The 8% return rate is very attractive, but it will soon be a thing of the past.

With the activation of Enhanced Dai Savings Rate (EDSR) at 8%, DAI has attracted a massive inflow of funds in the past few days, with many whales (represented by Mr. Sun) and retail investors rushing in, trying to share this rare low-risk, high-yield "cake".

However, unfortunately, the 8% yield, although enticing, is likely to soon become a thing of the past, considering the current on-chain data and the MakerDAO community's intentions.

Possible short-term adjustment: 8% > 5.58%

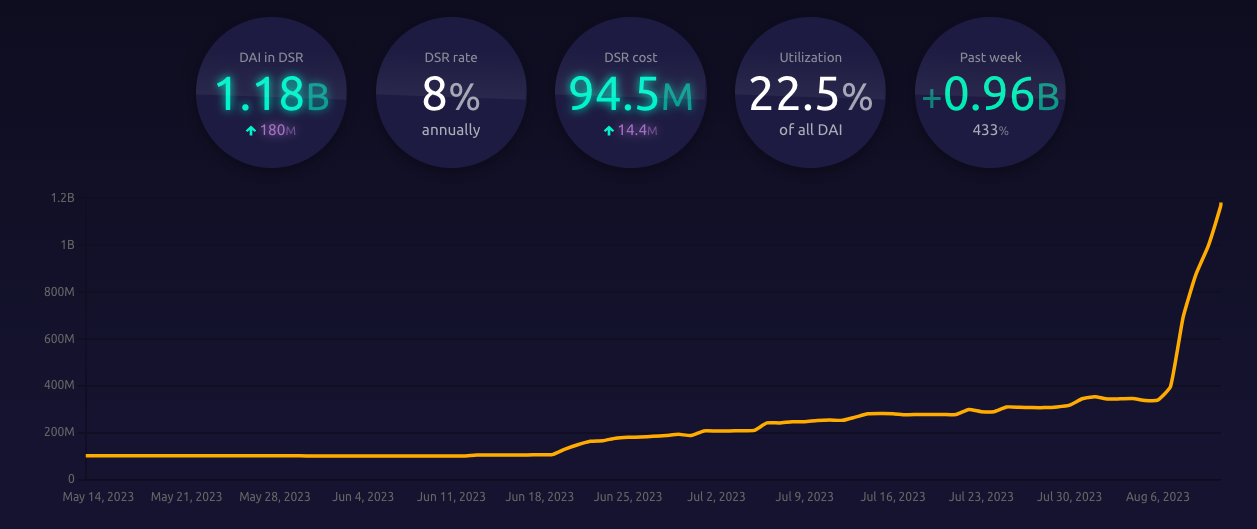

Makerburn data shows that as more DAI is deposited into the DSR contract, the overall utilization rate of the current DSR contract (the amount of DAI in the DSR contract / total DAI supply) has exceeded the threshold of 20%, with the current value at 22.5%.

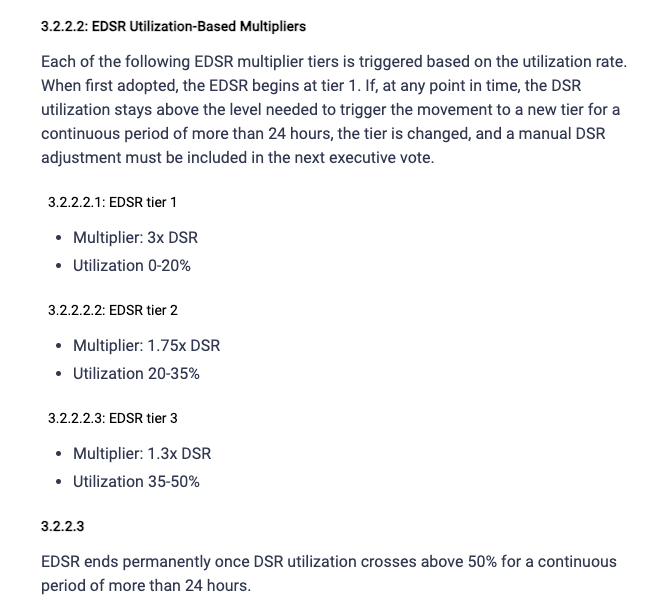

According to the previous design proposal from the MakerDAO community for the EDSR value, the amplification factor of EDSR will dynamically change based on four different scenarios of DSR utilization rate, as follows:

When the DSR utilization rate is below 20%, the amplification factor of EDSR is 3 times the base Dai Savings Rate (commonly referred to as "DSR"), but with a maximum cap of 8%. Since the current base DSR value is 3.19%, the EDSR value within this range will only be 8%;

When the DSR utilization rate is between 20% and 35%, the amplification factor of EDSR is 1.75 times the base Dai Savings Rate, so the EDSR value within this range will be approximately 5.58%;

When the DSR utilization rate is between 35% and 50%, the amplification factor of EDSR is 1.35 times the base Dai Savings Rate, so the EDSR value within this range will be approximately 4.15%;

When the DSR utilization rate exceeds 50%, EDSR will no longer be effective, and the contract will only use the base DSR value, which is 3.19%;

All the above dynamic changes will take effect after the DSR utilization rate has been in a certain range for 24 hours.

Combining the above design, it can be seen that the DSR utilization rate has now risen to the range of 20% - 35%. If it continues for 24 hours, EDSR is expected to decrease from 8% to 5.58% soon.

Long-term adjustments possible: 8% > 5%

As for why there may be another potential adjustment in the long run, it is because on August 9th, MakerDAO founder, Rune Christensen, has proposed (currently in the early discussion stage) to change the original EDSR value design scheme.

The reason for making this change is that Rune and other community users have found that although an 8% interest rate does effectively increase the demand for DAI, it has also bred a large number of loan arbitrage, which has led to most of the profits flowing to whale addresses rather than ordinary DAI holders.

The specific arbitrage operations involve MakerDAO's first SubDAO project, Spark Protocol.

Spark Protocol is a decentralized lending protocol forked from Aave, which allows users to borrow at the base DSR rate (i.e., 3.19%). It is obvious that there is a significant arbitrage space between the 8% interest rate within the DSR contract and the 3.19% loan costs within the Spark Protocol. As a result, a large number of whale addresses have begun to choose to borrow DAI from Spark Protocol and deposit it into the DSR contract, thereby amplifying their own profit situation.

In response to this, Rune proposed three improvement measures.

The first is to lower the upper limit of EDSR from 8% to 5%, and at the same time, change the dynamic adjustment scheme of EDSR with the DSR utilization rate. The new scheme is as follows:

When the DSR utilization rate is in the range of 0% - 35%, EDSR will increase with a multiplier of 3, but will not exceed 5%;

When the DSR utilization rate is in the range of 35% - 50%, EDSR will increase with a multiplier of 1.3;

When the DSR utilization rate exceeds 50%, EDSR will no longer take effect.

The second is to increase the loan interest rates of the Spark Protocol (excluding ETH-A, ETH-B, ETH-C pools) from the basic DSR value to the real-time EDSR value (it is expected to be increased to a maximum of 5% based on the current utilization rate), in order to prevent potential loan arbitrage activities.

The third is a compensatory measure. Since increasing loan interest rates will inevitably increase the costs for the lenders, Rune proposes to provide potential Spark Protocol tokens (SPK) as a retroactive airdrop for the lenders.

A Few Words about SPK

Regarding the potential airdrop mentioned earlier, let's talk a bit more about it.

On August 10th, Rune once again posted an article in the community, introducing the potential SPK pre-mining airdrop plan of the Spark Protocol. He pointed out that the statistics of the airdrop should start from when the loan interest rates are increased to 5% (i.e., the maximum EDSR value), and the specific allocation will be calculated based on the amount and duration of users' loan assets.

In addition, Rune also supplemented the economic model design for all SubDAO tokens, including SPK, in the article.

The article points out that each SubDAO will distribute 2 billion tokens through liquidity mining in the first ten years after the token generation event (TGE), with an annual distribution of 500 million tokens in the first two years, 250 million tokens in the next two years, 125 million tokens in the following two years, and 62.5 million tokens in the last four years.

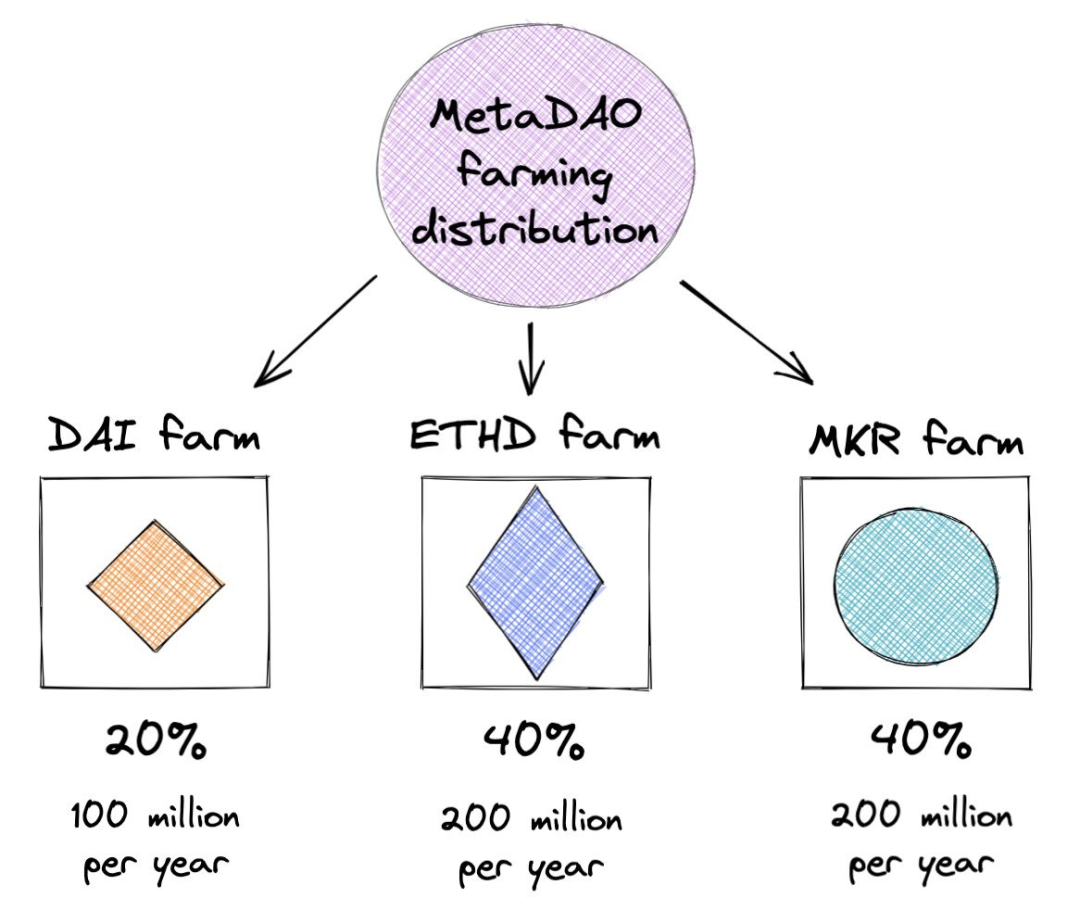

According to MakerDAO's disclosed Endgame Plan from last year (subject to potential changes), 20% of the liquidity mining for SubDAO (which was called MetaDAO at that time) tokens will be allocated to the DAI pool, 40% to the ETHD (the LSD token planned by MakerDAO) pool, and 40% to the MKR pool.

Considering the expanding business scale of the Spark Protocol, SPK might soon become the first SubDAO token to be launched. Whether it's for the hidden airdrop or to grab the initial mining opportunity, it's probably time to make some preparations in advance.