A glance at the encryption layout of Hollywood star Ashton Kutcher's Sound Ventures

Original Author: Zen, PANews

Original Author: Zen, PANews

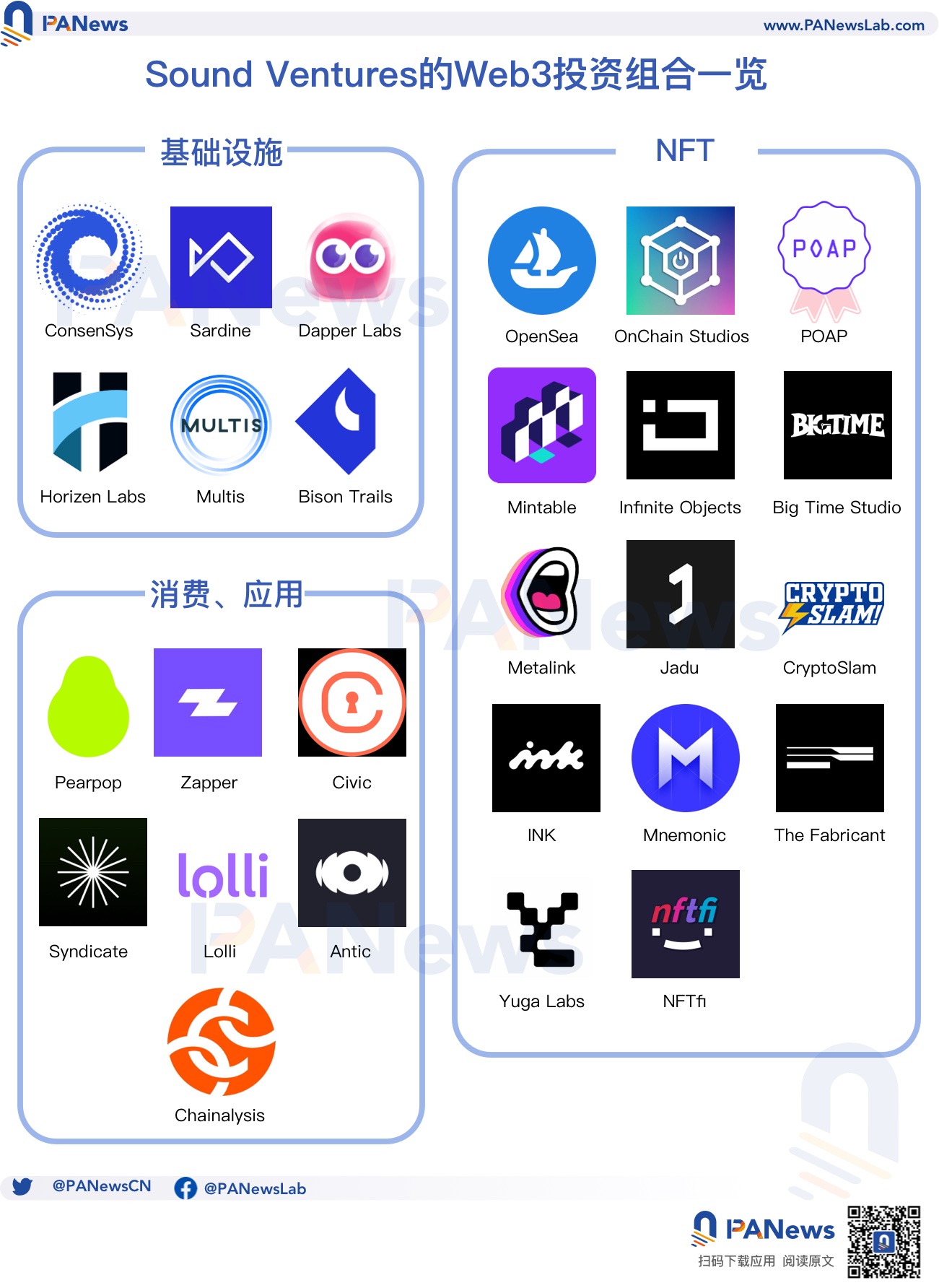

In May of this year, Sound Ventures completed the fundraising of its AI fund, which was oversubscribed by nearly 240 million US dollars. Sound Ventures currently manages more than $1 billion in assets, and has already "connected three yuan", investing in leading AI projects such as OpenAI, Anthropic and StabilityAI. In fact, it’s not just AI. Kutcher, who was an early “evangelist” for Bitcoin, led Sound Ventures, which is also an active member of the encryption industry. According to PANews statistics, he participated in nearly 30 financings, including ConsenSys, Well-known projects such as OpenSea, Chainalysis, Dapper Labs, and Yuga Labs.

first level title

From Hollywood stars to the most active tech investors

Ashton Kutcher is not the first celebrity in sports and entertainment to venture into investing, but he is one of the most active celebrity investors for more than a decade, and arguably the most experienced technology investor in Hollywood.

image description

Stills of Kutcher as Steve Jobs

Kutcher didn't get into investing because of his influence and connections after he became a well-known actor. In fact, after he founded the production company Katalyst in 2000, he began to participate in angel investment, and poached his digital director from the famous venture capital media TechCrunch, who introduced him to many famous people in Silicon Valley. Kutcher gradually began to strengthen his connection with the Silicon Valley technology and investment community. He spent 90% of his time listening, and gained a lot of experience and wealth in the process.

In 2009, Kutcher invested $1 million in instant messaging software Skype, a year and a half later, the company was acquired by Microsoft, quadrupling its market value, and the investment came from a16z co-founder and general partner Mark Anderson ( Marc Andreessen) proposal and invitation. Then, Kutcher took his investing career to the next level after seeking guidance from well-known Silicon Valley angel investor Ron Conway. "Ron, one of the godfathers of angel investing, completely opened up his portfolio to me and really started explaining how things work and what his strategy is," he says on his news and entertainment website A Plus. Probably my biggest mentor."

In 2015, Kutcher made a fresh start, announcing a new venture capital fund, Sound Ventures, during SXSW alongside Guy Oseary. Ronald Burkle, who had worked with Kutcher and Oseary and invested the most in A-Grade, did not serve as the general partner of Sound Ventures this time, nor did his assistants and fund managers participate in the business of Sound Ventures.

first level title

Bitcoin evangelist, focusing on interpersonal investment

After becoming a professional investor, Kutcher has often been able to grasp hot spots in technology. Before investing in the hottest new technologies such as AI, he was also an early evangelist of cryptocurrency. In 2014, a netizen asked on the question-and-answer site Quora: "What are the smart ways to effectively use my $25 a week and my free time." Kutcher's suggestion in the reply was: Buy Bitcoin. At that time, the price of 1 bitcoin was around $100, and now the price of bitcoin under the crypto bear market has basically remained above $25,000.

image description

Kutcher at TechCrunch Disrupt 2013

Kutcher's wife, fellow actress Mila Kunis, didn't share Kutcher's views on cryptocurrencies at the time. Still, Kunis eventually ventured into the digital asset space as the crypto industry grew. In June 2021, Kunis launched a new NFT project, Stoner Cats. Holders of this series of NFTs can access streaming episodes of Mila Kunis's animation series of the same name, known as "the first NFT animation series". In addition to Kutcher's support, the The play also attracted Hollywood first-line actors such as Jane Fonda, Chris Rock and others to join in the dubbing. In addition, Ethereum founder Vitalik Buterin also joined in and voiced a cat named Catsington.

From working odd jobs as a child to acting in Hollywood, Kutcher's career has taught him to empathize with the average consumer. He understands that emotions play an important role in how people react to products, and that communicating specific feelings and messages to users requires a strong sense of empathy. Empathy will also lead to wide-ranging relationships. Of all Kutcher's investments, he considers relationships to be the best investment he's ever made. "Take the time to understand people, what motivates them, what challenges they face," says Kutcher. Many investors focus too much on The payoffs and the numbers, so much so that they forget that the true privilege of their position is to share the journey with exceptional people.

first level title

NFT-based encryption investment layout

In addition to investing in AI star projects, interpret the encryption circle layout of Hollywood star Ashton Kutcher's Sound Ventures

NFT

The details of Sound Ventures' investment portfolio are as follows:

Metalink is an NFT portfolio management and social platform. It announced in March 2023 that it had completed a $6 million seed round of financing, with participation from Sound Ventures, Gary Vaynerchuk, and MoonPay CEO Ivan Soto-Wright. Metalink has launched a mobile app that creates a purportedly token-gated space that allows NFT collectors to interact, aggregate announcements, and track their portfolio performance, with a trading feature to follow so users can buy, sell, and swap digital assets.

OnChain Studios completed a $7.5 million seed round in October 2021. a16z led the round, with participation from Dapper Labs and Sound Ventures. The company owns Cryptoys, a blockchain-based Flow-based digital toy and game NFT platform. In June 2022, it completed its Series A financing of US$23 million, led by a16z again, and participated by Animoca Brands and Sound Ventures. Cryptoys launched Star Wars Cryptoys collectible digital toys, and the project party also plans to create a Cryptoys universe and other earning games.

The Fabricant, a digital fashion company, announced in April 2022 that it had completed a US$14 million Series A round of financing, led by Greenfield One, with participation from Sound Ventures and The Sandbox COO Sebastian Borget. The Fabricant has formed a partnership with Epic Games, and its NFT platform, The Fabricant Studio, aims to build a virtual world wardrobe.

Yuga Labs is the production company of the blue-chip NFT project Boring Ape. In March 2022, it announced the completion of a $450 million seed round of financing at a valuation of $4 billion, led by a16z, Animoca Brands, LionTree, Sound Ventures, Thrive Capital, FTX and MoonPay and others participated in the vote. The financing is the largest announced in the entire NFT space, and the funds are said to be used to hire more employees and develop brand partnerships.

CryptoSlam, an NFT data aggregator, announced in January 2022 that it had raised $9 million in financing, led by Animoca Brands, with participation from Mark Cuban, Sound Ventures, and The Sandbox co-founder Sebastien Borget. In early 2023, CryptoSlam and crypto news site Forkast.News announced their merger to form Forkast Labs, a Web3-focused media company.

Jadu, an NFT virtual accessory issuer, announced in December 2021 that it had completed a $7 million round of financing, led by General Catalyst and participated by institutions such as Coinbase Ventures and Sound Ventures. The startup's products include pixelated NFT jetpacks, hoverboards and more, with virtual accessories that can be used with other 3D avatars.

Mnemonic is an NFT infrastructure startup that provides NFT data, analysis, and insights. It completed a $4 million financing in December 2021, led by Kenetic, followed by Sound Ventures and other angel investors. By building a data layer for NFT, Mnemonic makes it easier for third-party companies to navigate and track the NFT market, and use its API to build their own applications.

NFTfi is a p2p market for mortgage NFT loans. In November 2021, it announced the completion of a US$5 million financing. Sound Ventures led the investment, and Maven 11 and others participated. Founded by Stephen Young in February 2020, NFTfi is a platform that allows NFT loans to borrowers. By staking their tokens, NFT holders will be able to unlock liquidity without selling.

Infinite Objects, an art hardware startup, has launched an NFT hardware screen that displays a single NFT and can be labeled with information about the work. It announced in May 2021 that it had completed $6 million in financing, led by Dapper Labs and Courtside VC, and participated by Sound Ventures and others.

Big Time Studio is an NFT game company founded by the former Decentraland CEO, with team members from Epic Games, Riot Games, Blizzard Entertainment and other companies. It announced in May 2021 that it had completed a $21 million financing round. The financing will be divided into two parts. The first part of the $10.3 million fund will be led by FBG Capital, with participation from Alameda Research and Sound Ventures, while the other $11 million fund will be used to invest in game companies to popularize NFT-related technologies.

INK is a digital art creation platform whose app allows creators to sign or draw on any digital content and instantly turn that content into a digitally scarce NFT. The platform will complete a pre-seed round of financing in April 2022. In addition to Sound Ventures, the participating investors include Mark Cuban, Betaworks Ventures, and Lupa Systems.

Mintable, an NFT trading platform, announced the completion of its seed round of financing in April 2021, with participation from CRC Capital, Time Ventures, and Sound Ventures. The company also completed its Series A round of financing in July of the same year, raising $13 million. Participating parties in this round included Ripple, Animoca Brands, Metapurse, Expedia Group, etc.

POAP is an Ethereum NFT badge application used to provide a way for attendees to attest to their record of life experiences. Creators of POAPs can provide additional value to their consumers by offering POAPs and collecting the special perks they may bring. It announced in January 2022 that it had completed $10 million in financing, led by Archetype and Sapphire Sport LLC, with participation from Delphi Digital, A Capital, and Sound Ventures.

OpenSea is a leading NFT trading platform. It completed a $100 million Series B round of financing at a valuation of $1.5 billion in July 2021, led by a16z and participated by Coatue and Sound Ventures.

consumption, application

Pearpop is a social media collaboration platform. It announced in November 2022 that it had completed a US$18 million Series A round of financing at a US$300 million valuation. Sound Ventures, Seven Seven Six, Avalanche’s Blizzard Fund and others participated in the investment. Pearpop has two products, Ovation, a brand interaction service, and Passport, a blockchain cross-platform engagement service, which can help brands better understand creators' influence and audience engagement.

Antic, a blockchain-based co-ownership platform, announced in September 2022 the completion of a $7 million seed round led by Seven Seven Six and Sheva, with participation from Sound Ventures, Dapper Labs, and others. Antic aims to create a new type of economic entity of "collective users". Through the "joint acquisition" option integrated on the platform, the entry threshold for specific assets is lowered and the experience is optimized. In addition to Web3 assets, its co-ownership is also open to non-crypto-related businesses.

Syndicate is a community-based investment system that simplifies the creation of decentralized autonomous organizations, providing the community with the tools to easily initiate decentralized investments. Syndicate completed a US$20 million Series A financing in September 2021, led by a16z and participated by Sound Ventures, Snoop Dogg and others. In May 2022, Syndicate completed another $6 million in financing, with participation from a16z, OpenSea, Circle Ventures, Polygon, etc.

Lolli is a Bitcoin rebate platform. In May 2020, it announced the completion of a $3 million seed round of financing. Participating parties include Sound Ventures, Craft Ventures, Company Ventures, Bain Capital, DCG, etc.

Chainalysis is a blockchain data analysis service provider founded in 2014 and headquartered in New York. The company uses its investigation and compliance software to help governments and private sector companies monitor and prevent Bitcoin and other cryptocurrencies from being used in illegal activities such as money laundering. use. It received a total of $13 million in investment from Ribbit Capital and Sound Ventures in July 2020. Chainalysis raised three more rounds in the following year, each at $100 million.

Zapper is a DeFi asset management platform. In May 2021, it announced the completion of a US$15 million Series A financing. Framework Ventures led the investment, and Sound Ventures, Mark Cuban and others participated in the investment.

infrastructure

infrastructure

ConsenSys is a blockchain software technology and Ethereum infrastructure development company. It announced in March 2022 that it completed a $450 million Series D round of financing at a valuation of $7 billion. ParaFi Capital led the investment, Temasek, Softbank Vision Fund Phase II, Microsoft , Sound Ventures and others participated in the investment. In March 2023, ConsenSys launched its Layer 2 solution, the ConsenSys zkEVM testnet, and rebranded it as Linea. Linea combines zero-knowledge proofs with EVM equivalence to provide developers with flexibility and scalability

Sardine is a fraud detection and encryption compliance platform for the financial technology industry. CEO and co-founder Soups Ranjan has previously served as the head of risk at Coinbase. The API developed by Sardine allows client companies to use it to address fraud and KYC checks when opening accounts, moving funds, and its payment platform enables individuals to purchase cryptocurrencies and NFTs using bank transfers and bank cards. In September 2022, Sardine completed a $51.5 million Series B round of financing, led by a16z, with participation from Visa, ConsenSys, Google Ventures, and Sound Ventures.

Crypto startup Multis, originally designed as a new type of bank for companies using cryptocurrencies, is now a software layer that helps Web3 organizations manage their crypto finances, building a stack of financial and operational tools for DAOs and DeFi startups. It announced in February 2022 that it had completed a financing of US$7 million. Sequoia Capital led the investment, and Sound Ventures, MakerDAO and others participated.

Horizen is a blockchain privacy service platform developed by Horizen Labs. It completed a US$7 million seed round of financing in August 2021. The co-lead investors Kenetic Capital, DCG and Liberty City each contributed US$2 million. Other participating investors include Sound Ventures, Artist Capital, etc.

Bison Trails is a blockchain protocol provider that helps clients deploy participating nodes on blockchains without developing their own supporting technology. It completed a US$25.5 million Series A financing in November 2019, led by Blockchain Capital, and participated by KPCB, Coinbase Ventures, and Sound Ventures.