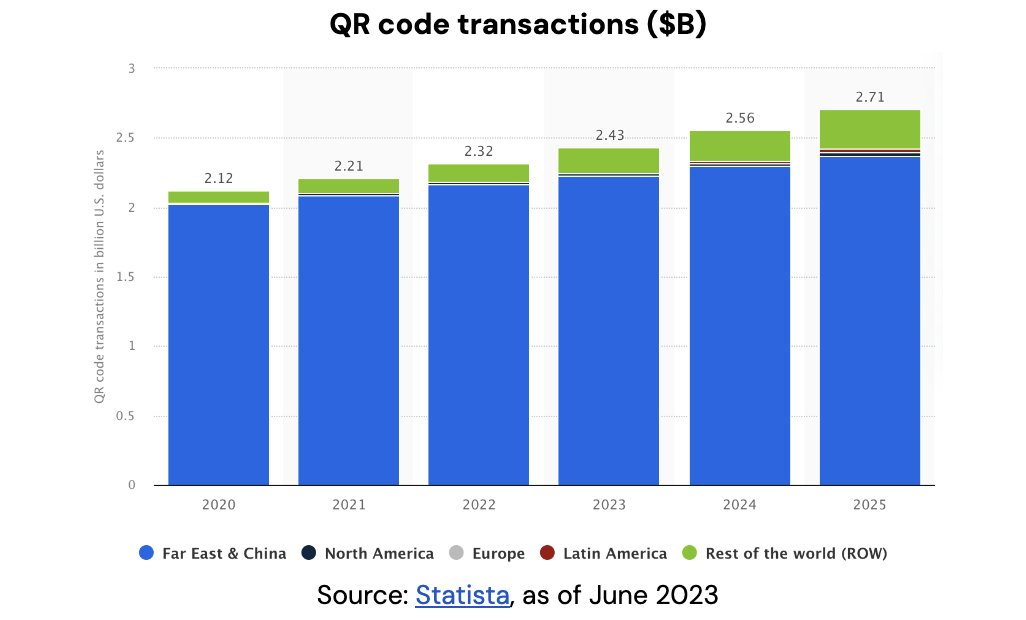

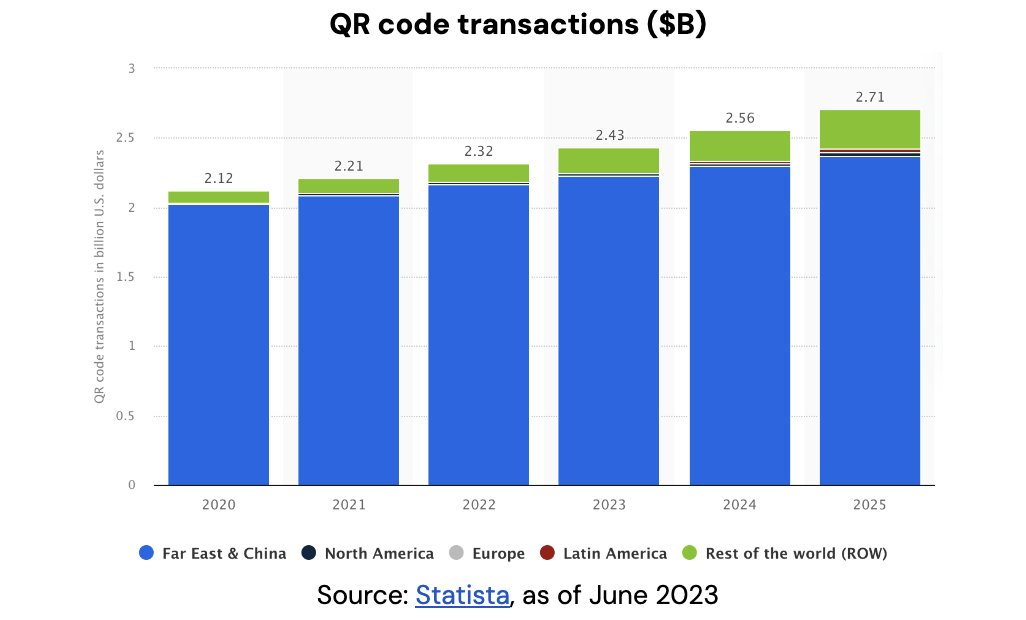

Cryptocurrency won’t be the first technology for global markets to surpass the U.S. in adoption, with mobile payments and QR codes both reaching billions of users and trillions in transaction value without U.S. consumers. Even today, U.S. adoption lags.

Tencent built WeChat Pay into a $25 billion revenue business despite almost zero U.S. consumers, while Alipay parent Ant Group is valued at $80 billion

The existing infrastructure makes it difficult for American consumers to see the utility of new payment systems. Most Americans have credit cards. The existing payment system was good enough, but eventually, the United States embraced the new technology of mobile payments. In the past 6 years, mobile payment volume in the United States has grown by more than 500%.

Like mobile payments and QR codes, cryptocurrencies can reach billions of users and create trillions in value without American consumers. Once that happens, the United States will capitulate again, and local players will need to adapt. Keep up with global competitors with cheap, more efficient cryptocurrency rails.

In the final analysis,Cryptocurrency political war hurts American consumers and businesses.Currently, U.S. consumers do not have access to products that are available in other parts of the world. Businesses cannot use cryptocurrencies to remain globally competitive.

Fortunately, recent judicial and congressional actions appear to indicate that the United States is slowly moving in the right direction. This is certainly good news, but no matter what happens in the United States recently, cryptocurrencies are global... always have been, and will continue to be.