Under high inflation, Turkey has become a hotbed for cryptocurrency investments.

Original translation: Felix, PANews

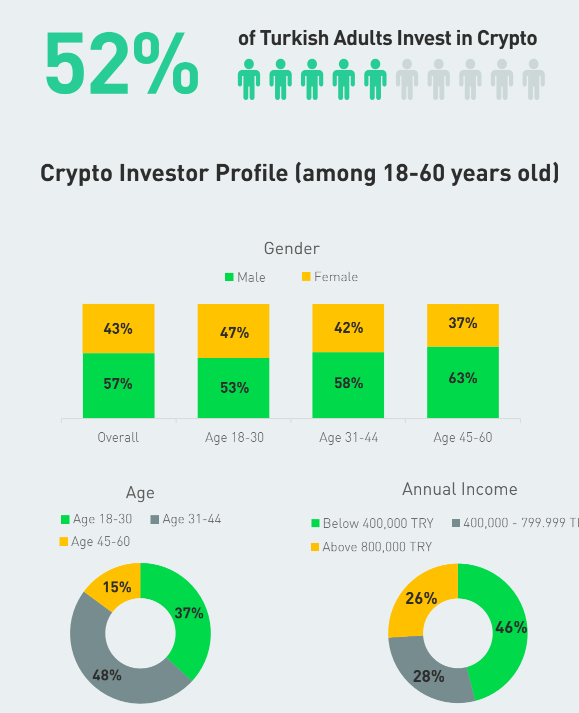

Introduction: The report shows that the participation rate of young women is increasing, with 36% of investors investing over $3,700, and cryptocurrencies are gradually becoming "mainstream assets".

In August, Turkey's inflation rate reached 58.94%, and forecasts show that with the rapid depreciation of the Turkish lira, Turkey's inflation rate will reach 85.5% in October, the highest point in 24 years. Under high inflation, Turkey has become a hotbed of cryptocurrency investment.

Cryptocurrency exchange KuCoin recently released a report outlining the cryptocurrency activities and expansion in Turkey. The report is based on a survey of 550 adult cryptocurrency investors in Turkey aged 18 to 60. Cryptocurrency users refer to users who currently own or invest in cryptocurrencies in the past six months. The survey was conducted online from May 5th, 2023 to May 12th, 2023. The following is the full translation of the report by PANews.

More than half of Turkish adults participate in cryptocurrency investment, with increased participation among young women

The survey shows a significant increase in cryptocurrency investors among Turkish adults. Over the past 18 months, the share of cryptocurrency investors among Turkish people aged 18 to 60 has increased by 12%, from 40% in November 2021 to 52% in May 2023, indicating a growing interest and acceptance of cryptocurrencies among the Turkish public. At the same time, the official currency of Turkey, the lira, has depreciated by more than 50% against the US dollar, making cryptocurrencies a safe haven against inflation.

Although male investors still make up 57% of all cryptocurrency investors, the trend of female participation is becoming increasingly apparent among the younger generation. Among cryptocurrency investors aged 18 to 30, almost half (47%) are women, while among investors aged 45 and above, this proportion is only 37%, indicating that as cryptocurrencies become mainstream, the gender gap is gradually narrowing.

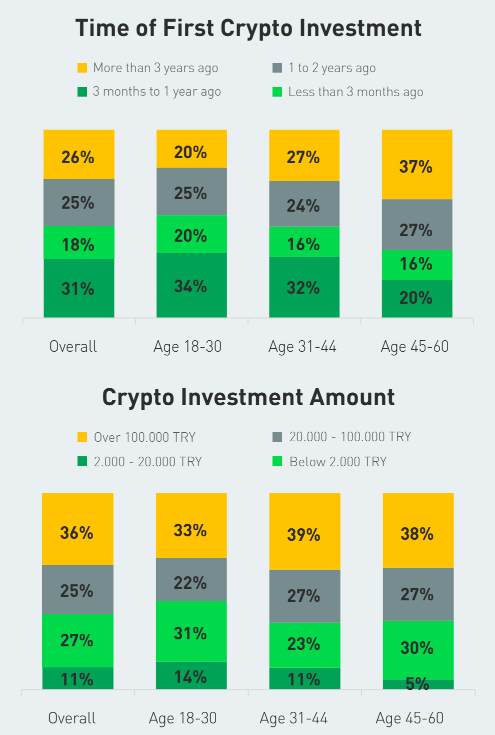

31% of cryptocurrency investors joined in the last quarter, with 36% investing over $3700

The age distribution of cryptocurrency investors indicates a higher level of involvement among the younger generation. People aged 31 to 44 account for 48% of the total number of cryptocurrency investors, followed by those aged 18 to 30, accounting for 37%. 31% of cryptocurrency investors made their first cryptocurrency investment in the past three months. The younger generation has shown a strong presence as newcomers, with 54% of cryptocurrency investors under the age of 30 entering the market in the past year.

On the other hand, among investors aged 45 and above, 37% have been investing in cryptocurrencies for over three years. The survey also shows differences in investment amounts. Despite their limited experience in cryptocurrency investments, a considerable proportion (33%) of investors under the age of 30 invest over 100,000 liras (approximately $3735). The increasing interest of young investors and the participation of the older generation further highlight the increasing acceptance of cryptocurrencies in Turkey.

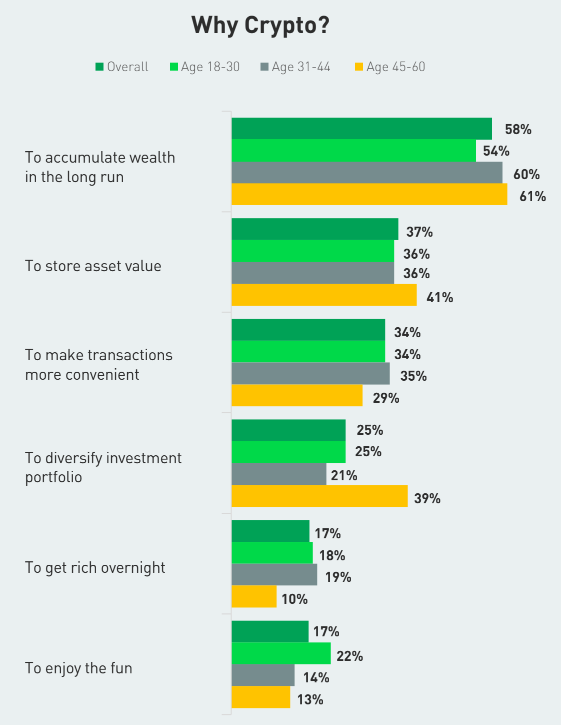

58% of people investment in cryptocurrency is for wealth accumulation, while 37% is for value storage

This survey reveals the motivations and preferences of adult cryptocurrency investors in Turkey. 58% of respondents said that their main motivation for investing in cryptocurrency is long-term wealth accumulation. This view is consistent across all age groups and emphasizes the role of cryptocurrency as a tool for achieving financial growth.

However, the motivations of each generation are slightly different. Older investors prioritize value storage and diversified investment portfolios, while the younger generation places more emphasis on the convenience of transactions and faster profits. 37% of people mentioned that the main reason for investing in cryptocurrency is to store asset value, and 25% of people consider diversified investment portfolios as the main motivation, recognizing the benefits of cryptocurrency in reducing risks. These motivations are particularly evident among investors aged 45 and older.

34% of people hold cryptocurrency for easier transfers, indicating their recognition of the efficiency and speed brought by cryptocurrency. 17% of people admit that their motivation is short-term profits and the pure enjoyment of the investment process, which is consistent with the experimental and exploratory nature of the cryptocurrency market. These sentiments are more pronounced among the younger generation.

71% of people are interested in investing in Bitcoin, followed by Ethereum (45%) and stablecoins (33%)

This survey provides insights into specific cryptocurrencies and crypto-related concepts that differ among investors of different ages.

Bitcoin is widely popular among adult cryptocurrency investors in Turkey. 71% of all investors and 79% of older investors express interest in investing in Bitcoin. This reflects Bitcoin's status as a cryptocurrency pioneer and its recognition as a store of value and digital gold.

Ethereum ranks number two, with 45% of investors and 52% of younger investors expressing interest in investing in it.

Stablecoins, which are tied to fiat currency and other stable assets, attract investment interest from 33% of respondents, reflecting a desire for stable and reliable digital assets that can be used for trading, transferring, and holding value.

The survey also highlights interest in the concepts of NFTs and the Metaverse. Approximately 21% of respondents expressed interest in NFTs, while 19% of respondents are interested in the Metaverse.

18% of respondents are interested in emerging categories such as meme coins, with public chains and DeFi each accounting for around 12%.

70% of people use cryptocurrency for trading, and 22% use it to purchase NFTs

The survey emphasizes the various use cases of cryptocurrency. Trading is the most common use of cryptocurrency, accounting for 70%, indicating a strong interest in using cryptocurrency as an investment tool.

22% of people use cryptocurrency to purchase NFTs. 19% of people hold and stake cryptocurrency, indicating a significant portion of individuals view cryptocurrency as a means of generating passive income. The data also shows that as age increases, the proportion of individuals engaging in holding, earning, and staking tends to rise. This may indicate that older respondents are more inclined towards long-term investment strategies.

14% of people use cryptocurrency for gifting purposes, indicating that cryptocurrency is not only seen as a personal asset but also as a means to transfer value as gifts to others. 13% of people use cryptocurrency for peer-to-peer transfers, suggesting that cryptocurrency has the potential to become a convenient alternative to traditional transfer methods.

Interestingly, 9% of respondents use cryptocurrency to receive or pay wages, and 8% of respondents use cryptocurrency to donate to non-profit organizations, highlighting the potential applications of cryptocurrency in employment and charitable causes.

57% of people are introduced by friends or family, 35% are introduced from the community

The appeal of cryptocurrencies is often driven by word of mouth. 57% of respondents said they were introduced to cryptocurrencies by friends or family. This highlights the crucial role of interpersonal relationships in sparking curiosity and encouraging newcomers to venture into the digital finance field.

The community has become another influential avenue, accounting for 35% of respondents. Whether through online forums, social groups, or local gatherings, communities provide individuals with a conducive environment for learning and exploring cryptographic concepts, reflecting the collaborative nature of the Turkish crypto community.

32% of respondents pointed out that other traders played a role in their introduction to cryptocurrencies, highlighting the interconnected nature of the trading environment.

Finally, social media has had a significant impact, with 27% of respondents attributing their entry into the crypto world to influential Key Opinion Leaders (KOLs). As for sources of information, crypto investors (especially the younger demographic) primarily rely on: YouTube (41%), Twitter (34%), Telegram (29%), Instagram (19%).