friend.tech detonates the Base ecosystem, these ten projects deserve special attention

Original |

Author | Qin Xiaofeng

Leveraging Coinbases network effect, the L2 expansion solution Base network expanded rapidly in the bear market.

Since the launch of the mainnet on August 10, in just two weeks, Base mainnet TVL has reached US$240 million, currently ranking fifth in L2, second only to Arbitrum, OP Mainnet, zkSync Era and dYdX. Tom Wan, a data analyst on the 21co chain, wrote that in terms of the L2 Ethereum penetration rate indicator, Base took far less time to grow than Arbitrum and Optimism - reaching a penetration rate of 0.25%. Arbitrum took 9 months, and Optimism took about 8 months, Base takes about 1 month.

Jesse Pollak, head of the Base protocol, said that more than 100 DApps and service providers have joined, further strengthening the Base ecosystem. Unlike other L2 protocols, Base officials have made it clear that they will not issue coins, so the expectations for airdrops have been greatly reduced. If you want to obtain the early dividends of the new ecology, you can only place your hope on the ecological project itself.

In this issue, Odaily has selected ten key projects on the Base network for readers’ reference. Screening criteria for the project part: (1) Base network native projects with high TVL, old multi-chain deployment projects such as Uniswap and Compound are not included in the statistical scope; (2) Have received Coinbase Venture investment, have great potential, and have been launched on the Base network ; (3) Base is a well-known project with explosive network popularity and a large number of users. As follows:

Project name: friend.tech

Official website:https://www.friend.tech/

Introduction: friend.tech is a decentralized social platform that allows users to buy and sell the shares of other users in the network. It is essentially a bet on the influence of big Vs; investors who buy the shares of big Vs You will be given direct access to that users content and messaging with that user. Previously, friend.tech announced the completion of seed round investment, with Paradigm participating.

Dune data shows that friend.techs current trading volume exceeds 40,000 ETH, and its protocol revenue reaches 1,824 ETH (approximately US$3.03 million), ranking first in the Base ecosystem; the Total Friend Value totals 12,692.7 ETH, approximately US$21.1 million.

It should be noted that friend.tech has not released tokens yet, but it will airdrop points to users every Friday. friend.tech will distribute 100 million points during the six-month test phase. Each airdrop will take place on Friday. The points will be recorded off-chain and will have a special purpose after the test phase is over - possibly redeemed for tokens.

Project name: BaseSwap

Official website:https://baseswap.fi/

Introduction: BaseSwap is a decentralized trading platform and claims to be built by the Base team - but it has not been confirmed yet. It uses a dual-token model: the platform currency BSX and the revenue token BSWAP. The platform provides the following services: (1) Transaction, quick exchange of tokens with a fee of 0.25%; (2) Liquidity provision, becoming an LP; (3) Pledge service, supporting USDC, WETH and BSX pledges; (4) Farm, supports LP pledge to obtain BSWAP tokens; (5) Cross-chain bridge, supports cross-chain transfers across 8 networks including Base; (6) NFT market, trades Base network NFTs.

DefiLlama data shows that BaseSwap’s current TVL is US$54.39 million, ranking first in the Base ecosystem.

Project name: SwapBased

Official website:https://swapbased.finance/

Introduction: SwapBased is a one-stop trading platform that has issued the platform currency BASE (not the official token of Base, please do not confuse it). It currently provides the following services: (1) Token trading, charging a fee of 0.3%; (2) Liquidity provision; (3) Farm, supports LP pledge to obtain BASE income; (4) Cross-chain bridge, provides 32 chain transfers; (5) Perpetual contract, supports up to 30 times leverage, currently online ETH/USD Trading pairs, trading volume exceeds $1.7 million, and more than 120 users.

DefiLlama data shows that SwapBased’s current TVL is US$21 million, ranking second in the Base ecosystem.

Project name: Alien Base

Official website:https://www.alienbase.xyz/

Introduction: Alien Base is a decentralized trading platform based on the Base network, providing Swap, liquidity provision and staking functions. Alien Base’s liquidity mining program allows users to provide liquidity and stake LP tokens (currently 10) to earn ALB tokens; staking ALB tokens can also earn rewards and platform revenue, up to 50% of platform fees Will be owned by DAO. DefiLlama data shows that Alien Base’s current TVL is US$16.6 million, ranking third in the Base ecosystem.

Project name: Maverick Protocol

Official website:https://app.mav.xyz/boosted-positions?chain=8453

Introduction: Maverick Protocol is a decentralized trading protocol that adopts the dynamic distribution AMM model. It can dynamically adjust the asset distribution in the liquidity pool according to market demand. It is the only one in the market that can achieve optimal liquidity efficiency and optimal price. AMM model for discovery, optimal capital control and optimal cross-chain interoperability, while supporting high-speed, low-cost, and secure cross-chain transactions. Currently, Maverick Protocol supports Base, Ethereum, BNB Chain and zkSync Era, and the TVL on the Base chain is US$1.25 million.

In June this year, Maverick completed US$9 million in financing, led by Peter Thiel’s fund, with participation from Pantera Capital, Binance Labs, Coinbase Ventures and Apollo Crypto.

Project name: WOOFi

Official website:https://fi.woo.org/

Introduction: WOOFi is an all-in-one decentralized application (DApp) built by WOO Network that aims to optimize users experience with DeFi by providing ultra-low slippage, competitive exchange fees, and other useful features. On August 15, WOOFi announced the launch of the Base mainnet, which will provide traders with competitive quotes through the composite active market making model and provide seamless cross-chain exchange services. Users can now cross-chain assets from 6 chains through WOOFi. Base network. Additionally, WOO token stakers will receive 80% of transaction fees and the remaining 20% will be paid to brokers.

In terms of financing, WOO Network raised US$30 million in November 2021, with participation from BitTorrent, Avalanche, Crypto.com Capital, etc.; in February 2022, WOO Network completed a US$12 million Series A financing, led by Binane Labs.

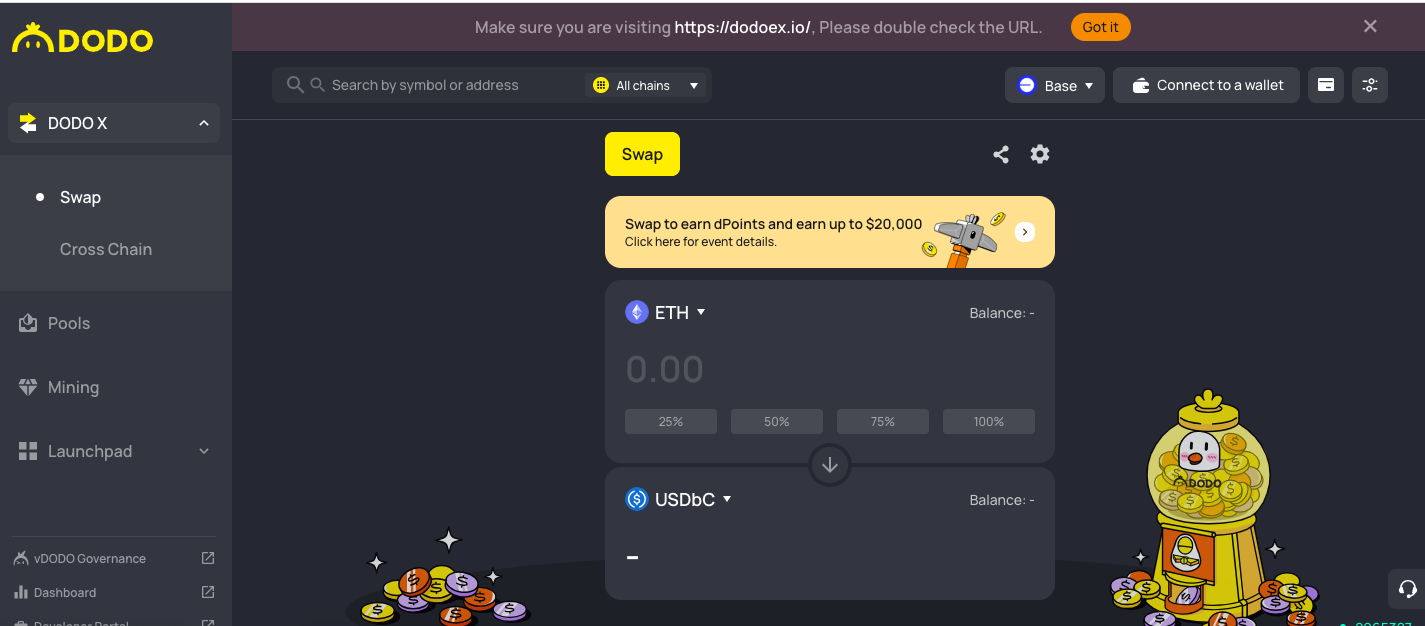

Project name: DODO X

Official website:https://dodoex.io/zh

Introduction: DODO Currently, DODO ) limit order, users can create a limit order to exchange desired tokens at a specific minimum price (i.e. limit price). Only when the market price reaches the limit price set by the user, the transaction will be executed; (3) Trading widget, allowing users to build customized front-end interfaces and embed them into DeFi applications to achieve rapid asset exchange, etc. Multiple uses; (4) Trading API, allowing users to use intelligent routing algorithms to obtain efficient third-party token exchange routes to find the best price on the chain.

Project name: Magnate Finance

Official website:https://www.magnate.finance/

Introduction: Magnate Finance is a decentralized lending protocol based on the Base network. It uses a dynamic interest rate model to create a more capital-efficient risk management pool and supports a variety of collaterals, including encrypted tokens, stable coins, synthetic assets, and NFTs. , and other various assets - currently four types of cryptocurrency lending including ETH, WETH, USDC, and DAI are online.

Official website data shows that Magnate Finance TVL is currently 16.48 million, ranking first in the Base ecological lending protocol track. The project plans to expand to the Arbitrum ecosystem in the next step. The governance token of Magnate Finance is MGA, which is currently online with a circulating market value of US$1.5 million.

Project name: Moonwell

Official website:https://moonwell.fi/

Introduction: Moonwell is an open lending DeFi protocol based on Moonbeam and Base. Similar to lending products such as Aave, MakerDAO and Compound, it allows users to over-collateralize and lend cryptocurrency. After launching the Base mainnet, Moonwell TVL once rose to more than 20 million US dollars, and now it has fallen back to 15.2 million US dollars, ranking second in the Base ecological lending track.

The project co-founder Luke Youngblood is a former Coinbase senior staff engineer and AWS chief engineer. In April 2022, Moonwell completed a US$10 million private placement financing with a valuation of US$90 million. The investment was jointly led by Hypersphere and ArringtonXRPcap, with participation from Coinbase Ventures and others.

In terms of tokens, Moonwell issued the governance token WELL in May 2022. The public offering was fully unlocked in May this year, and the current circulating market value is US$5.05 million.

Project name: EDE Finance

Official website:https://www.ede.finance/

Introduction: El Dorado Exchange (EDE) is a decentralized spot and perpetual trading platform with dynamic pricing powered by the PYTH oracle.

EDE draws on the GMX mechanism and currently uses two ELP pools including different assets to support transactions. Users can earn income by making markets, providing liquidity for Swap and leverage transactions, and can also freely choose to mint different ELP tokens. Assets can also be redeemed by burning them. EDE also provides users with more convenient ELP transactions, users can directly use a single asset to buy or sell ELP. EDE is the utility token of the platform. Stake EDE to get the governance token gEDE, as well as EUSD and EDE rewards. Users can stake EDE for 7 days to 4 years. The longer the stake, the more EUSD and EDE rewards you will get.

DefiLlama data shows that EDE’s current TVL is less than US$1 million, ranking second among Base ecological derivatives protocols.