SignalPlus Volatility Column (20230919): The encryption market has regained resilience, and traders are optimistic about the market outlook.

On the eve of the opening of the Federal Reserve meeting, the three major U.S. stock indexes were basically unchanged, and the market generally expected that the meeting would suspend interest rate increases. According to indicator analysis, the low point of US core CPI is well above the Feds long-term target of 2%. At the same time, crude oil prices rose for the third consecutive week due to supply-side influences. Brent crude oil prices rose to about US$95 per barrel, breaking through the high since November last year, increasing the upward risk of the CPI index in the short term.

Source: SignalPlus, Economic Calendar

In terms of digital currencies, the price of BTC has gradually rebounded after a short-term fall from a high point close to 27,500, and has recovered most of its losses and once again stood at the 27,000 mark. The overall price is still in an upward trend.

Source: Binance & TradingView

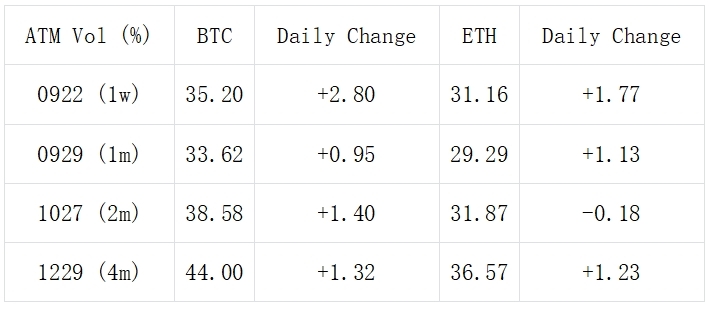

Looking back at the market situation over the past month, the price trend of digital currencies has escaped the quagmire of low volatility and sideways trading. Boosted by the recent continued price rise, the implied volatility surface of BTC/ETH has once again increased by 1% to 1.5%. vol, mid- and long-term ATM IV and RR have reached their highs in the past month.

In addition, although the interest rate swap market has almost Price-In the expectation that the FOMC will not raise interest rates on Thursday, Powells question and answer session after the decision may convey important guidance information. Therefore, compared with other maturities, 21 Sep 23 and 22 Sep 23 There is still a 3% to 4% premium for IV. From a trading perspective, yesterday BTC 22 Sep also had a 26,000-28,000 Strangle transaction that accumulated 1,614 BTC Notioanl, which promoted the increase in volatility pricing.

Source: Deribit (as of 19 Sep 16:00 UTC+8)

Source: SignalPlus,IV continues to rise

Source: SignalPlus,Distal IV has reached recent highs

Source: SignalPlus,Skew is at a high level in each period

In addition, in yesterdays rising market, ETH could see call spread buying of 1750 vs 1900 on Wing at the end of September (3250 ETH per leg), and almost the same amount of transactions on Tail at 1900 vs 2300. Sell (3500 per leg), which saves part of the cost of buying CSpread when the upside space is limited; on BTC, it continues to sell Put Spread at the end of October to build a position, with a total of 600 BTC per leg of 23000 vs 26000 PSpread, conveying Increased traders confidence in the 26,000 support level.

Source: Deribit Block Trade

Source: Deribit Block Trade

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web 3, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends .

SignalPlus Official Website:https://www.signalplus.com