Bankless: Tokenized Treasury Bonds and the RWA Revolution

Original title: "Tokenized Treasuries and an RWA Revolution"

Original author: Jack Inabinet

Original translation: Kate, Marsbit

Why upgrading Uncle Sam's debt into financial products will stimulate the adoption of the next wave of RWAs, and ponder what will happen next with tokenization. Bankless delves into the world of Real World Assets (RWAs) and discusses the potential of tokenizing U.S. debt to drive further adoption of cryptocurrencies. Full translation by MarsBit:

BlackRock CEO Larry Fink boldly refers to this crypto industry as the "next-generation market," and Boston Consulting Group predicts that the scale of this opportunity will be 42 times larger than the current TVL of DeFi in just 7 years.

Which crypto phenomenon has caught the attention of TradFi? It's tokenized assets, of course! Fans of Real World Assets (RWAs) have long predicted a bull market led by tokenization, but until recently, the industry has struggled to gain traction in the cryptocurrency space.

While protocols such as RealT and Centrifuge have successfully created on-chain representations of real-world assets, they have been struggling to attract a market of significant size. TradFi institutions, with the ability to underwrite these transactions, have been hesitant to lend due to regulatory uncertainty, and the opaque off-chain nature of these types of products (along with relatively lower returns) has hindered cryptocurrency enthusiasts from participating in these markets.

Tokenization has been slow to progress, but fortunately, there is one asset class that is becoming a champion for mass adoption: U.S. debt!

Today, we will use MakerDAO as a case study to validate the bullish arguments behind tokenizing U.S. debt, reveal why upgrading Uncle Sam's debt into financial products will stimulate the adoption of the next wave of RWAs, and ponder what will happen next with tokenization.

MakerDAO's Journey with RWAs

MakerDAO is no stranger to real-world assets. Since April 2021, its stablecoin DAI has been partially backed by RWA.

In the early days, Maker acquired RWAs through a customized credit protocol. However, the protocol quickly realized the limitations of this facility. Customized credit is difficult to scale and carries high risks. Each loan requires a time-consuming due diligence process and is collateralized by assets with relatively illiquid markets (e.g., property deeds or receivables).

In pursuit of scale and risk reduction, Maker chose to completely bypass the difficulties of customized credit by becoming a lender to the US government!

First is the Monetalis Clydesdale treasury, a subsidiary of Maker, which earns profits by investing in highly liquid US Treasury Exchange Traded Funds (ETFs). Following closely behind is the BlockTower Andromeda treasury (a similar investment vehicle) and the Coinbase Custody treasury, the latter of which helps redirect a portion of the returns on US Treasury securities back to Maker in USDC.

Especially with the introduction of these treasuries, Maker is now able to deploy idle stablecoins into RWAs at scale, and their high liquidity allows Maker to expand alongside increasing stablecoin reserves, managing duration and reducing exposure like traditional financial entities.

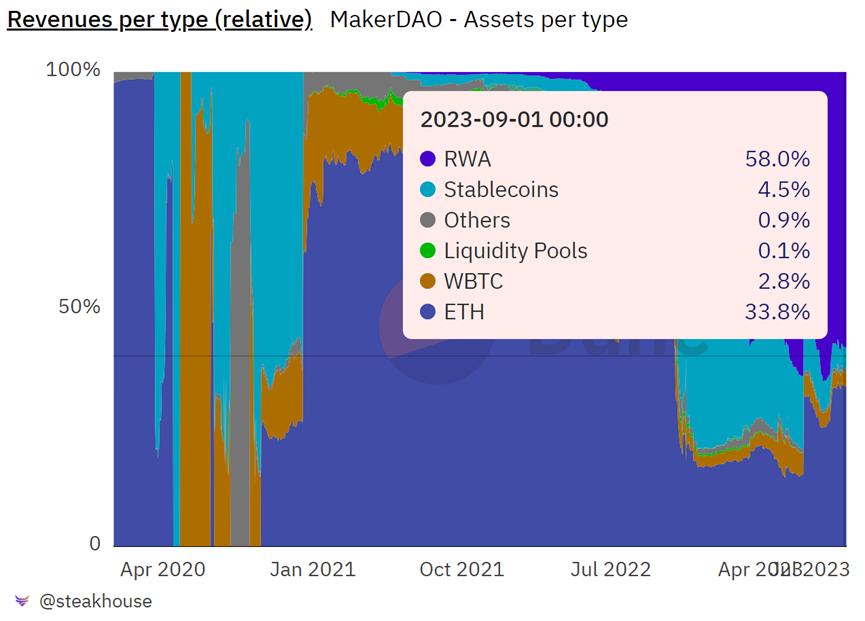

Although only 2% of DAI was collateralized by RWA before the launch of Monetalis Clydesdale in October 2022, the composition of Maker's balance sheet has undergone fundamental changes in the 10 months since its introduction.

Currently, 47% of outstanding DAI is collateralized by RWA, and these vaults account for 58% of Maker's revenue🤯

With the massive income influx brought by RWA in 2023, Maker is able to provide returns for MKR and DAI holders through MKR burning and increasing the DAI Savings Rate (DSR)!

The burning of MKR since July 19th has undoubtedly played a role in helping the token rise 40% against ETH.

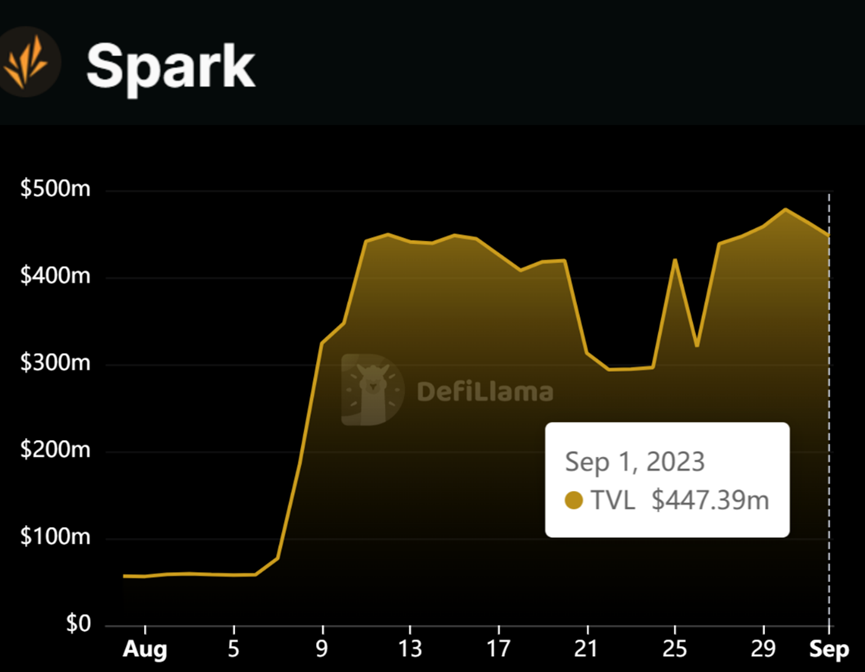

The soaring DSR yield has not been successful in combating the decline of unpaid debt in DAI - a fate that has befallen almost all stablecoin supplies except USDT - but it certainly incentivizes the use of Maker's currency market - the Spark protocol.

Since the launch of DSR, Spark Protocol's TVL has skyrocketed and is currently close to $450 million.

Maker is the fifth best-performing cryptocurrency among the top 100 cryptocurrencies so far this year, and the differentiating factor that sets it apart in 2023 is undoubtedly its RWA investment portfolio's yield-generating machine.

Why U.S. Treasury Bonds?

In TradFi, U.S. Treasury bonds are the top collateral and adopting them in decentralized financial systems seems natural to an extent.

Unlike other types of securities such as corporate bonds or accounts receivable, the default risk of U.S. Treasury bonds is almost zero and they are regarded as "risk-free" because the government has the ability to print money to repay old debts. In practice, this means that holding a portfolio of short-term U.S. Treasury bonds has a risk profile similar to holding U.S. dollars while earning additional yields.

Tokenized stablecoins like USDT can serve as efficient settlement and payment tools, but the current stablecoin model is not feasible for consumers seeking returns!

Due to the historically low yields of Traditional Finance (TradFi) and the relatively lower returns of cryptocurrencies compared to the peak of the bull market, it is now a good time for protocols to leverage Real World Assets (RWA). Maker is just one of the protocols attempting to gain a competitive advantage by using US Treasury bonds as collateral.

Ondo Finance has attracted nearly $160 million in deposits for its Ondo Short-Term US Government Bond Fund (OUSG). Ondo's associated money market, Flux Finance, has a Total Value Locked (TVL) of nearly $40 million, outstanding loans of $25 million, and its fUSDC deposit receipts even include protocols like Pendle.

Risk-Weighted Assets (RWA) protocols based on credit haven't shied away from the tokenization game by the US Treasury Department! Maple Finance recently launched its own Cash Management Pool to put funds to work by investing in US Treasury bonds and Reverse Repurchase Agreements (another form of ultra-low-risk securities).

Frax Finance is another stablecoin issuer looking to expand its V3 offerings by launching FraxBonds. A recent governance vote approved FinresPBC as the financial channel for V3, which will provide access to US Treasuries, establishing a high-quality source of income for FraxBonds and offering unlimited scalability.

The Future of Tokenization

US Treasuries may be the starting point for widespread tokenization, but other forms of high-quality debt securities that are accepted by the money markets and require minimal review or management, such as AAA-rated mortgage-backed bonds and certificates of deposit, will not lag behind! Their secure income streams can easily be converted into a variety of financial products, helping meet the endless demand for passive returns by market participants.

There is no doubt that the biggest obstacle to future tokenization is the current lack of regulation. Large financial institutions are simply waiting for further clarity on cryptocurrency regulations before entering, and the success of tokenization depends on resolving the pending regulatory and legal issues surrounding cryptocurrencies.

The inconsistent global regulatory framework is also a major risk for tokenization. While cryptocurrencies may be a global phenomenon, different regulations in each country only serve to isolate markets. This will pose significant challenges for companies forced to navigate different digital asset framework characteristics and prevent the formation of a truly global asset market, thereby limiting the full potential of tokenization.

Once cryptocurrencies gain clear regulation to pave the way for institutions, our initial tokenization products will take hold of the traditional financial markets with no turning back!

Enterprises love creating operational and cost efficiencies, and once they realize the cost-saving potential of tokenization, they will quickly move everything onto the chain. Everyone will flee the traditional financial system in exchange for the liquidity of the global blockchain market, where they can benefit from instant settlement and complete transparency.

Despite the regulatory hurdles, one thing is certain: tokenization will continue to exist!

While we wait for clarity, remember that the growing popularity of US Treasuries in the crypto space (along with the specific types of securities accepted by the money markets) is laying the foundation for an inevitable asset tokenization-led bull market 🚀