Deep Dive into Coinbase Q2 Financial Report: What Did the Data and Conference Calls Say?

Financial Report Data

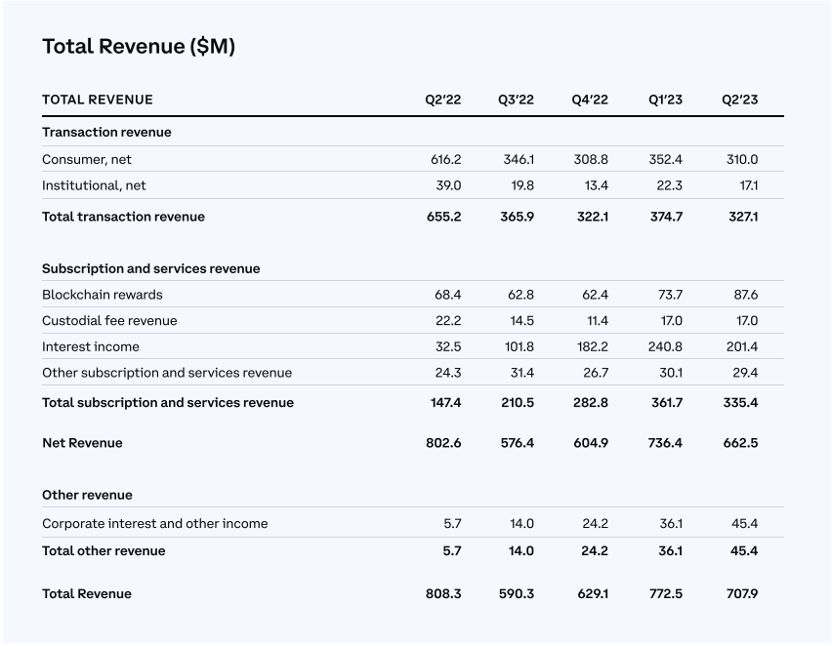

In the second quarter of this year, Coinbase's performance (COIN) exceeded market expectations. The reported revenue reached $708 million and the adjusted loss per share was $0.42, surpassing the market's expected revenue of $628 million and loss per share of $0.76. However, despite the overall revenue exceeding expectations, trading revenue and trading volume decreased to $327 million and $92 billion respectively, both lower than the first quarter.

On the revenue front, Coinbase's financial situation underwent significant changes in the second quarter of this year. Subscription and service revenue (including custodial fees, interest income, and staking revenue) reached $335 million, accounting for 51% of total net revenue. This is the first time in the company's history that non-trading revenue has surpassed trading revenue. Nevertheless, some key aspects of the subscription and service business, such as interest income, showed a decline in market value. Among them, $151 million of interest income in the second quarter came from its holdings of USDC.

In the second quarter, Coinbase's institutional trading revenue was $17 million, a decrease of 24% compared to the previous quarter. Institutional trading volume was $78 billion, a decrease of 37% compared to the first quarter. The decline in institutional trading volume was mainly due to a decrease in market trading volume (including market-maker trading volume on the trading platform) caused by low volatility. However, trading volume on Coinbase Prime continued to grow, which contributed to higher average fees in the second quarter compared to the first quarter.

Coinbase second quarter revenue data. Source: Coinbase Official Website

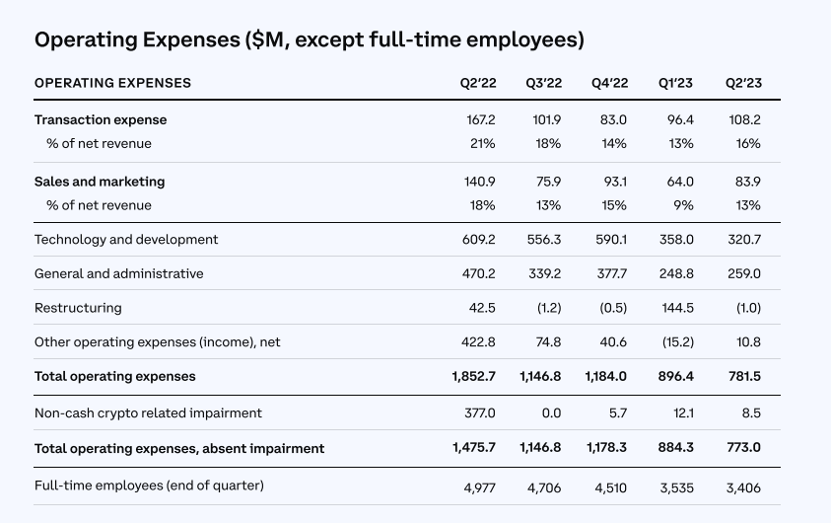

Regarding costs, Coinbase continues to focus on higher costs and efficiency. The total operating expenses for the second quarter were $781 million, a quarter-on-quarter decrease of 13%. Among them, recurring operating expenses - including technology development, sales and marketing, and general administrative expenses - decreased by 1% to $664 million.

In the second quarter, Coinbase's transaction expenses were $108 million, a quarter-on-quarter increase of 12%. The main drivers of the expense increase were the increase in staking rewards paid to consumers and the rise in miner fees due to increased Ethereum network activity. Transaction expenses accounted for 16% of net revenue in the second quarter, up from 13% in the first quarter. This increase is due to the shift in revenue composition towards blockchain reward income and the increase in miner fees.

Coinbase second quarter expense data. Source: Coinbase official website

In terms of trading volume, although Coinbase's stock price has risen by 160% this year, it has not changed its challenges in trading volume. The total trading revenue in the second quarter decreased by 50% to $327 million, compared to $655 million a year ago. The ratio of individual to institutional trading volume remains unbalanced. Institutional trading volume accounted for 85% of the total, reaching $78 billion, while retail consumers accounted for only $14 billion. Despite the rebound in cryptocurrency prices, it did not attract more traders to return to the Coinbase platform for trading, and the monthly number of trading users decreased by 19% to 7.3 million in the second quarter.

Key questions for earnings and analyst conference calls

Below are some key questions taken from a phone conference, and Coinbase's CEO Brian Armstrong and CFO Alesia Haas, among other executives, have provided answers to these questions.

Investor Relations Vice President Anil Gupta: Our next question is, how does Coinbase plan to generate revenue directly or indirectly from the upcoming Base L2 platform? Will this harm trading volume by encouraging more users to move off Coinbase and transact on-chain? Brian?

Co-founder and CEO Brian Armstrong: Yes, I can answer that question. First, I'd like to correct a misconception within the question itself. So the question is, will more users leave Coinbase to transact on-chain? Coinbase fully embraces on-chain transactions. In fact, I believe it will be the simplest way to access everything you want to do on-chain. This is not something new. It has been the case for a long time, even when Coinbase launched 10 years ago, we allowed people to transact on-chain when sending and receiving transactions while you were logged off the platform.

Furthermore, in recent years, we have enabled people to access decentralized exchanges, various smart contract protocols through Coinbase Wallet, and we have made this increasingly easier in our major retail applications. So, just to clarify, we want Coinbase to be the easiest way to access everything on-chain. We see on-chain as a very important part of the industry's future development. People will achieve this through Coinbase. So, these projects are not contradictory.

I think the key essence of this question is really about how we directly and indirectly monetize through Base (our Layer 2 solution). Just to provide a brief introduction for those who may not be fully aware, blockchain transactions are happening on what we call Layer 1. They often take longer to confirm and have slightly higher transaction fees. Therefore, the industry has been researching for a long time on how to make it more scalable, reduce costs, and make it easier for developers to build on what we call Layer 2.

This is similar to how the internet transitioned from dial-up to broadband. As a company driving innovation, Coinbase has been trying to facilitate this transition. Building on top of the Optimism stack, we have launched our own Layer 2 solution called Base, which will decentralize over time. There has been a lot of developer interest, and we are actively engaged in activities around this.

So how do we make money with it? In simple terms, Base will generate revenue through what is known as sorter fees. Whenever any transactions are performed on Base, these sorter fees can be earned, essentially, Coinbase can run such a sorter over time just like anyone else. Indirectly, it also helps us generate revenue because it helps us grow the market. It helps us expand the ecosystem. Again, it goes back to these internet analogies. However, if we can improve so much utility as to make global payments faster and cheaper, more and more people will use cryptocurrencies every day, and that is how it indirectly helps grow our business.

Anil Gupta: Next question. The recent enforcement actions remain a significant concern for many stakeholders. With this in mind, could you provide an update on the litigation process with the SEC? What are the key issues? How should we view the future timeline and milestones? Paul?

Chief Legal Officer Paul Grewal: Thank you, Anil. Regarding the litigation with the SEC, I want to be clear that we do believe we can win. We expect to win. But it's important to understand that our focus is not just on the litigation but also on all our interactions with the SEC and the entire US government. Our goal is to achieve regulatory clarity, protect consumers, foster innovation, and establish clear pathways and rules that everyone can understand and follow. We believe that regardless of the outcome of any particular case, this is the way we all win. That's why, while we are focused on the enforcement actions, we are also looking at legislation and other efforts that could provide the clarity I mentioned earlier.

Now, why are we so focused on driving regulatory clarity in the US? It's because in the current state of affairs, we have received very conflicting messages about the laws, especially considering that these laws were enacted before the internet existed. Take, for example, the conflicting statements from the SEC chairman and the CFTC chairman regarding whether Ethereum is a security. Or consider how the SEC chairman's position on whether there is regulatory authority applicable to cryptocurrency exchanges like Coinbase has changed significantly over the past two years. Therefore, in any particular case, the result is the regulatory clarity that we ultimately define as victory...

In fact, tomorrow, in our case in the Southern District of New York, we will be asking the court to dismiss the entire case. We will submit a brief outlining all the arguments we present to the court for consideration, which we expect to file by the end of October. We are confident in the arguments we are presenting to the court. We certainly appreciate the opportunity for an early hearing that the court has given us, as we have been working hard for clarity.

Bank of America Jason Kupferberg: Your growth in collateral is really impressive, and I'm curious about what trends you're seeing in adoption. I'm guessing most of it is Ethereum, right? If you can provide more information on this, that would be great.

CFO Alesia Haas: We've seen good adoption in collateral. In the second quarter, one exciting thing we observed after the Shapella upgrade is a widespread adoption by our institutional clients once they can actually make their assets liquid on Ethereum. Clearly, a big barrier for their participation in collateral has been their inability to access liquidity. Therefore, we've seen a quick acceptance of these balances. As of the end of the second quarter, our institutional clients have collateralized approximately $2 billion worth of Ethereum. We have also noted stable growth in collateral balances for the quarter.

One point I'd like to comment on is that each chain tells a different story. So, every investor in each chain first wants to own that asset, and then once they have that asset, they'll decide if they want to collateralize it. So, this will depend on the growth and interest in each different proof-of-stake network. But we do see, especially on the institutional side, Ethereum becoming a growth driver.

KBW Kyle Voigt: Maybe we can come back to the question of retail rates. The commentary on the first quarter was that there were rate changes in the first quarter. I think that implies that the first quarter doesn't represent a run rate for simple transaction rates. So, I understand that most of the retail rate increase is related to the mix. But I also want to know if you can quantify how much of the increase in retail fees from the first quarter to the second quarter is due to the impact of rate increases fully implemented in the previous quarter?

CFO Alesia Haas: So we do internally consider and attribute it, but the vast majority of the impact is mixed. That impact outweighs any other changes in this quarter.

Kyle Voigt: It appears that customer fiat balances decreased by $1.5 billion this quarter. I'm curious about what drove this quarter-over-quarter change. And also, did the Coinbase platform experience net customer inflows or outflows in the second quarter?

CFO Alesia Haas: Speaking specifically to customer fiat balances, I need to go back and remind everyone what happened in the first quarter. In the first quarter, due to the banking crisis, we actually saw inflows of fiat this quarter. And these fiat inflows were primarily concentrated among a few institutional clients. So, large, bulk deposits came in at the end of the first quarter. When people perceived moving fiat from some challenged banks to Coinbase as safer, it generated a chase for quality assets. As we saw the banking industry stabilize, these funds flowed out in the second quarter.

Overall, if I expand from the first quarter to the second quarter, the fiat balance tends to track overall market activity. So, as we see lower volatility and declining trading volume, we naturally see a decrease in fiat currency on the platform. Our fiat balance at the end of the second quarter is similar to our fiat balance during other low volatility, low trading volume periods. Therefore, I think we should consider the second quarter to be slightly more normal, while the first quarter appears higher due to overall events in the banking market.

Coinbase Q2 Events and Summary

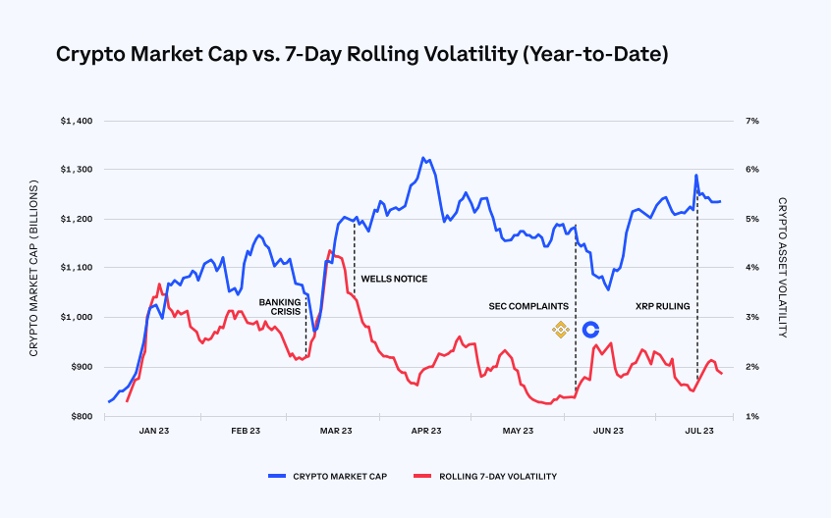

In terms of timeline, the major events Coinbase experienced in the second quarter were mainly the SEC lawsuit, so the downturn in data was expected. The US Silicon Valley Bank crisis and Wells notice occurred in the first quarter, and the XRP ruling that caused Coinbase's stock price to skyrocket happened in July. Its impact on Coinbase's revenue will be reflected in the third quarter, so it can be seen that Coinbase's outlook for the third quarter is good.

Correlation between crypto market total market capitalization and weekly volatility. Source: Coinbase Official Website

Overall, although Coinbase's overall financial performance in the second quarter exceeded market expectations, the decline in trading revenue and volume reflects the impact of reduced cryptocurrency market volatility. However, the company's subscription and service revenue performed well, surpassing trading revenue for the first time, indicating that Coinbase is diversifying its business model to adapt to market changes. For institutional clients, the decrease in trading volume is mainly due to reduced market activity. In terms of operating expenses, Coinbase achieved a sequential decrease and continues to focus on cost and efficiency improvements. Looking ahead, Coinbase will continue to adjust its business strategy to address the challenges and opportunities in the cryptocurrency market.