SignalPlus Volatility Column (20230918): The whale bought ETH forward options and held a bullish position

Last Friday, the three major U.S. stock indices collectively fell, with NASDAQ falling more than 1.5%. So far, the two-year Treasury yield has risen to 5.05%, and the ten-year Treasury yield has returned to 4.34%, approaching recent highs. Market price predictions show that the probability of a rate hike at this week's Wednesday Fed meeting has dropped to 1%, while the probability of a pause in rate hikes in November is 72.3%.

Source: SignalPlus, the FOMC meeting will be held this week

In terms of cryptocurrencies, after experiencing weekend consolidation, the price of BTC rises again with the opening of the Asian market, surpassing the 27,000 level. On the other hand, so far, the total staked amount of ETH 2.0 has exceeded 29 million (about 47.8 billion USD). As part of the Ethereum Dencun upgrade, the EIP-7514 proposal has been launched, aiming to slow down the percentage growth rate of ETH staking in the worst-case scenario, changing the maximum validator growth rate from exponential growth to linear growth, slowing down the growth of ETH staking rate, and buying time for the community until a longer-term solution is found.

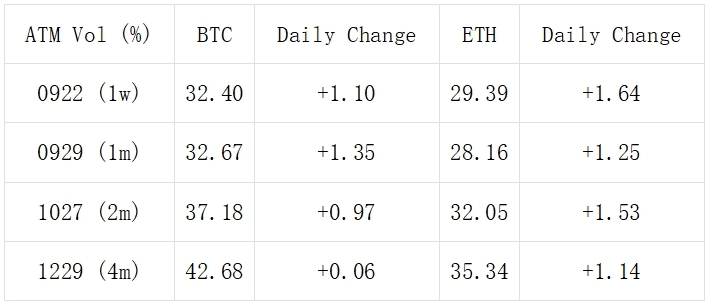

Regarding options, the first thing to note is that the recent IV has gradually returned from its weekend low. The IV in the past two weeks has been priced higher due to the uncertainty brought by the Thursday FOMC meeting and a series of heavy data releases in the evening, which has lifted the volatility curve in the first half and flattened its slope. On the other hand, starting from 10 am today (UTC+8), the medium to long-term IV has been rising along with the price. As of now, the BTC/ETH medium to long-term IV has increased by about 1% to 1.5%.

Source: Binance & TradingView

Source: Deribit (as of 18 Sep 16:00 UTC+8)

Source: SignalPlus

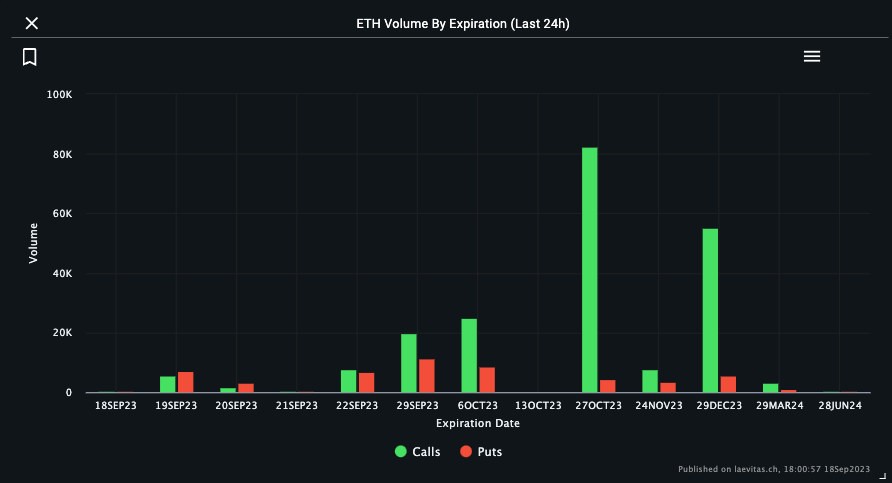

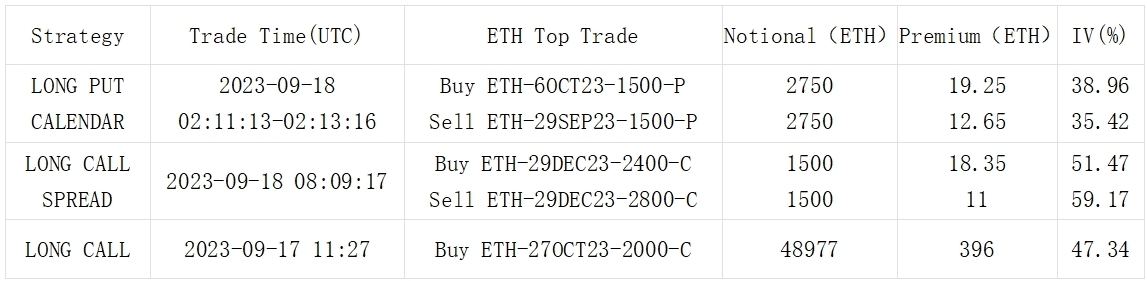

As for trading, the most attractive in the market in the past 24 hours is the two sets of large outright call options trades for ETH in October/December. Among them, ETH-27 OCT 23-2000-C was purchased by a whale in a single transaction for close to 49K contracts, and a similar purchase of around 42K contracts for the December 2200-C call options indicates a bullish outlook. Based on the analysis of open interest, the OI for these two strike prices decreased by 29K/29.62K respectively, suggesting the probability of two sets of closing trades.

Source: Laevitas, ETH trading focused on two sets of buying and closing call options for 27 OCT/29 DEC

Source: Deribit Block Trade

Source: Deribit Block Trade

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates instantly, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: SignalPlus123), Telegram group, and Discord community to interact and communicate with more friends.

SignalPlus Official Website: https://www.signalplus.com