Original author: mysexylife.eth, Crypto KOL

Original translation: Felix, PANews

After the UST crash, many traders lost faith in decentralized stablecoins. Therefore, they will switch from one centralized stablecoin to another based on the current situation.

With the upcoming stablecoin protocols that use LST (Liquidity Staking Token) as collateral, greed may be triggered. Most of these protocols are currently far from UST. Many of them are even modified forks of Liquity. Currently, the CDP (Collateralized Debt Position) market is becoming increasingly huge and difficult to supervise, with replicas also present. This article is a tally of the stablecoin protocols that currently use LST as collateral, by crypto KOL mysexylife.eth.

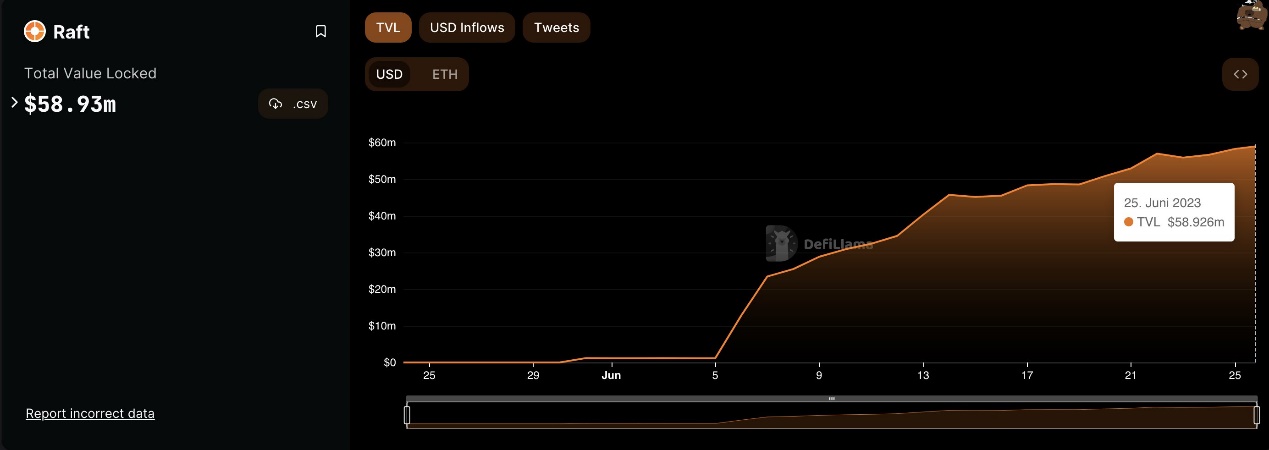

Raft

Built on Ethereum.

Collateral: wstETH, rETH

Stablecoin: R, market value of $31 million

Raft is a decentralized lending protocol that allows users to borrow stablecoin R using LST (currently supporting stETH) as collateral. Raft's product features include flash swaps and one-step leverage, with leverage of up to 11x.

Ethos Reserve

Built on Optimism.

Collateral: ETH, wBTC, OP

Stablecoin: ERN, market value of $3.4 million

Ethos Reserve will allow anyone to obtain interest-free loans in the form of ERN while generating yield using their collateral. Currently there is no LST, but it will be launched with v2.

Shade Protocol

Builds on Secret Network.

Collateral: stATOM, stOSMO, stkd-SCRT

Stablecoin: SILK, market value of $2.8 million

Shade Protocol is a privacy-focused DeFi application built on Secret Network. The privacy-protected stablecoin SILK is pegged to gold, bitcoin, and the US dollar using the algorithmic stablecoin model pioneered by Terra/Luna.

Vesta

Builds on Arbitrum

Collateral: ETH, wstETH, GMX, ARB, GLP, DPX, gOHM

Stablecoin: VST, market value of $7.3 million

Users can deposit assets as collateral based on their collateralization ratio (CR) to mint the VST stablecoin. The assets held in Vesta will enter the active pool. Vesta is still considered the best CDP protocol on Arbitrum by the author.

Prisma Finance

Builds on Curve ecosystem

Collateral: wstETH, cbETH, rETH, sfrxETH, and WBETH

Stablecoin: acUSD

The core need addressed by Prisma Finance is improving capital efficiency. Users can mint stablecoins through CDPs to leverage their exposure while retaining price volatility and yield of LST.

TapiocaDAO

Tapioca is a full-chain currency market built on LayerZero. Users can mint USD, a full-chain stablecoin: usd 0. Variable borrowing fees are used to incentivize arbitrageurs to maintain the peg.

Sable Finance

Sable Finance is a decentralized lending protocol where users can borrow the stablecoin USDS using BNB as collateral, with zero interest and a minimum collateral ratio of 110%. Loans are secured by a stability pool, which consists of USDS and guarantors, ensuring maximum protection. Compared to Liquity's original model, users can access additional sources of income.

Lucid Finance

Lucid Finance is a platform that provides a lending protocol for LST-LPT, with its stablecoin dUSD being over-collateralized. The project will initially launch on the Ethereum network and later operate on the Polygon, Arbitrum, and Optimism networks. Collateral includes LST and blue-chip LP tokens.

Seneca

Seneca is a full-chain independent lending market focused on collateral. The platform allows users to borrow senUSD using whitelisted, revenue-generating collateral, providing institutional-grade loans and leverage to maximize capital efficiency. The Seneca lending market operates with an independent debt pool. The Seneca protocol will launch on Arbitrum.