Collation | Odaily

Author | Qin Xiaofeng

1. Overview

Fox reporter Eleanor Terrett wrote on platform X that Bitwise has requested the withdrawal of its initial application for the Bitwise Bitcoin and Ether Equal Weight Strategy ETF, which was submitted on August 3rd. The fund aims to provide investors with market value-weighted exposure to BTC and ETH futures contracts.

According to official sources, the Ethereum Foundation announced the official launch of the Ethereum Execution Layer Specification (EELS) after over a year of development. EELS is a Python reference implementation of the core components of Ethereum execution clients, focusing on readability and clarity, and is more programmer-friendly and in sync with merged and forked branches. EELS provides a complete snapshot of the protocol on each fork (including upcoming forks), making it easier to follow than EIPs (which only propose changes) and production clients (which typically mix multiple forks in the same code path). The Ethereum Foundation hopes that EELS will become the default way to specify core EIPs, the preferred way for EIP authors to prototype their proposals, and the best reference for understanding how Ethereum works.

In the secondary market, the short-term price of ETH may continue to consolidate, with support at $1600 and resistance at $1650.

2. Secondary Market

1. Spot Market

OKX market data shows that last week ETH fell to 1602 USDT at one point and closed at 1633 USDT for the week, a decrease of 1.4% compared to the previous week.

ETH Daily Chart from OKX

The daily chart shows that the price is currently consolidating around $1630, with support at $1600. If it breaks below, it may further drop to $1500; the resistance above is at $1650.

2. Network Status

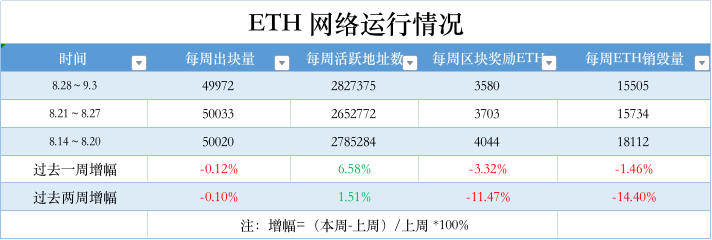

Etherscan data shows that the Ethereum network produced 49972 blocks in the past week, a decrease of 0.1% compared to the previous week; the number of weekly active addresses increased by 6.5% to 2827375; block rewards amounted to 3580 ETH, a decrease of 3.3%; and the weekly ETH burn reached 15505, a decrease of 1.5%.

3. Major Changes

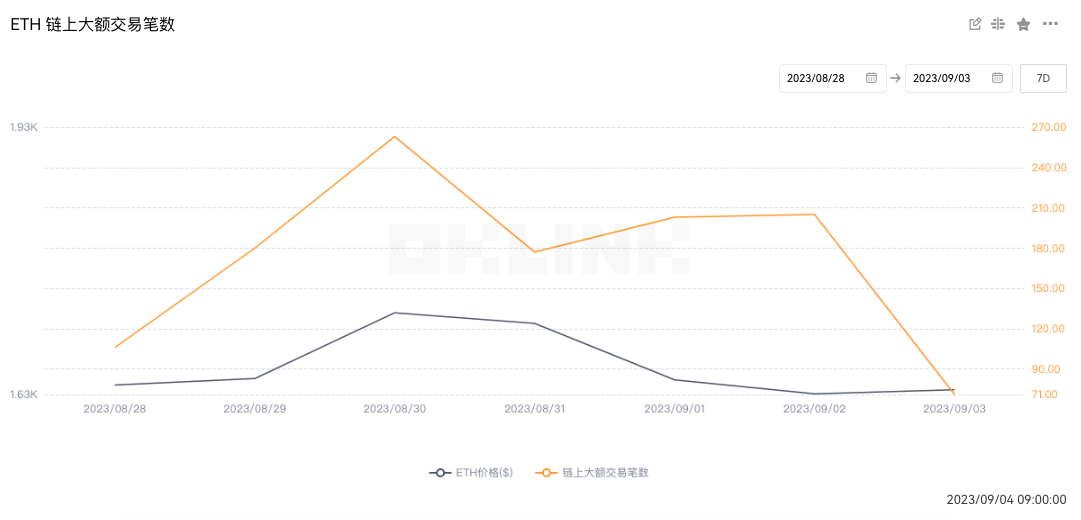

OKLink data shows that the number of on-chain large transactions reached 1205 last week, a decrease of 12.5% compared to the previous week (1377), indicating a significant decrease in whale trading activity.

4. Rich List Addresses

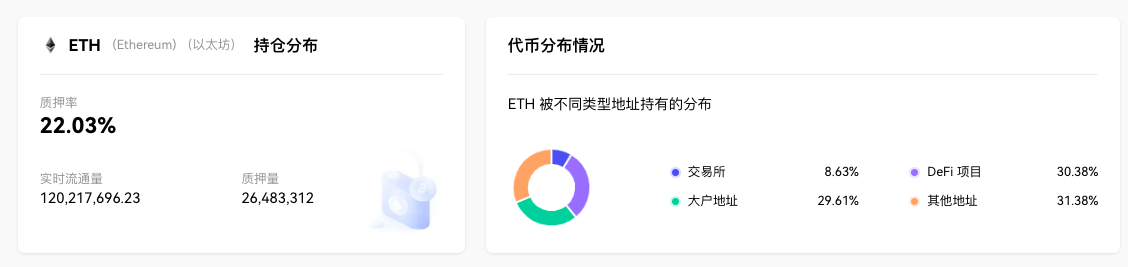

OKLink Data shows that the total amount of deposits in ETH 2.0 has reached 26.48 million ETH, with a pledge rate of 22.03%; in terms of ETH holding address distribution, exchanges account for 8.63%, a 0.01% increase compared to the previous period; DeFi projects account for 30.38%, a 0.21% increase compared to the previous period; addresses of large holders (top 1000 addresses excluding exchanges and DeFi projects) account for 29.61%, a 0.06% decrease compared to the previous period; other addresses account for 31.38%, a 0.16% decrease compared to the previous period.

5. Lock-up Data

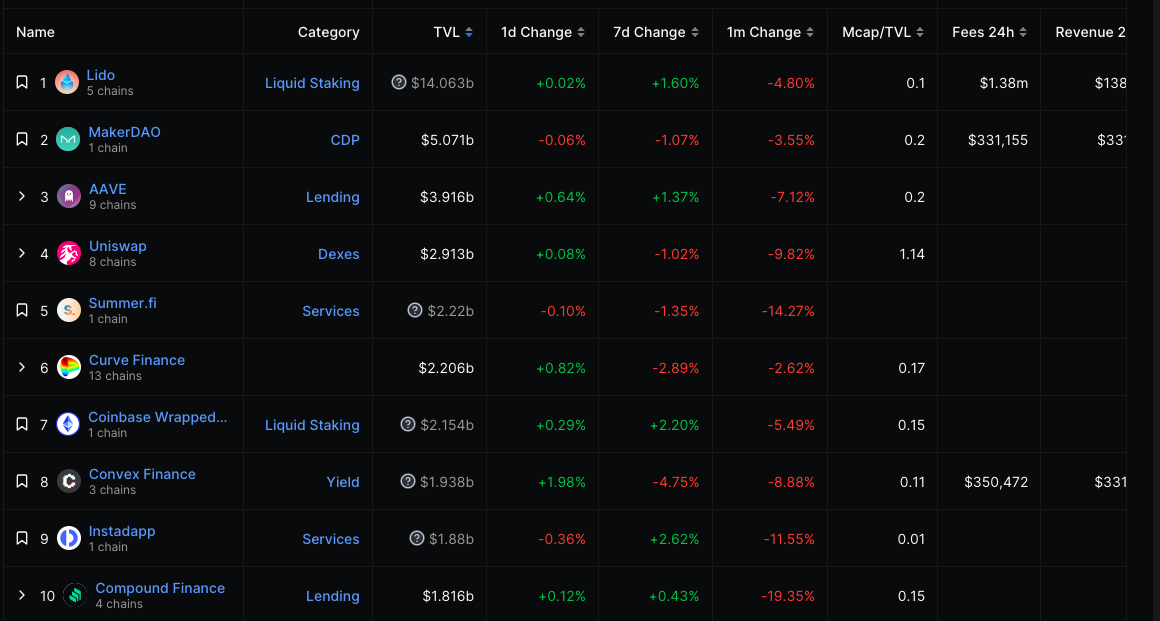

DeFiLlama data shows that the total value of on-chain locked collateral decreased from $22 billion to $21.73 billion last week, a decrease of 1.2% compared to the previous period; the top three projects in terms of locked-up value are: Lido ($14.06 billion), MakerDAO ($5.07 billion), Aave ($3.91 billion).

III. Ecosystem and Technology

1. Technological Progress

(1) Ethereum Foundation officially launches Ethereum Execution Layer Specification

According to official news, the Ethereum Foundation has announced the official launch of the Ethereum Execution Layer Specification (EELS) after more than a year of development. EELS is the Python reference implementation of the core components of the Ethereum execution client, which focuses on readability and clarity, is more programmer-friendly, and stays in sync with the merged fork.

EELS provides a complete snapshot of the protocol on each fork (including upcoming forks), making it easier to follow than EIPs (which only propose changes) and production clients (which often mix multiple forks in the same codebase).

The Ethereum Foundation hopes that EELS will become the default way to specify core EIPs, the preferred way for EIP authors to prototype their proposals, and the best reference for how Ethereum works.

(2) Ethereum client Nethermind releases Version 1.20.2 in preparation for Holesky testnet

According to official sources, Ethereum client Nethermind has released Version 1.20.2 in preparation for the Holesky testnet. The Holesky testnet will launch on September 15, 2023, at 14:00 UTC, replacing Goerli.

2. Community Voices

Consensys lawyer Bill Hughes posted on X stating that a judge in the Southern District of New York made a clear ruling in the Uniswap class-action lawsuit on August 29th, stating that Ethereum is a commodity, not a security. Hughes added that the ruling did not provide analysis, only conclusions, but he believes it is still a fairly clear statement. Additionally, the ruling document implies that Wrapped BTC is a commodity, but it does not explicitly state this.

Previously, a judge in the Southern District of New York dismissed a collective lawsuit against Uniswap and Paradigm. The plaintiffs attempted to hold these companies responsible for the sale of "fraudulent tokens" on the Uniswap AMM. Community members commented that the dismissal of the collective lawsuit largely implies that protocol developers should not be held responsible for the misconduct of third parties.

3. Project Updates

(1) Shibarium Mainnet has reopened bridge withdrawals

On August 28, Shibarium reopened fund withdrawals on its mainnet's cross-chain bridge with the Ethereum network. Shytoshi Kusama, the Chief Developer of Shiba Inu, stated that the Shibarium mainnet is currently running smoothly. Users can complete withdrawals of assets such as ETH, SHIB, LEASH, and WETH within 45 minutes to 4 hours. Withdrawals of the native token BONE on the Shibarium network may take up to 7 days to complete. (The Block)

Previously, the Shibarium mainnet was launched on August 17 but was quickly paused. On August 24, the Shibarium team announced the resumption of block generation, and the cross-chain of token issuance will be gradually completed.

According to the official announcement, Boba Network, an Ethereum Layer 2 scaling solution, has announced the closure of its BobaAvax solution on Avalanche on October 31. Users are required to transfer all their funds to Avalanche mainnet before that date to avoid the permanent loss of access to any assets on BobaAvax.

Regarding this, Sushi also issued a notice stating that users providing liquidity to Sushi on the BobaAvax chain must take the following actions by October 31: 1. Remove all existing liquidity from BobaAvax; 2. Transfer funds out of BobaAvax to ensure safety.

In addition, Sushi strongly advises against adding any new liquidity to BobaAvax. Failure to remove liquidity or transfer assets by the specified date may result in permanent loss of access to assets on BobaAvax.

(3) Polygon Labs launches Chain Development Kit for developing and connecting Ethereum L2

Polygon Labs has released a software tool called Chain Development Kit (CDK), which allows developers to build zero-knowledge proof-supported L2 for Ethereum. L2s deployed using CDK will be able to connect to shared ZK bridges, enabling interoperability. The code repository for CDK will be open-source. This tool will be provided as part of the Polygon 2.0 roadmap scheduled for next year, aiming to provide a framework for developing L2s that can run on the Ethereum network. (The Block)

(4) OpenSea introduces redeemable NFT standard, bringing on-chain redemption support to creators

According to official sources, OpenSea recently announced the release of two Ethereum Improvement Proposals (ERC-7496 and ERC-7498) and two Seaport Improvement Proposals (SIP-14 and SIP-15) to drive the development of the redeemable ecosystem. In the coming weeks, OpenSea will collaborate with developers and creators, seeking feedback to ensure the above standards meet the ecosystem's needs. Their team will launch more product plans based on this standard to support various use cases of redeemable NFTs.

OpenSea has released a public concept verification to showcase the experience, such as Burnie the Flame: allowing the minting of Baby Burn egg on the OpenSea Drop page, then going to the redemption page to destroy the egg and exchange it for Burnie; afterwards, it will be directly introduced to all creators on OpenSea as chain-redeemable support, and the on-chain redemption standards will be expanded to make it easier for creators to link items in their series to off-chain redemption experiences outside of OpenSea while still tracking redemption status on-chain through features or destruction.

Additionally, the team is also exploring partnerships to enable no-code solutions that make it easier for creators to achieve off-chain redemption in common verticals.

(5) Altitude, the composability-native asset bridge supported by LayerZero Labs, is now live.

The composability-native asset bridge Altitude, supported by LayerZero Labs, is now live. Altitude integrates with LayerZero to provide support for asset bridging between Ethereum, BNB Chain, Avalanche, Arbitrum, Polygon, Optimism, and Fantom.

(6) Circle will launch native USDC on Optimism and Base.

According to official news, Circle announced the launch of native USDC on Optimism. Prior to this, the USDC bridge on Ethereum will be renamed as USDC.e for distinction. In addition, Circle also announced the launch of native USDC on Base. Over time, Circle expects the liquidity of native USDC to grow and potentially replace the circulating USDbC liquidity bridged from Ethereum. In terms of liquidity migration, Base will collaborate with ecosystem applications to provide a smooth transition from USDbC to USDC. The Base Bridge will not be immediately changed and will continue to operate normally.

Previously, informed sources revealed that USDC will be launched on 6 new blockchains including Polygon PoS, Base, Polkadot, NEAR, Optimism, and Cosmos through the Noble network.

(7) Gitcoin Passport launches Onchain Stamps to help projects fight against front-running attacks

Gitcoin Passport announced the launch of Onchain Stamps to seamlessly integrate with the Ethereum ecosystem. Onchain Stamps is built on Ethereum Assurance Services (EAS). Onchain Stamps will be provided on the OP mainnet and plans to expand Gitcoin Passport to other EVM-compatible chains. Through interoperable proofs, projects can choose relevant proofs to defend against front-running attacks and authorization.

Fox reporter Eleanor Terrett wrote on the X platform that Bitwise has requested to withdraw its initial application for the Bitwise Bitcoin and Ether Equal Weight Strategy ETF, which was submitted on August 3. The fund aims to provide investors with market-value weighted exposure to BTC and ETH futures contracts.

Turkish fintech company BiLira has launched a stablecoin called TRYB that is pegged to the Turkish Lira (TRY) on the Ethereum network. According to CoinGecko data, the market cap of TRYB has surged 325% in three weeks, reaching $136.1 million. TRYB has become the second-largest non-dollar pegged stablecoin globally, second only to the euro stablecoin EURT launched by Tether, which has a market cap of $224 million. (CoinDesk)