WealthBee Macro Monthly Report: Global Safe Haven Sentiment Rises, Short-term Pressure on Risk Assets

From the economic data released by the United States in August, there are some signs of deceleration in the US economy - this speeding locomotive.

In July, the CPI in the United States rose by 3.2% year on year, ending a continuous decline in the previous 12 months. The forecast was 3.3%, with the previous value being 3.0%; in July, the core CPI in the United States rose by 4.7% year on year, with a forecast of 4.8% and a previous value of 4.8%. The CPI has increased, but it is still below market expectations, and the Fed's rate hikes have been effective.

In terms of employment, the US labor market has also shown some degree of slowdown. In July, the non-farm payrolls in the United States increased by 187,000, lower than market expectations. In terms of hourly wages, the average hourly wage growth rate in the second quarter was 4.5% year on year, slightly slower compared to the previous quarter's 4.8% growth rate. The latest salary tracking data from the job-search website Indeed shows that the annual salary growth rate on the website's job advertisements is 4.7%, lower than the 5.8% in April and 8% in July last year. The labor market has always been an important reference for the Fed's rate hikes, because wages and prices often rise synchronously. The current decrease in wage expectations undoubtedly puts the labor market on the side of the Fed.

Similarly, the initial value of the Markit Services PMI in the United States in August was 51 (expected 52.2, previous value 52.3); the initial value of the Markit Manufacturing PMI in August was 47 (expected 49.3, previous value 49). Manufacturing is contracting, and the expansion of the service industry is also below expectations.

Many economic data show that the US economy has slowed down this month. However, the economic data for a single month is not enough to determine the long-term trend of the economy. The strength of the US economy is still in a relatively high position. Powell also made a hawkish statement at the Jackson Hole conference, stating that given the strong performance of the US economy, interest rates may continue to rise in the future.

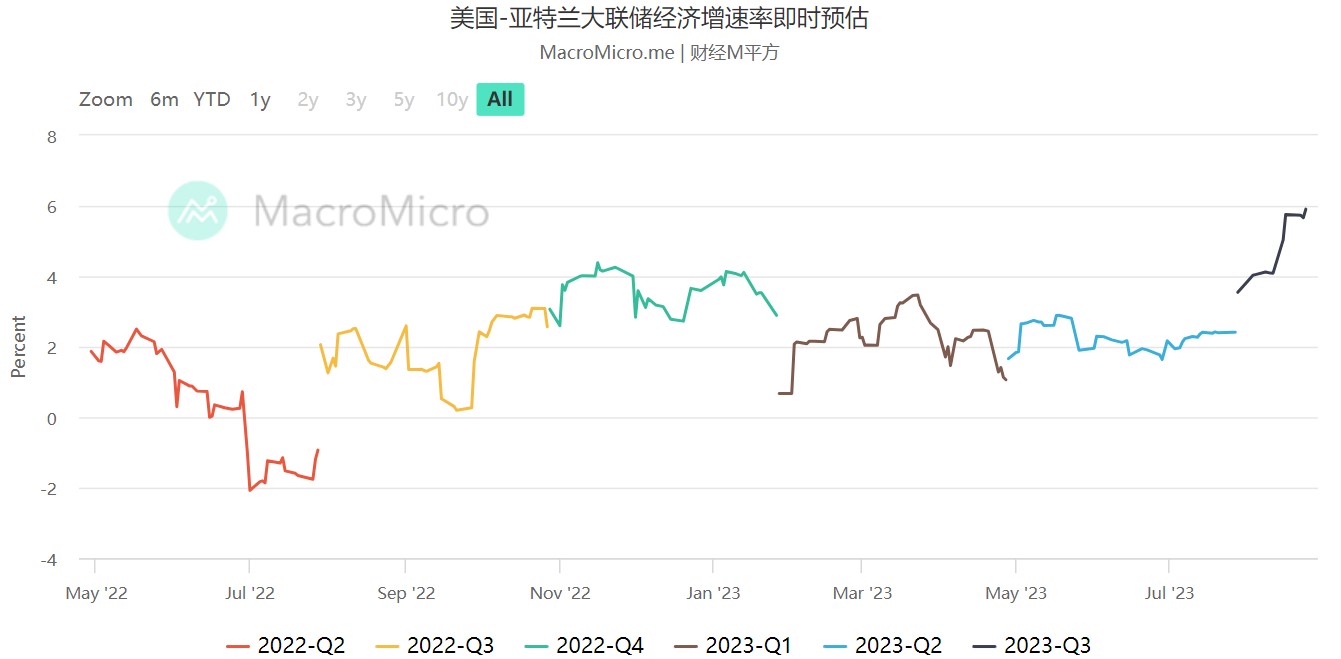

Opinions from institutions are "stalemate": the Atlanta GDP model predicts that the US economy will grow by 5.8%, but Fitch Ratings has downgraded the US credit rating.

The US Atlanta Fed model GDPNow predicts that the US GDP growth rate for the third quarter based on currently available data is 5.9%. However, the market believes that the data used in the model's prediction (July retail sales, auto sales, housing starts, etc.) only reflect the short-term situation, and the model's predictions will follow adjustments as future data is released and revised.

On one hand, the model provides super-optimistic expectations, but on the other hand, Fitch Ratings has downgraded the credit ratings of municipal bonds related to US sovereign ratings to "AA+", marking the first downgrade of the US credit rating since Fitch Ratings released this rating in 1994. Blackstone Group's Su Shimin also agreed with this, stating that Fitch's downgrade behavior is "in line with the data". Fitch not only downgraded municipal bonds, but also indicated the possibility of downgrading the ratings of dozens of US banks, including JPMorgan Chase. Institutions generally have reservations about the long-standing fiscal problems and debt problems of the federal government, and Fitch's downgrade of ratings may be a concentrated manifestation of this dissatisfaction.

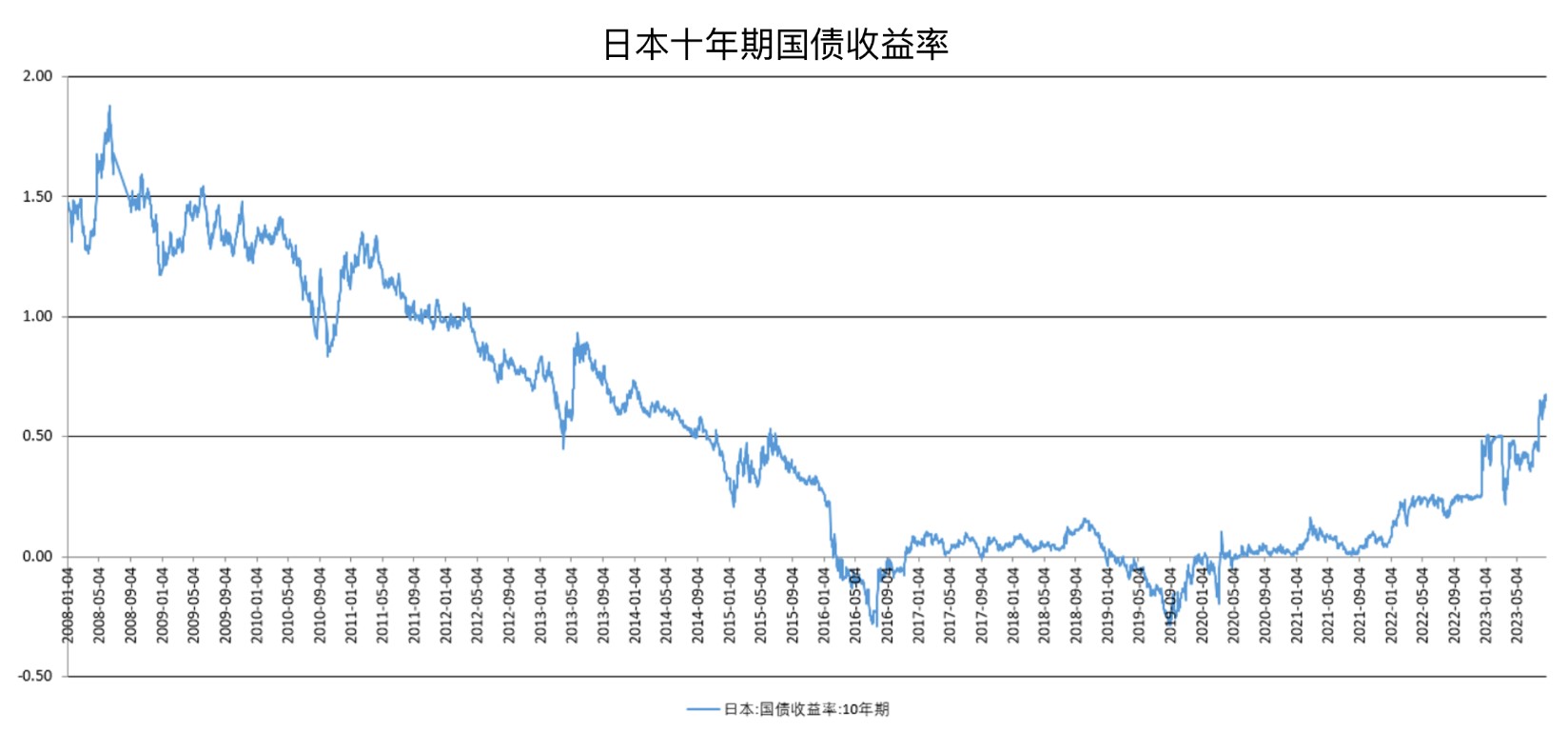

In August, the skyrocketing yields of US bonds have become a "beautiful landscape" in the global financial market, with both short-term and long-term bond yields surging. The yields of US 10-year and 30-year Treasury bonds have reached their highest levels since 2007 and 2011 respectively; short-term bond rates such as 1-year, 2-year, and 5-year remain high and have been hovering at high levels for several months.

It's not just US Treasury bonds, the bond yields of countries such as Japan and Germany are also remaining high.

Why did US bond yields soar so rapidly? The recent increase in the interest rates of government bonds is likely a quick response to the possibility of rate hikes. The US economy continues to be strong and many scholars no longer anticipate a recession in the US this year. This has fueled market expectations of another rate hike by the Federal Reserve, leading to a continuous rise in interest rates. In addition, Fitch Ratings believes that the deterioration of government fiscal risks has eroded market confidence in US bonds, inevitably resulting in an increase in the cost of US bond financing.

The soaring US bond yields have put significant pressure on risk assets. This month, the three major US stock indexes have all experienced declines, and risk assets such as Bitcoin witnessed a concentrated sell-off on August 18th, but have yet to recover from the losses. Although "the global AI leader" NVIDIA has continued to trade at high levels and reached new highs, other technology heavyweights have shown a sustained downward trend. In NVIDIA's second-quarter report released this month, its revenue doubled year-on-year, exceeding expectations by 22%. EPS earnings increased more than fourfold year-on-year, surpassing expectations by nearly 30%. Third-quarter revenue guidance is expected to be $16 billion with a year-on-year increase of 170%, higher than market expectations by 28%. Subsequently, NVIDIA unexpectedly announced a $25 billion share repurchase program, causing a shock in the market and sparking endless speculation among investors. Various institutions have raised their price targets for NVIDIA, with the most optimistic bulls raising their price target to $1100 (Rosenblatt).

As the "largest arms dealer of the AI era," NVIDIA's momentum is unstoppable. Indeed, AI is still the most certain and expansive new track in the US stock market under the pressure of US bonds. Generally, when a giant corporation exceeds market expectations for two consecutive quarters, it is an important signal indicating good synergy between the upstream and downstream sectors, namely, the formation of the industry chain. AI may be the track with the highest certainty in the US stock market under the suppression of US bonds, and it may attract institutional investors to flock to it.

The cryptocurrency market is currently showing signs of a bottom.

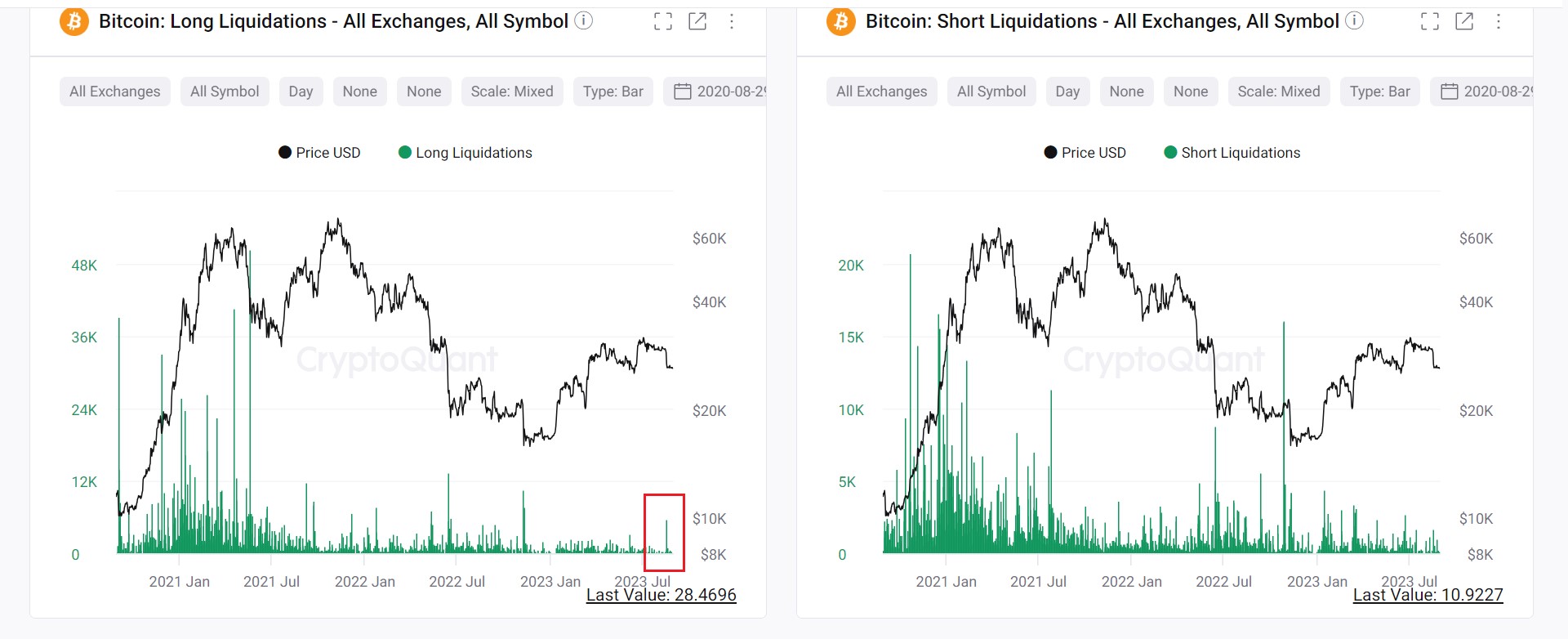

First, in August, the price of Bitcoin suddenly plummeted, causing the liquidation of long positions and intensifying speculation in the market. On the 18th, the cryptocurrency market experienced an "earthquake": major mainstream coins crashed, with Bitcoin hitting a low of 24220 USDT and ETH hitting a low of 1470.53 USDT, and they have yet to recover from the decline. As mentioned earlier, this crash was mainly due to the concentrated release of risk-aversion sentiment, rather than caused by certain news. During this crash, the total liquidation amount across all exchanges reached 990 million US dollars within 24 hours, an increase of 737.87% compared to the previous trading day, indicating a significant increase in the liquidation of long positions.

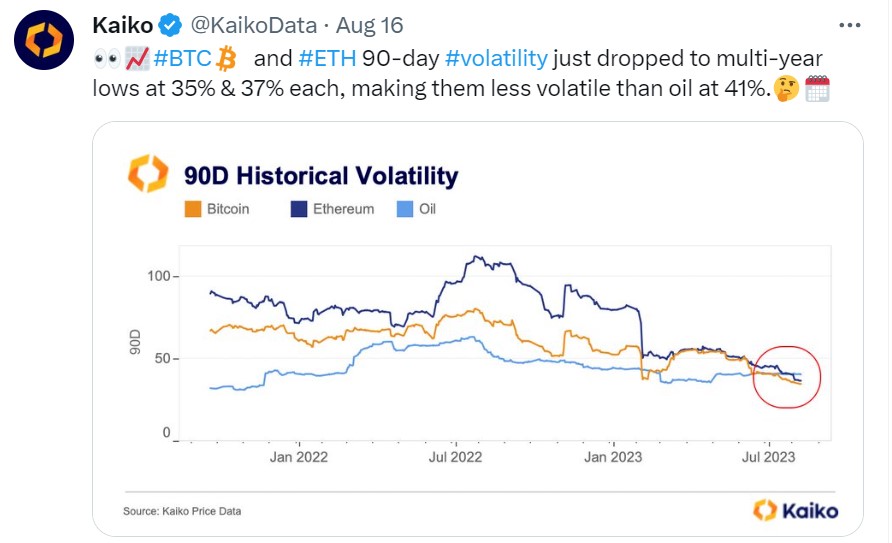

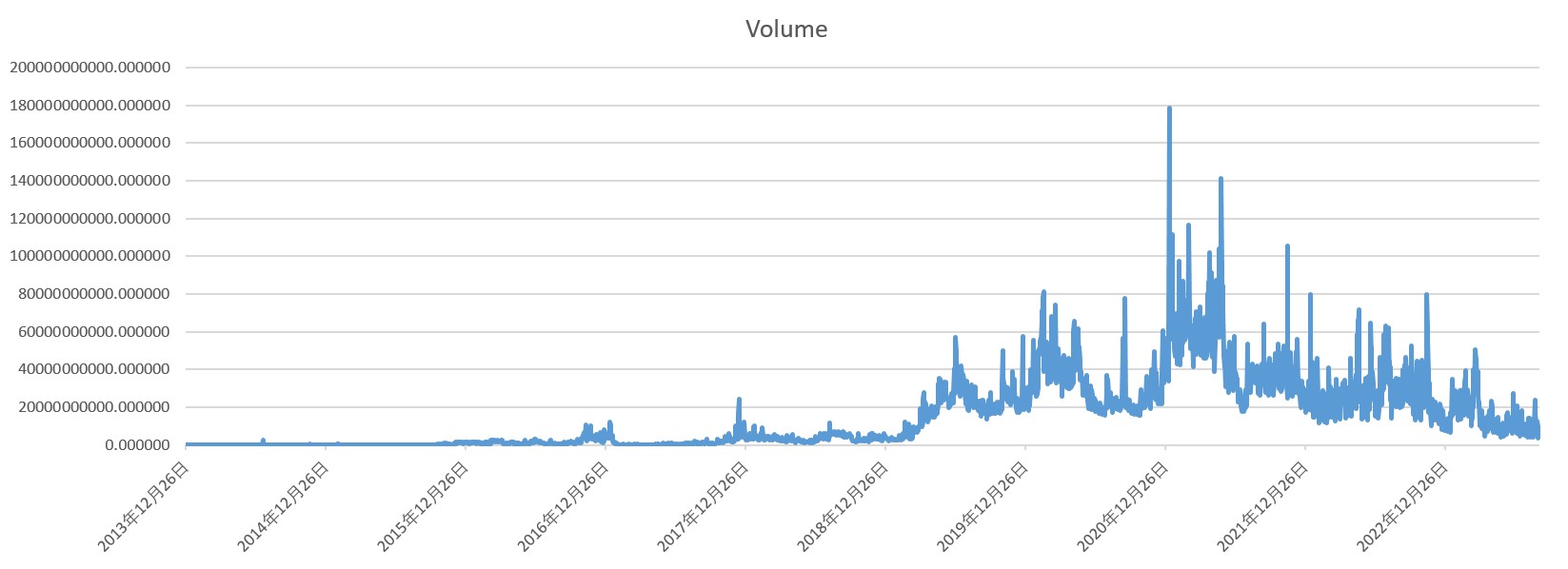

Secondly, the volatility and trading volume of Bitcoin are both at historic lows, and the price performance is sluggish. This month, European asset management company Jacobi launched the Jacobi FT Wilshire Bitcoin Spot ETF, which debuted on the Amsterdam-based Pan-European Exchange on August 15th. However, the market has hardly reacted to this news and instead experienced a stampede-like crash. This has shown that the market sentiment is quite sensitive and lacks confidence. One of the characteristics of the bottom of the secondary market is being insensitive to positive news but highly sensitive to negative news, making it prone to pessimistic stampede-like crashes. Currently, both from the market perspective and sentiment perspective, the possibility of the cryptocurrency market bottoming out is relatively high.

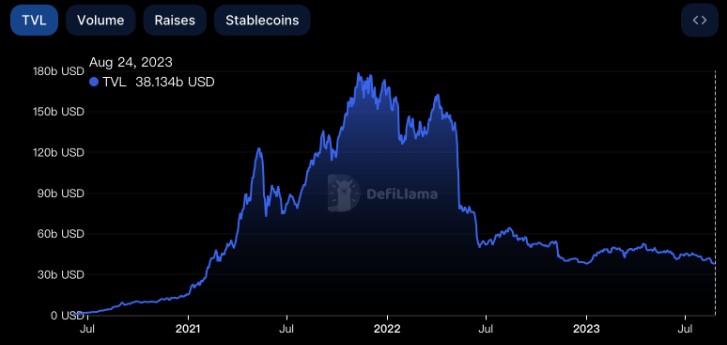

In addition, the Total Value Locked (TVL) in DeFi has been continuously declining this month, reaching the lowest point since February 2021, currently about 38.134 billion US dollars. Compared to the peak of over 170 billion US dollars during the 2021 DeFi Summer, it has dropped by more than 70%.

On the other hand, from a global perspective, the Web3 industry has been thriving. Since the beginning of this year, nearly 10 major financial institutions, including BlackRock, have submitted Bitcoin spot ETF applications to the SEC. On August 30th, there was news that a federal court in the United States approved the launch of the first Bitcoin ETF by cryptocurrency fund Grayscale Investments in the United States, and the court overturned the SEC's decision to block the ETF, paving the way for the first Bitcoin ETF.

At the same time, crypto regulations around the world are becoming more comprehensive, especially in Hong Kong where the crypto market is advancing rapidly. From the vice president of Hong Kong University of Science and Technology calling for government support for a stablecoin pegged to the Hong Kong dollar, to Secretary Paul Chan Mo-po stating that they are actively exploring stablecoin regulations, and to HashKey Exchange supporting compliant account opening and trading for Hong Kong residents, Hong Kong's crypto-friendly environment is progressing rapidly. Currently, the first batch of licensed cryptocurrency exchanges in Hong Kong have been established, with HashKey Exchange and OSL Digital Securities announcing their approval by the Hong Kong Securities and Futures Commission in August, allowing them to provide virtual asset trading services to retail users. As one of the three major financial centers in the world, Hong Kong's role in promoting compliant digital asset trading sets an example and gives us hope for the future of crypto assets.

The economies of China and the United States are currently undergoing a "divergence" phase, with the resilience of the US economy combining with temporary pressure on the Chinese economy, casting uncertain shadows over global investors. Safe-haven sentiment has dominated the global secondary market this month, resulting in underwhelming performances in both US stocks and Chinese A-shares, and the crypto market has experienced a sharp decline that has caused many to go bankrupt.

However, there are clear signs of the bottoming out of the crypto market, and the sentiment is experiencing the most difficult "darkness before dawn". From the establishment of the first licensed cryptocurrency exchanges in Hong Kong to the upcoming release of a Bitcoin spot ETF, these are all indicative of the ongoing development of Web3. From a market perspective, the current round of cryptocurrency market has been showing a trend of volatile upward movement, and there may be events in the future that will stimulate the price to break the $30,000 resistance level, thus ushering in a new wave of growth.

Copyright statement: If you need to reproduce, please contact the assistant on WeChat. Without permission, any reprinting or plagiarism will be subject to legal liability.

Disclaimer: The market carries risks, and investment should be approached with caution. Readers should strictly adhere to local laws and regulations when considering any opinions, views, or conclusions mentioned in this article. The above content does not constitute any investment advice.